New Jersey Self-Employed Awning Services Contract

Description

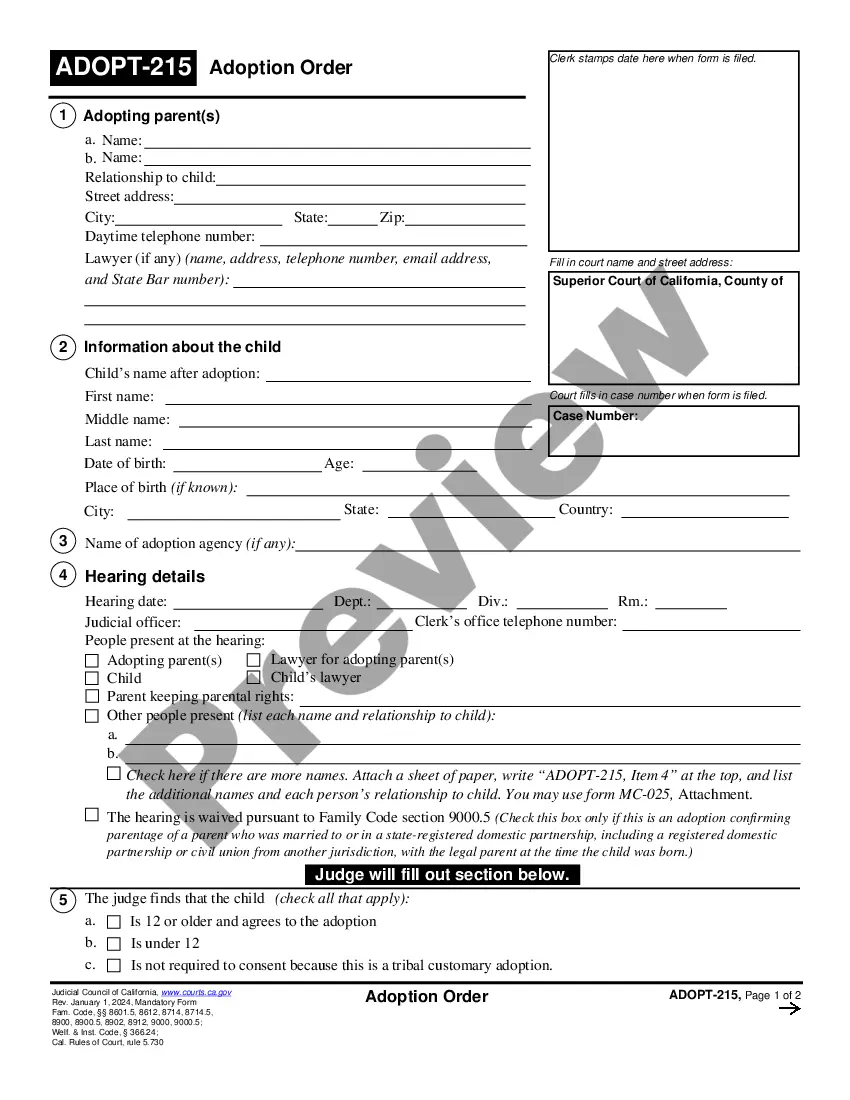

How to fill out Self-Employed Awning Services Contract?

You can allocate time online searching for the legal document template that fulfills the federal and state stipulations you will require.

US Legal Forms offers thousands of legal forms that have been evaluated by professionals.

You can conveniently acquire or print the New Jersey Self-Employed Awning Services Contract from the service.

If available, use the Preview button to browse through the document template as well. If you wish to get another version of your form, use the Search field to find the template that meets your needs and requirements. Once you have identified the template you want, click on Get now to proceed. Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the payment. You can use your credit card or PayPal account to purchase the legal form. Choose the file format of your document and download it to your device. Make alterations to your document if possible. You can complete, modify, sign, and print the New Jersey Self-Employed Awning Services Contract. Download and print thousands of document templates using the US Legal Forms site, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain button.

- Afterwards, you can complete, modify, print, or sign the New Jersey Self-Employed Awning Services Contract.

- Each legal document template you obtain is yours permanently.

- To acquire another copy of any obtained form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the form outline to confirm you have chosen the appropriate form.

Form popularity

FAQ

New Jersey exempts several services from sales tax, including most professional services and certain personal services. Understanding which services apply is crucial, especially if you are operating under a New Jersey Self-Employed Awning Services Contract. Consulting with a tax advisor can help you navigate these exemptions effectively.

New Jersey does not legally require an operating agreement for an LLC, but having one is highly recommended. An operating agreement outlines the management structure and operating procedures of your LLC, providing clarity and protection. If you're operating under a New Jersey Self-Employed Awning Services Contract, consider drafting one for your peace of mind.

In New Jersey, landscaping services are generally exempt from sales tax. However, certain aspects of landscaping, such as supplies or materials used, may be taxable. If your work relates to a New Jersey Self-Employed Awning Services Contract, it's wise to clarify these nuances with a tax expert.

In New Jersey, professional services are generally not subject to sales tax. However, there can be exceptions depending on the nature of the service provided. If you are offering services under a New Jersey Self-Employed Awning Services Contract, you should consult with a tax professional to clarify your specific situation.

Yes, New Jersey does require contractors to hold a license for most types of work, including awning services. This requirement ensures that contractors comply with state regulations and maintain a certain level of professionalism. When entering into a New Jersey Self-Employed Awning Services Contract, always check for proper licensing to protect your interests. Using platforms like uslegalforms can help you find licensed contractors and streamline your legal processes.

The statute of limitations on construction-related claims in New Jersey is generally four years. This applies to various issues, including those stemming from a New Jersey Self-Employed Awning Services Contract. Understanding this timeline is crucial for ensuring that you can hold contractors accountable for their work. Keep detailed records to support any claims within this timeframe.

As previously mentioned, you typically have four years to sue a contractor in New Jersey. This timeframe applies to disputes that arise from a New Jersey Self-Employed Awning Services Contract. Be aware that this period starts when the issue is discovered, not when the contract was signed or the work completed. Staying informed about your rights will empower you to take action when necessary.

Yes, you can sue a contractor for taking an unreasonable amount of time to complete work under a New Jersey Self-Employed Awning Services Contract. If their delays are excessive and violate the terms of the contract, you may have grounds for legal action. It's important to document all communications and timelines to support your claim effectively. Consider consulting a legal professional for guidance on the best course of action.

Yes, in New Jersey, commercial contractors are required to obtain a license to operate legally. This requirement ensures that they meet specific standards and regulations, providing you with peace of mind. When hiring a contractor under a New Jersey Self-Employed Awning Services Contract, verify their licensing status to ensure they are qualified to perform the work. This step can help you avoid potential issues down the line.

You generally have a four-year period to sue a contractor in New Jersey. This applies to disputes related to contracts, including those covered by a New Jersey Self-Employed Awning Services Contract. The clock starts ticking from the time you discover the issue, not necessarily when the work was completed. It's advisable to act promptly to ensure your claim is valid.