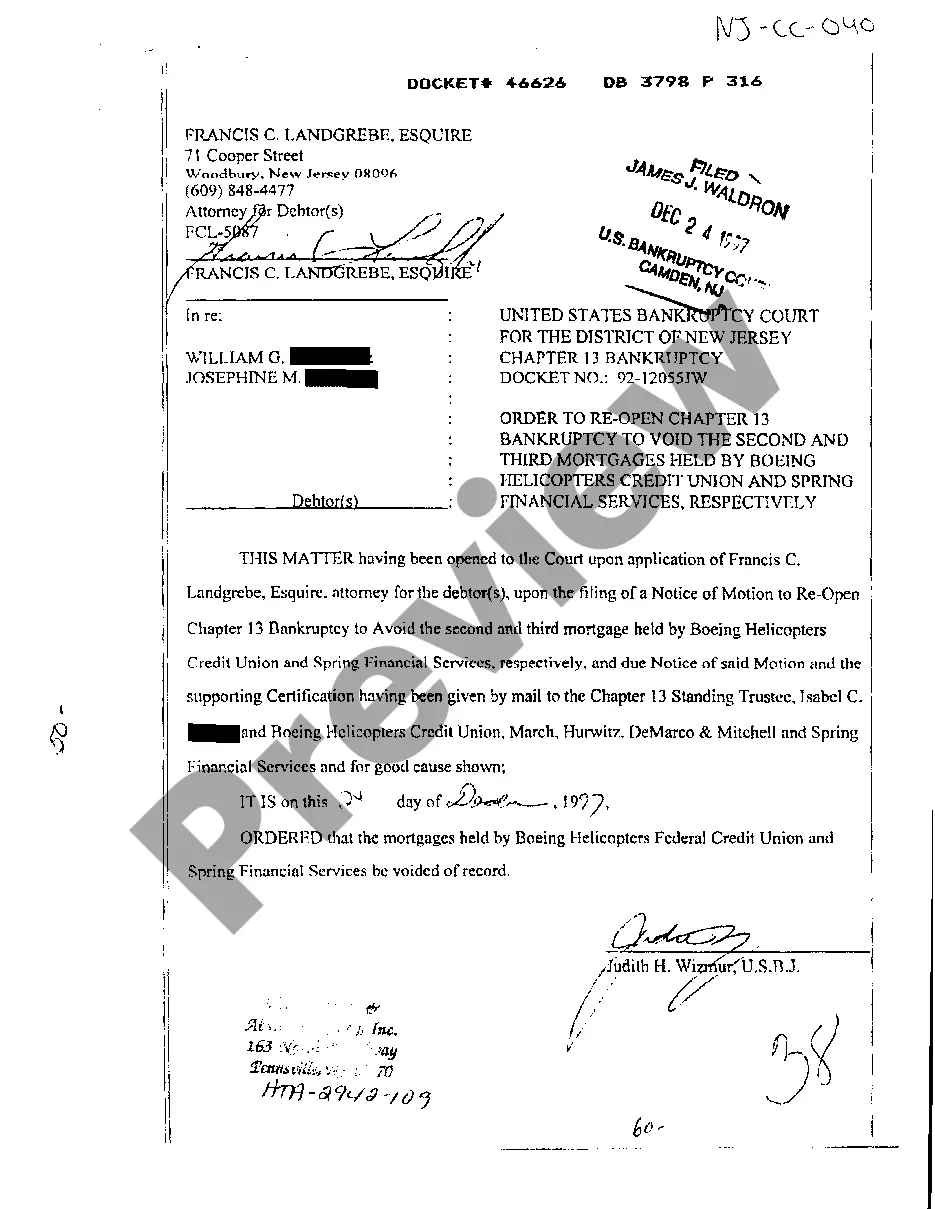

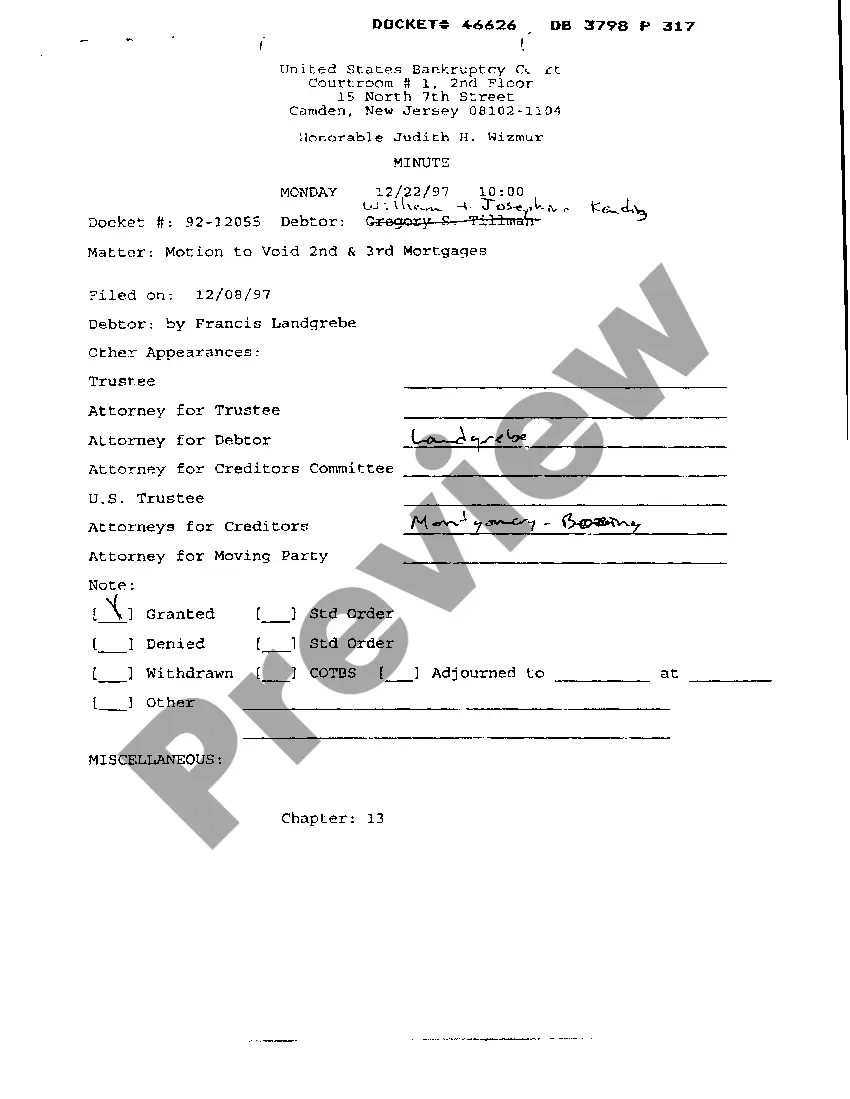

New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

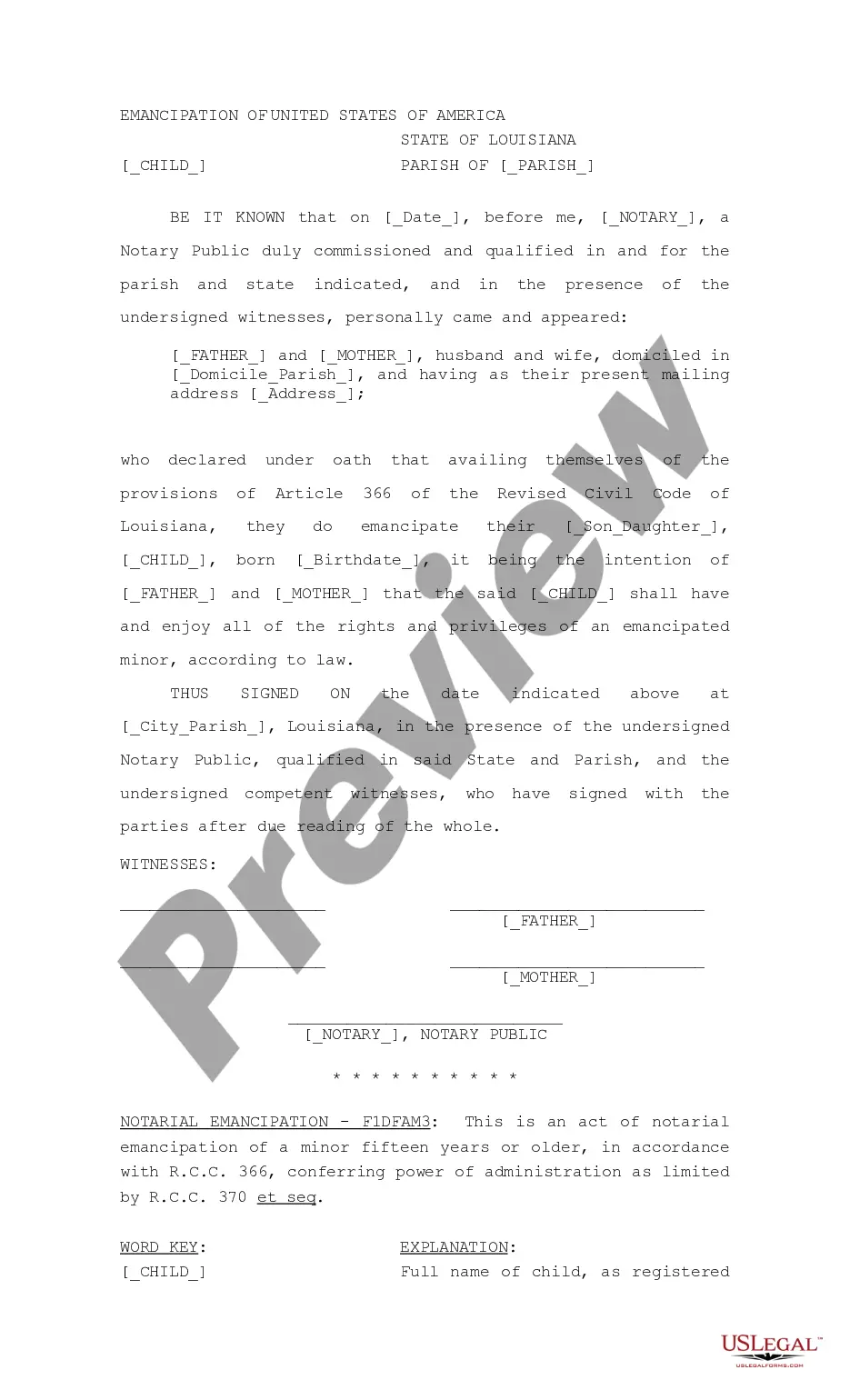

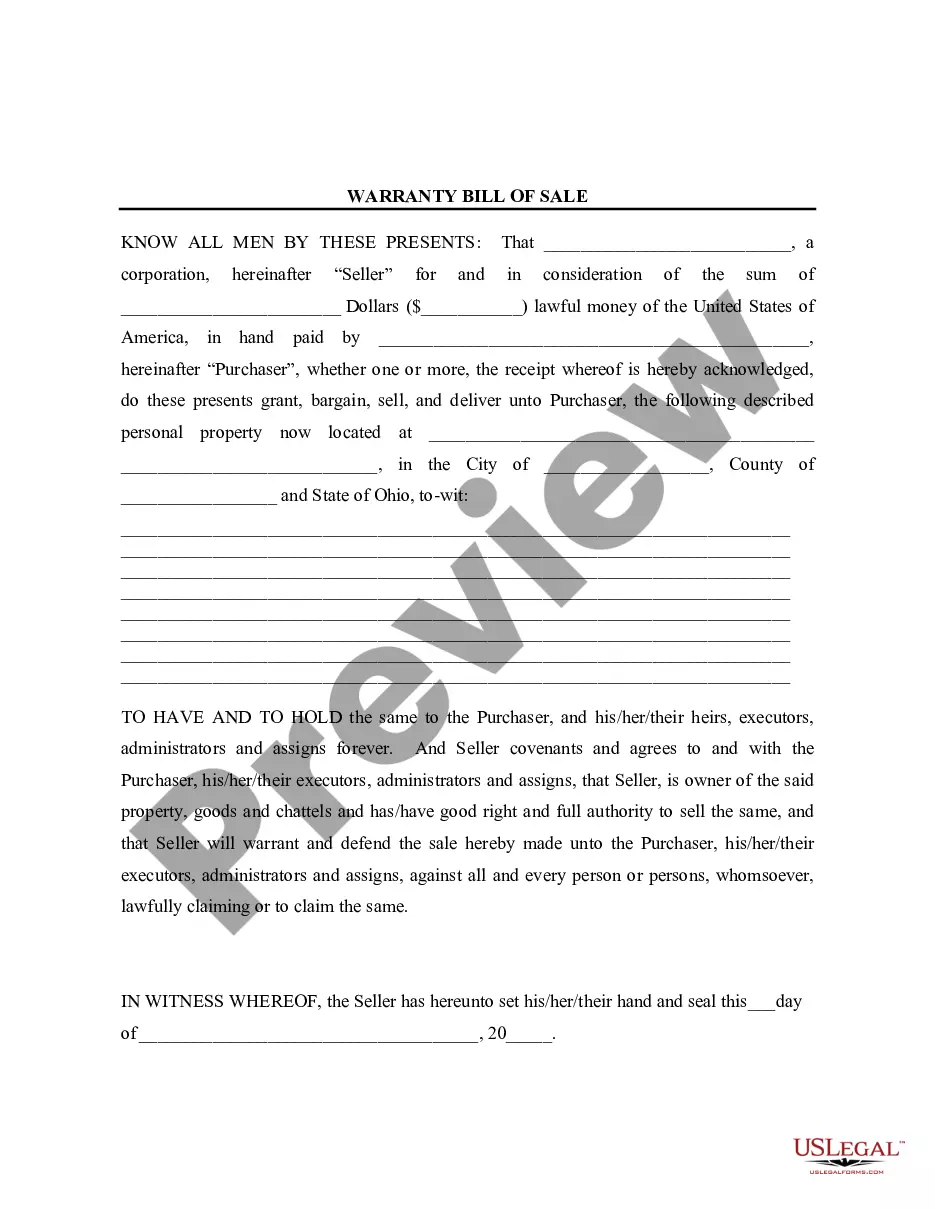

Looking for another form?

How to fill out New Jersey Order To Reopen Chapter 13 To Avoid Second And Third Mortgages?

US Legal Forms is actually a special platform where you can find any legal or tax document for filling out, including New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages. If you’re tired with wasting time searching for suitable examples and paying money on document preparation/attorney fees, then US Legal Forms is exactly what you’re looking for.

To experience all the service’s benefits, you don't need to download any application but simply pick a subscription plan and create an account. If you have one, just log in and look for an appropriate sample, save it, and fill it out. Downloaded files are stored in the My Forms folder.

If you don't have a subscription but need to have New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages, check out the recommendations below:

- Double-check that the form you’re checking out applies in the state you need it in.

- Preview the form and look at its description.

- Click Buy Now to reach the register webpage.

- Pick a pricing plan and keep on registering by entering some info.

- Select a payment method to finish the registration.

- Save the file by choosing the preferred file format (.docx or .pdf)

Now, fill out the file online or print it. If you are unsure about your New Jersey Order to Reopen Chapter 13 to avoid Second and Third Mortgages form, contact a lawyer to analyze it before you send out or file it. Get started without hassles!

Form popularity

FAQ

In a traditional Chapter 13 plan, your mortgage payment isn't included in your repayment plan.If you miss even one mortgage payment, the lender has the right to ask the bankruptcy court to lift the automatic stay to pave the way for a foreclosure proceeding.

Chapter 13 comes with a right to dismiss. This means that at any point of your case you can get out of the case and out of the bankruptcy system altogether.So knowing that you have this right to dismiss can make Chapter 13 a more attractive choice when you are trying to decide what type of bankruptcy to file.

"Lien stripping" in Chapter 13 bankruptcy allows certain homeowners to get rid of a second mortgage or home equity line of credit.If your house has gone down in value since you bought it, a Chapter 13 bankruptcy may help you to get rid of your second mortgage.

If you refile your case within one year of your first case's dismissal, the automatic stay protecting you from actions by your creditors will last only 30 days. You can get this time period extended if you make a motion and have a hearing in which you demonstrate that your second filing is in good faith.

Dismissal of chapter 13 nullifies your automatic stay. Creditors will again start baying for your blood. They will file lawsuits anew, against you, for the right to confiscate your property and auction them. You may have no other option but to file for chapter 7.

Answer. Your second-mortgage debt has not been canceled or forgiven. A charge off is an accounting term that means the creditor no longer considers the money you owe as a source of profit, but rather, counts it as a loss. A charged-off loanunlike forgiven debtis still considered an obligation that you must pay.

Refiling After the Trustee Dismisses Your Case If your case is dismissed, you can refile your Chapter 13 case. Essentially, this means you are starting anew. You must prepare a new petition, schedules, and plan based on your current situation. A new filing fee will be due also.

If the court does dismisses your Chapter 13 bankruptcy for nonpayment, you may be able to appeal the dismissal to a higher court. However, in most cases you can work something out before the case is dismissed, or refile a new case after dismissal.

You may be able to discharge a second mortgage or home equity line of credit in Chapter 13 if your home is underwater if you owe more than it's worth. Whether or not a court will wipe out your second mortgage depends on the particular judge and your particular circumstances.