New Jersey Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission

Description

How to fill out Notice Of Violation Of Fair Debt Act - Letter To The Federal Trade Commission?

US Legal Forms - one of the largest repositories of legal documents in the USA - offers a range of legal template documents that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the New Jersey Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission in just minutes.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, choose the payment plan you prefer and provide your credentials to create an account.

- If you already have a subscription, Log In and download New Jersey Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are straightforward instructions to help you get started.

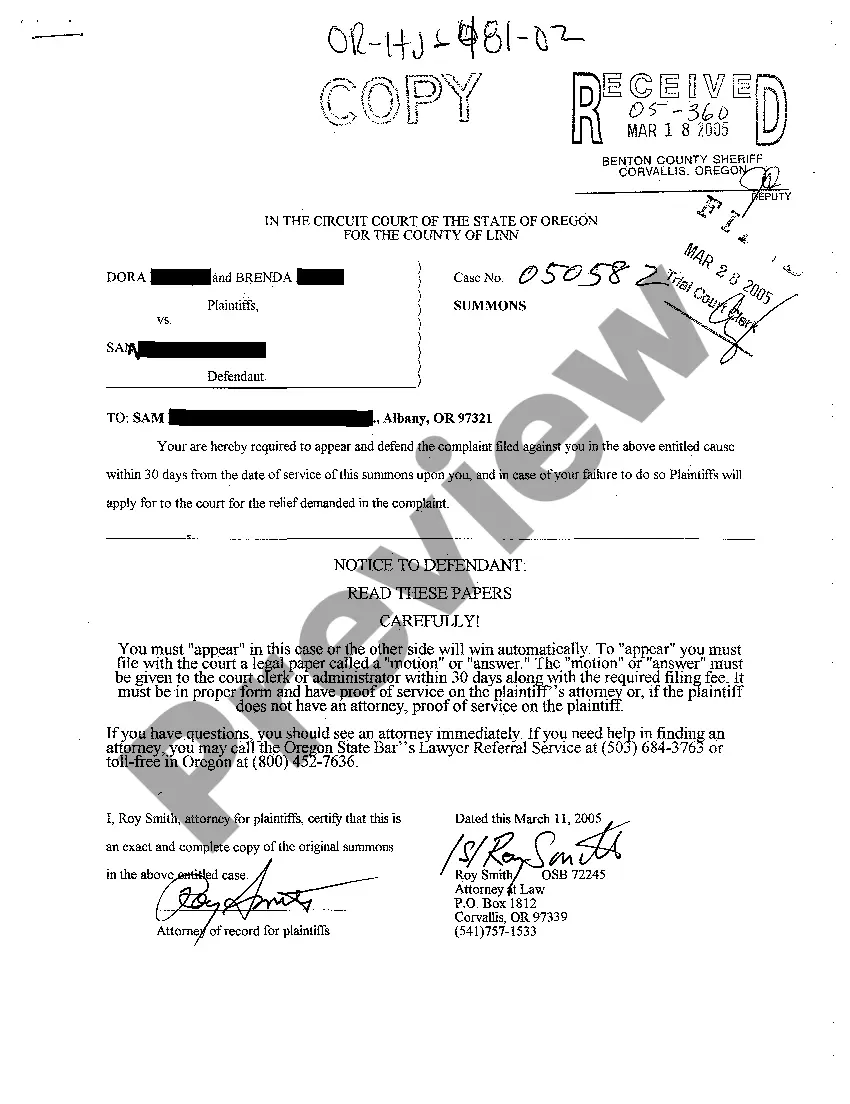

- Ensure you have selected the correct form for the city/state. Click the Review button to evaluate the form's content.

- Read the form description to confirm that you have chosen the appropriate form.

Form popularity

FAQ

Response times from the FTC can vary based on the complexity of the complaint and their workload. Generally, you may expect to hear back regarding the status of your complaint related to the New Jersey Notice of Violation of Fair Debt Act within a few weeks. However, detailed investigations can take longer.

One of the most frequent violations of the Fair Debt Collection Practices Act includes debt collectors failing to provide written verification of a debt after a consumer requests it. This lack of communication directly impacts your rights, especially regarding the New Jersey Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission. These violations can lead you to take necessary actions to protect yourself.

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

This becomes very confusing for merchants because New Jersey currently has no licensing law that specifically applies to debt buying or collecting agencies on the books, However, the court decision, clearly states you can't engage in any of debt buying or lending activities as a consumer lender or sales finance company

The FTC enforces the Fair Debt Collection Practices Act (FDCPA), which prohibits deceptive, unfair, and abusive debt collection practices.

The creditor or the debt collector still can sue you to collect the debt. The Fair Debt Collection Practices Act prohibits debt collectors from using abusive, unfair or deceptive practices when attempting to collect a debt.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

New Jersey consumers, like those in all states, are protected by the Federal Debt Collection Fair Practices Act. The law has restrictions for when and how debt collectors can contact consumers, and also has protections against deception and harassment by creditors.

What Is an FDCPA Validation Letter? The FDCPA is a federal law that protects consumers from abusive collection practices by debt collectors and collection agencies. Whether the FDCPA applies to foreclosures generally depends on if the foreclosure is judicial or nonjudicial.

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.