New Jersey Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard

Description

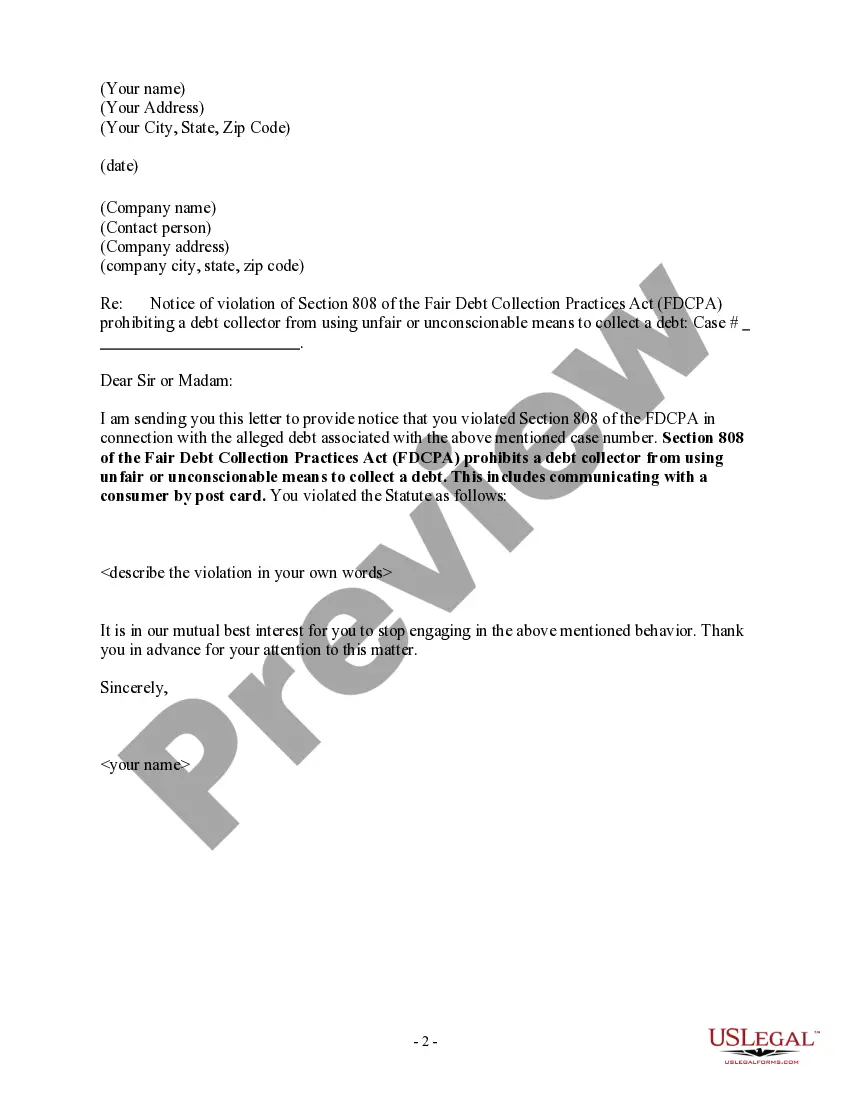

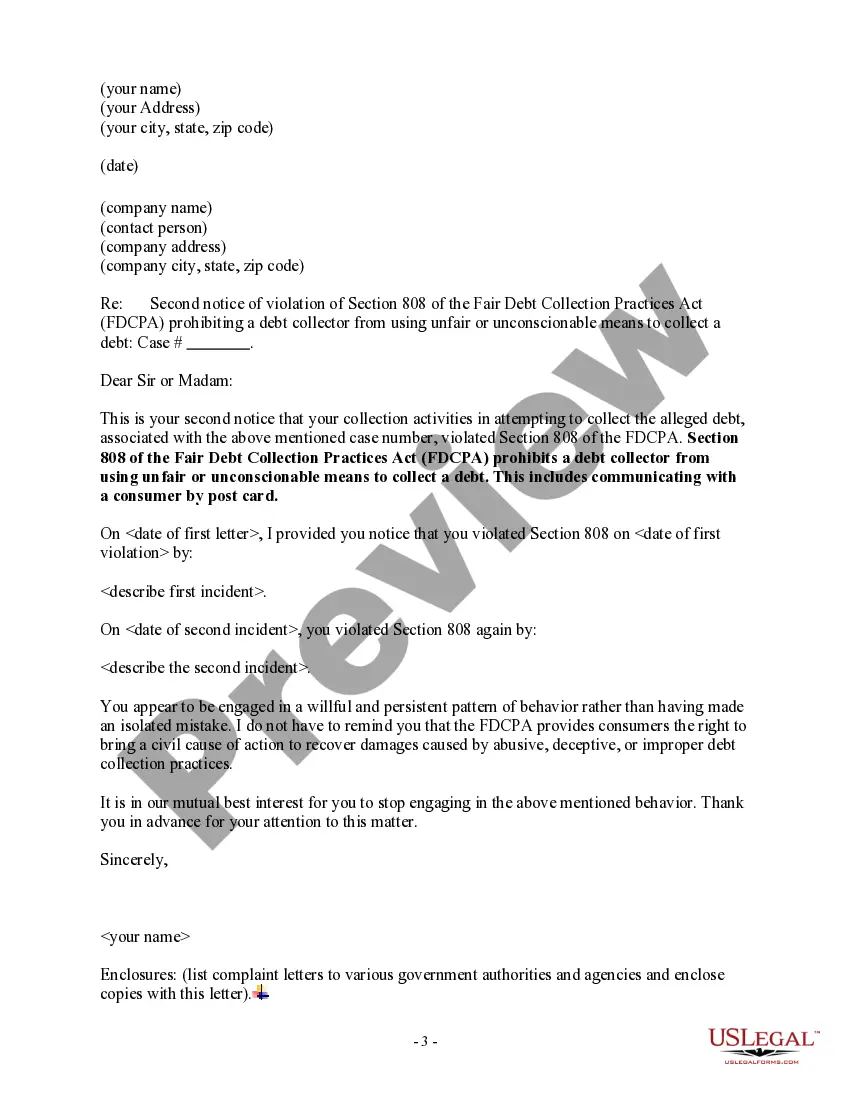

How to fill out Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

Have you ever found yourself in situations where you require documents for both business and personal purposes almost every workday.

There are numerous legal document templates available online, but finding reliable versions isn't straightforward.

US Legal Forms offers thousands of document templates, including the New Jersey Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard, which are designed to comply with state and federal regulations.

Choose the payment plan that suits you, fill in the necessary information to create your account, and complete the transaction using your PayPal or credit card.

Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the New Jersey Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard anytime, if necessary. Just choose the desired document to download or print the template. Make use of US Legal Forms, the largest collection of legal forms, to save valuable time and avoid mistakes. The service provides professionally crafted legal document templates suitable for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the New Jersey Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it is for the correct region/county.

- Utilize the Review option to assess the form.

- Check the description to confirm that you have chosen the correct document.

- If the document doesn't meet your needs, use the Search field to find the form that fits your requirements.

- Once you obtain the correct document, click Purchase now.

Form popularity

FAQ

The phrase 'Cease and desist all communication' can stop debt collectors immediately. By using this statement, you inform collectors that you do not wish to communicate further. This is particularly relevant under the New Jersey Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard. Make sure to send your request in writing for legal security.

In New Jersey, a debt judgment lasts for a period of 20 years. While this extensive timeframe provides a debt collector with opportunities to collect, it can also indicate the need for consumers to be vigilant about their rights. If you feel there has been a violation, like with the New Jersey Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard, seeking assistance through platforms like uslegalforms can be beneficial.

In New Jersey, a debt judgment typically lasts for 20 years, giving creditors this duration to collect on the amount owed. A judgment can create significant pressure, affecting your credit report and finances. It’s essential to be aware of your rights, particularly when facing communication that may violate the New Jersey Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard.

The 7-7-7 rule in collections suggests that creditors should follow a structured approach when attempting to collect debt. Specifically, they should wait seven days before contacting a debtor again, and this should occur for up to seven attempts within the specified period. Understanding these guidelines can help protect you from potential violations of the Fair Debt Collection Practices Act, including those highlighted in the New Jersey Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

One is to report them to the Financial Consumer Protection Department of the BSP (i.e. email consumeraffairs@bsp.gov.ph or call 632-708-7087). Be sure to document all communications with your debt collectors including text messages and e-mails. If you can, record your conversation with their consent.