New Jersey Co-Executor Reserving Right To Qualify for Ocean County

Description

How to fill out New Jersey Co-Executor Reserving Right To Qualify For Ocean County?

US Legal Forms is actually a unique system to find any legal or tax document for filling out, including New Jersey Co-Executor Reserving Right To Qualify for Ocean County. If you’re tired of wasting time looking for perfect samples and paying money on papers preparation/lawyer charges, then US Legal Forms is precisely what you’re looking for.

To reap all the service’s benefits, you don't need to download any software but simply pick a subscription plan and sign up your account. If you have one, just log in and get an appropriate sample, save it, and fill it out. Saved documents are stored in the My Forms folder.

If you don't have a subscription but need New Jersey Co-Executor Reserving Right To Qualify for Ocean County, check out the recommendations listed below:

- make sure that the form you’re considering applies in the state you need it in.

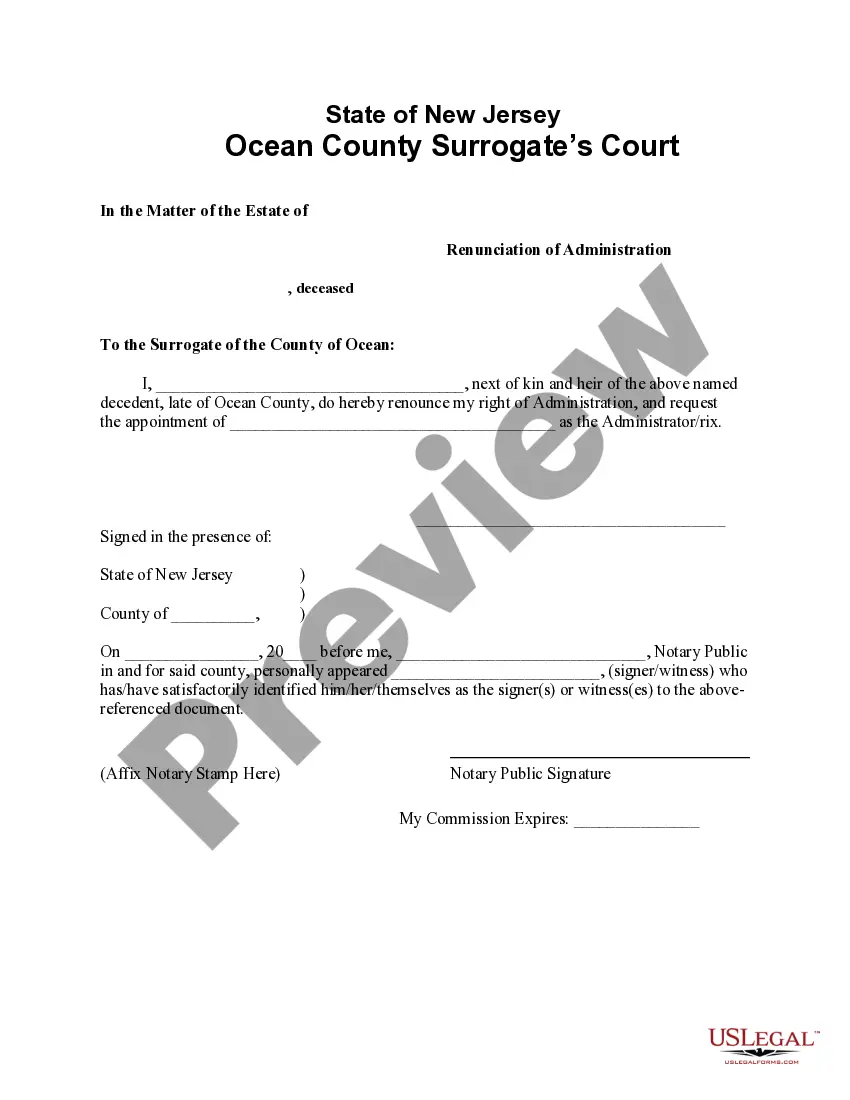

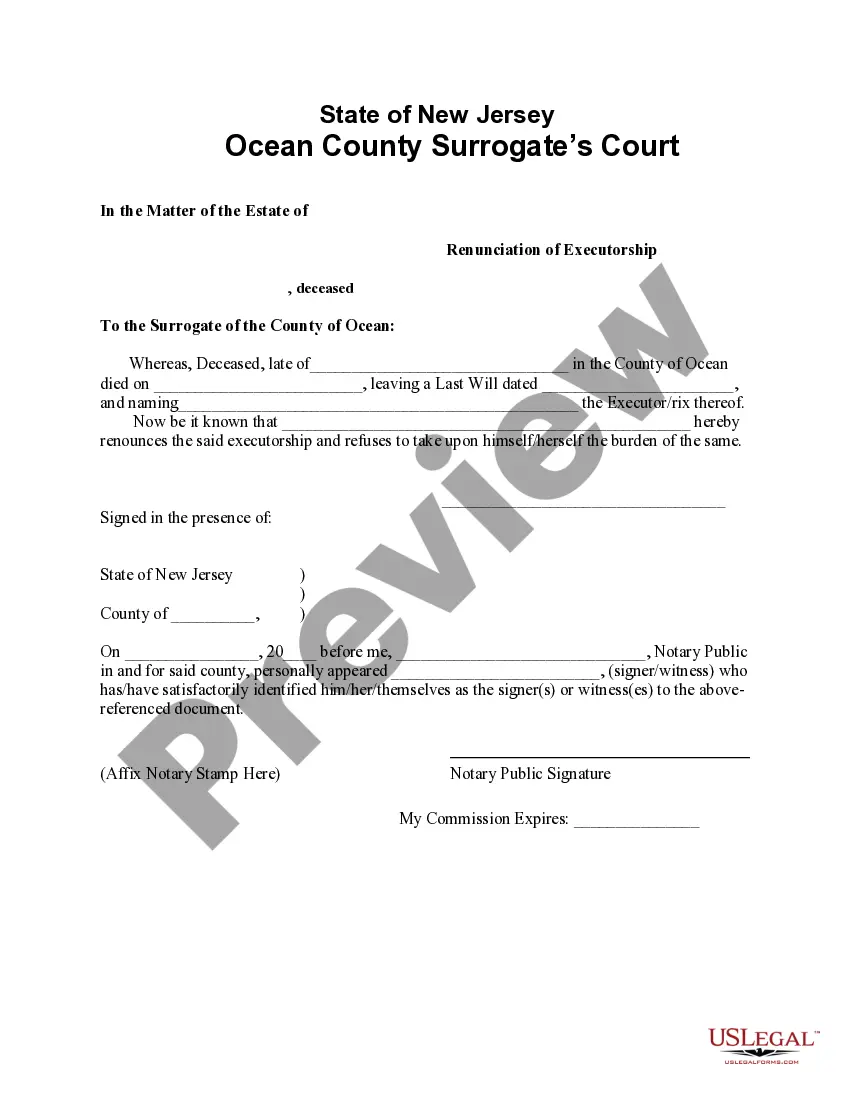

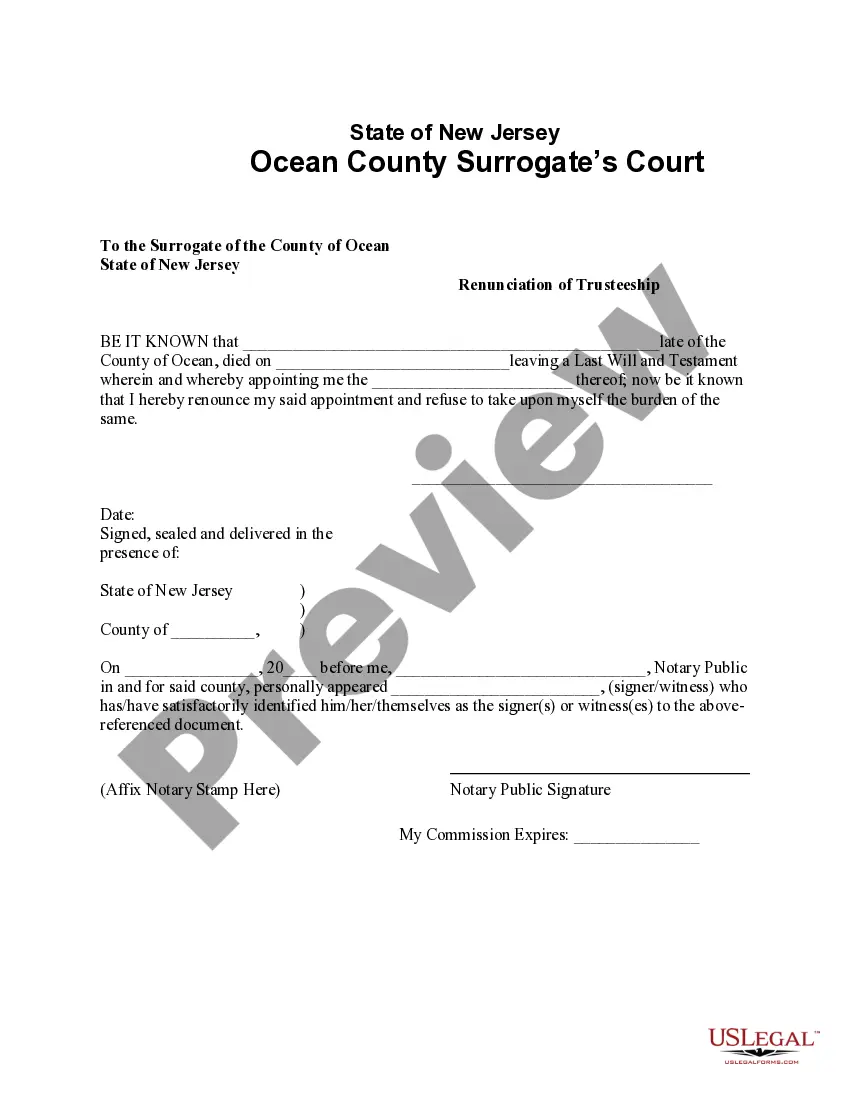

- Preview the example and read its description.

- Simply click Buy Now to access the sign up page.

- Choose a pricing plan and keep on registering by providing some info.

- Decide on a payment method to finish the registration.

- Download the file by selecting the preferred file format (.docx or .pdf)

Now, fill out the document online or print out it. If you are uncertain concerning your New Jersey Co-Executor Reserving Right To Qualify for Ocean County sample, speak to a attorney to check it before you decide to send out or file it. Start without hassles!

Form popularity

FAQ

The Probate process is required by the state of NJ whenever someone dies. It is the government's way of making sure the assets of the deceased pass properly to their decedents. And of course to insure that any taxes or lien's owed to the state or other parties are fully paid.

An Executor must wait at least ten (10) days from the death of the decedent to probate a Will. Probate must occur before the Surrogate in the County of the decedent's residence at the time of death.

The value of all of the assets left by the deceased person doesn't exceed $20,000, and the surviving spouse or domestic partner is entitled to all of it without probate (NJ Rev Stat § 3B:10-3), or. there is no surviving spouse or domestic partner and the value of all of the assets doesn't exceed $20,000.

A Short Certificate is a legal document that shows the decedent's name and date of death. It will also show the name of the Executor/Executrix who has been named to handle the affairs of the estate. A Short Certificate can be obtained at the Register of Wills office in the county court house.

A will may not be filed for probate until ten days have elapsed since the death of the deceased person. N.J.S.A.The Court Rules only require that notice of probate be mailed to beneficiaries and next of kin within 60 days after the date of the probate of a will.

An estate can be closed in one of four fashions: (1) the funds can simply be distributed directly by the Executor or Administrator to estate beneficiaries; (2) the funds can be distributed to heir(s) after each signs a Release and Refunding Bond waiving his or her right to a formal accounting; (3) distribution can be

An executor is entitled to receive 6% of all income received. (N.J.S.A. 3B:18-13) For example, if an estate receives $50,000 income from stocks and bonds held in a brokerage account. The executor would be entitled to $3,000.