New Jersey Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners

Description

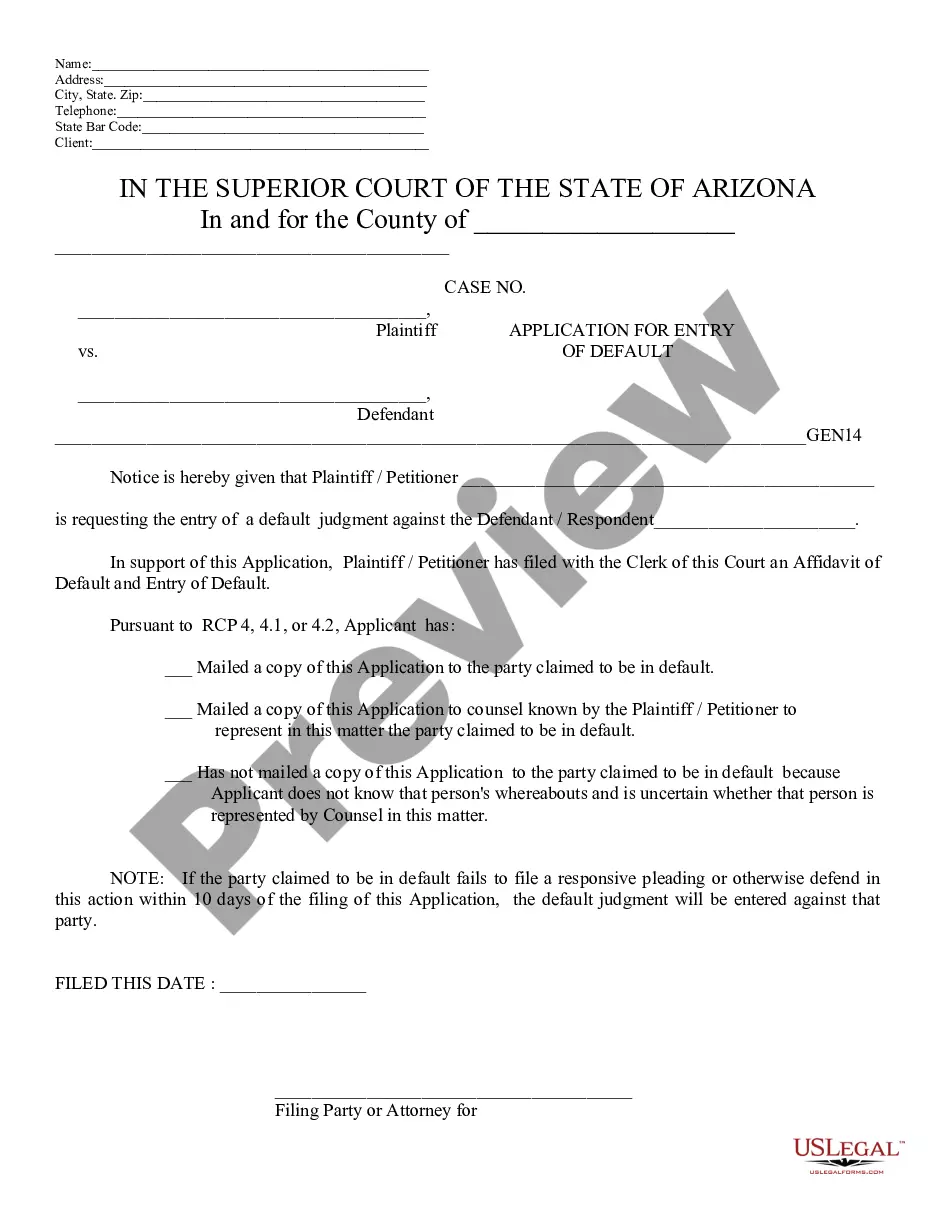

How to fill out Assignment Of Partnership Interest To A Corporation With Consent Of Remaining Partners?

US Legal Forms - one of many largest libraries of legitimate varieties in America - provides an array of legitimate document web templates it is possible to download or print. Using the web site, you can get a huge number of varieties for company and personal reasons, categorized by classes, states, or key phrases.You will find the most recent variations of varieties like the New Jersey Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners in seconds.

If you already have a subscription, log in and download New Jersey Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners through the US Legal Forms collection. The Down load key can look on each develop you look at. You have accessibility to all earlier saved varieties inside the My Forms tab of the accounts.

If you would like use US Legal Forms initially, allow me to share easy recommendations to help you started off:

- Be sure you have chosen the correct develop for your personal city/state. Select the Preview key to check the form`s articles. Look at the develop explanation to ensure that you have chosen the appropriate develop.

- In the event the develop doesn`t suit your needs, utilize the Research industry near the top of the screen to find the one that does.

- If you are satisfied with the form, verify your choice by visiting the Get now key. Then, opt for the pricing prepare you prefer and provide your accreditations to sign up for an accounts.

- Process the deal. Use your credit card or PayPal accounts to accomplish the deal.

- Pick the structure and download the form in your product.

- Make adjustments. Load, change and print and sign the saved New Jersey Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners.

Each and every design you included in your bank account does not have an expiration time and is the one you have eternally. So, in order to download or print one more backup, just proceed to the My Forms area and click about the develop you require.

Obtain access to the New Jersey Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners with US Legal Forms, probably the most comprehensive collection of legitimate document web templates. Use a huge number of expert and express-distinct web templates that satisfy your business or personal needs and needs.

Form popularity

FAQ

Transferring Interest ing to state laws, partnership interests are free to transfer, so the only way a partner might run into difficulties is if there are restrictions in the partnership agreement.

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

An Assignment of Partnership Interest occurs when a partner sells their stake in a partnership to a third party. The assignment document records the details of the transfer to the new partner.

A partner's interest in a limited partnership is not freely transferable. An assignee of a general or limited partnership interest is not necessarily a partner, but is entitled only to the assigning partner's share of capital and profits, absent a contrary agreement.

Transfer of limited partnership interest is allowed as long as the general partner consents to the arrangement and it is done in concert with the established partnership agreement. A common example of a limited partnership is the family limited partnership, which is often created to administer a family business.

California law allows an individual to sell his or her interest in a partnership without your consent. However, it may be possible to override state law by creating a custom partnership agreement. Let's take a look at what might happen if your partner decides that he or she doesn't want to work with you anymore.

General partners should remember that one partner may be able to commit the business to a contract without the other partners' agreement or even knowledge. Because of this, your partnership agreement should address this issue and document how decisions will be made BEFORE going into business with a partner.