New Hampshire Partial Release of Mortgage / Deed of Trust For Landowner

Description

How to fill out Partial Release Of Mortgage / Deed Of Trust For Landowner?

US Legal Forms - one of several biggest libraries of legitimate kinds in the USA - provides a wide array of legitimate file templates you may download or print. Utilizing the site, you can find 1000s of kinds for organization and specific uses, sorted by groups, states, or keywords and phrases.You can find the most up-to-date versions of kinds much like the New Hampshire Partial Release of Mortgage / Deed of Trust For Landowner in seconds.

If you currently have a monthly subscription, log in and download New Hampshire Partial Release of Mortgage / Deed of Trust For Landowner from the US Legal Forms collection. The Acquire button will show up on each and every develop you view. You have access to all previously delivered electronically kinds from the My Forms tab of the bank account.

If you would like use US Legal Forms for the first time, listed below are basic guidelines to help you started off:

- Be sure you have selected the best develop for your personal metropolis/area. Select the Review button to review the form`s articles. Browse the develop explanation to ensure that you have chosen the correct develop.

- In case the develop does not satisfy your requirements, utilize the Lookup field near the top of the monitor to obtain the the one that does.

- If you are content with the form, validate your selection by clicking on the Acquire now button. Then, select the prices plan you favor and supply your references to sign up for an bank account.

- Approach the deal. Make use of bank card or PayPal bank account to accomplish the deal.

- Select the structure and download the form in your gadget.

- Make changes. Complete, change and print and sign the delivered electronically New Hampshire Partial Release of Mortgage / Deed of Trust For Landowner.

Each template you put into your account does not have an expiration date and it is the one you have permanently. So, if you want to download or print yet another copy, just check out the My Forms segment and click in the develop you require.

Gain access to the New Hampshire Partial Release of Mortgage / Deed of Trust For Landowner with US Legal Forms, by far the most substantial collection of legitimate file templates. Use 1000s of specialist and status-particular templates that meet up with your small business or specific requires and requirements.

Form popularity

FAQ

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

A deed transfers ownership of a property from one party to another, while a deed of trust secures a loan on a property. As a mortgage consultant, it's essential to understand the differences between these documents and how they affect the homebuying process.

A Deed of Trust is an agreement between a borrower, a lender and a third-party person who's appointed as a Trustee. It's used to secure real estate transactions where money needs to be borrowed in order for property to be purchased.

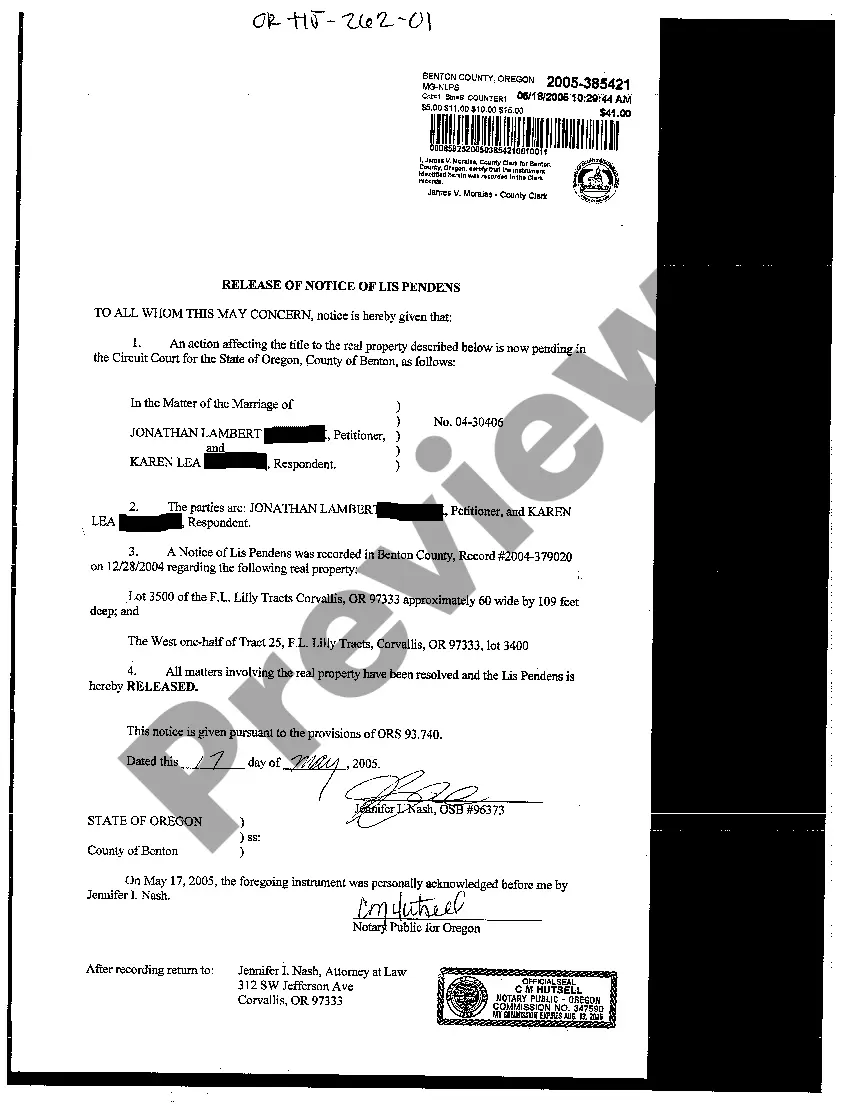

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.

Once a document is recorded, it cannot be altered. To change or add a name to a deed, we suggest you consult a lawyer who may prepare and record a new document which would change or add the name.