New Mexico Tax Free Exchange Package

Understanding this form package

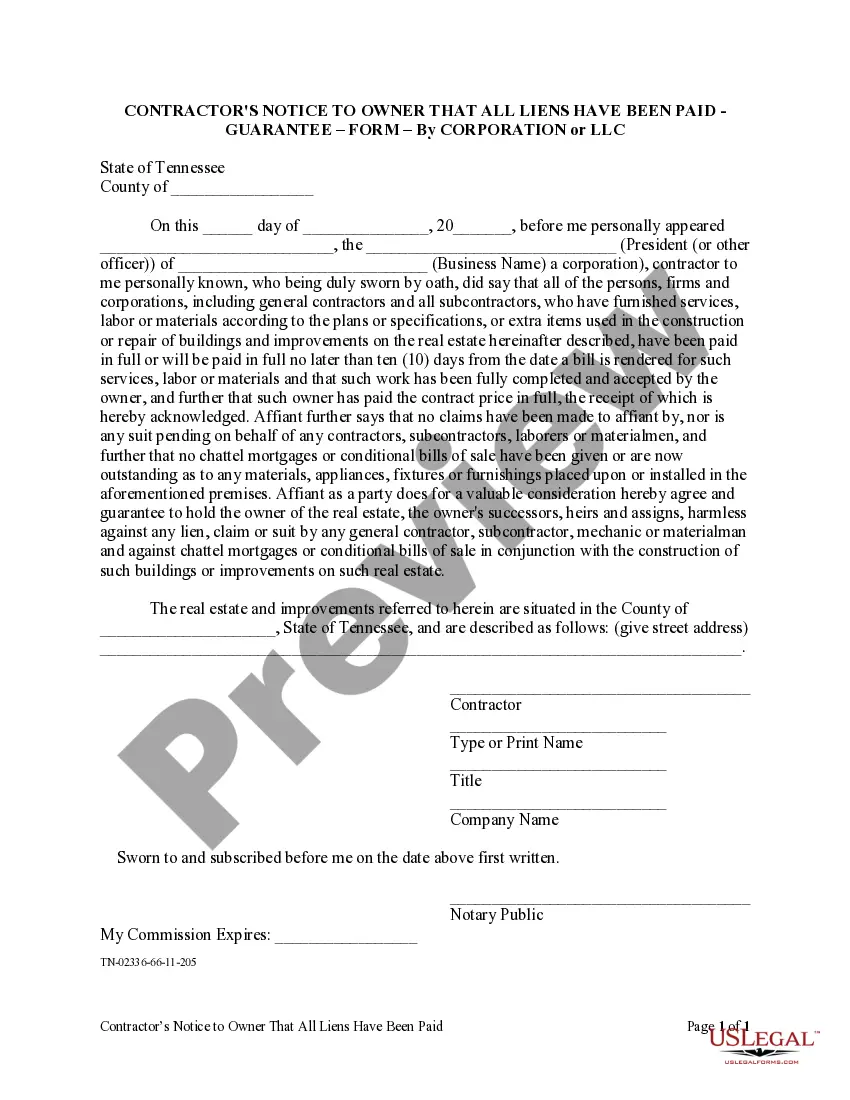

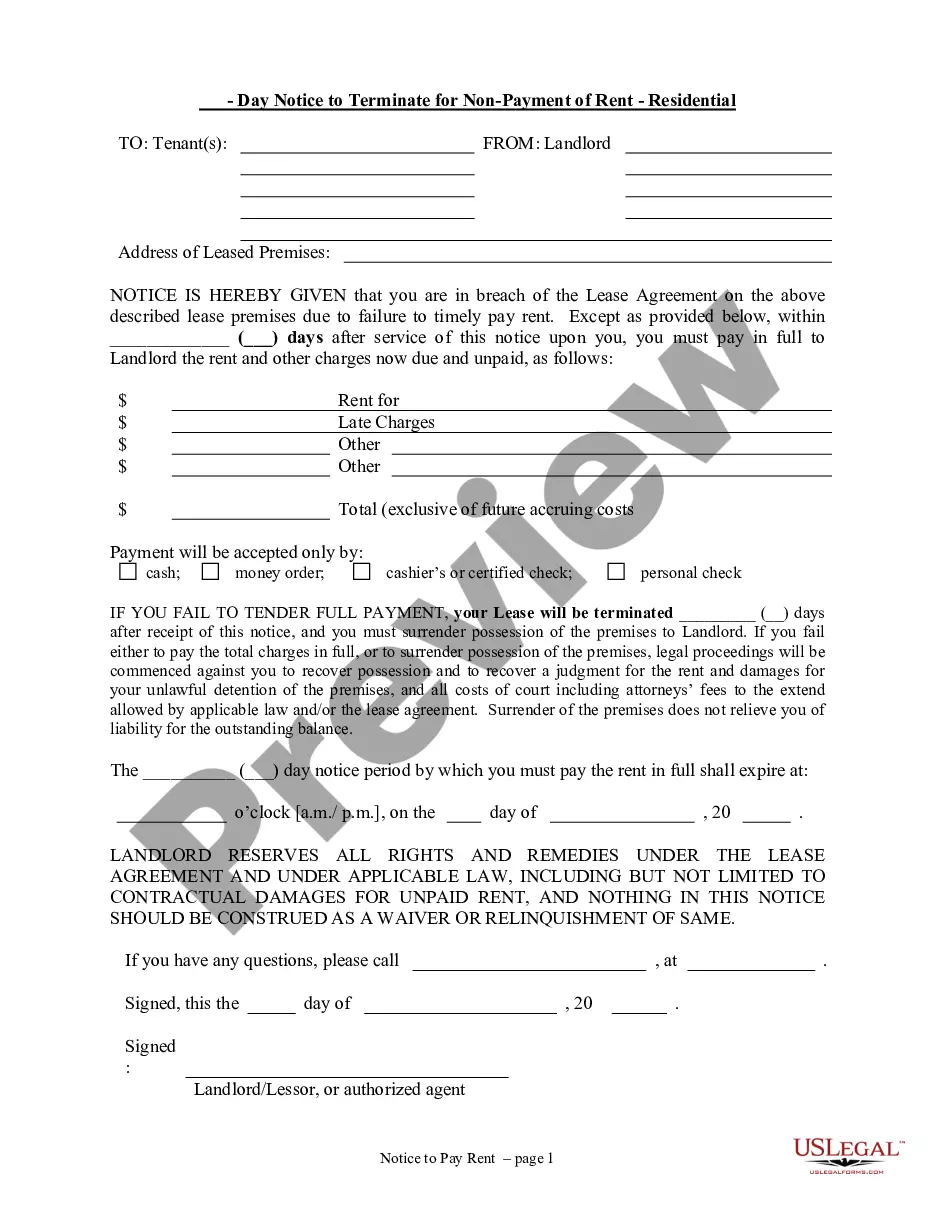

The New Mexico Tax Free Exchange Package is a collection of legal forms designed to facilitate a tax-free exchange of like-kind property. This package distinguishes itself by providing essential documents drafted by licensed attorneys, ensuring that users can efficiently navigate the complexities of Section 1031 exchanges while complying with state and federal regulations.

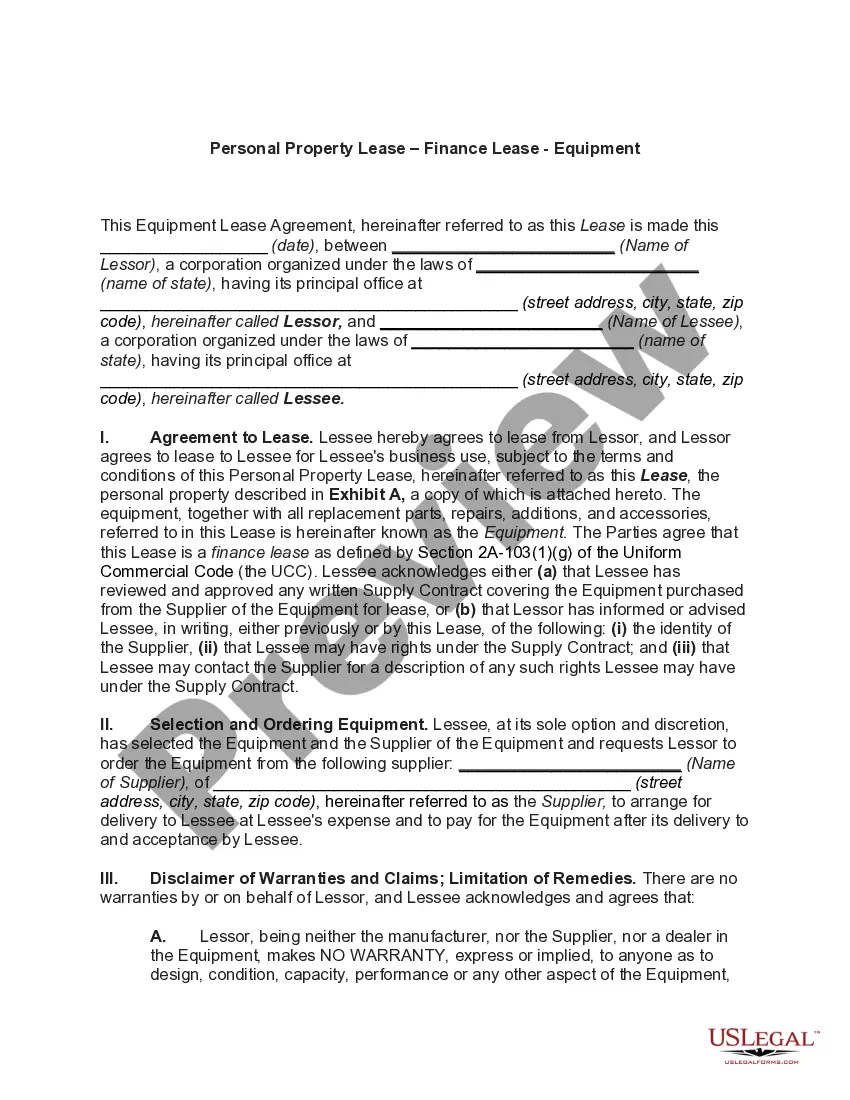

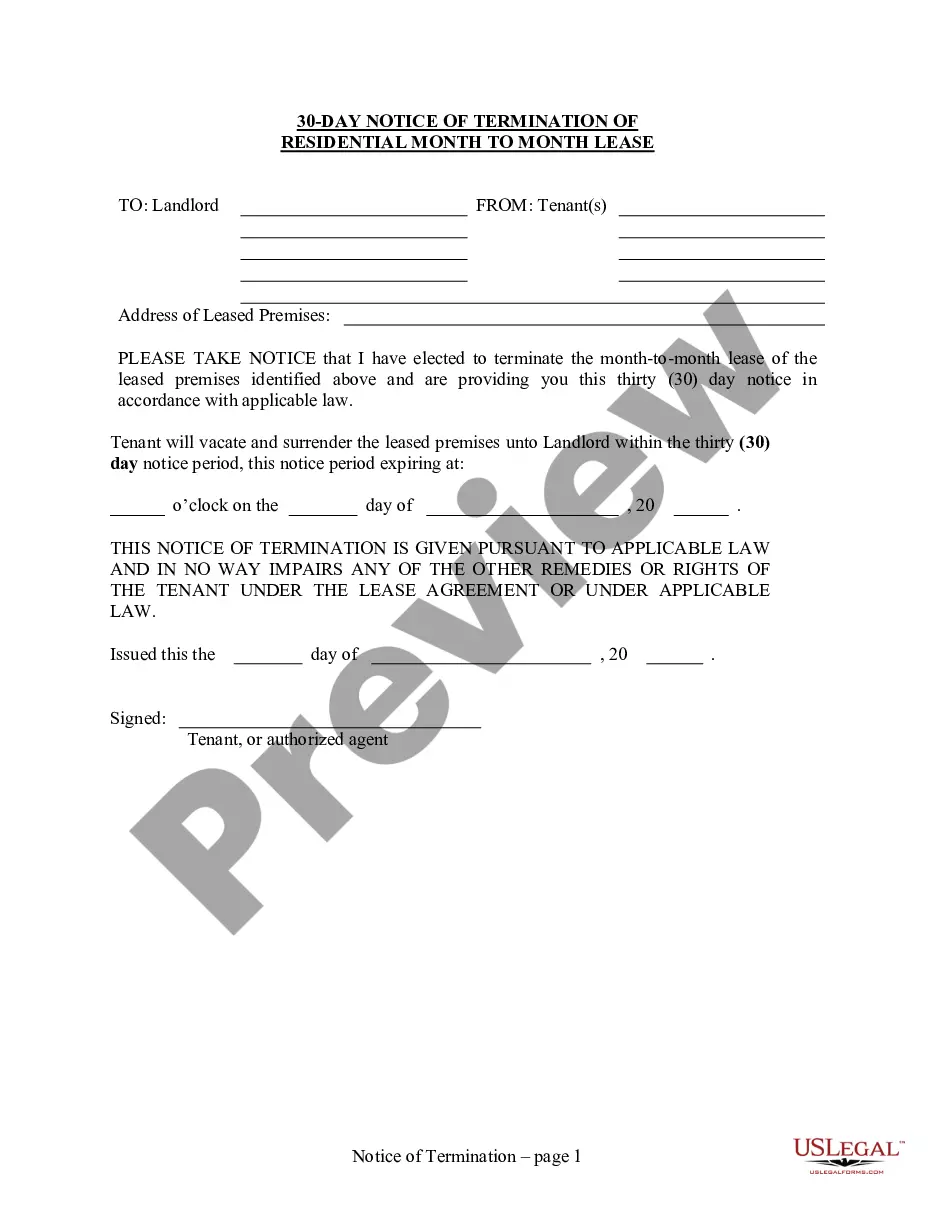

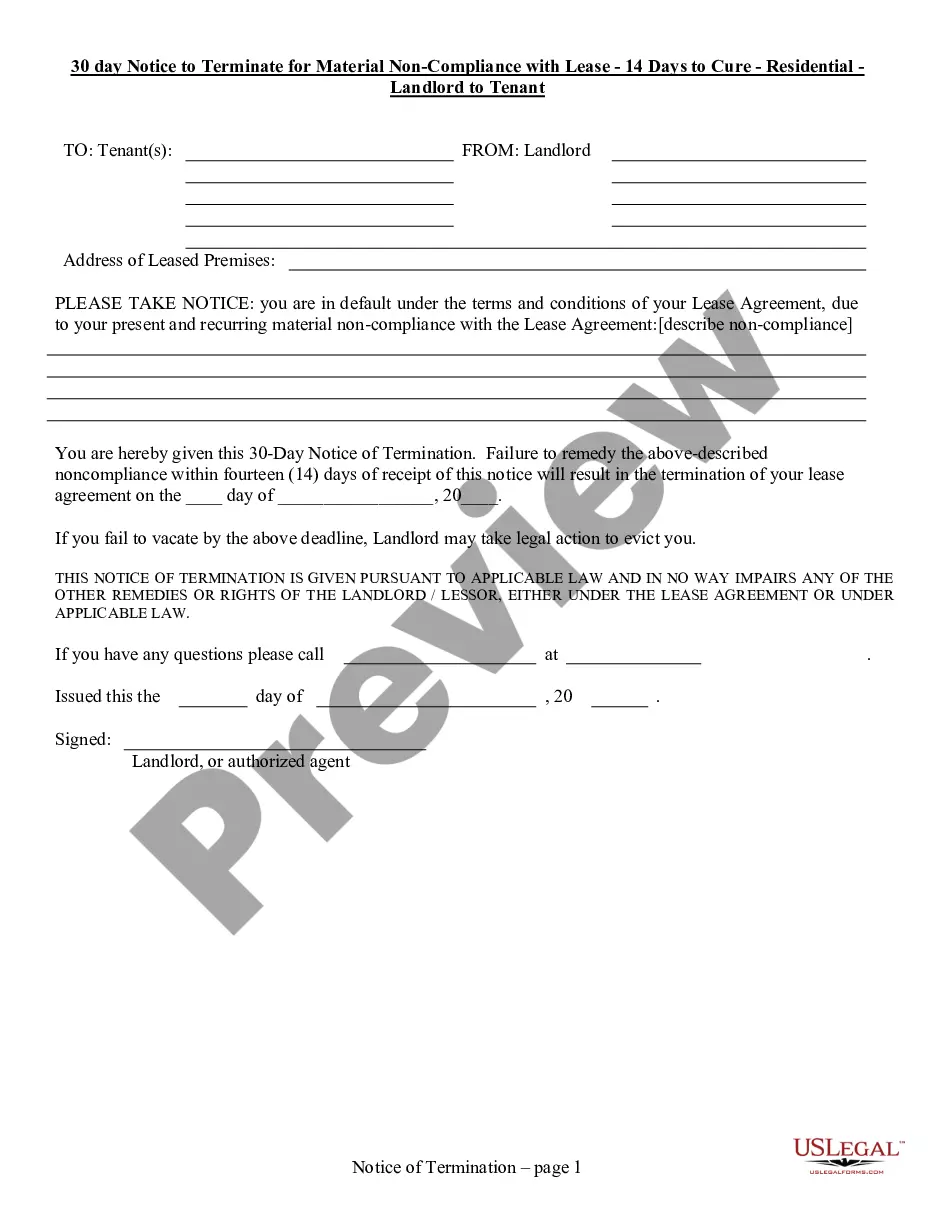

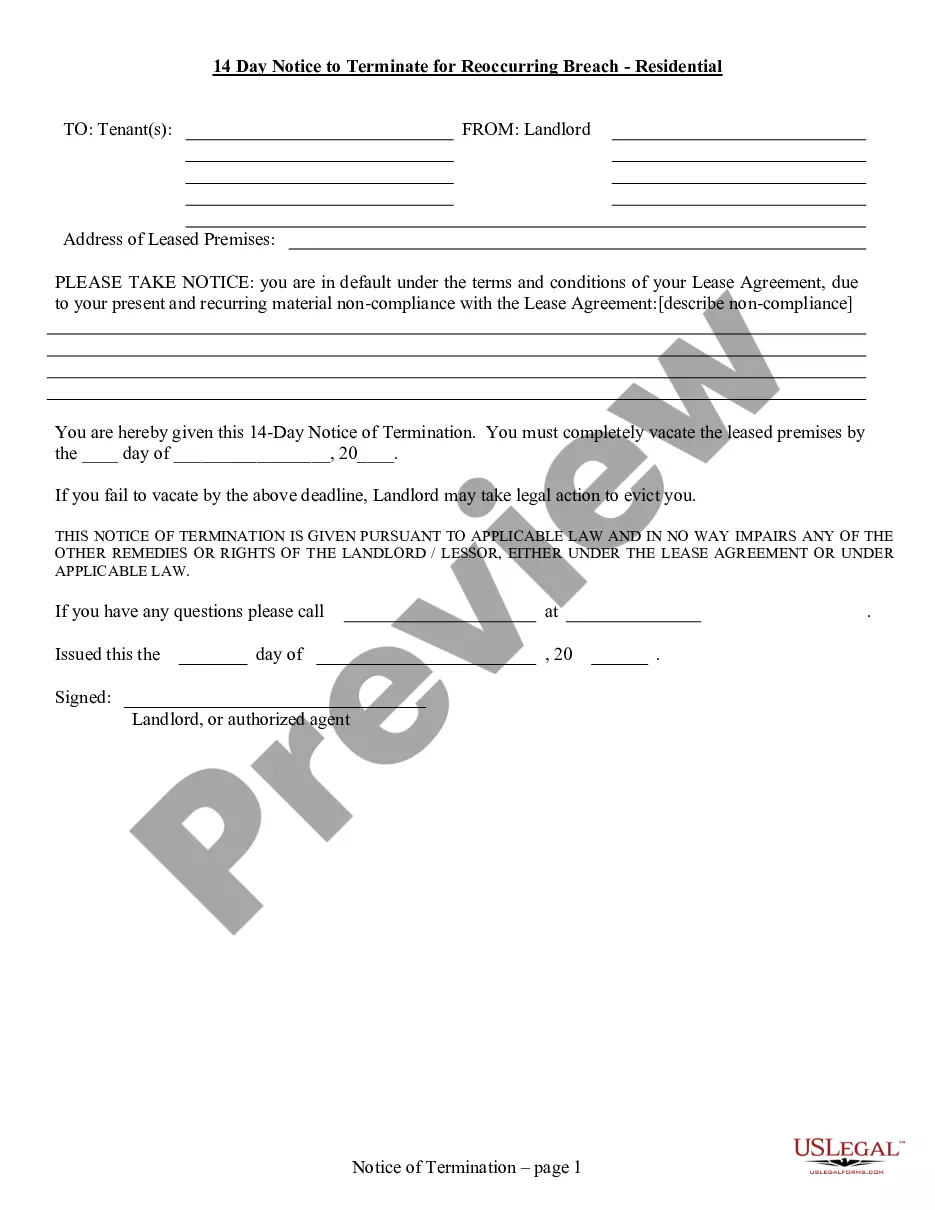

Forms included in this package

When this form package is needed

This form package is useful in several scenarios, including:

- When you plan to exchange real estate properties, such as commercial or residential real estate, without incurring immediate tax liabilities.

- When you are involved in a business property sale and need to reinvest the proceeds into like-kind property.

- When you are amending existing contracts to facilitate the exchange process under tax regulations.

Who should use this form package

- Real estate investors looking to defer capital gains taxes through like-kind exchanges.

- Property owners who wish to swap one piece of real estate for another under section 1031 of the Internal Revenue Code.

- Businesses selling property to reinvest in similar assets while minimizing tax implications.

How to prepare this document

- Review the included forms thoroughly to understand what each document requires.

- Identify all parties involved in the exchange and gather necessary information.

- Enter the relevant details into each form, ensuring accuracy and completeness.

- Sign the forms where required, adhering to the specific signing guidelines outlined.

- Store the completed forms securely and consider consulting a tax professional for any liabilities or reporting requirements.

Do forms in this package need to be notarized?

Some forms in this package require notarization to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to identify all parties involved in the transaction.

- Incomplete or incorrect information in the forms, which can delay the process.

- Not understanding the timeline requirements for completing exchanges.

Advantages of online completion

- Convenient downloadable access allows for flexible completion.

- Editability of forms means users can easily make necessary adjustments.

- Reliable legal templates drafted by licensed attorneys to ensure compliance.

Legal use & context

- These forms are designed to comply with New Mexico laws regarding tax-free exchanges.

- Using these forms can help avoid tax penalties associated with improper reporting.

- Ensuring accurate completion of these forms is crucial for upholding the legality of the transaction.

Key takeaways

- The Tax Free Exchange Package provides essential forms for navigating real estate exchanges.

- It's designed for both individual investors and businesses looking to defer taxes.

- Understanding and accurately completing these forms is vital to ensure compliance with tax regulations.

Looking for another form?

Form popularity

FAQ

If all of a business's receipts are exempt, the business doesn't have to register with the state for GRT purposes. Common exemptions are receipts of a 501(c)(3) nonprofit and governmental entities, receipts from isolated or occasional sales, employee wages, interest and dividends and insurance company receipts.

New Mexico charges a gross receipts tax on persons engaged in business in the state for the privilege of doing business in the state. Tax rates vary across the state from 5.125% to 8.8125% and the rate is determined as a combination of the rates imposed by the state, the counties, and the municipalities.

Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind.

Trade up in real estate value with one or more replacement properties. Reinvest all of your 1031 exchange proceeds from the relinquished property into the replacement property.

In New Mexico, the seller pays the tax on the sales price of a product or service even if the seller doesn't collect it from the buyer and even if the buyer lives out of state. GRT was intended to widen the tax base by taxing more items at a lower rate than would be typical in states with a sales tax.

A Taxpayer Must Not Receive "Boot" from an exchange in order for a Section 1031 exchange to be completely tax-free. Any boot received is taxable (to the extent of gain realized on the exchange).Boot received is the money or the fair market value of "other property" received by the taxpayer in an exchange.

The State of New Mexico imposes a tax on the gross receipts of businesses operating within the state known as the Gross Receipts Tax. The state allows cities and counties to also impose a smaller GRT rate for their operations. Within the Albuquerque city limits the GRT rate is 7%.

New Mexico is among the "tax-friendly" states of the U.S., offering numerous economic incentives and tax breaks on personal and corporate income. It does not have inheritance tax, estate tax or franchise taxes.