New Hampshire How to Request a Home Affordable Modification Guide

Description

How to fill out How To Request A Home Affordable Modification Guide?

If you wish to finalize, obtain, or print authentic document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s user-friendly and convenient search feature to find the documents you need.

A variety of templates for business and personal use are organized by categories and jurisdictions, or keywords.

If you are not satisfied with the form, utilize the Search field at the top of the page to find other versions of the legal form template.

Step 4. Once you have found the form you need, select the Purchase now option. Choose the pricing plan you prefer and provide your details to sign up for an account.

- Use US Legal Forms to obtain the New Hampshire How to Request a Home Affordable Modification Guide with just a few clicks.

- If you are already a US Legal Forms customer, Log Into your account and select the Obtain button to access the New Hampshire How to Request a Home Affordable Modification Guide.

- You can also find forms you have previously purchased in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review feature to examine the form’s content. Be sure to read the summary.

Form popularity

FAQ

To qualify for a mortgage modification under the New Hampshire How to Request a Home Affordable Modification Guide, you typically need to demonstrate a financial hardship. This may include job loss, significant medical expenses, or other unforeseen circumstances that impact your ability to make monthly payments. Lenders will also review your income, expenses, and overall financial situation. Using uslegalforms can simplify your application process, providing you with the right documents needed for a successful mortgage modification.

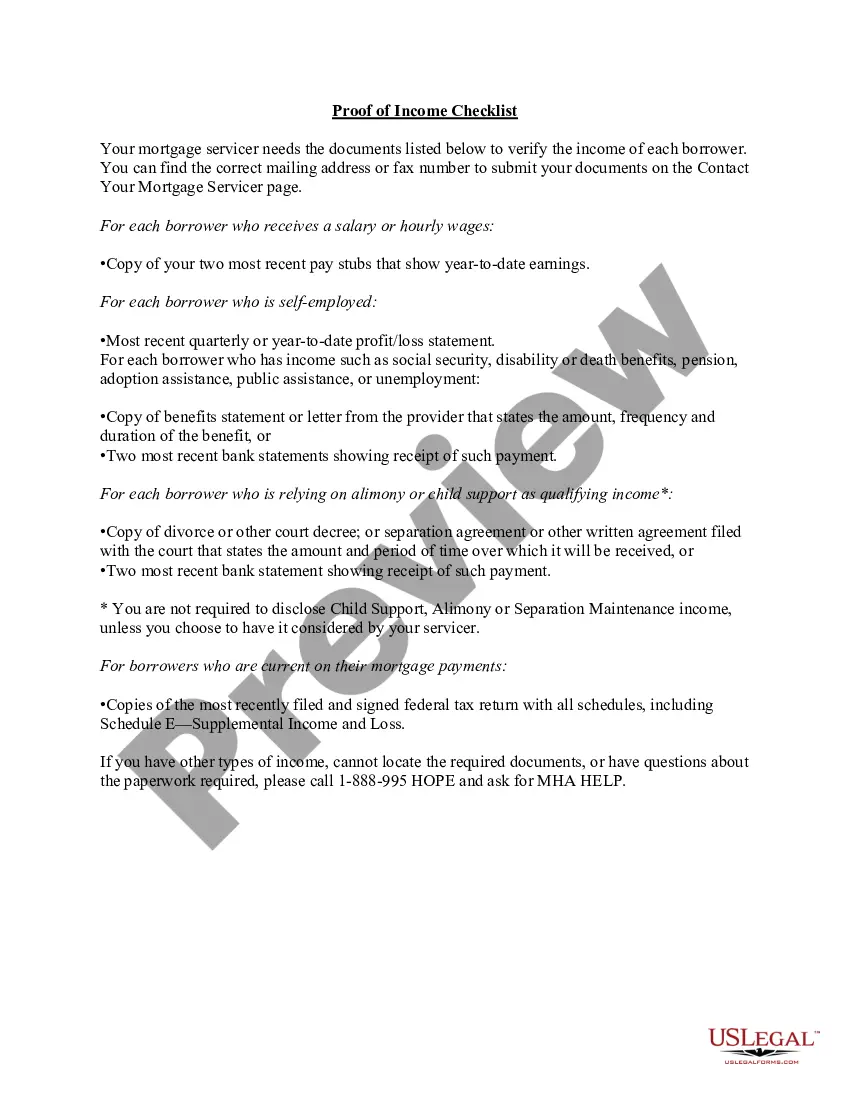

To apply for a mortgage modification in New Hampshire, begin by gathering your financial documents. These may include income statements, bank statements, and any relevant information on your current mortgage. Next, reach out to your lender or servicer to express your interest in a modification and request their specific application forms. Additionally, you can refer to the New Hampshire How to Request a Home Affordable Modification Guide for detailed steps and helpful insights that can simplify the process.

Yes, Congress has enacted several mortgage relief programs over the years aimed at helping homeowners recover from economic difficulties. The most notable during recent times includes laws designed to support those struggling with their mortgages. If you are looking for specific assistance on your mortgage, the New Hampshire How to Request a Home Affordable Modification Guide can help you understand which programs are currently available.

HAMP, or the Home Affordable Modification Program, is no longer active in its original form. However, there are still options for homeowners in New Hampshire seeking home modifications. It is important to explore alternative programs that can help you achieve affordable mortgage payments. For detailed guidance, refer to the New Hampshire How to Request a Home Affordable Modification Guide.

The loan modification process typically takes 6 to 9 months, depending on your lender.

Generally, conventional mortgage loan guidelines require you have 24 months of payment history on the subject property (the property you want to get a new mortgage on) since the date of the modification, or 12 months of payment history if you trying to finance the non-subject property.

Second Lien Modification Program or (2MP) was developed by U.S. Treasury Department to help homeowners with the second mortgage on their property who already modified their first mortgage with the Home Affordable Modification Program (HAMP) but continue to face financial difficulties.

Tips for Getting a Mortgage Modification ApprovedApply as soon as you can.Pay attention to detail.Send in all items requested by your loan servicers.Hold on to all information provided by your servicer.Put together a new monthly budget.Write a hardship letter and put careful thought into it.More items...?

A property became eligible if the analysis showed a lender or investor currently holding the loan would make more money by modifying the loan rather than foreclosing. Other than the requirement that a homeowner prove financial hardship, the home had to be habitable and have an unpaid principal balance under $729,750.

The loan modification process can be complicated and difficult. Most homeowners are denied a few times before they are finally approved. Often, the denials are legitimate--because the process is confusing, many homeowners don't do it correctly.