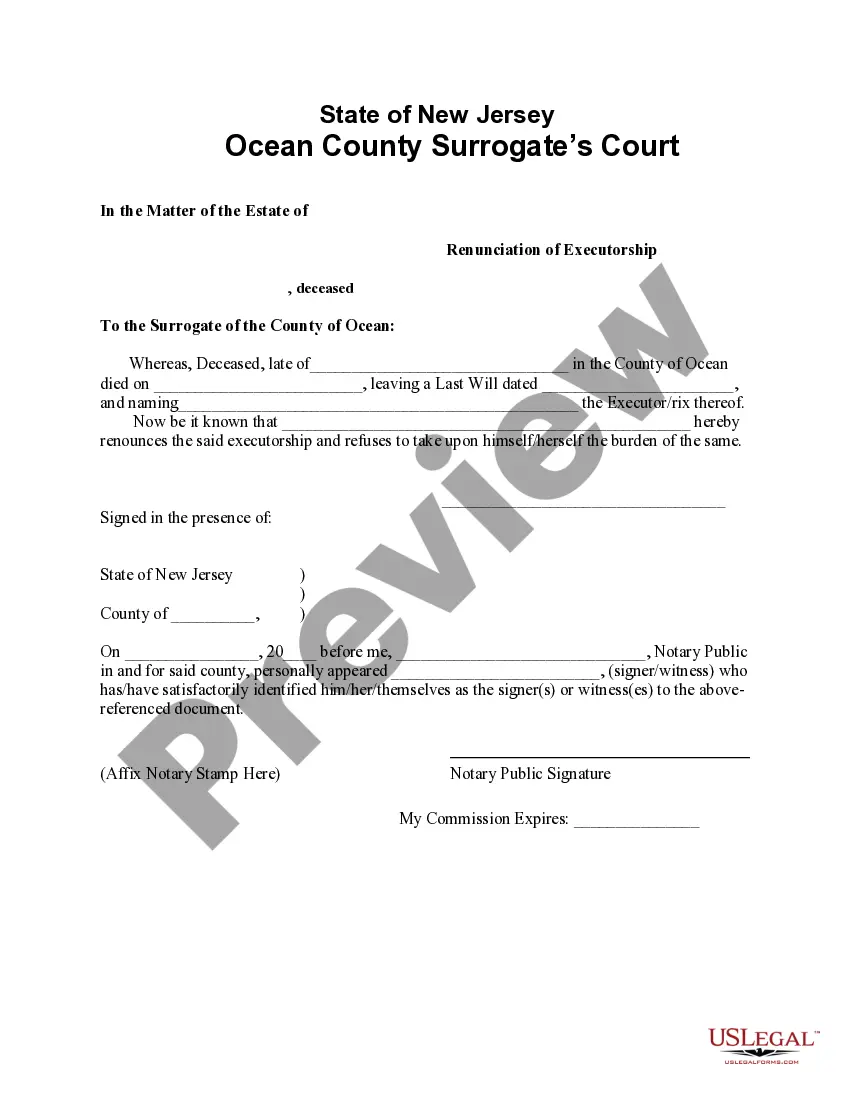

New Jersey Renunciation of Executor ship is a legal document in which an individual appointed to serve as the executor of an estate renounces the right to serve in that capacity. This document is commonly referred to as a “renunciatioexecutoroshipsip.” By signing this document, the individual is relinquishing the duty to serve as executor of the estate. There are two types of New Jersey Renunciation of Executor ship: Voluntary and Involuntary. A voluntary renunciation is signed by the appointed executor, and it voluntarily relinquishes the executor’s right to serve. An involuntary renunciation is signed by the court, and it is the result of the court’s decision to remove the executor from his or her position. The document must be signed by the appointed executor, dated, and notarized, and then filed with the Surrogate of the county in which the will was executed. Once filed, the document is considered binding and the executor’s duties will no longer be valid.

New Jersey Renunciation of Executorship

Description

How to fill out New Jersey Renunciation Of Executorship?

Coping with official documentation requires attention, accuracy, and using properly-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your New Jersey Renunciation of Executorship template from our library, you can be certain it meets federal and state regulations.

Working with our service is straightforward and fast. To get the necessary document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to obtain your New Jersey Renunciation of Executorship within minutes:

- Remember to attentively check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the New Jersey Renunciation of Executorship in the format you need. If it’s your first experience with our website, click Buy now to continue.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the New Jersey Renunciation of Executorship you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

Each creditor has nine months from the decedent's passing to claim the estate. After nine months, and if there are no unpaid or pending claims, the executor can distribute the assets and issue a declaration of discharge.

The total fee for an Executor in New Jersey is comprised of two sources: corpus commissions and income commissions. Corpus includes all the assets received by the executor upon the death of the decedent. The executor is entitled to charge a percentage-based fee scaled to the size of the estate.

If the named Executor wishes to renounce, we would prepare the paperwork and give the renunciation of an executor or administrator to the attorney or the representative to be mailed out along with the certification of authentication for a notary to be filled out, signed & returned to us.

Just because you are nominated as executor of a Will does not mean that you must serve. You can renounce your rights as executor and decline to act by simply signing and having notarized a Renunciation of Nominated Executor form and filing it with the Surrogate's Court in the county in which your aunt resided.

Each creditor has nine months from the decedent's passing to claim the estate. After nine months, and if there are no unpaid or pending claims, the executor can distribute the assets and issue a declaration of discharge.

To finalize the estate and to be discharged from his/her responsibilities, the Executor must obtain a Court Order of Discharge. To accomplish this, the Executor or Administrator must file an Order to Show Cause and Verified Complaint with an attached formal accounting.

A Deed of Renunciation is a legal document that you sign when you don't want to or are unable to act as the Administrator of an Estate. If you've been named as an Executor in a Will and you don't think you can do what's required, you may need a Deed of Renunciation to remove you from your duties.