New Jersey Expense Reimbursement Form for an Employee

Description

How to fill out Expense Reimbursement Form For An Employee?

If you want to compile, download, or print legitimate document formats, utilize US Legal Forms, the largest assortment of legal templates, accessible online.

Take advantage of the website's straightforward and user-friendly search to locate the documents you need.

Various templates for business and individual purposes are organized by categories and states, or keywords.

All legal document formats you purchase are yours forever. You have access to every form you downloaded in your account.

Be proactive and download, and print the New Jersey Expense Reimbursement Form for an Employee with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to quickly find the New Jersey Expense Reimbursement Form for an Employee.

- If you are a current US Legal Forms user, Log In to your account and click the Download button to get the New Jersey Expense Reimbursement Form for an Employee.

- You can also access forms you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

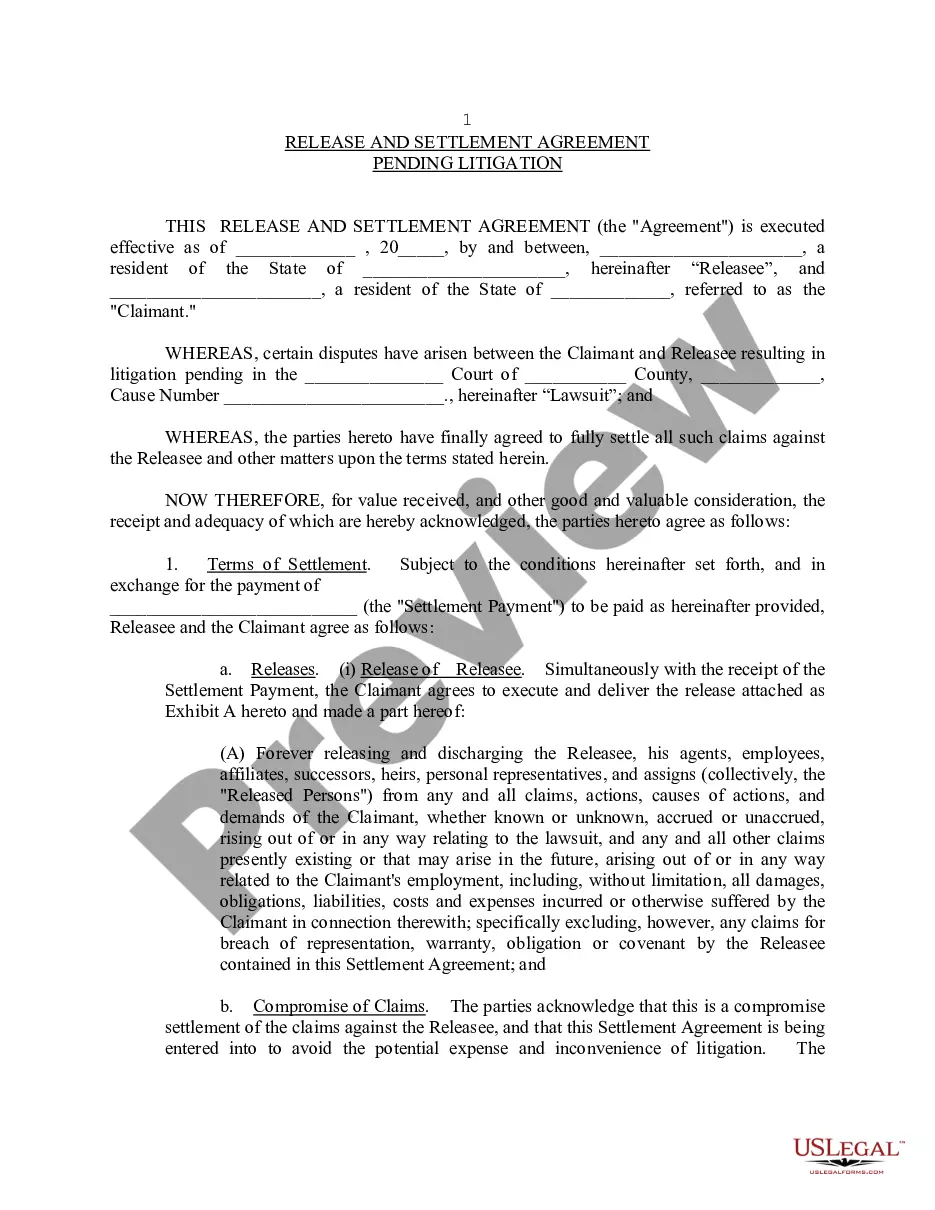

- Step 2. Use the Preview option to review the contents of the form. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other variations of the legal document format.

- Step 4. Once you locate the form you need, click the Get Now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You may use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the New Jersey Expense Reimbursement Form for an Employee.

Form popularity

FAQ

If you have an accountable plan, expense reimbursements shouldn't be processed through payroll. Instead, ask employees to periodically gather documentation of expenses and then issue an expense reimbursement check. These payments should be recorded as company expenses.

bystep guide to employee expense reimbursementForm a policy for the expense reimbursement process.Determine what expenses employees can claim.Create a system for collecting employee expense claims.Verify the legitimacy of expenses.Pay reimbursements within a specified timeframe.

Expenses reimbursed to employees under this type of plan are generally not considered income to the employee for federal income tax purposes and, therefore, are exempt from all employment taxes and withholding for federal and state income taxes, FICA, and Medicare (including the employer payroll taxes).

This deduction excludes from the employee's taxable income provided that the expenses are legitimate business expenses and the reimbursements comply with IRS rules. The best way to reimburse employees for expenses can be accomplished by using either the per diem method or an accountable plan.

How to Write1 The Form Used To Seek Reimbursement Is Available By Download Here.2 Supply Some Standard Information To The Header.3 Itemize Each Expense That Should Be Repaid To The Spender.4 Supply A Summary Report On Reimbursable Expenses.5 Verify These Facts Then Submit For Approval.More items...?

Reimburse without cash advance They make the whole payment to suppliers and reimburse the company. They have to record expenses and cash paid to the employees. The journal entry is debiting expense and credit cash. The transaction will record the expense on income statement and cash paid to the employees.

Can expenses be reimbursed through payroll? While the IRS does allow employers to reimburse employee expenses through payroll, some tax implications can come with doing it this way. For example, if the reimbursement is not made as part of an accountable plan, it will be taxable to the employee as wages.

How to Create an Expense Reimbursement Invoice?The employee's name, address, and contact information.Their company's name, address, and contact information.An invoice number (if necessary).A detailed list of the expenses that they paid with their own money on behalf of the company.The total amount.

An expense reimbursement form is submitted by employees whenever they need to be reimbursed for expenses that they paid for themselves on the company's behalf. Expenses noted on the form may include office supplies, travel, accommodations, etc.

Expenses reimbursed to employees under this type of plan are generally not considered income to the employee for federal income tax purposes and, therefore, are exempt from all employment taxes and withholding for federal and state income taxes, FICA, and Medicare (including the employer payroll taxes).