Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement

Description

How to fill out Qualified Subchapter-S Trust For Benefit Of Child With Crummey Trust Agreement?

Make use of the most extensive legal catalogue of forms. US Legal Forms is the best place for getting updated Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement templates. Our service provides a large number of legal documents drafted by certified attorneys and sorted by state.

To obtain a template from US Legal Forms, users just need to sign up for a free account first. If you’re already registered on our platform, log in and select the template you are looking for and purchase it. After buying forms, users can find them in the My Forms section.

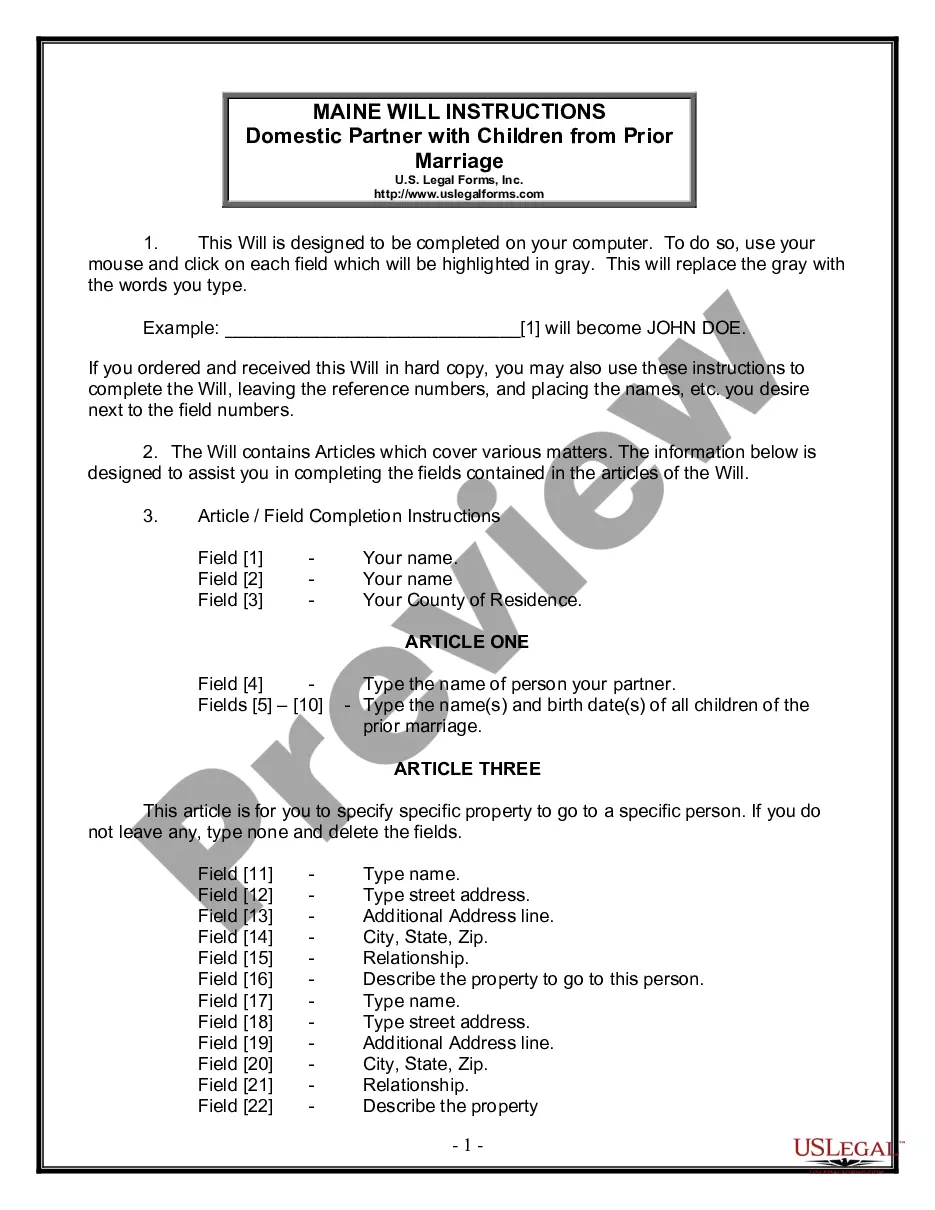

To get a US Legal Forms subscription on-line, follow the guidelines listed below:

- Find out if the Form name you’ve found is state-specific and suits your requirements.

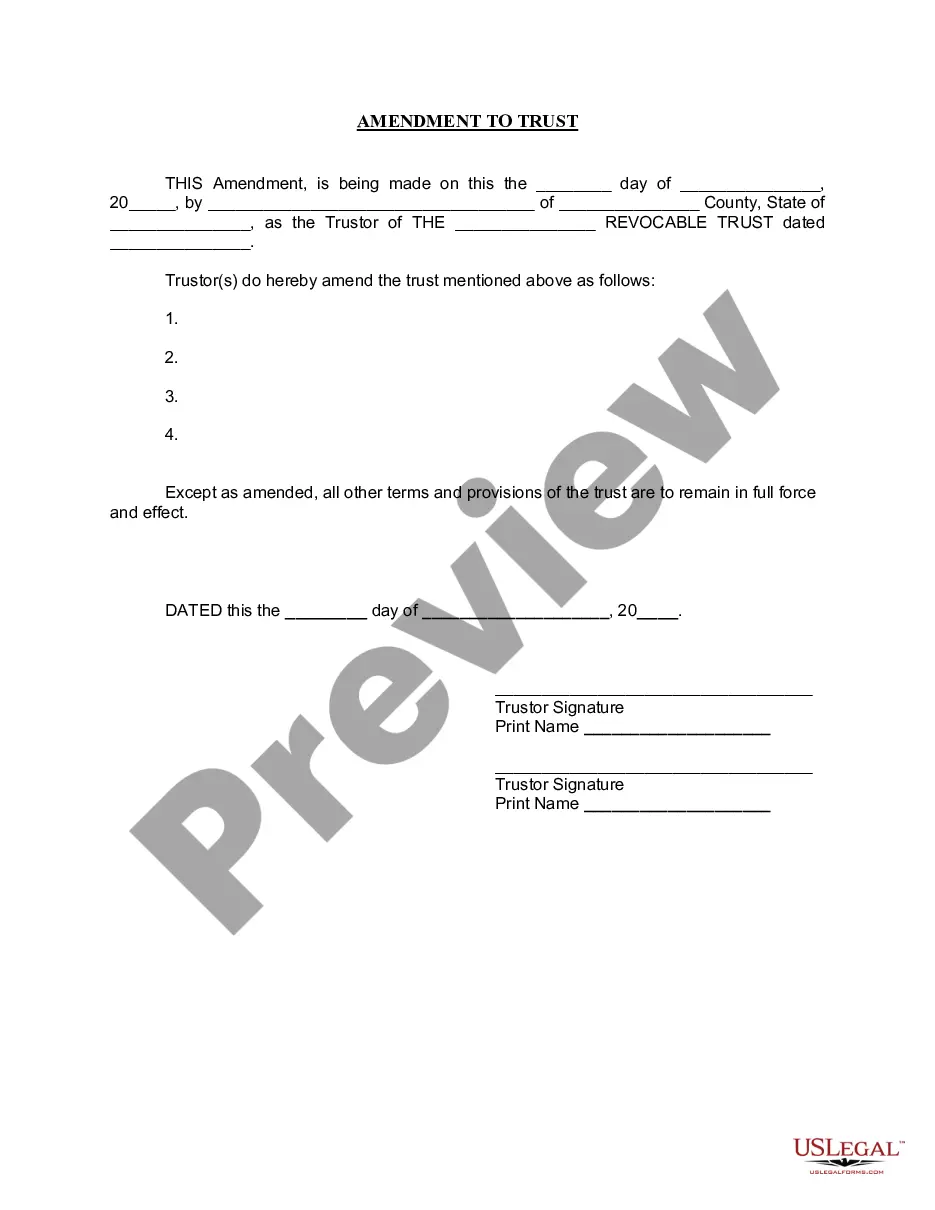

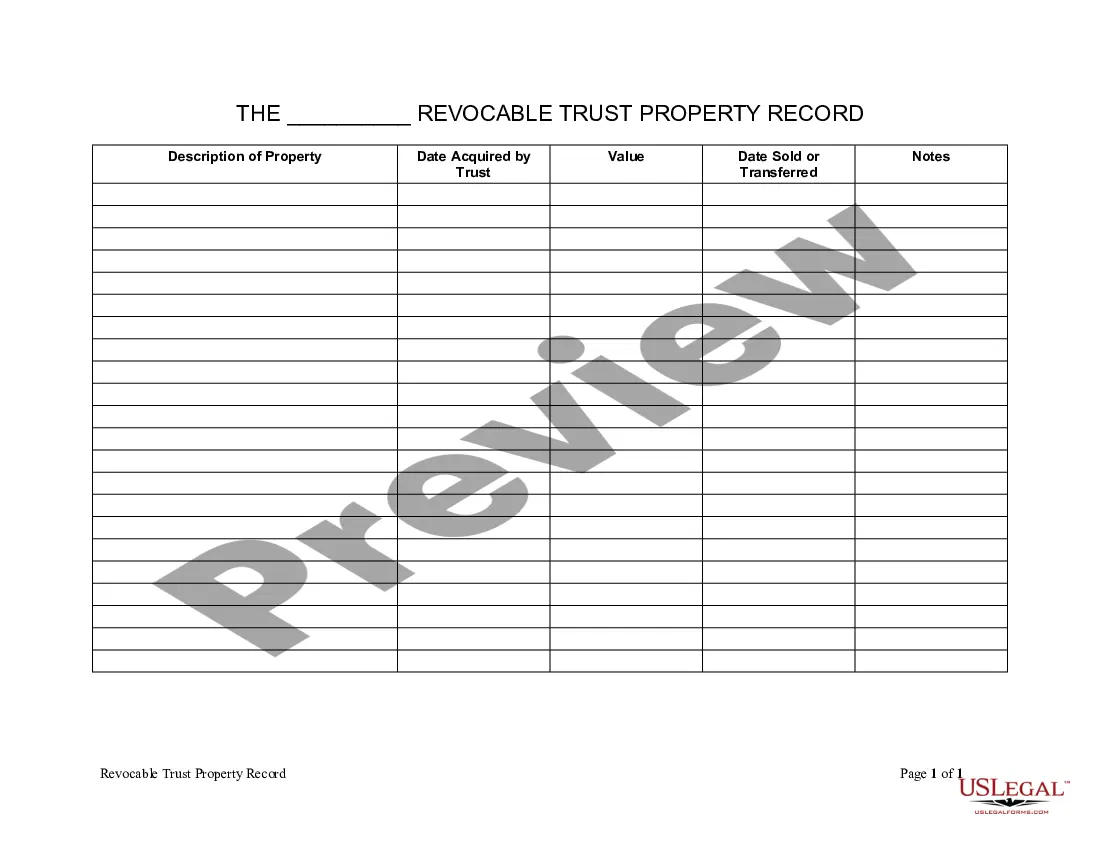

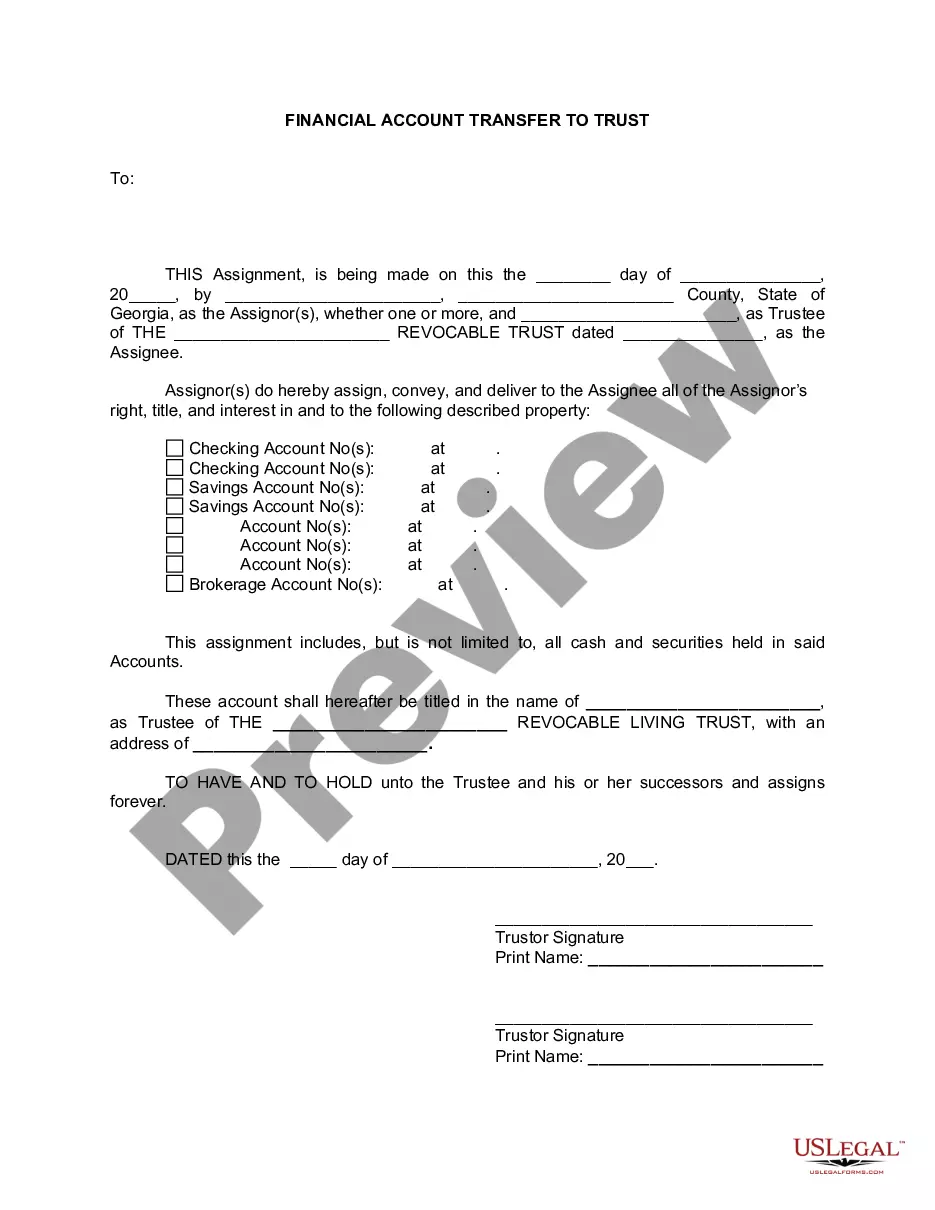

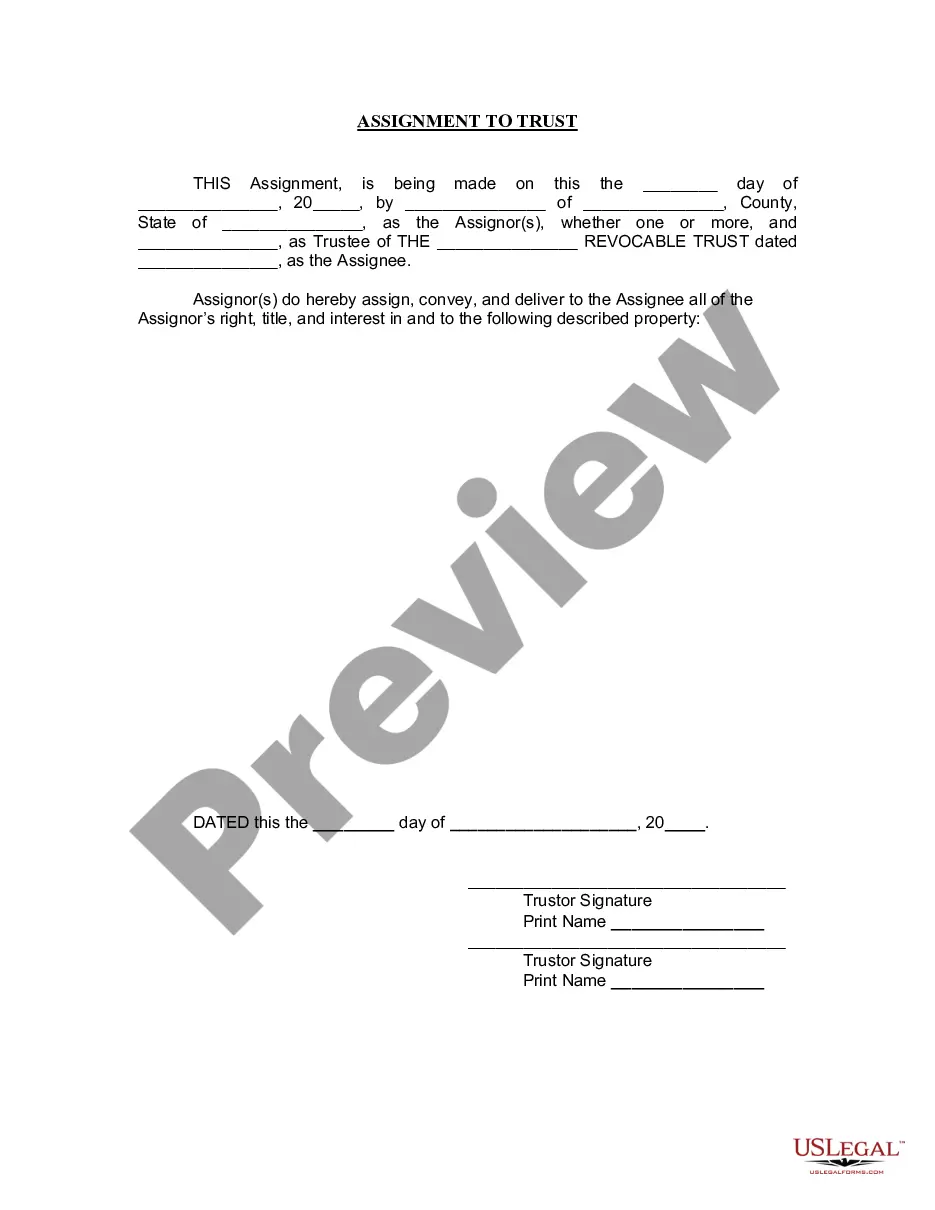

- When the form features a Preview option, utilize it to check the sample.

- If the template doesn’t suit you, use the search bar to find a better one.

- Hit Buy Now if the template corresponds to your needs.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with yourr debit/credit card.

- Select a document format and download the sample.

- When it’s downloaded, print it and fill it out.

Save your effort and time with our service to find, download, and complete the Form name. Join thousands of happy customers who’re already using US Legal Forms!

Form popularity

FAQ

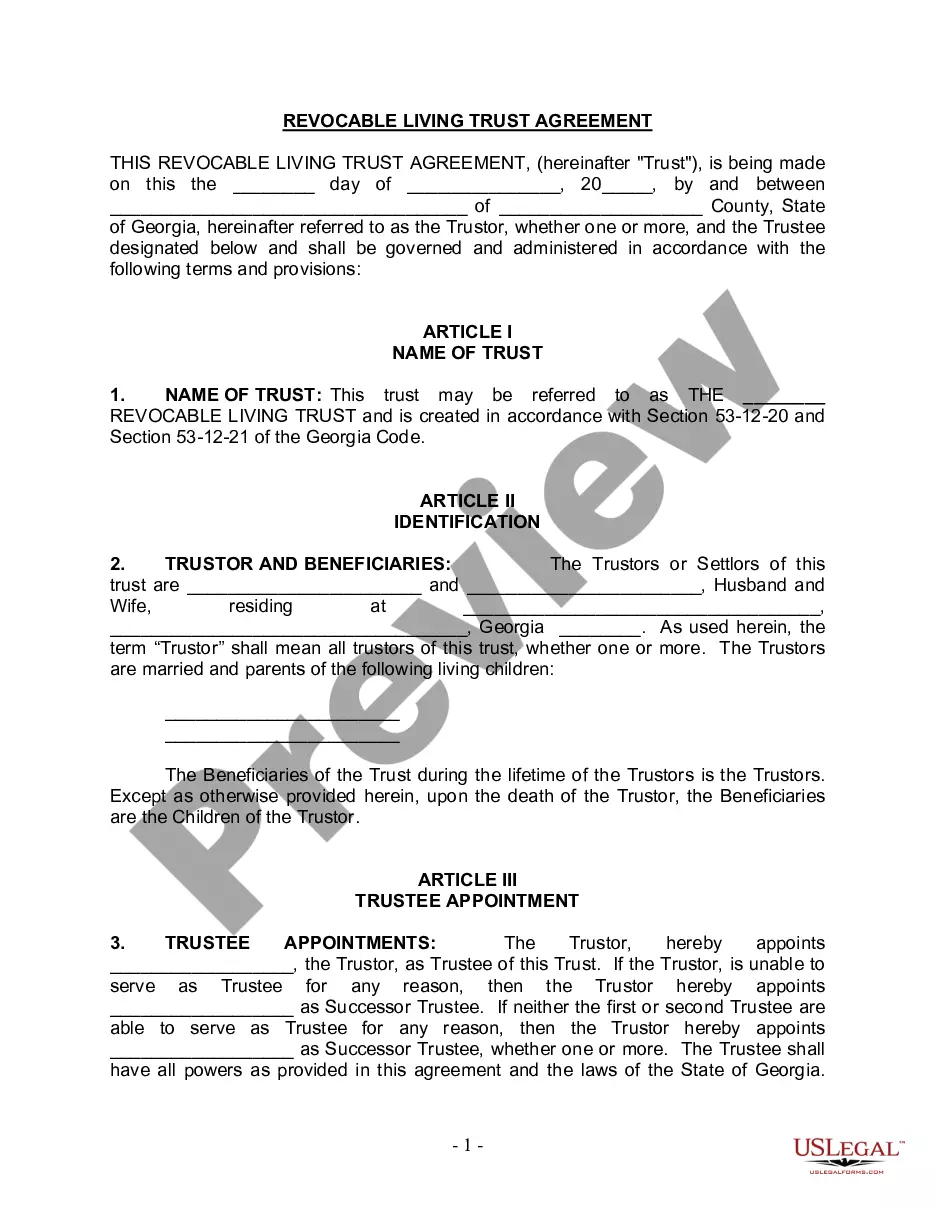

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

1361(d)(3), for a trust to qualify as a QSST, its terms must require that during the life of the current income beneficiary, the trust will have only one income beneficiary; and all of the trust's accounting income must either be required by the terms of the trust instrument to be distributed, or actually be

Generally, estates and six types of trusts are eligible as S corporation shareholders, these include grantor trusts, electing small business trusts (ESBTs), qualified subchapter S trusts (QSSTs), and testamentary trusts (for two years after funding.

If the trust is a grantor trust, testamentary trust, qualified Subchapter S trust (QSST), revocable trust, or retirement account trust, the trust counts as one shareholder. However, the number of beneficiaries of an electing small business trust (ESBT) or voting trust are all counted as shareholders for an S corp.

While there can only be one income beneficiary, a QSST may designate successor beneficiaries. With an ESBT, you can set up one trust that includes all of the income beneficiaries. However, note that any ESBT designated beneficiaries must be an individual, estate or charity eligible to own S corporation stock.

Only estates, individuals, and certain trusts can own shares in an S corp. Corporations, partnerships, and non-resident aliens cannot own stock.If the trust is a grantor trust, testamentary trust, qualified Subchapter S trust (QSST), revocable trust, or retirement account trust, the trust counts as one shareholder.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

In order to become an S corporation, the corporation must submit a completed Form 2553 (Election by a Small Business Corporation) that has been signed by all the shareholders. The following information must be provided: The corporation's name and address. The tax year when the election will take effect.