New Jersey Expense Account Form

Description

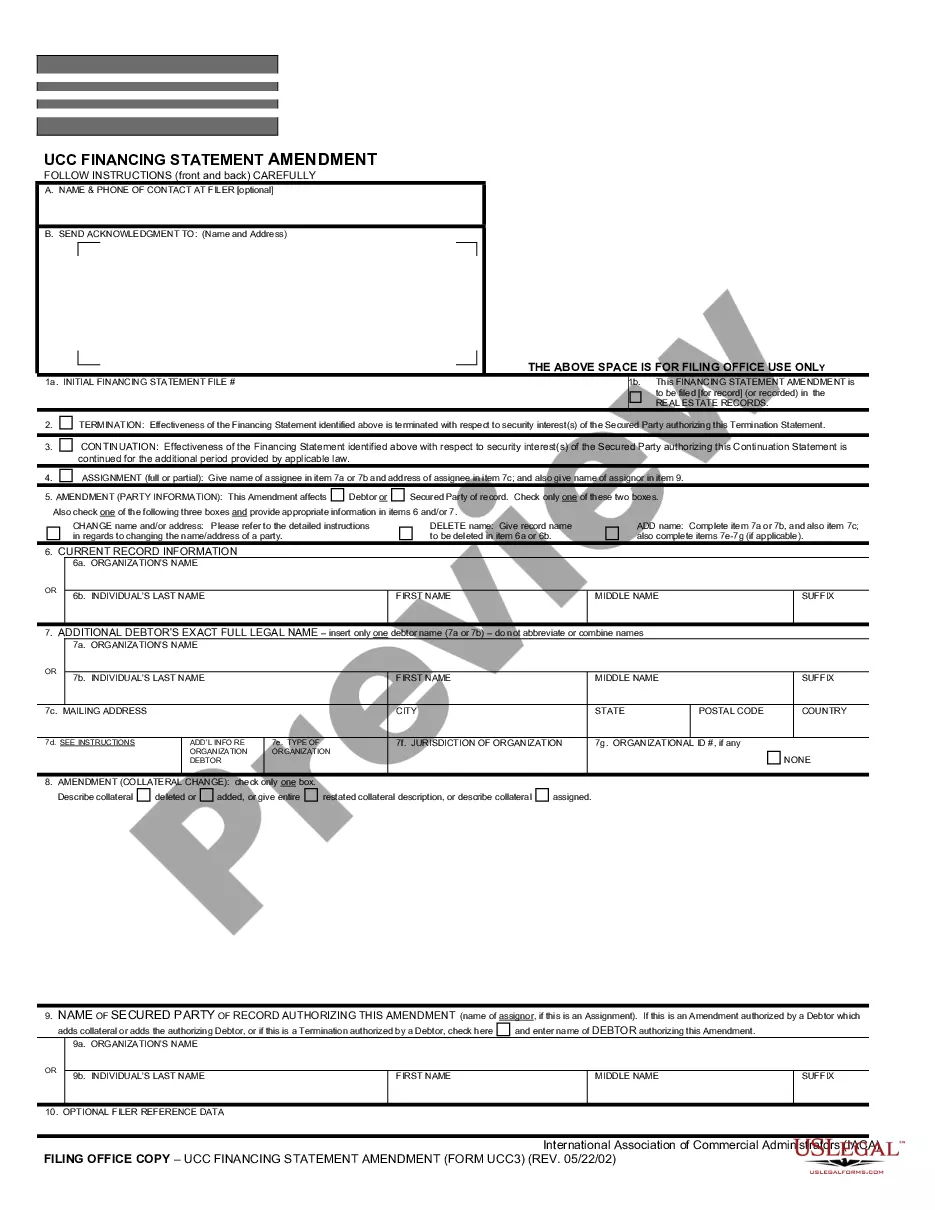

How to fill out Expense Account Form?

You might invest hours online trying to discover the authentic document template that meets the state and national requirements you need.

US Legal Forms offers thousands of authentic templates that are evaluated by experts.

You can easily download or print the New Jersey Expense Account Form from our platform.

If available, take advantage of the Review button to browse through the document template as well. If you wish to find another version of the form, utilize the Lookup field to search for the template that suits your needs and requirements. Once you have found the template you want, click Acquire now to proceed. Select the payment plan you would like, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your Visa, Mastercard, or PayPal account to pay for the authentic form. Choose the format of the document and download it to your device. Make alterations to the document if necessary. You can complete, modify, sign, and print the New Jersey Expense Account Form. Download and print thousands of document templates using the US Legal Forms website, which provides the largest collection of authentic forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Afterward, you can complete, modify, print, or sign the New Jersey Expense Account Form.

- Every authentic document template you acquire is permanently yours.

- To access another copy of any acquired form, head to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your state/city of preference.

- Check the form description to make sure you have selected the proper form.

Form popularity

FAQ

Allowance Value As of publication, New Jersey gives $2.70 per allowance for a daily pay period, which equals $19.20 weekly, $38.40 biweekly, $41.60 semimonthly, $83.30 monthly, $250 quarterly, $500 semiannually and $1,000 annually -- see page 4 of Publication NJ-WT.

How to fill out a W-4 formStep 1: Personal information.Step 2: Account for multiple jobs.Step 3: Claim dependents, including children.Step 4: Refine your withholdings.Step 5: Sign and date your W-4.» MORE: See more about what it means to be tax-exempt and how to qualify.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

NJ instructions indicate the state taxable income is pulled from the W-2 box 16 entry. The state of New Jersey does not have a standard deduction amount. If you enter your itemized federal deductions into the return, amounts that apply to NJ will be pulled to the New Jersey return.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each.

A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. You can also claim your children as dependents if you support them financially and they're not past the age of 19.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each.