New Hampshire Term Nonparticipating Royalty Deed from Mineral Owner

Description

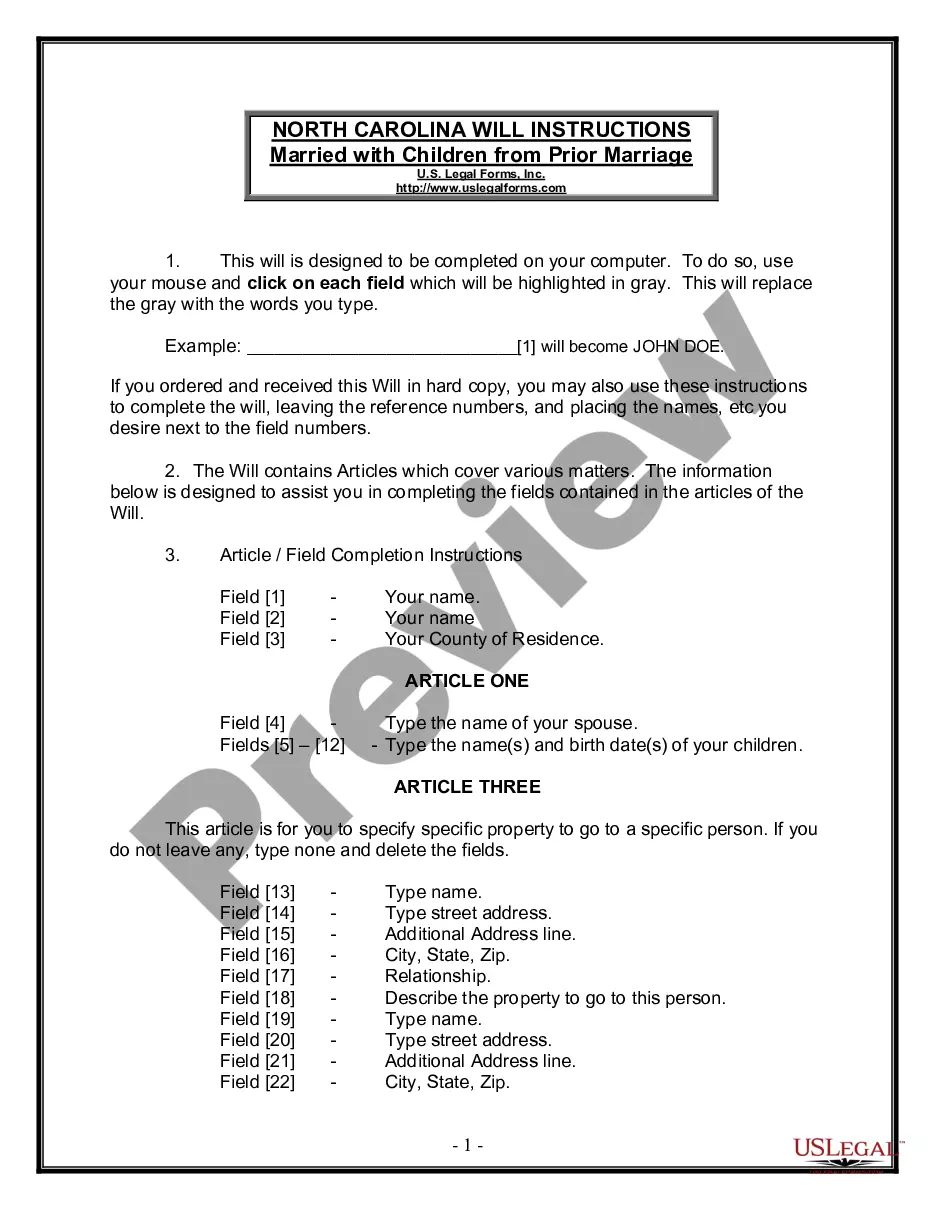

How to fill out Term Nonparticipating Royalty Deed From Mineral Owner?

If you need to complete, acquire, or printing lawful file layouts, use US Legal Forms, the most important assortment of lawful varieties, which can be found on the Internet. Use the site`s easy and hassle-free research to obtain the paperwork you need. Numerous layouts for enterprise and individual functions are categorized by types and claims, or search phrases. Use US Legal Forms to obtain the New Hampshire Term Nonparticipating Royalty Deed from Mineral Owner in a couple of click throughs.

When you are previously a US Legal Forms customer, log in in your account and click the Obtain key to get the New Hampshire Term Nonparticipating Royalty Deed from Mineral Owner. You can even access varieties you formerly saved from the My Forms tab of your account.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have selected the form for the appropriate area/nation.

- Step 2. Make use of the Review option to look through the form`s content material. Never neglect to learn the description.

- Step 3. When you are unsatisfied using the kind, utilize the Look for industry near the top of the display screen to find other models of your lawful kind format.

- Step 4. When you have discovered the form you need, go through the Buy now key. Select the pricing program you favor and add your qualifications to sign up for an account.

- Step 5. Approach the transaction. You may use your Мisa or Ьastercard or PayPal account to accomplish the transaction.

- Step 6. Select the formatting of your lawful kind and acquire it on your device.

- Step 7. Comprehensive, revise and printing or signal the New Hampshire Term Nonparticipating Royalty Deed from Mineral Owner.

Each lawful file format you purchase is your own property forever. You might have acces to each and every kind you saved within your acccount. Click on the My Forms area and pick a kind to printing or acquire once more.

Contend and acquire, and printing the New Hampshire Term Nonparticipating Royalty Deed from Mineral Owner with US Legal Forms. There are millions of skilled and express-particular varieties you may use for your personal enterprise or individual requirements.

Form popularity

FAQ

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

Typically, NPRIs are created by an express grant or reservation in a deed and are entirely different from a ?leasehold? royalty. The holder of a NPRI has no power to negotiate or execute an oil and gas lease and has no power to enter upon the land to extract the hydrocarbons.

An ORRI is a fractional, undivided interest with the right to participate or receive proceeds from the sale of oil and/or gas. It is not an interest in the minerals, but an interest in the proceeds or revenue from the oil & gas minerals sold.

The most common way is through a will or estate plan. When the mineral rights owner dies, their heirs will become the new owners. Another way to transfer mineral rights is through a lease. If the mineral rights are leased to a third party, the new owner will need approval from the current lessee to claim them.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Royalty Interest (RI) ? this type of mineral interest is obtained when an owner decides to lease their mineral interest to a company that plans to drill and operate a well on the land.