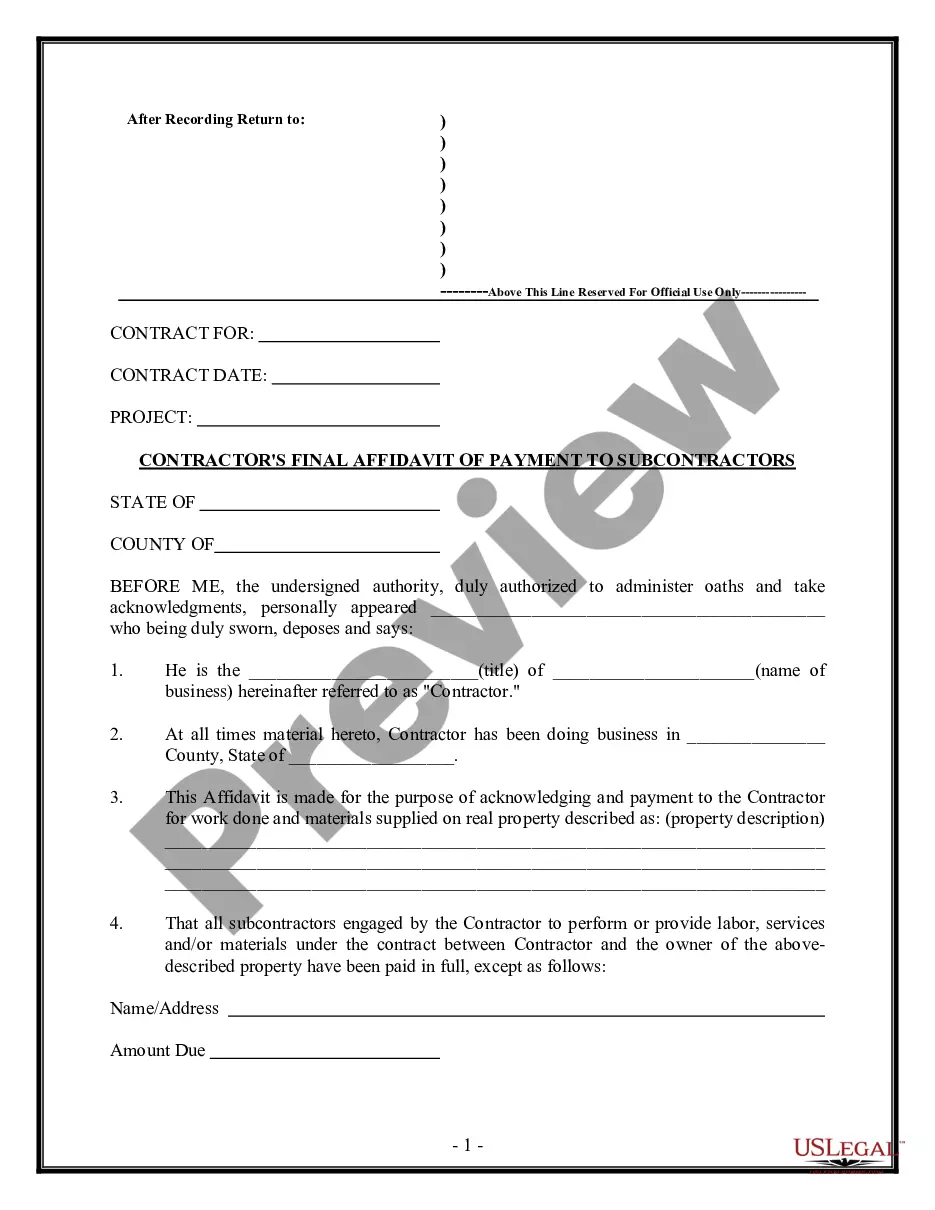

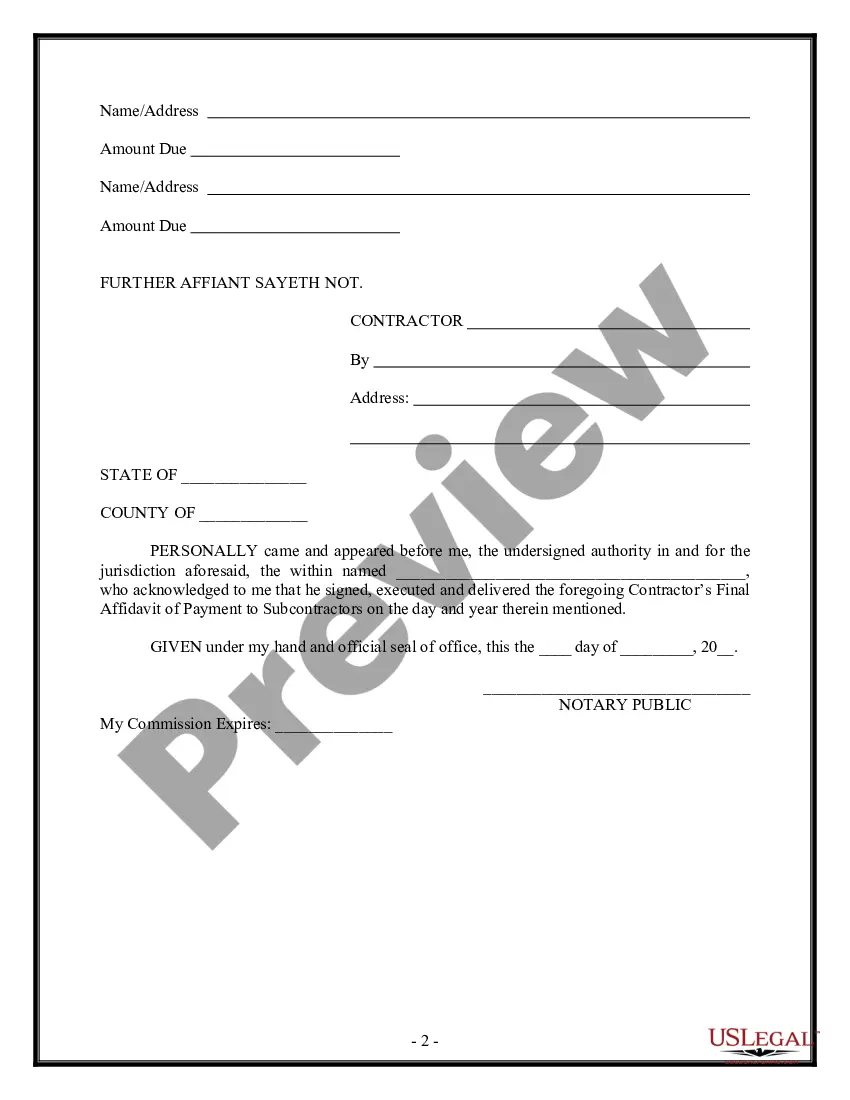

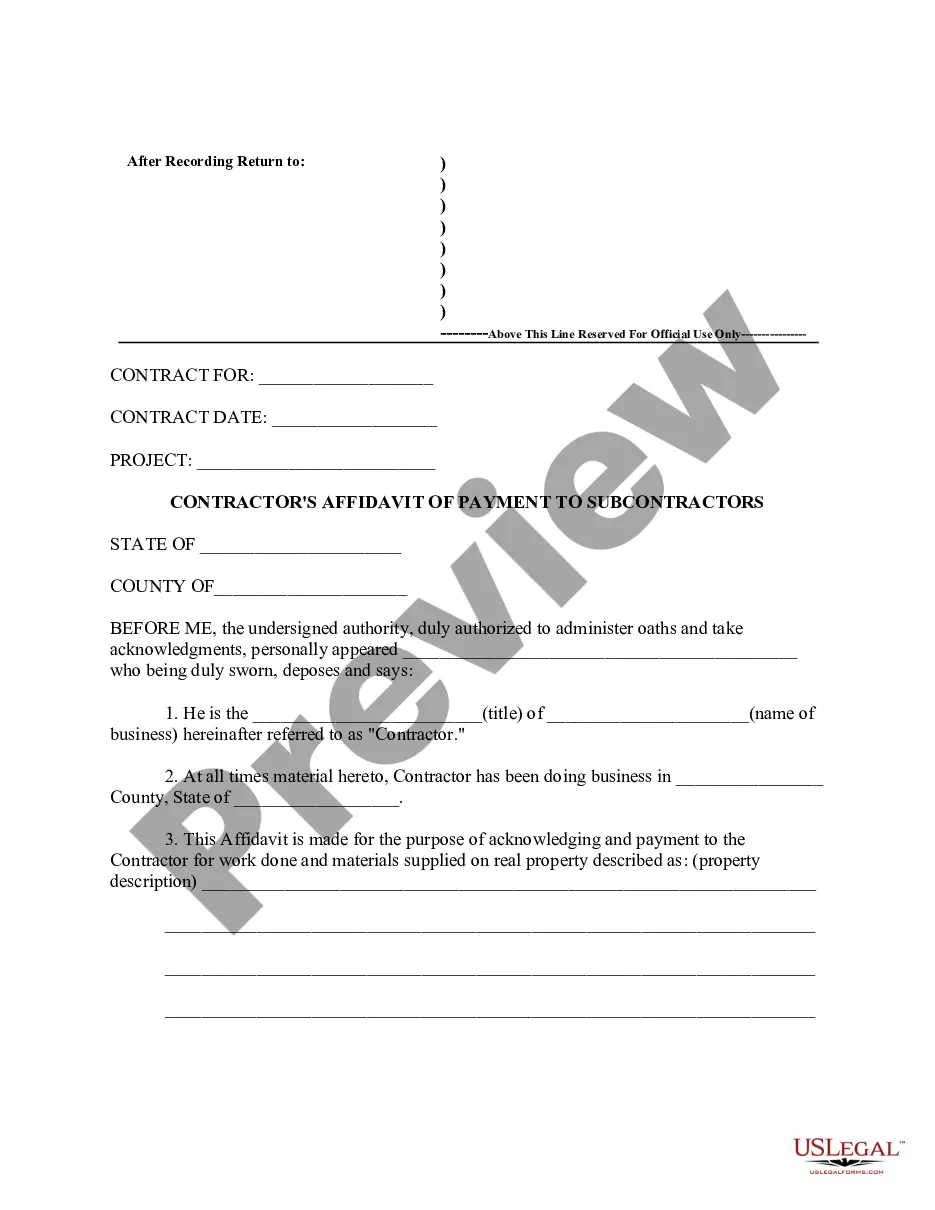

New Mexico Contractor's Final Affidavit of Payment to Subcontractors

Description

How to fill out Contractor's Final Affidavit Of Payment To Subcontractors?

If you need to finalize, obtain, or produce authentic document templates, utilize US Legal Forms, the largest assortment of authentic forms, which can be accessed online.

Utilize the website's straightforward and user-friendly search feature to find the documents you require.

A range of templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, select the Acquire now option. Choose the pricing plan you prefer and enter your details to register for an account.

Step 6. Choose the format of the legal form and download it to your device.

- Utilize US Legal Forms to find the New Mexico Contractor's Final Affidavit of Payment to Subcontractors in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and then click on the Download option to obtain the New Mexico Contractor's Final Affidavit of Payment to Subcontractors.

- You can also access forms you have previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions in the legal form template.

Form popularity

FAQ

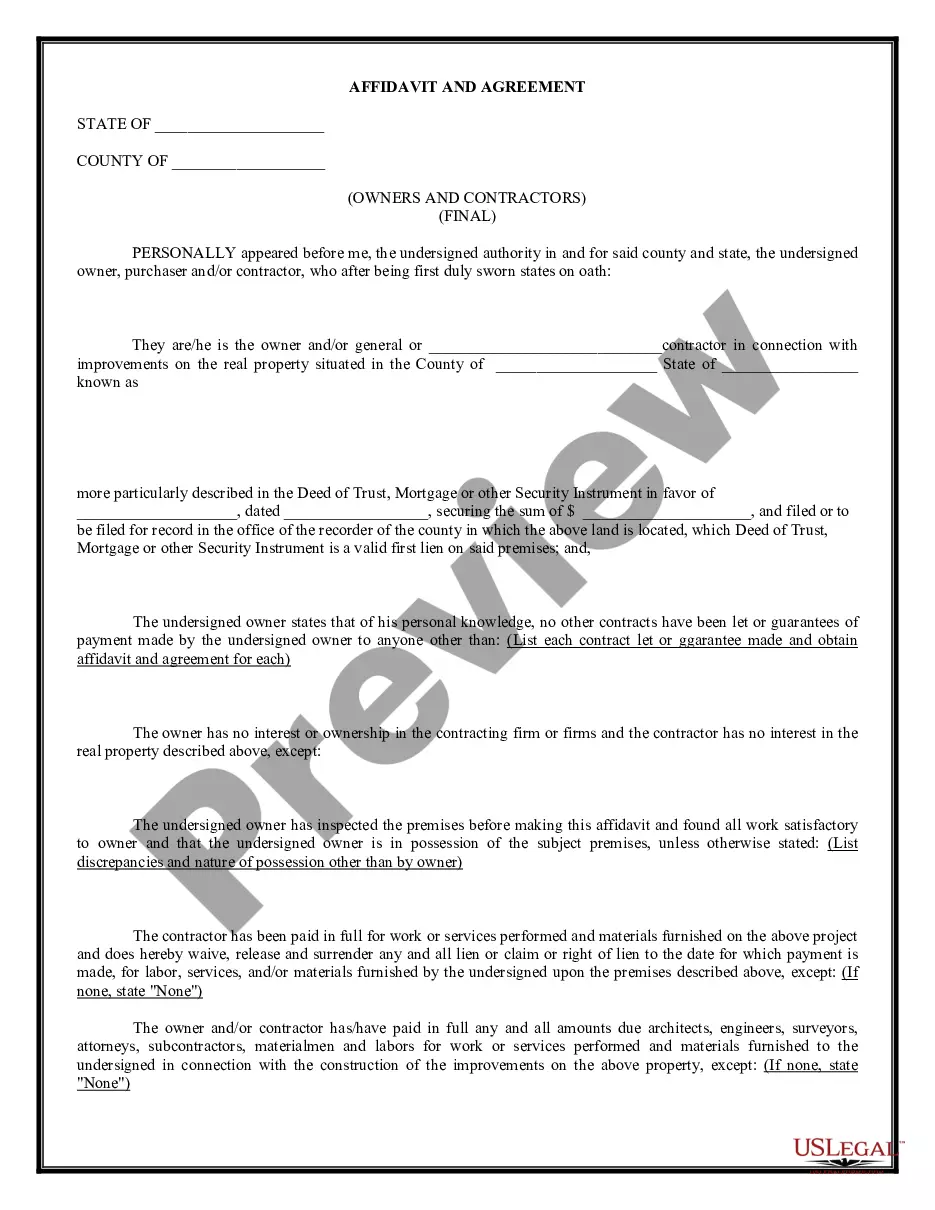

AIA Document G70621221994 requires the contractor to list any indebtedness or known claims in connection with the construction contract that have not been paid or otherwise satisfied.

You usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

When you pay subcontractors, you'll usually need to make deductions from their payments and pay the money to HMRC. Deductions count as advance payments towards the subcontractor's tax and National Insurance bill. You'll need to file monthly returns and keep full CIS records - you may get a penalty if you do not.

When Can Contractors Withhold Payment From Subcontractors? The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

In order to get paid, subcontractors need to issue invoices to the contractors they work for. Every invoice you issue needs to include some basic information, including: An invoice number: a unique code that follows a sequential order.

A general rule of contributory negligence is that a main contractor is not liable for the negligence of its independent subcontractor. There are some exceptions to this rule, including: The main contractor had actual knowledge that the sub-contractor's work had been done in a foreseeably dangerous way and condoned it.

How to get paid (faster) on every construction projectGet licensed.Write a credit policy.Prequalify potential customers.Get the contract in writing.Collect information about the property and other parties.Track your deadlines.Send Preliminary Notice.Submit Detailed Pay Applications or Invoices.More items...?

Paying subcontractorsYou usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

AIA Document G706 is intended for use when the Contractor is required to provide a sworn statement verifying that debts and claims have been settled, except for those listed by the Contractor under EXCEPTIONS in the document. AIA Document G706 is typically executed as a condition of final payment.

AIA Document G702®1992, Application and Certificate for Payment, and G703A®1992, Continuation Sheet, provide convenient and complete forms on which the contractor can apply for payment and the architect can certify that payment is due.