A profit-sharing plan is a defined-contribution plan established and maintained by an employer to provide for the participation in profits by employees and their beneficiaries. The plan must provide a definite predetermined formula for allocating the contributions made to the plan among the participants and for distributing the funds accumulated under the plan.

Mississippi Profit-Sharing Plan and Trust Agreement

Description

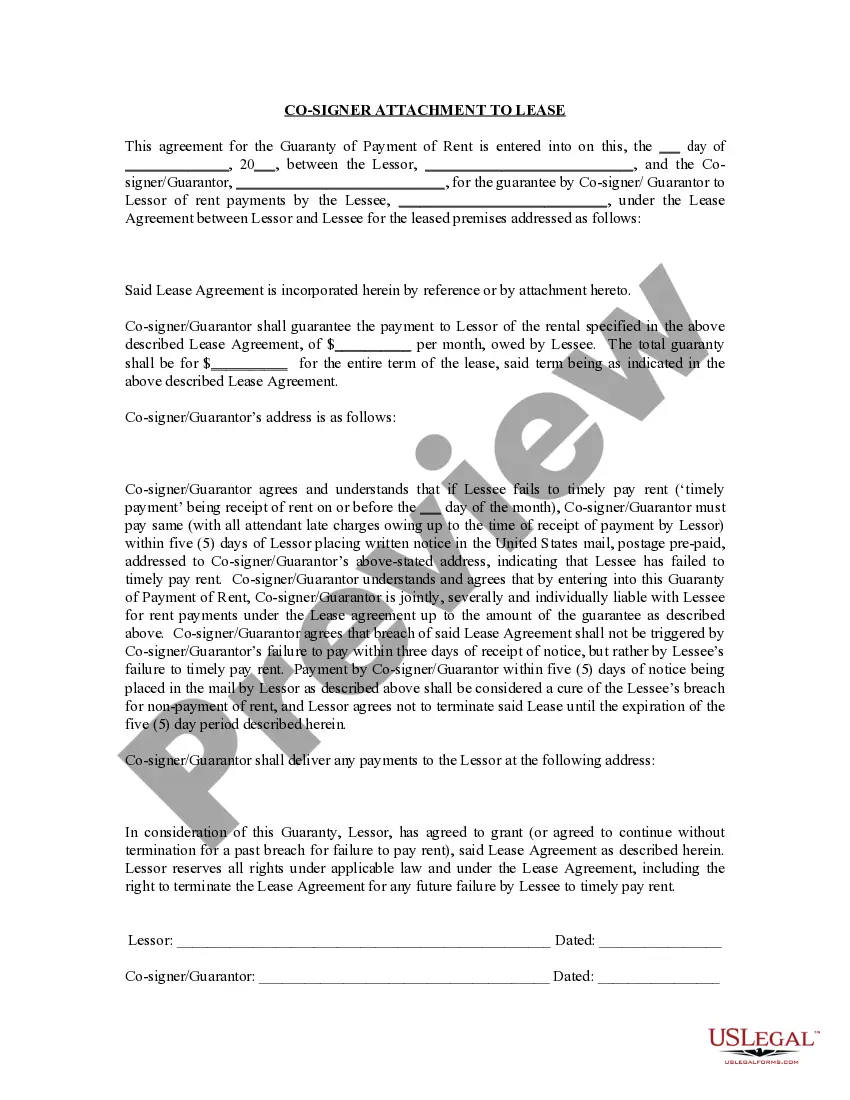

How to fill out Profit-Sharing Plan And Trust Agreement?

You can spend time online seeking the valid document template that meets the state and federal standards you require. US Legal Forms offers a vast selection of legal forms that have been vetted by experts.

You can download or print the Mississippi Profit-Sharing Plan and Trust Agreement from my service.

If you already have a US Legal Forms account, you can Log In and click on the Acquire button. After that, you can complete, edit, print, or sign the Mississippi Profit-Sharing Plan and Trust Agreement. Every legal document template you purchase is yours permanently. To obtain another copy of any purchased form, go to the My documents tab and click on the corresponding button.

Select the document format and download it to your device. You can make changes to your document if needed. You are able to complete, edit, sign, and print the Mississippi Profit-Sharing Plan and Trust Agreement. Download and print a large number of document templates using the US Legal Forms website, which offers the greatest variety of legal forms. Utilize expert and state-specific templates to address your business or personal requirements.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document template for your locality/city of choice. Review the form description to confirm you have chosen the proper form.

- If available, use the Preview button to review the document template as well.

- To find another version of the form, use the Search field to locate the template that meets your needs and criteria.

- Once you have identified the template you want, click Acquire now to proceed.

- Select the pricing plan you desire, enter your credentials, and sign up for an account on US Legal Forms.

- Complete the purchase. You can use your credit card or PayPal account to pay for the legal form.

Form popularity

FAQ

In Mississippi, you must usually work for at least 25 years to qualify for full retirement benefits. Thanks to the Mississippi Profit-Sharing Plan and Trust Agreement, you can build a secure financial future as you accumulate your retirement fund. However, if you meet certain conditions, you might retire earlier with reduced benefits. It's a good idea to explore various retirement strategies to determine what works best for you.

To be vested in a state position in Mississippi, you generally need to work for a minimum of four years. The Mississippi Profit-Sharing Plan and Trust Agreement delineates the terms under which you gain access to retirement benefits, ensuring that your dedication pays off. Taking the time to understand these policies can significantly affect your future. Make sure to consult with your HR department for specific details.

Typically, vesting in a government job in Mississippi takes at least four to five years, depending on the specific job and retirement plan. The Mississippi Profit-Sharing Plan and Trust Agreement offers various scenarios, influencing how your retirement benefits accrue over time. Understanding your employer's policies can help you plan accordingly. Stay informed about these requirements to maximize your retirement savings.

Mississippi state retirement operates through a system that provides benefits based on your years of service and salary history. The Mississippi Profit-Sharing Plan and Trust Agreement plays a crucial role in ensuring you accumulate a reliable retirement fund. Upon retirement, you can receive monthly benefits that reflect your contributions over the years. It's important to familiarize yourself with the retirement options available to you.

In Mississippi, full vesting typically requires you to work a minimum of five years. The Mississippi Profit-Sharing Plan and Trust Agreement outlines specific vesting schedules that help you secure your benefits as you continue your employment. This means you will earn more of your retirement benefits the longer you stay with your employer. Understanding your vesting schedule is essential for making informed career decisions.

In a profit-sharing plan, ownership typically resides with the business that establishes the plan; however, the employees benefit from it based on their contributions and the company's profits. With a Mississippi Profit-Sharing Plan and Trust Agreement, the company designs the terms, but employees receive distributions according to the agreed-upon framework. Therefore, while the business maintains ownership, employees have a vested interest in the plan's success. This shared investment can foster stronger workplace loyalty and commitment.

The downside of deferred compensation primarily includes tax implications and the potential lack of liquidity. When you invest in a Mississippi Profit-Sharing Plan and Trust Agreement, you might not access your funds until a certain age or following specific conditions. This means you could face unexpected taxes when you finally withdraw those funds. Understanding these limitations is essential for making informed decisions about your retirement planning.

One significant disadvantage of a deferred compensation plan is the risk of losing the investment if the employer faces financial difficulties. In the context of a Mississippi Profit-Sharing Plan and Trust Agreement, this means that your intended benefits may become less secure if the company goes bankrupt or faces legal issues. Additionally, deferred compensation can tie up funds that you may need sooner rather than later, limiting your financial flexibility. Weigh these factors carefully when considering such plans.

Structuring a profit-sharing plan involves several key steps. Start by determining how profits will be shared among employees, factoring in performance and tenure. It's vital to create clear eligibility criteria and vesting schedules, which can foster employee retention and satisfaction. For assistance, consider US Legal Forms, which offers templates and guidance for creating a Mississippi Profit-Sharing Plan and Trust Agreement tailored to your business needs.

A common example of a profit-sharing plan is one that rewards employees based on the company's annual profits. For instance, a Mississippi Profit-Sharing Plan and Trust Agreement can allocate a percentage of profits to employee accounts, enhancing motivation and performance. This model not only encourages teamwork but also aligns employees' interests with the success of the company. Platforms like US Legal Forms can help you design such plans effectively.