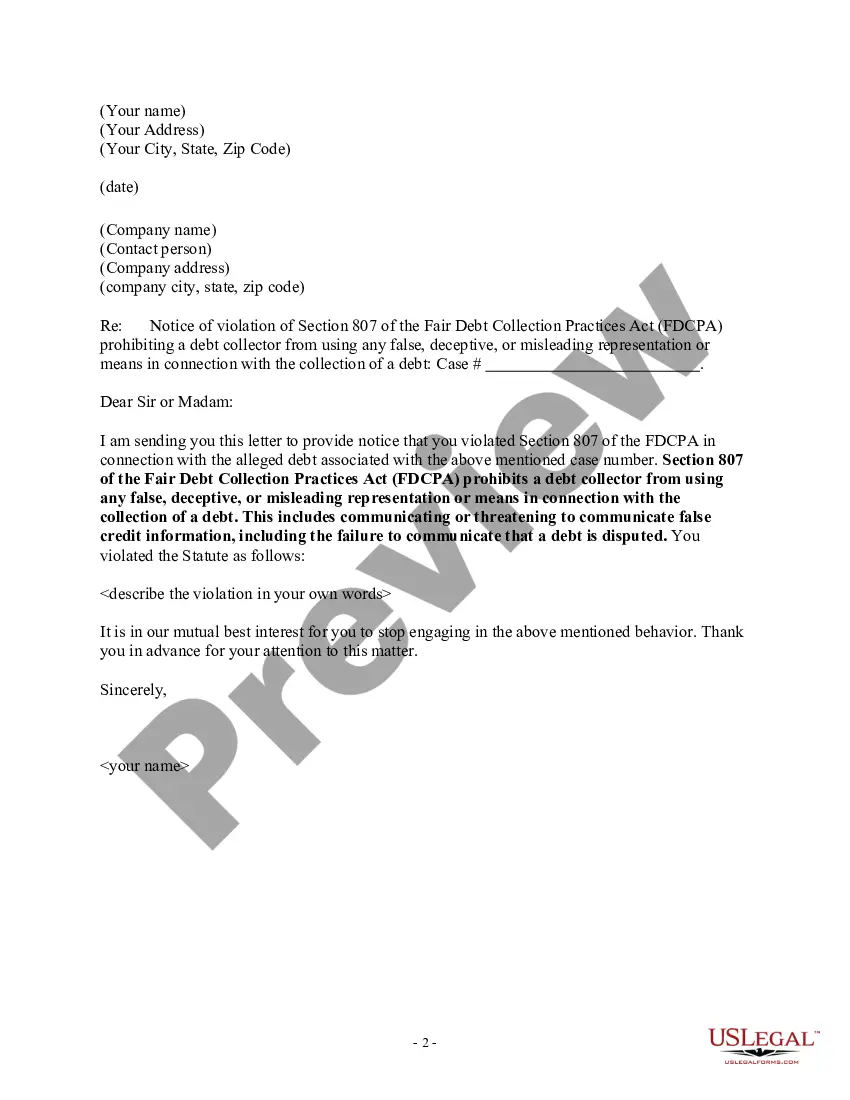

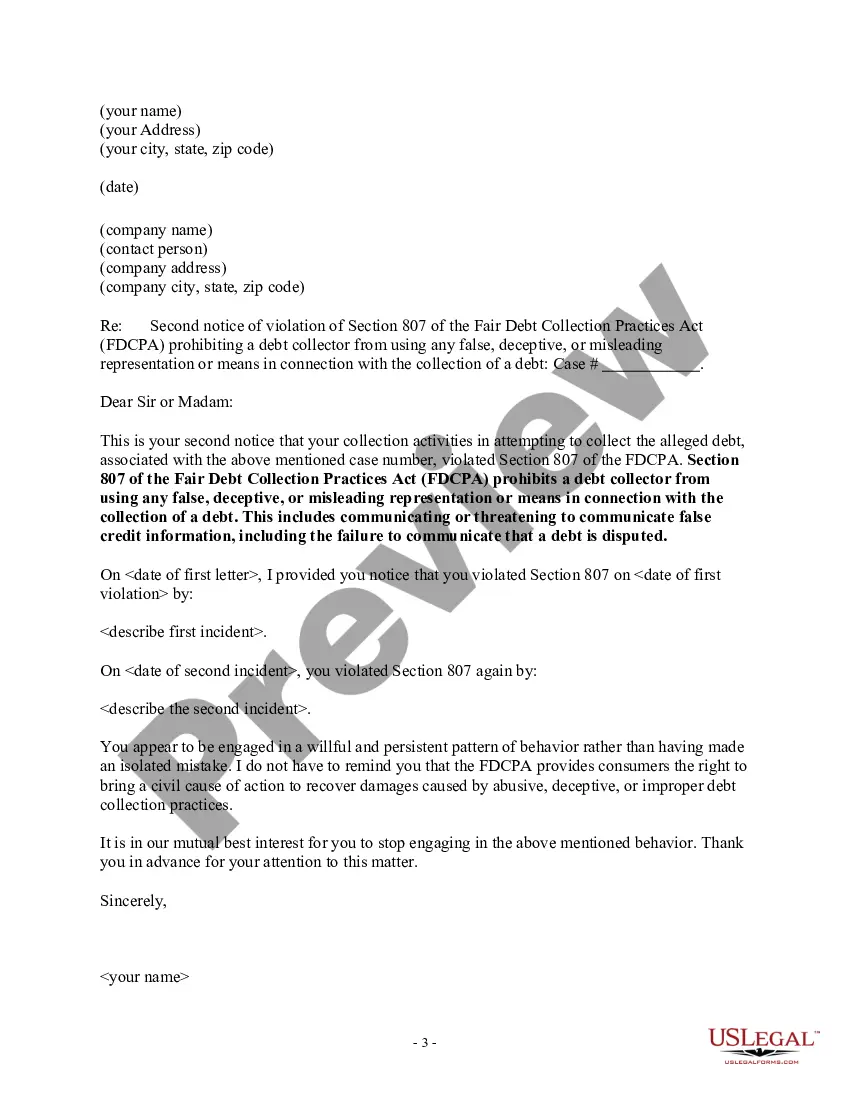

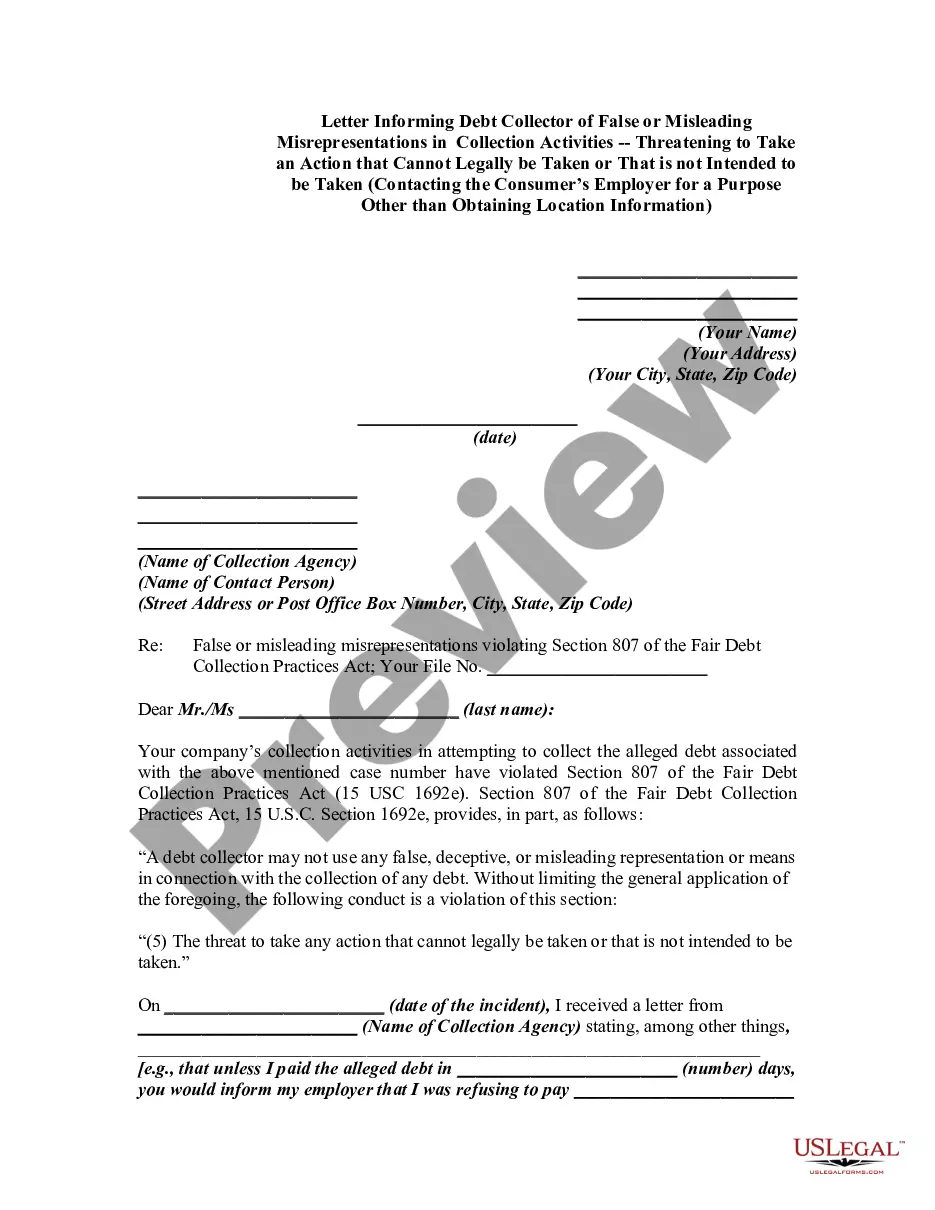

New Jersey Notice of Violation of Fair Debt Act - False Information Disclosed

Description

How to fill out Notice Of Violation Of Fair Debt Act - False Information Disclosed?

You can spend time on the web looking for the legal document format that meets the state and federal requirements you need.

US Legal Forms offers countless legal templates that have been reviewed by experts.

You can easily download or print the New Jersey Notice of Violation of Fair Debt Act - False Information Disclosed from our platform.

To find another version of the template, use the Search area to locate the format that fits your needs and requirements.

- If you have a US Legal Forms account, you can sign in and click the Download button.

- After that, you can complete, modify, print, or sign the New Jersey Notice of Violation of Fair Debt Act - False Information Disclosed.

- Each legal document template you acquire is yours forever.

- To obtain another copy of a purchased template, visit the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for the state/region of your choice.

- Review the template description to confirm you have chosen the right template.

Form popularity

FAQ

You have the right to be treated fairly by debt collectors. The Fair Debt Collection Practices Act (FDCPA) applies to personal, family, and household debts. This includes money you owe for the purchase of a car, for medical care, or for charge accounts.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16-Sept-2020

This becomes very confusing for merchants because New Jersey currently has no licensing law that specifically applies to debt buying or collecting agencies on the books, However, the court decision, clearly states you can't engage in any of debt buying or lending activities as a consumer lender or sales finance company

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

New Jersey consumers, like those in all states, are protected by the Federal Debt Collection Fair Practices Act. The law has restrictions for when and how debt collectors can contact consumers, and also has protections against deception and harassment by creditors.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

The creditor or the debt collector still can sue you to collect the debt. The Fair Debt Collection Practices Act prohibits debt collectors from using abusive, unfair or deceptive practices when attempting to collect a debt.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.