Delaware Sample Letter for Credit - Christmas Extension Announcement

Description

How to fill out Sample Letter For Credit - Christmas Extension Announcement?

Are you currently in a situation where you require forms for both business or personal purposes almost every day.

There is a wide range of legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of template documents, including the Delaware Sample Letter for Credit - Christmas Extension Announcement, which can be customized to meet federal and state requirements.

Once you find the correct form, click Buy now.

Select the pricing option you prefer, fill out the necessary information to create your account, and purchase the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Delaware Sample Letter for Credit - Christmas Extension Announcement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct jurisdiction/county.

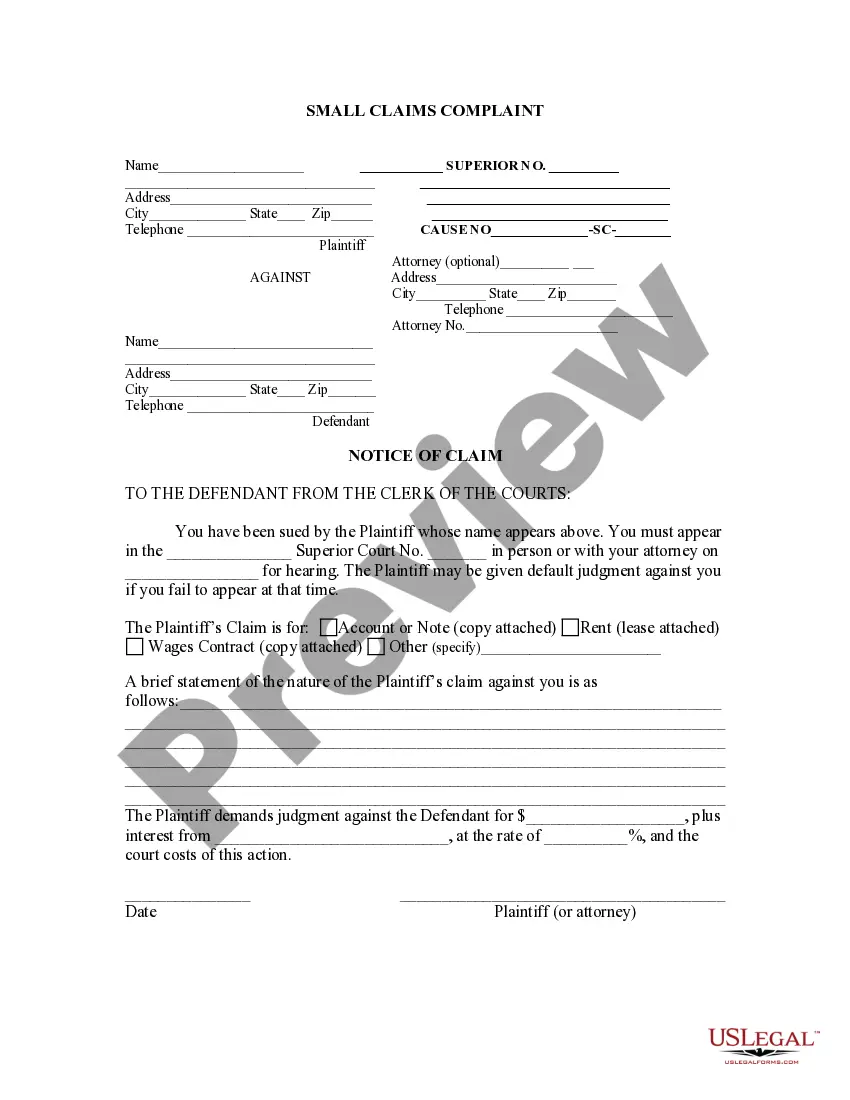

- Utilize the Review button to examine the form.

- Check the summary to confirm you have selected the appropriate template.

- If the template does not meet your needs, use the Search bar to find the form that fits your criteria.

Form popularity

FAQ

The Delaware tax extension is not automatic; you must specifically file Form 1027 to take advantage of the extension. By proactively using the Delaware Sample Letter for Credit - Christmas Extension Announcement alongside this form, you can ensure that your request is clearly communicated. This approach helps you avoid penalties and remains compliant with Delaware tax laws.

Delaware does accept federal extensions; however, they require you to file Form 1027 to extend your Delaware tax return specifically. It's important to note that while a federal extension provides you with extra time for filing your federal return, it does not automatically extend your Delaware state tax return. Therefore, utilizing the Delaware Sample Letter for Credit - Christmas Extension Announcement along with Form 1027 ensures you fulfill both state and federal requirements.

Delaware State Income Tax Extension Form 1027 is the designated document for individuals requesting an extension on their state income tax filings. It grants you additional time to submit your tax documentation without incurring immediate penalties. Using the Delaware Sample Letter for Credit - Christmas Extension Announcement can enhance your communication with the state regarding this process.

The tax extension form for Delaware is known as Form 1027. This form allows you to request an extension to file your state income tax return. By submitting this form along with the Delaware Sample Letter for Credit - Christmas Extension Announcement, you convey your intention to file later, helping you manage your financial obligations more effectively.

The deadline for filing Delaware state taxes generally falls on April 30 for individual income tax returns. However, if you file for an extension using the Delaware Sample Letter for Credit - Christmas Extension Announcement, you could give yourself additional time. It's crucial to be aware of these deadlines to avoid penalties or interest on unpaid taxes.

To obtain a tax extension form in Delaware, you can visit the Delaware Division of Revenue's website, where you'll find the necessary forms available for download. Additionally, the Delaware Sample Letter for Credit - Christmas Extension Announcement can guide you in writing a proper request for an extension. If you require assistance, consider using services like uslegalforms, which provide easy access to tax extension templates and forms.

The extension form for the estate tax return is typically the Delaware Form 700, which allows you to request additional time to file your estate tax return. By using the Delaware Sample Letter for Credit - Christmas Extension Announcement, you can formally notify the state of your intent to extend the filing deadline. This form can help alleviate the pressure of completing the return by the original due date.