New Jersey Assignment of Partnership Interest

Description

How to fill out Assignment Of Partnership Interest?

If you wish to summarize, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest repository of legal forms, available online.

Leverage the site’s straightforward and user-friendly search to locate the documents you require.

A range of templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Every legal document template you purchase belongs to you indefinitely.

You can access every form you downloaded through your account. Visit the My documents section and select a template to print or download again.

- Utilize US Legal Forms to find the New Jersey Assignment of Partnership Interest with just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click on the Obtain button to access the New Jersey Assignment of Partnership Interest.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have chosen the form for the correct city/state.

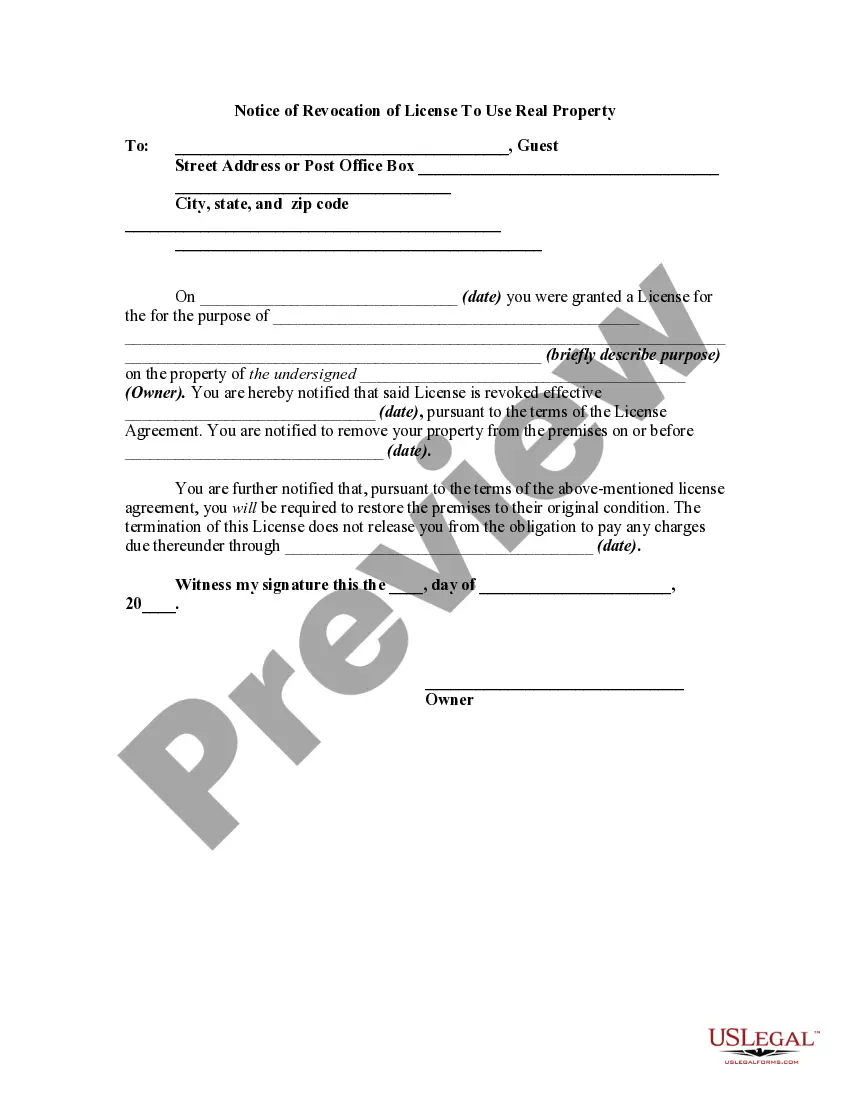

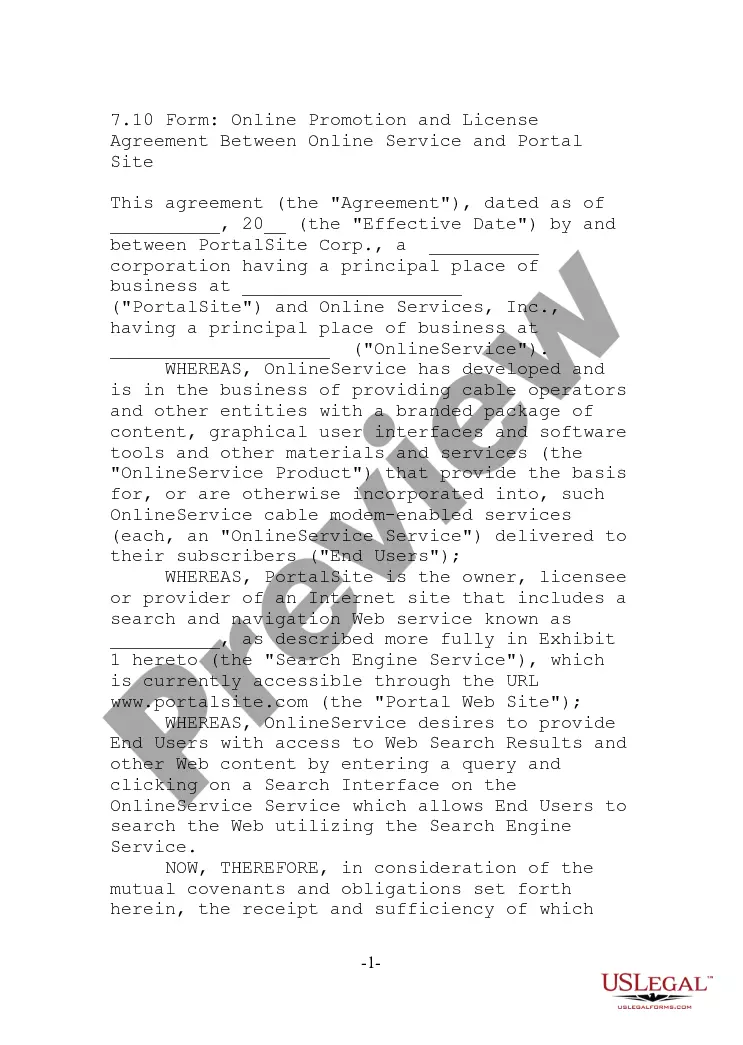

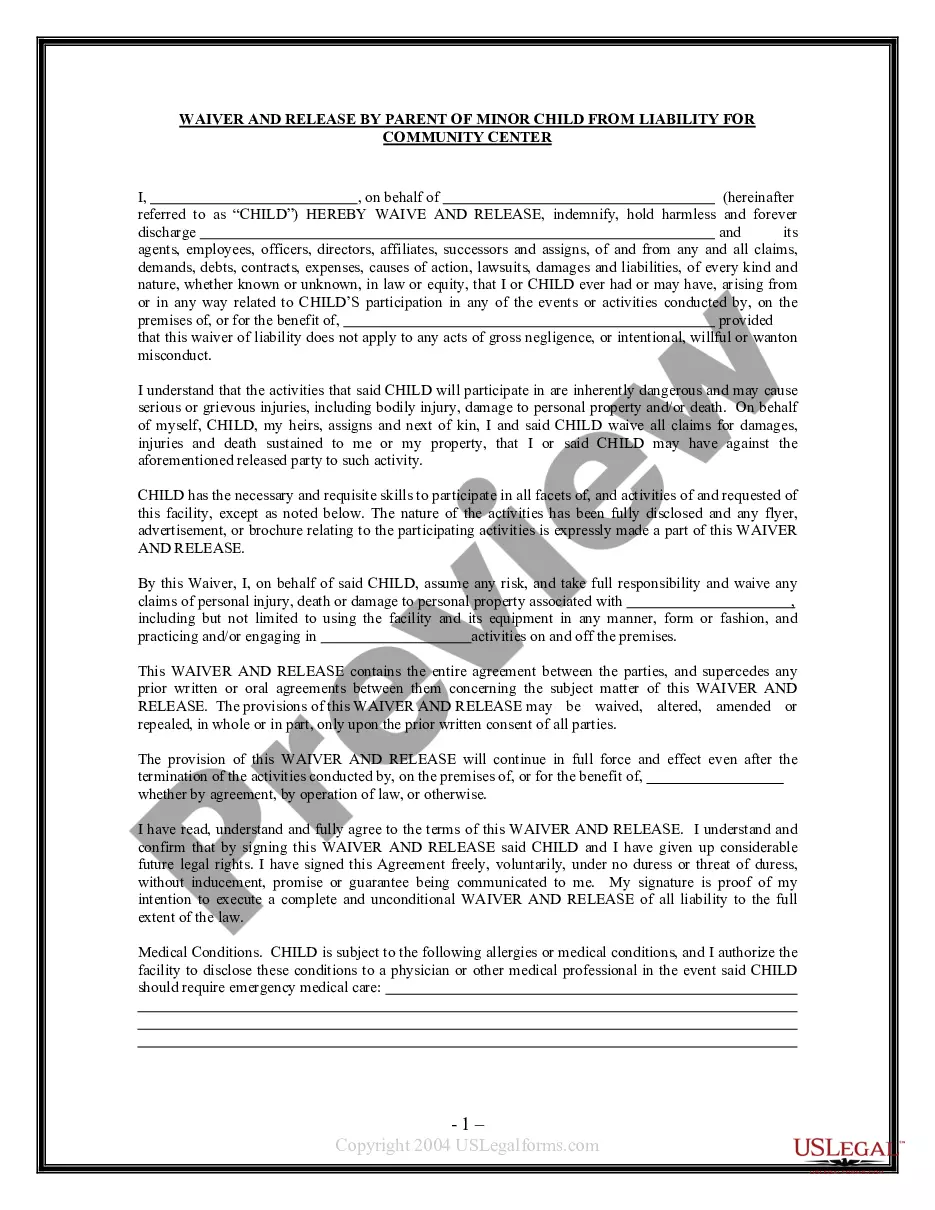

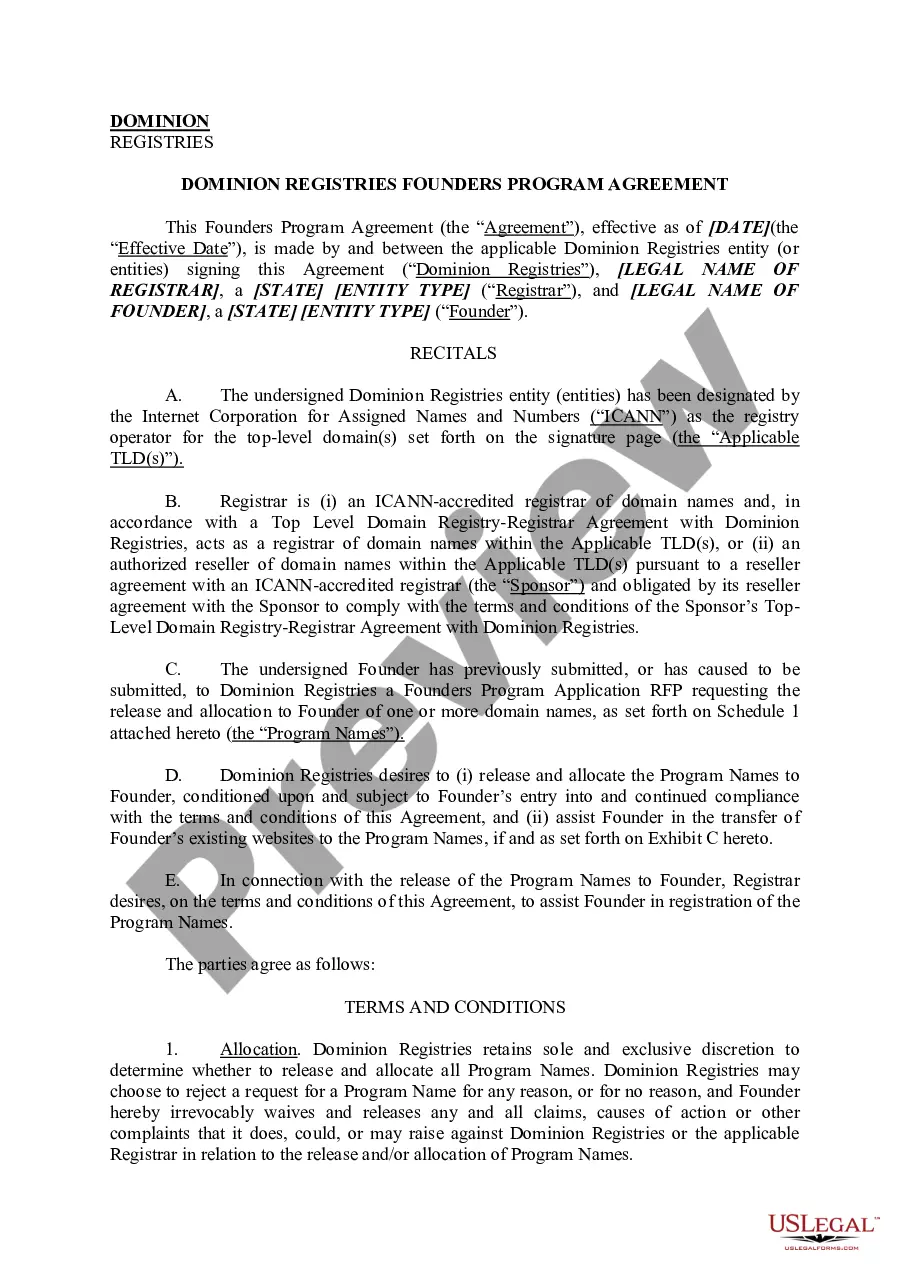

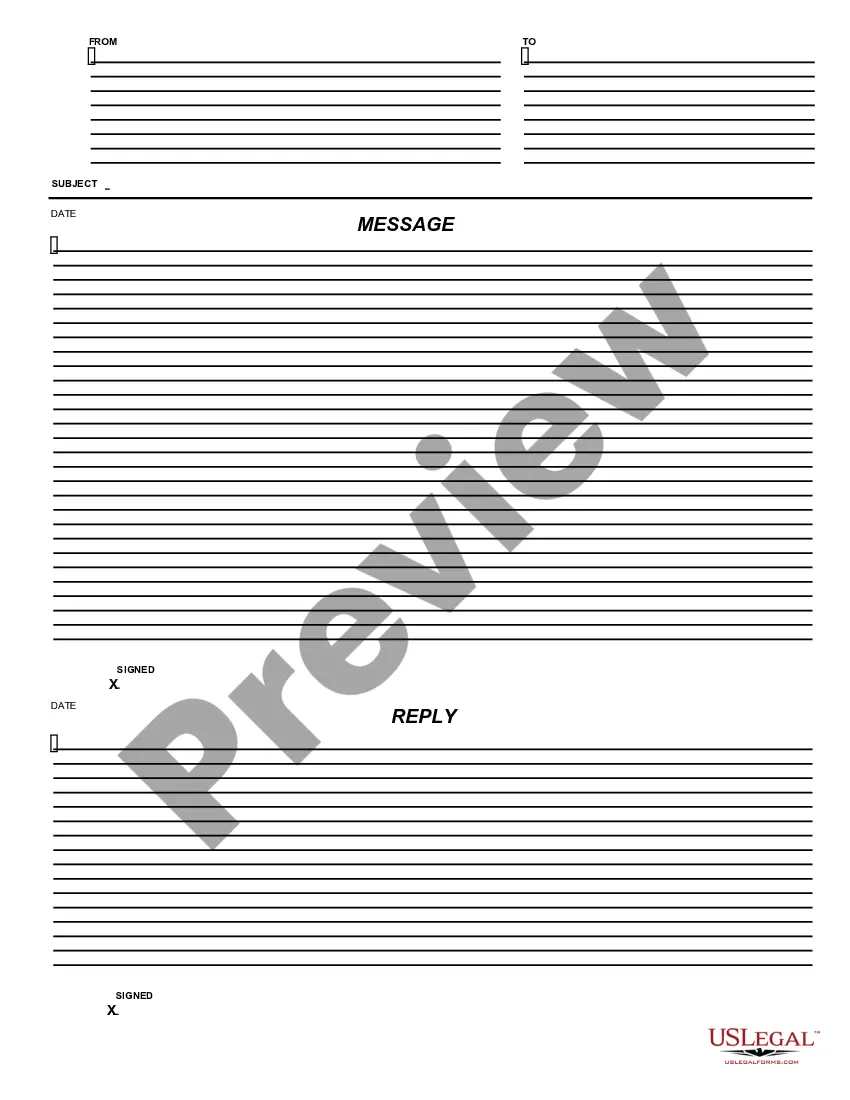

- Step 2. Take advantage of the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other templates in the legal form format.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your credentials to register for the account.

- Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the New Jersey Assignment of Partnership Interest.

Form popularity

FAQ

New Jersey generally follows federal filing status guidelines, yet there are distinctions, particularly in how income and deductions are treated. Understanding these differences, especially for partnerships and the New Jersey Assignment of Partnership Interest, is essential for accurate tax reporting. Staying informed will help you navigate both state and federal tax obligations effectively.

The tax extension form for New Jersey is Form 8801, which you can use to request an extension for filing personal tax returns. For business entities, different forms apply depending on the type of entity involved, especially in cases dealing with the New Jersey Assignment of Partnership Interest. Always verify that you use the appropriate form to avoid any unexpected issues.

Yes, New Jersey accepts Form 7004, which provides an automatic extension of time for certain taxpayers to file their federal returns. This acceptance is beneficial for partnerships as it allows more time to gather necessary financial information. However, ensure you also address New Jersey-specific requirements during this extended filing period.

The Pass-Through Entity (PTE) rate in New Jersey is currently set at 5.5%. This applies to partnerships and some entities that pass income to their owners, affecting how taxes are calculated based on the New Jersey Assignment of Partnership Interest. Understanding this rate is crucial for accurate tax planning and compliance.

Yes, New Jersey imposes a partnership tax that partners must understand to remain compliant. This tax applies to various business entities, including those with a New Jersey Assignment of Partnership Interest. Being aware of your tax obligations can help prevent penalties and streamline your filing process.

New Jersey does accept federal extension Form 7004, which allows partnerships and corporations additional time to file their federal tax returns. However, it's crucial to ensure you also understand the requirements for extending your New Jersey tax filings, as they might differ. Filing Form 7004 does not automatically extend your New Jersey tax obligations related to the New Jersey Assignment of Partnership Interest.

The assignee of a partner's interest is an individual or entity that receives the transferred rights and interests from a partner. In the context of New Jersey Assignment of Partnership Interest, the assignee gains financial benefits without taking on management responsibilities. It’s crucial to document this assignment formally to protect all parties involved.

Yes, you can gift an interest in a partnership, subject to the partnership agreement’s stipulations. A New Jersey Assignment of Partnership Interest allows for such transfers, but all partners must typically be notified. It is wise to consult with legal experts to navigate the gifting process properly.

Assignment in partnership refers to the process of transferring a partner's rights and obligations to another party. Through a New Jersey Assignment of Partnership Interest, the assignee acquires the right to receive profits and losses, but not necessarily management rights. Ensure compliance with your partnership’s rules when executing assignments.

You can transfer partnership interest, but it often requires the consent of other partners. This process may involve a formal New Jersey Assignment of Partnership Interest, ensuring that all legal requirements are met. Always check your partnership agreement for specific guidelines on transferring interest.