Notice of Qualifying Event from Employer to Plan Administrator

Description

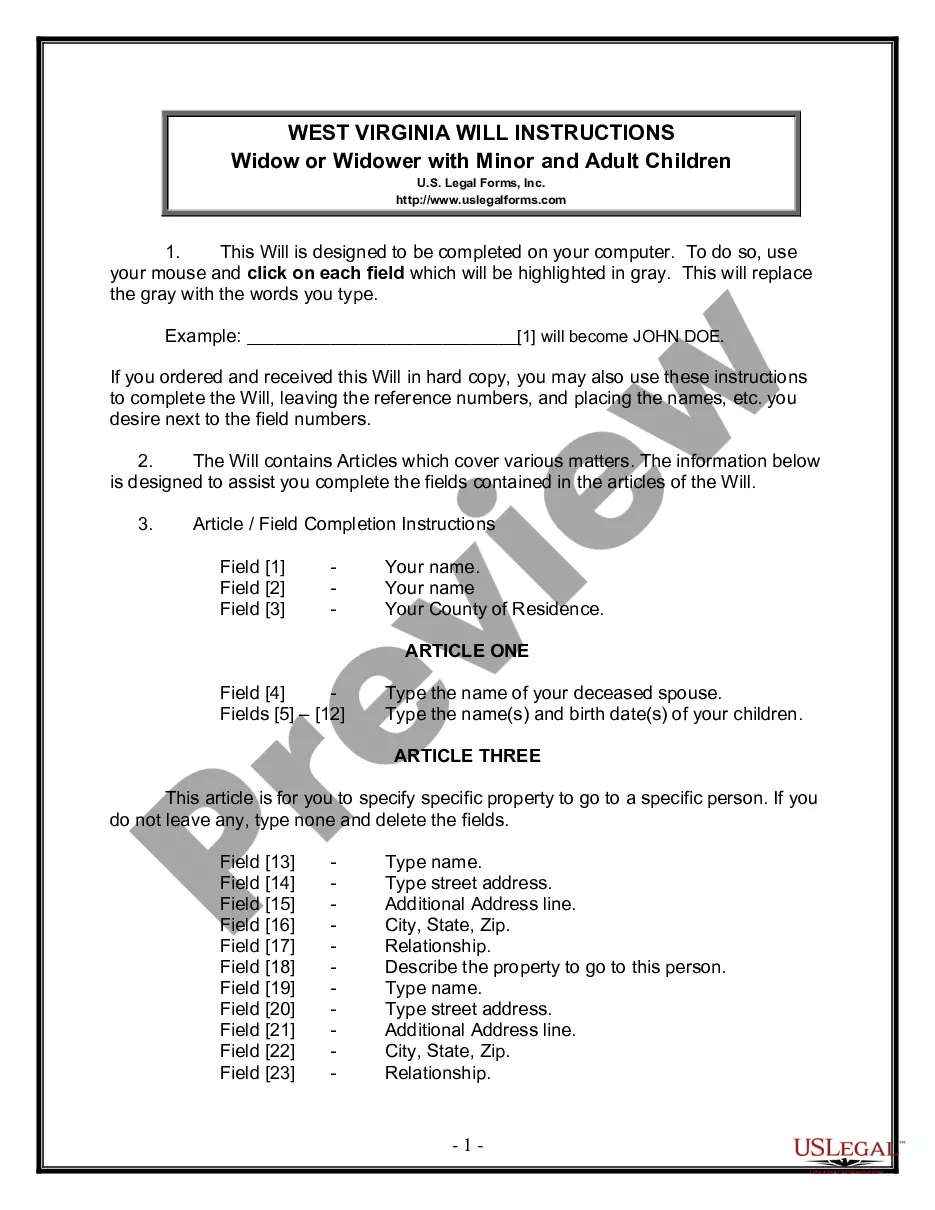

How to fill out Notice Of Qualifying Event From Employer To Plan Administrator?

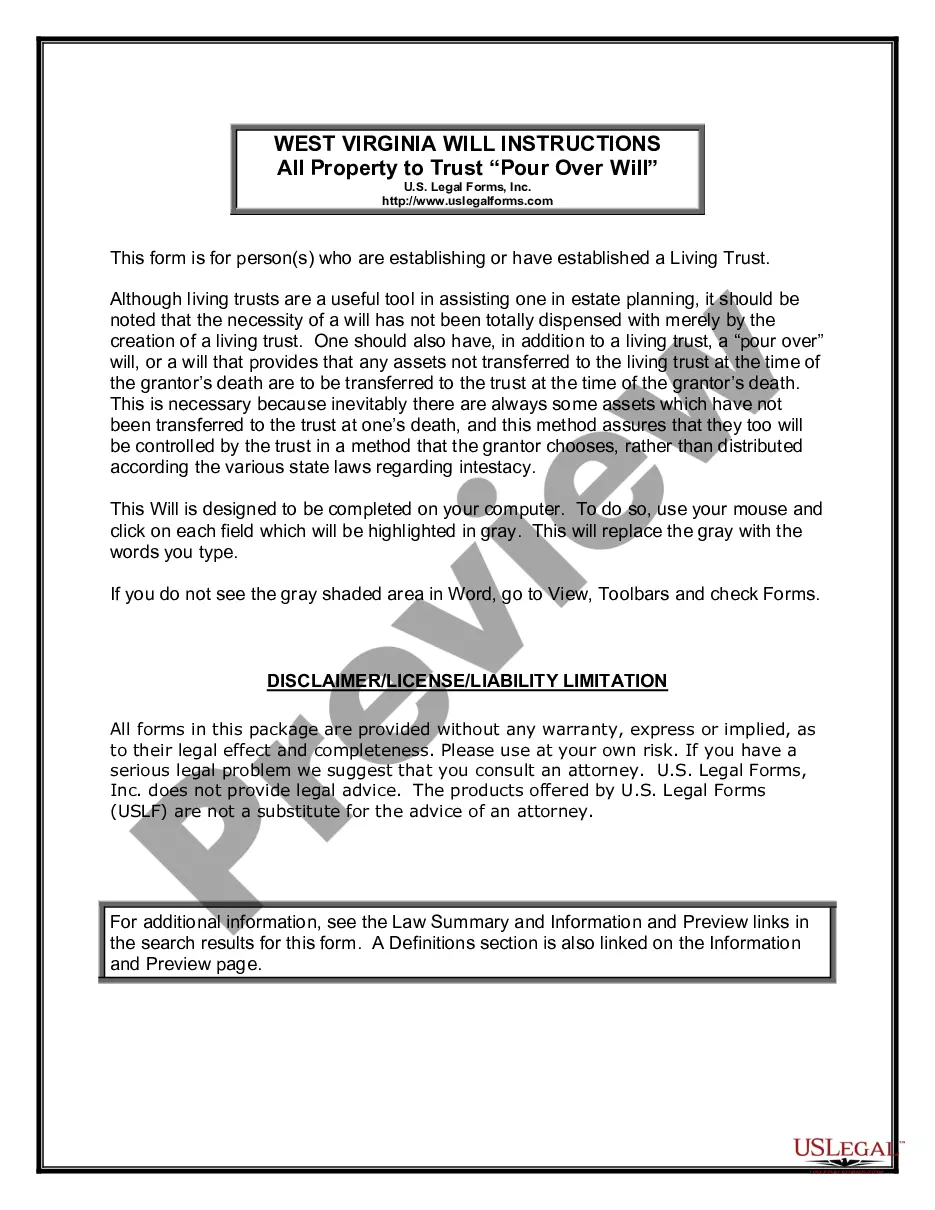

Employ the most extensive legal library of forms. US Legal Forms is the perfect platform for finding updated Notice of Qualifying Event from Employer to Plan Administrator templates. Our platform offers 1000s of legal forms drafted by certified attorneys and sorted by state.

To download a sample from US Legal Forms, users just need to sign up for a free account first. If you are already registered on our service, log in and select the document you need and purchase it. After buying forms, users can see them in the My Forms section.

To get a US Legal Forms subscription online, follow the steps listed below:

- Find out if the Form name you’ve found is state-specific and suits your needs.

- If the form has a Preview function, use it to review the sample.

- In case the template does not suit you, use the search bar to find a better one.

- Hit Buy Now if the template meets your needs.

- Choose a pricing plan.

- Create a free account.

- Pay via PayPal or with yourr debit/visa or mastercard.

- Choose a document format and download the template.

- As soon as it is downloaded, print it and fill it out.

Save your effort and time using our service to find, download, and fill in the Form name. Join thousands of delighted clients who’re already using US Legal Forms!

Form popularity

FAQ

A qualifying event is an event that triggers a special enrollment period for an individual or family to purchase health insurance outside of the regular annual open enrollment period.

Employers should send notices by first-class mail, obtain a certificate of mailing from the post office, and keep a log of letters sent. Certified mailing should be avoided, as a returned receipt with no delivery acceptance signature proves the participant did not receive the required notice.

Reduction of Hours The reduction of hours is a qualifying event for a covered employee, spouse, and dependent children if it causes them to lose coverage and is not accompanied by an immediate termination.

Since losing COBRA coverage early is not a qualifying event, you would not be eligible to sign up for coverage through the Exchange. (If your COBRA runs out after the normal period, which is typically 18 or 36 months, you should be eligible for a Special Enrollment and could sign up for coverage through the Exchange).

Notices properly mailed are generally considered provided on the date sent, regardless of whether they're actually received. 1. COBRA Initial Notice must be provided. Within 30 days after the employee first becomes enrolled in the group health plan.

You must have an event that qualifies you for COBRA coverage. COBRA must cover your group health plan. You must be a beneficiary that is qualified for the specific event.

Plans must give each qualified beneficiary at least 60 days to choose whether or not to elect COBRA coverage, beginning from the date the election notice is provided, or the date the qualified beneficiary would otherwise lose coverage under the group health plan due to the qualifying event, whichever is later.

The following are qualifying events: the death of the covered employee; a covered employee's termination of employment or reduction of the hours of employment; the covered employee becoming entitled to Medicare; divorce or legal separation from the covered employee; or a dependent child ceasing to be a dependent under

COBRA (Consolidated Omnibus Budget Reconciliation Act of 1985) is a federal law that requires employers of 20 or more employees who offer health care benefits to offer the option of continuing this coverage to individuals who would otherwise lose their benefits due to termination of employment, reduction in hours or