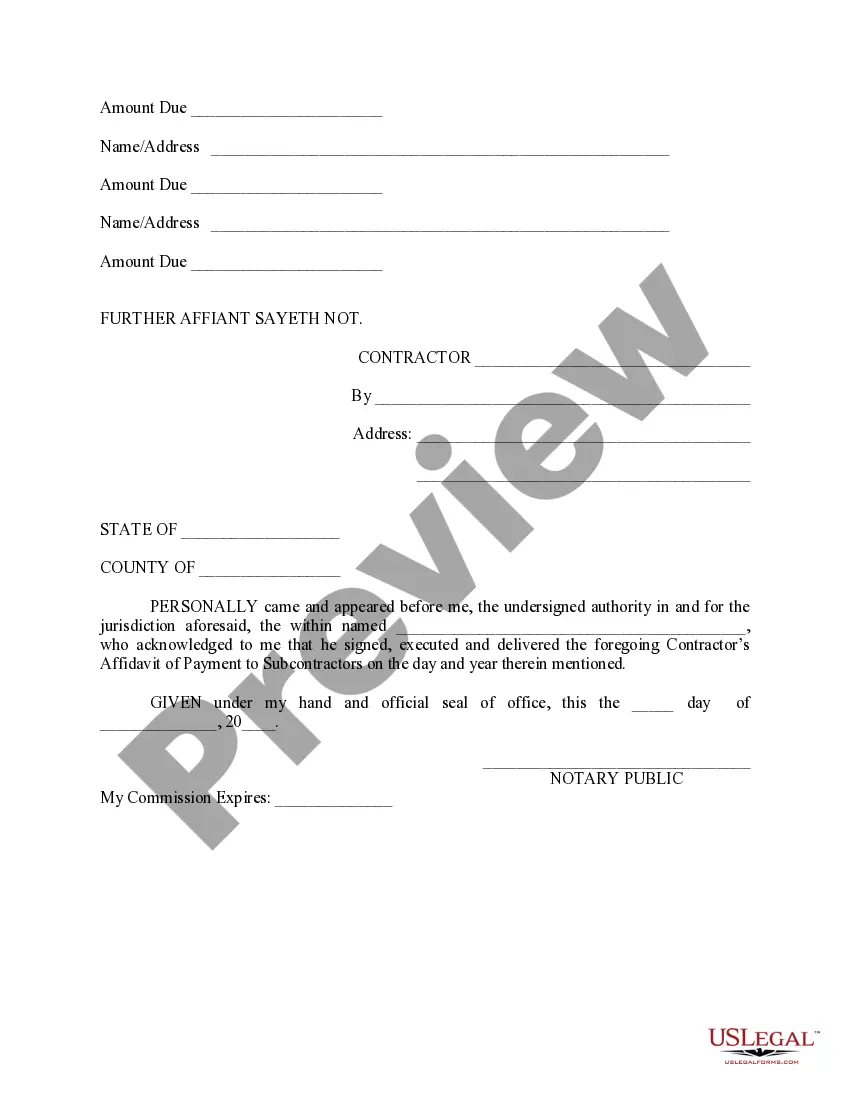

New Mexico Contractor's Affidavit of Payment to Subs

Description

How to fill out Contractor's Affidavit Of Payment To Subs?

Selecting the appropriate legal document template can be somewhat challenging.

Clearly, there are numerous designs accessible online, but how can you acquire the legal form you seek.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have chosen the correct form for your locality/county. You can view the form using the Review button and read the form description to confirm it is suitable for you. If the form does not fulfill your requirements, utilize the Search field to find the appropriate form. Once you are confident that the form is suitable, click on the Acquire now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and process the payment using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, modify, print, and sign the acquired New Mexico Contractor's Affidavit of Payment to Subs. US Legal Forms is the largest repository of legal forms where you can find numerous document templates. Utilize the service to download correctly crafted documents that comply with state requirements.

- The service offers thousands of templates, including the New Mexico Contractor's Affidavit of Payment to Subs, which can be utilized for business and personal purposes.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to locate the New Mexico Contractor's Affidavit of Payment to Subs.

- Use your account to browse the legal forms you have purchased previously.

- Visit the My documents section of your account to obtain another copy of the document you need.

Form popularity

FAQ

A subcontractor is a person who works for a contractor. A contractor is a person or company who works with businesses on a contract basis and is paid for completing projects. Like contractors, subcontractors are self-employed, and they can help contractors on projects that require additional help or skills to complete.

An affidavit of loss is a document declaring that a security, such as a stock certificate, is lost or destroyed. The security issuer requires an affidavit in order to indemnify the holder or replace the certificate.

6.2. The total "retention money" shall be due for release upon final acceptance of the works.

Form G702 (Application and Certificate for Payment) is used by subcontractors throughout America to make the procedure for receiving payments for work performed regulated and convenient for all parties to the process. Such forms indicate the amount of payment paid for the work done for a certain period.

AIA Document G706 is intended for use when the Contractor is required to provide a sworn statement verifying that debts and claims have been settled, except for those listed by the Contractor under EXCEPTIONS in the document. AIA Document G706 is typically executed as a condition of final payment.

Subcontractor Costs means all costs incurred by subcontractors for the project, including labor and non-labor costs.

Typically, a contractor works under a contractual agreement to provide services, labor or materials to complete a project. Subcontractors are businesses or individuals that carry out work for a contractor as part of the larger contracted project.

You can claim:Fuel costs.Repairs and servicing costs.Maintenance costs.Interest owed on the vehicle loan.Insurance premiums related to the vehicle.Payments on any lease agreements for the vehicle.Registration costs.Depreciation.01-Jan-2019

Independent subcontractors regularly purchase materials and equipment related to their specific projects. Expenses for materials necessary for completion of a job may be directly deducted from taxable income on your tax return.

This is a standard form for use when a surety company is involved and the owner/contractor agreement contains a clause whereby retainage is reduced during the course of the construction project.