No definite rule exists for determining whether one is an independent contractor or an employee. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor. Finally, independent contractors are generally free to perform the same type of work for others.

New Jersey Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause

Description

How to fill out Contract With Self-Employed Independent Contractor To Sell Video Surveillance Cameras With Provisions For Termination With Or Without Cause?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a variety of legal form templates that you can obtain or create.

By using the website, you can find numerous forms for business and personal purposes, organized by categories, states, or keywords.

You can quickly access the latest versions of forms such as the New Jersey Agreement with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose your desired pricing plan and provide your information to register for an account.

- If you already hold a monthly subscription, Log In and acquire the New Jersey Agreement with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause from the US Legal Forms collection.

- The Download button will appear on every form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some straightforward steps to help you begin.

- Make sure you have selected the appropriate form for the city/county.

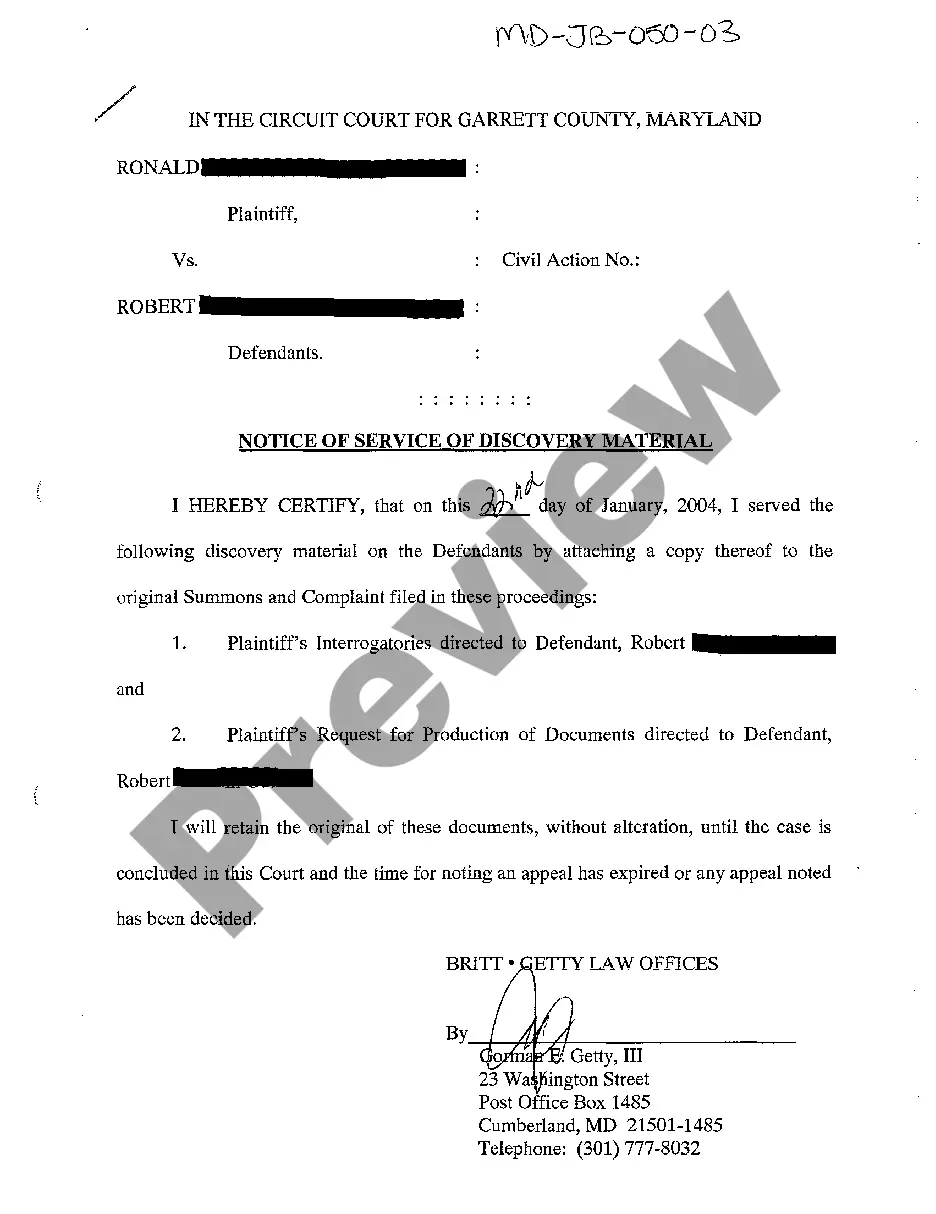

- Click the Preview button to review the form's content.

Form popularity

FAQ

To terminate an independent contractor without a formal contract, you should first check the terms discussed during the engagement. Clear communication is essential; express your decision to end the working relationship verbally and then follow up with written notice for documentation. Remember, the New Jersey Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause can provide guidelines on how to structure this process effectively. If you need a proper framework, consider using the US Legal Forms platform to draft a compliant termination notice.

To minimize self-employment tax, consider setting up an S Corporation or other business structure that offers tax advantages. Additionally, you can maximize your deductions for business expenses. Understanding the tax implications of your work under a New Jersey Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras can also help in planning your tax strategy.

Yes, independent contractors file taxes as self-employed individuals. They report their business income and expenses on their tax returns. It is important to keep organized records to accurately reflect income earned under a New Jersey Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras.

In New Jersey, whether an independent contractor needs a business license depends on the type of work performed. Some professions require specific licenses or permits. Reviewing local regulations and ensuring compliance is vital when entering into a New Jersey Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras.

To write an independent contractor agreement, start by identifying the parties involved and outlining the scope of work. Include payment terms, deadlines, and confidentiality clauses. Incorporating specific provisions for termination with or without cause in your New Jersey Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras will provide additional clarity.

Indeed, independent contractors are classified as self-employed. This status grants them the flexibility to operate their own businesses while working on specific projects for clients. It’s crucial to have a suitable contract, like a New Jersey Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras, to define this relationship clearly.

Yes, if you receive a 1099 form, you are considered self-employed for tax purposes. This form reports the income you earned as an independent contractor. To navigate these responsibilities, ensure your agreements, like the New Jersey Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination, are well-structured.

Independent contractors typically file taxes using Schedule C to report their income and expenses. They should keep meticulous records of all income generated from their services and any allowable deductions. It's essential to consult a tax professional to understand how to manage taxes effectively under a New Jersey Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras.

An independent contractor agreement in New Jersey outlines the terms between a business and a self-employed individual. This document specifies the responsibilities of the contractor, payment details, and provisions for termination with or without cause. By using a solid New Jersey Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras, you can ensure a clear understanding of each party's obligations.

In New Jersey, anyone planning to start a business that requires specific regulatory compliance, like selling certain products or services, may need a business license. This includes contractors who offer specialized services. When drafting a New Jersey Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause, it's wise to consult legal resources, such as uslegalforms, to ensure you understand any licensing requirements.