New Hampshire Notices

Description

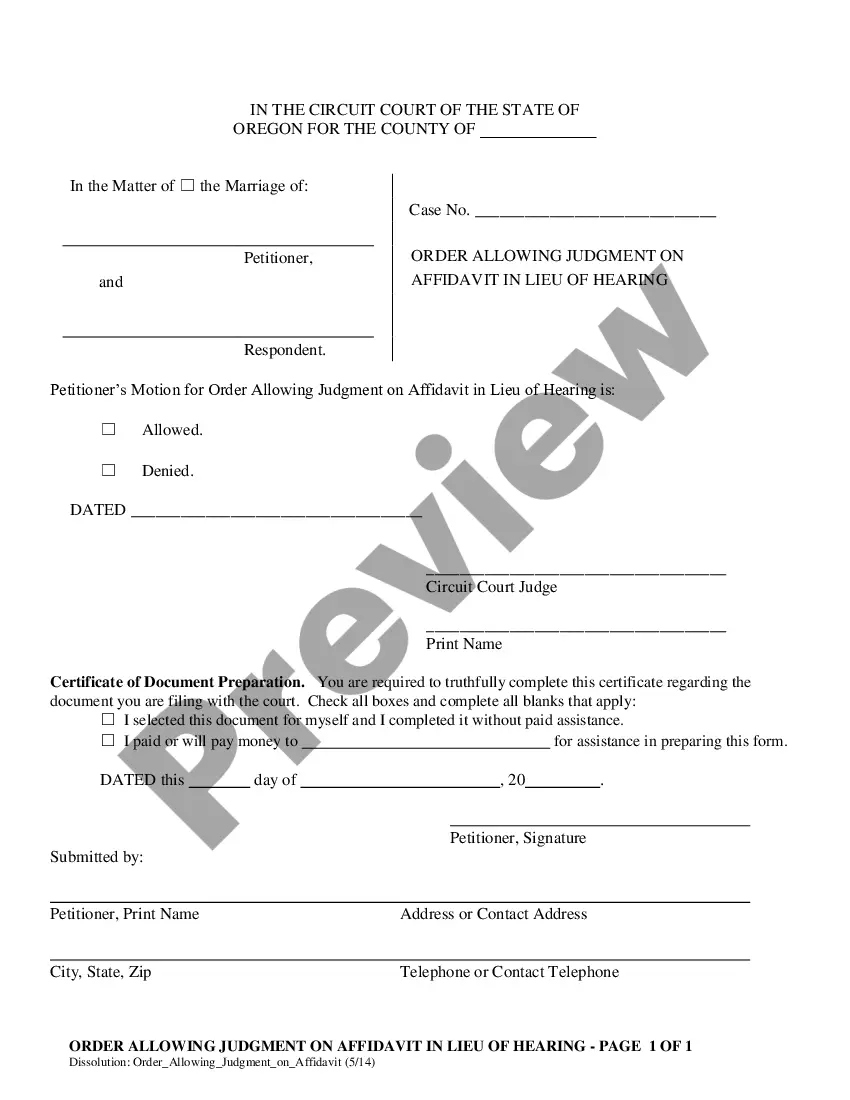

How to fill out Notices?

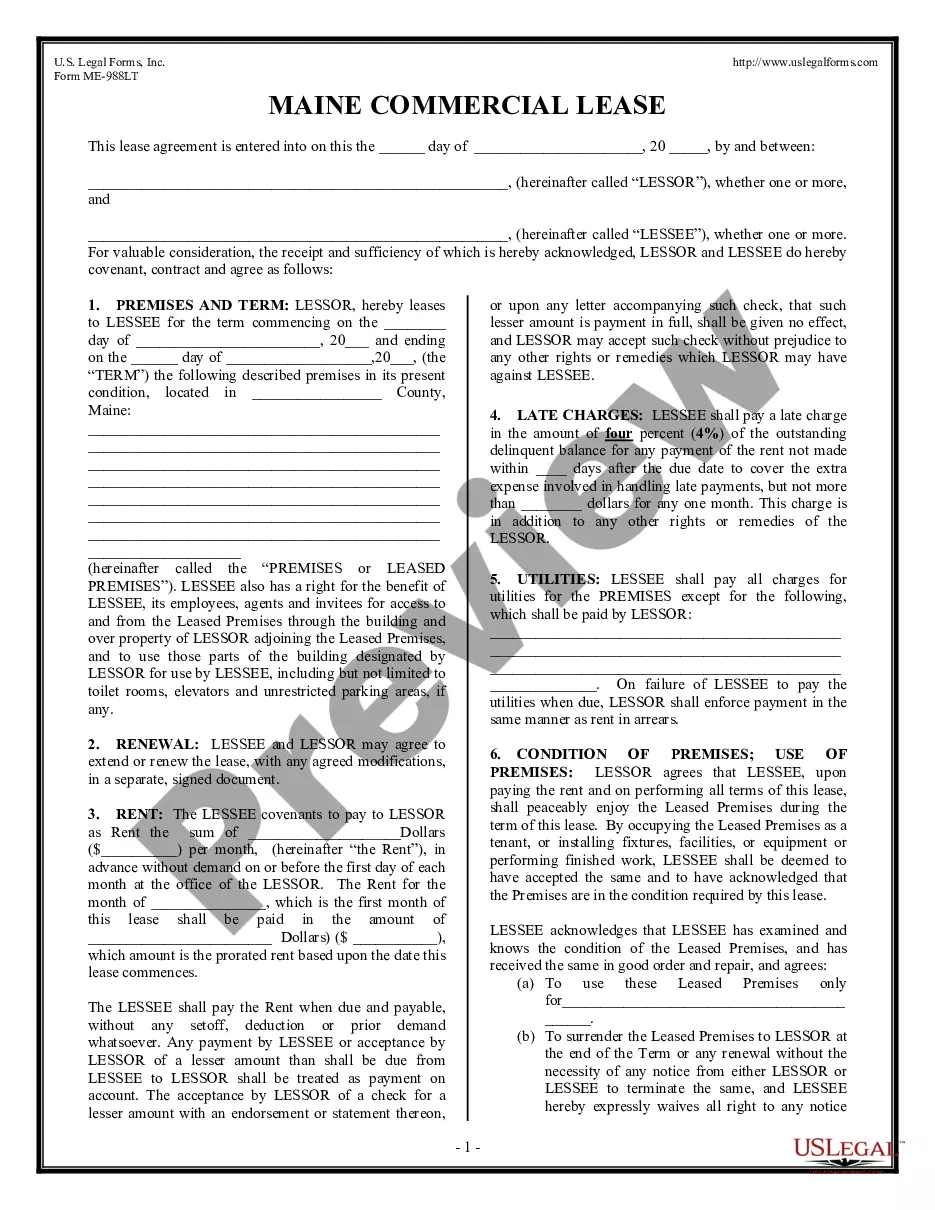

If you want to total, down load, or print legitimate document layouts, use US Legal Forms, the largest assortment of legitimate types, which can be found online. Use the site`s simple and easy handy lookup to find the papers you require. Different layouts for company and individual uses are categorized by types and states, or search phrases. Use US Legal Forms to find the New Hampshire Notices in a few clicks.

When you are previously a US Legal Forms buyer, log in to the account and click the Down load button to obtain the New Hampshire Notices. You can also access types you formerly saved from the My Forms tab of your respective account.

If you are using US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for that right area/region.

- Step 2. Use the Preview method to check out the form`s content. Do not forget about to read the explanation.

- Step 3. When you are unsatisfied together with the kind, make use of the Lookup industry near the top of the display screen to discover other variations of your legitimate kind design.

- Step 4. Upon having found the form you require, click the Purchase now button. Choose the rates strategy you like and put your references to register to have an account.

- Step 5. Procedure the deal. You should use your credit card or PayPal account to accomplish the deal.

- Step 6. Find the file format of your legitimate kind and down load it on your own system.

- Step 7. Complete, revise and print or signal the New Hampshire Notices.

Every single legitimate document design you acquire is yours for a long time. You have acces to every kind you saved within your acccount. Click on the My Forms section and decide on a kind to print or down load once again.

Contend and down load, and print the New Hampshire Notices with US Legal Forms. There are many skilled and express-specific types you can use to your company or individual requires.

Form popularity

FAQ

In order to be eligible for unemployment compensation, an individual: Must be totally or partially unemployed. Must register for work unless you have been specifically exempted. Must be available for work on all shifts customary to the claimant's normal occupation. Eligibility | Services for Claimants New Hampshire Employment Security (.gov) ? services ? eligibility New Hampshire Employment Security (.gov) ? services ? eligibility

New Hampshire looks at your ?base period?, which is normally the first 4 of the last 5 completed calendar quarters prior to the effective date of the claim. The minimum earnings required for eligibility are $2800 ($1400 each in 2 separate quarters), which would result in a $32 weekly benefit amount. Welcome to NH Employment Security UNEMPLOYMENT ... New Hampshire Employment Security (.gov) ? forms ? documents New Hampshire Employment Security (.gov) ? forms ? documents PDF

In New Hampshire, employers pay a tax that funds UI. It is not deducted from your paycheck. Additional eligibility requirements may need to be met and they can be found here on the web site or in the Rights and Obligations booklet.

If you were fired because you lacked the skills to perform the job or simply weren't a good fit, you won't necessarily be barred from receiving benefits. However, if you were fired for misconduct relating to your job, you will be disqualified from receiving benefits. Collecting Unemployment Benefits in New Hampshire - Nolo nolo.com ? legal-encyclopedia ? collecting-... nolo.com ? legal-encyclopedia ? collecting-...

To be timely to claim the week in which you last worked, you must file your initial claim within three business days of your last day worked. You must file no later than the last day of the first week for which you wish to file for benefits. File your weekly claim online.