A counter offer is an offer made in response to a previous offer by the other party during negotiations for a final contract. It is a new offer made in response to an offer received. It has the effect of rejecting the original offer, which cannot be accepted thereafter unless revived by the offeror. However, with regard to sales of goods, Article 2-207 of the Uniform Commercial Code provides: "A definite and seasonable expression of acceptance or a written confirmation which is sent within a reasonable time operates as an acceptance even though it states terms additional to or different from those offered or agreed upon, unless acceptance is expressly made conditional on assent to the additional or different terms."

Letter with Conditional Acceptance of Property Specifying Place of Performance

Description

Key Concepts & Definitions

Conditional Acceptance of Property: In real estate, a letter with conditional acceptance of property is a formal document where the potential buyer agrees to accept the property under certain stipulated conditions. This often includes contingencies on property inspections, mortgage approvals, or the sale of another property.

Step-by-Step Guide

- Gather Information: Begin by collecting all relevant information about the property and your conditions for purchase.

- Draft the Letter: Compose a letter stating your acceptance of the property, contingent on specified conditions.

- Specify Conditions: Clearly outline the conditions that need to be met. This may include passing a home inspection, obtaining financing, or other legal stipulations.

- Legal Review: Have a real estate attorney review the letter to ensure all legal bases are covered.

- Send the Letter: Send the letter to the seller or their agent. It is typically recommended to use certified mail for documentation purposes.

Risk Analysis

- Non-Acceptance: The seller may reject the conditions, leading to a breakdown in negotiations.

- Vagueness in Terms: Ambiguities in the conditions stated can lead to legal disputes or misunderstandings.

- Time Constraints: Setting conditions can delay the closing process. If not timed well, it might lead to missing out on other potential properties.

Common Mistakes & How to Avoid Them

- Lack of Specificity: Be explicit about each condition to avoid ambiguity. Use clear and precise language.

- Skipping Legal Review: Always have a real estate attorney review any legal documents to ensure compliance and validity.

- Poor Timing: Timely follow-ups on condition fulfillment can prevent delays in property acquisition.

Key Takeaways

Understanding and correctly drafting a letter with conditional acceptance of property is crucial in the U.S. real estate market. It protects the interests of the buyer by setting legally binding contingencies that must be satisfied for the transaction to proceed.

How to fill out Letter With Conditional Acceptance Of Property Specifying Place Of Performance?

Aren't you tired of choosing from hundreds of samples each time you need to create a Letter with Conditional Acceptance of Property Specifying Place of Performance? US Legal Forms eliminates the wasted time millions of Americans spend surfing around the internet for appropriate tax and legal forms. Our professional group of lawyers is constantly modernizing the state-specific Templates collection, so it always provides the proper documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

Users who don't have an active subscription should complete a few simple steps before having the capability to get access to their Letter with Conditional Acceptance of Property Specifying Place of Performance:

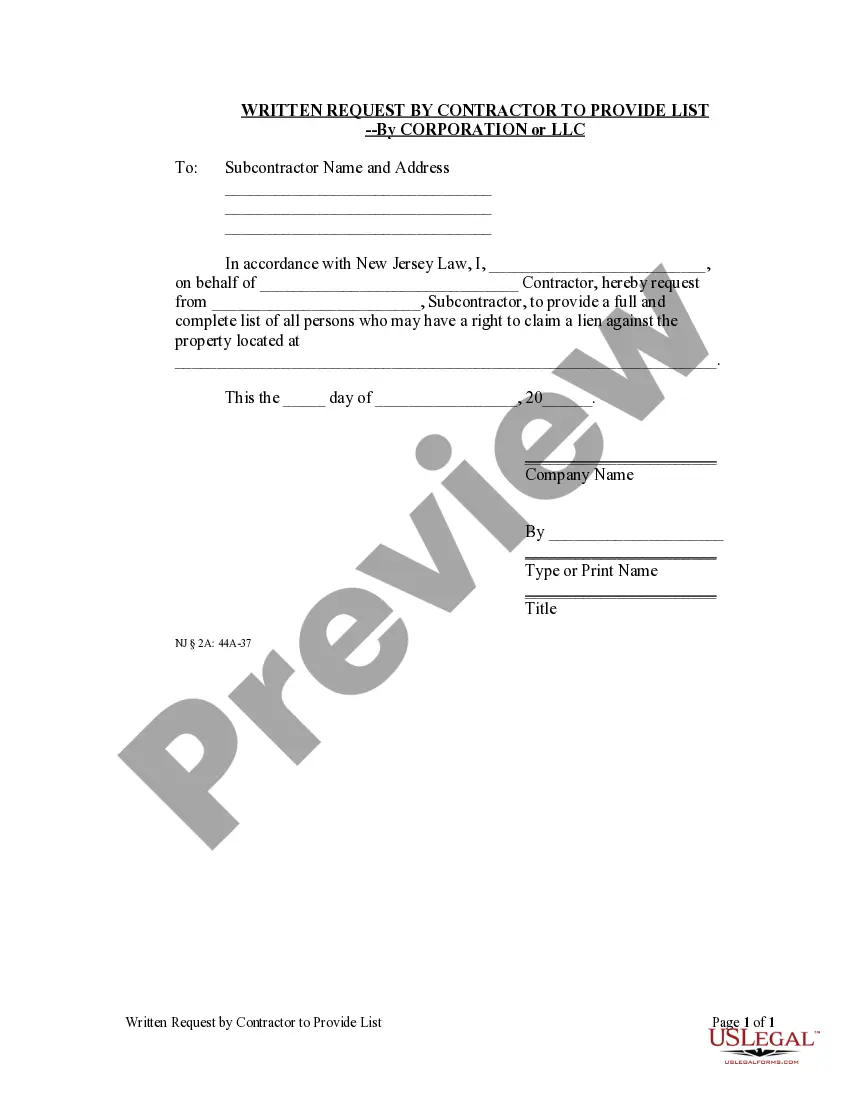

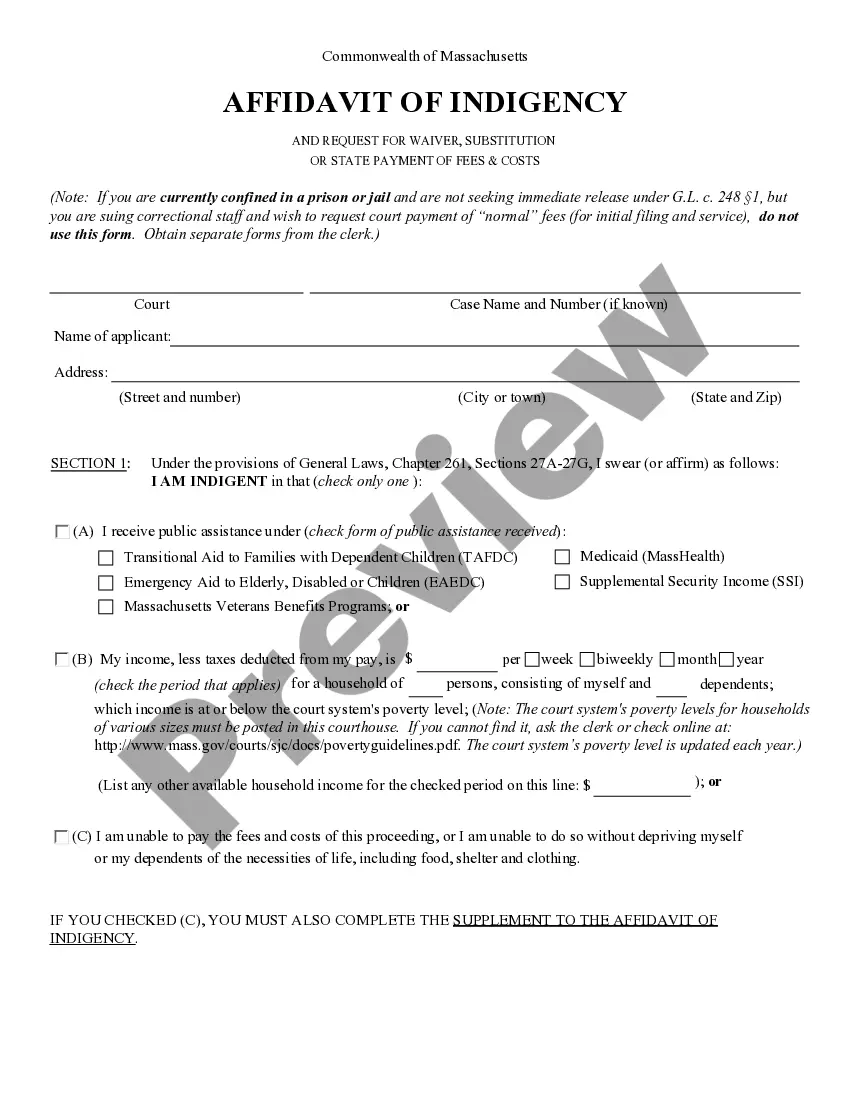

- Use the Preview function and read the form description (if available) to be sure that it is the right document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the correct example for the state and situation.

- Make use of the Search field at the top of the webpage if you have to look for another file.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your template in a needed format to finish, print, and sign the document.

Once you’ve followed the step-by-step recommendations above, you'll always be capable of log in and download whatever document you need for whatever state you want it in. With US Legal Forms, finishing Letter with Conditional Acceptance of Property Specifying Place of Performance samples or any other official paperwork is easy. Get going now, and don't forget to look at your examples with accredited attorneys!

Form popularity

FAQ

What does conditionally accepted mean? Conditional acceptance means that there are still terms that need to be met before your acceptance can be finalized. For example, maybe you're a high school or college student and you've applied and submitted your official transcript for your midterm grades.

On the one hand, conditional admission proves that you're 100 percent academically qualified for a school you want to attend. On the other hand, conditional admission can be frustrating because it means that your English ability is the only factor preventing you from being regularly admitted to a school.

Conditional admission, also called provisional admission or conditional acceptance, means that you will be admitted to a college or university on the condition that you make up for a certain requirement you do not presently meet.

Conditional. Applicants whose academic records indicate that they may have difficulty performing satisfactorily in a graduate degree program are designated as conditional students by the Graduate Studies Committee or by the Graduate School.

On the one hand, conditional admission proves that you're 100 percent academically qualified for a school you want to attend. On the other hand, conditional admission can be frustrating because it means that your English ability is the only factor preventing you from being regularly admitted to a school.

A conditional offer is an offer that a university makes to a student. The offer is dependent on the grades that the student is likely to get at either A Level or college level.Whereas an unconditional offer guarantees a student a place on a course regardless of their academic performance, a conditional offer does not.

An offer letter essentially means that you have been accepted for the program you applied to.It means you need to have certain grades or marks for the same, whereas unconditional offer letter has no conditions with it, and reflects that your grades, whether high or low, have been accepted by the University.

Conditional admission means they'll accept you if you can meet some condition, normally that your final semester's grades are good or that you take a summer class or an additional test. Waitlisted means they'll accept you only if enough other people turn their own offer of acceptance.

What Is Conditional Admission? Conditional Admission is a program offered by colleges and universities, admission to a degree program, to eligible international students, with a requirement that they must improve their English language skills by attending the university's English language program.