New Jersey Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

How to fill out Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

Finding the appropriate legal document format can be a challenge.

Certainly, there are numerous templates available online, but how do you obtain the legal form you require.

Utilize the US Legal Forms platform. The service offers thousands of templates, such as the New Jersey Notice of Violation of Fair Debt Act - Notice to Stop Contact, that can be utilized for both business and personal needs.

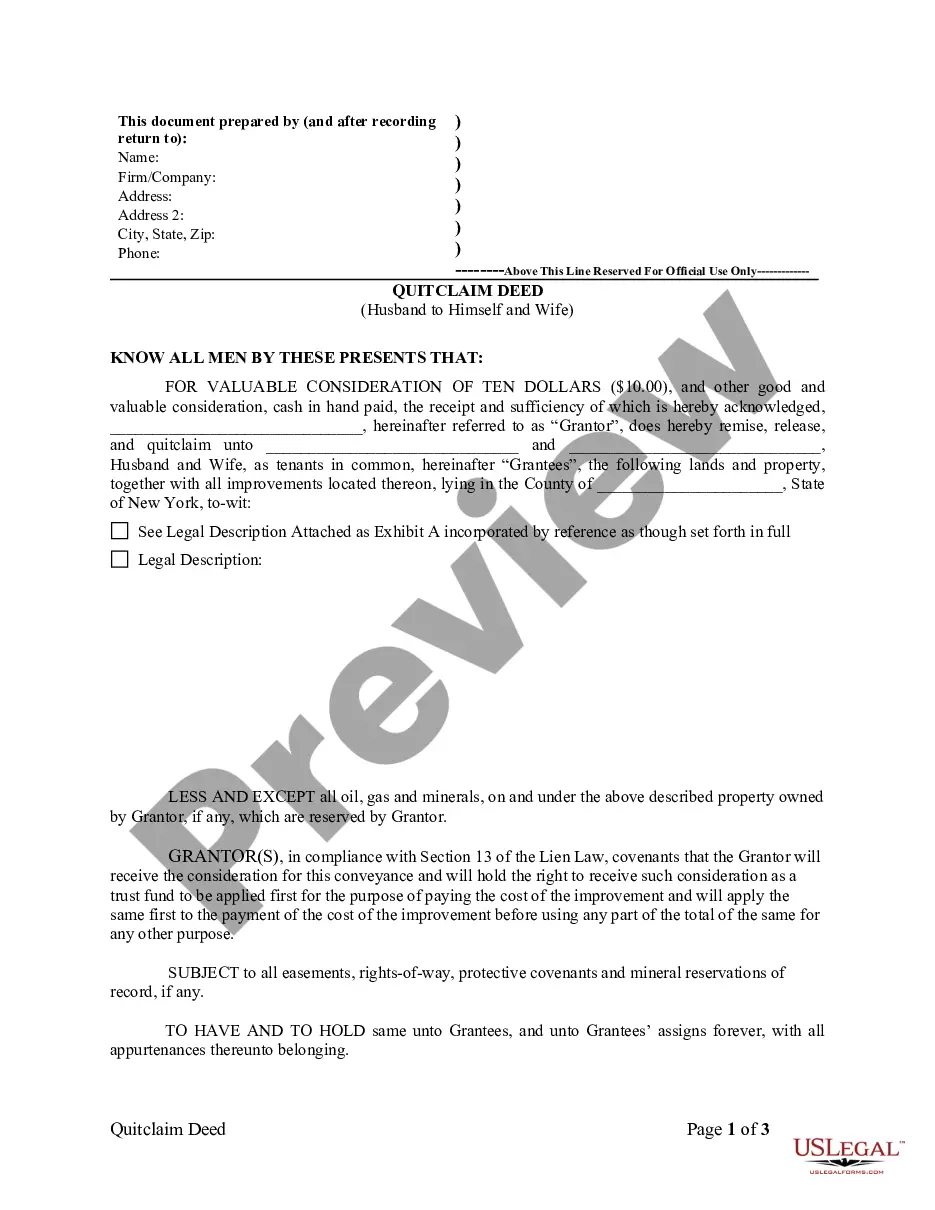

You can examine the form using the Preview option and look at the form description to verify that this is indeed the correct one for you.

- All the documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Obtain option to receive the New Jersey Notice of Violation of Fair Debt Act - Notice to Stop Contact.

- Use your account to review the legal documents you may have purchased previously.

- Proceed to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your area/region.

Form popularity

FAQ

If you need to take a break, you can use this 11 word phrase to stop debt collectors: Please cease and desist all calls and contact with me, immediately. Here is what you should do if you are being contacted by a debt collector.

Fortunately, there are legal actions you can take to stop this harassment:Write a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

The FDCPA prohibits debt collectors from calling you repeatedly, using profane language, making threats, or otherwise harassing you. If a debt collector is constantly calling you and causing you stress, sending a cease and desist letter can stop the collector from harassing you.

Can a debt collector come to your house without notice? Yes, there's no formal process that debt collectors have to follow, unlike court appointed representatives, such as bailiffs.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

Statute of Limitations in New Jersey The statute of limitations on credit card debt and most other debt in New Jersey is six years (it's four years for auto loans). That means that the debt collector has that amount of time to file a lawsuit.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

You have the right to tell a debt collector to stop communicating with you. To stop communication, send a letter to the debt collector and keep a copy of the letter. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.