New Hampshire Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest

Description

How to fill out Mineral Deed With Grantor Reserving Nonparticipating Royalty Interest?

US Legal Forms - among the most significant libraries of authorized kinds in America - provides a wide range of authorized papers web templates it is possible to download or print out. Utilizing the site, you may get thousands of kinds for organization and person uses, sorted by categories, states, or search phrases.You will find the most recent versions of kinds just like the New Hampshire Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest in seconds.

If you currently have a monthly subscription, log in and download New Hampshire Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest through the US Legal Forms library. The Obtain button will appear on every develop you view. You get access to all in the past delivered electronically kinds inside the My Forms tab of your profile.

In order to use US Legal Forms initially, allow me to share easy instructions to help you started out:

- Make sure you have picked out the best develop for your personal area/county. Go through the Review button to analyze the form`s articles. Browse the develop information to actually have chosen the correct develop.

- In the event the develop doesn`t fit your needs, utilize the Lookup area towards the top of the display screen to obtain the one who does.

- When you are happy with the form, validate your decision by visiting the Buy now button. Then, pick the costs strategy you like and give your references to sign up to have an profile.

- Approach the transaction. Utilize your charge card or PayPal profile to complete the transaction.

- Select the format and download the form on your own product.

- Make alterations. Load, modify and print out and indicator the delivered electronically New Hampshire Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest.

Each and every design you included in your account lacks an expiry particular date and it is the one you have forever. So, in order to download or print out one more duplicate, just check out the My Forms segment and click on in the develop you want.

Obtain access to the New Hampshire Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest with US Legal Forms, the most extensive library of authorized papers web templates. Use thousands of expert and express-particular web templates that satisfy your small business or person needs and needs.

Form popularity

FAQ

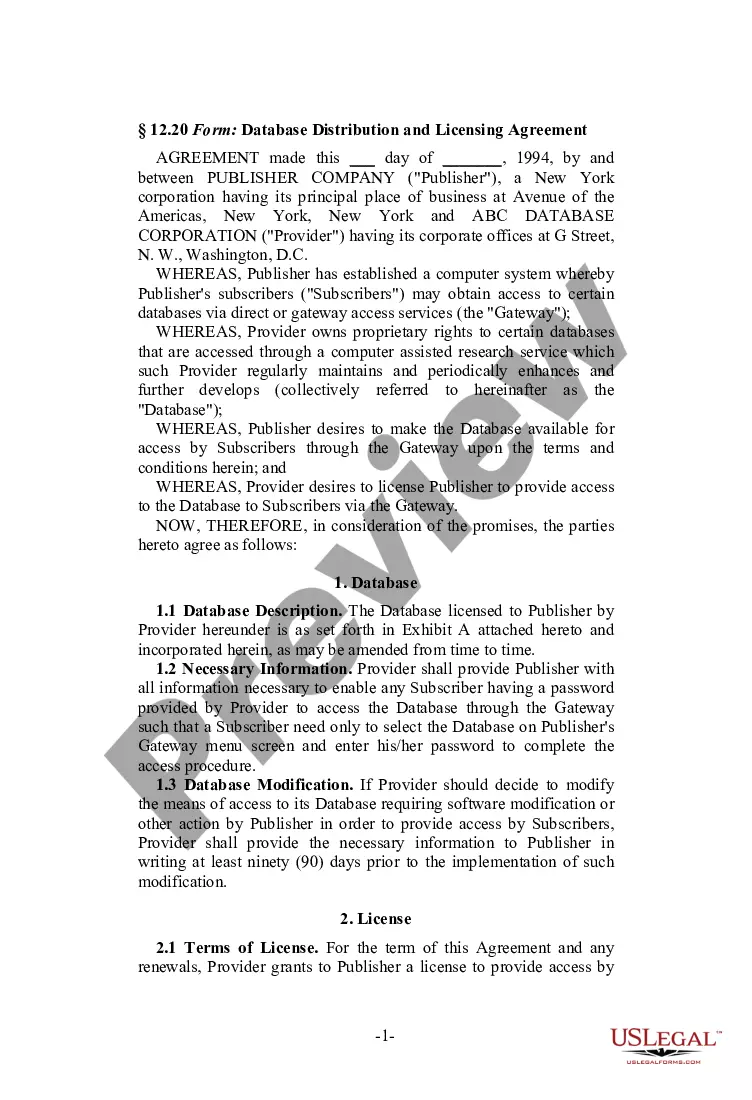

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

Royalty Interest (RI) ? this type of mineral interest is obtained when an owner decides to lease their mineral interest to a company that plans to drill and operate a well on the land.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

The term ?undivided interest? refers to a type of ownership in which multiple parties share ownership of a single asset without the property being physically divided among them. This is commonly seen in real estate, natural resource holdings, and certain types of financial investments.

A mineral interest is simply a real property interest obtained from the severance or exploitation of minerals ? say natural gas ? from the surface. On the other hand, a royalty interest is the property interest that grants an owner a portion of the production revenue generated.

Typically, NPRIs are created by an express grant or reservation in a deed and are entirely different from a ?leasehold? royalty. The holder of a NPRI has no power to negotiate or execute an oil and gas lease and has no power to enter upon the land to extract the hydrocarbons.