California Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc.

Description

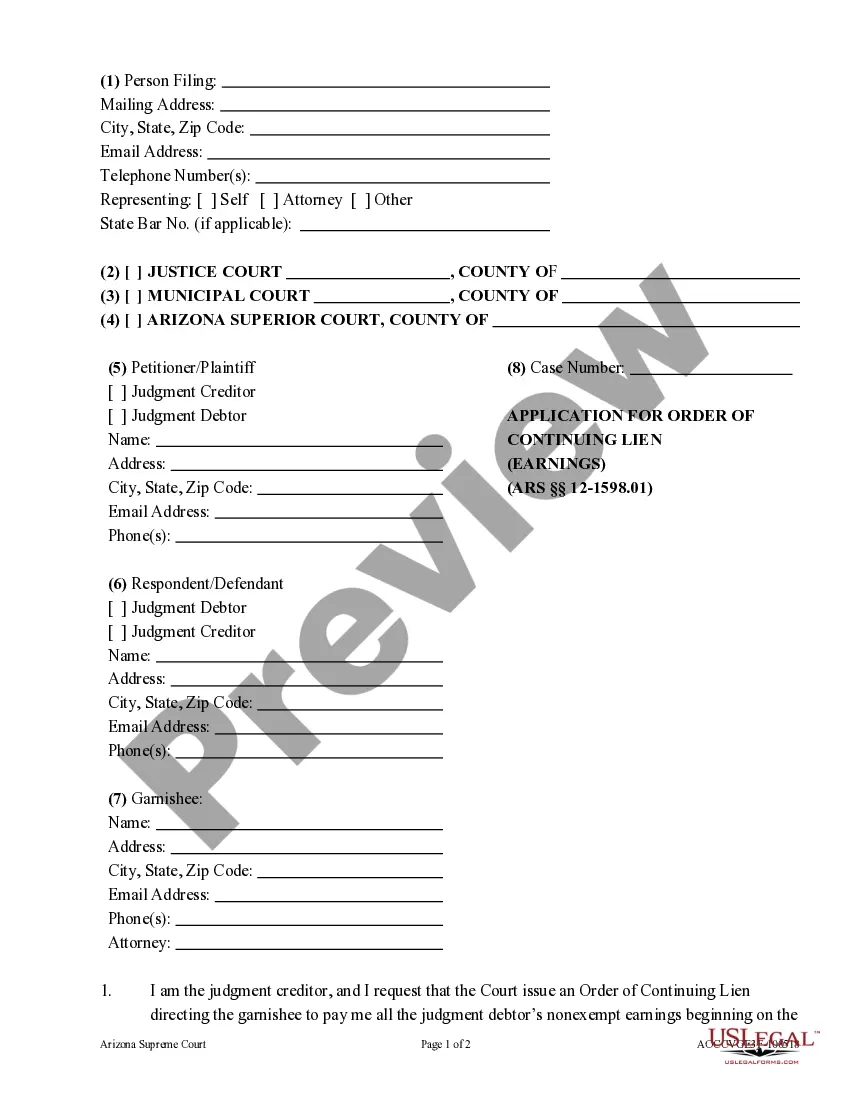

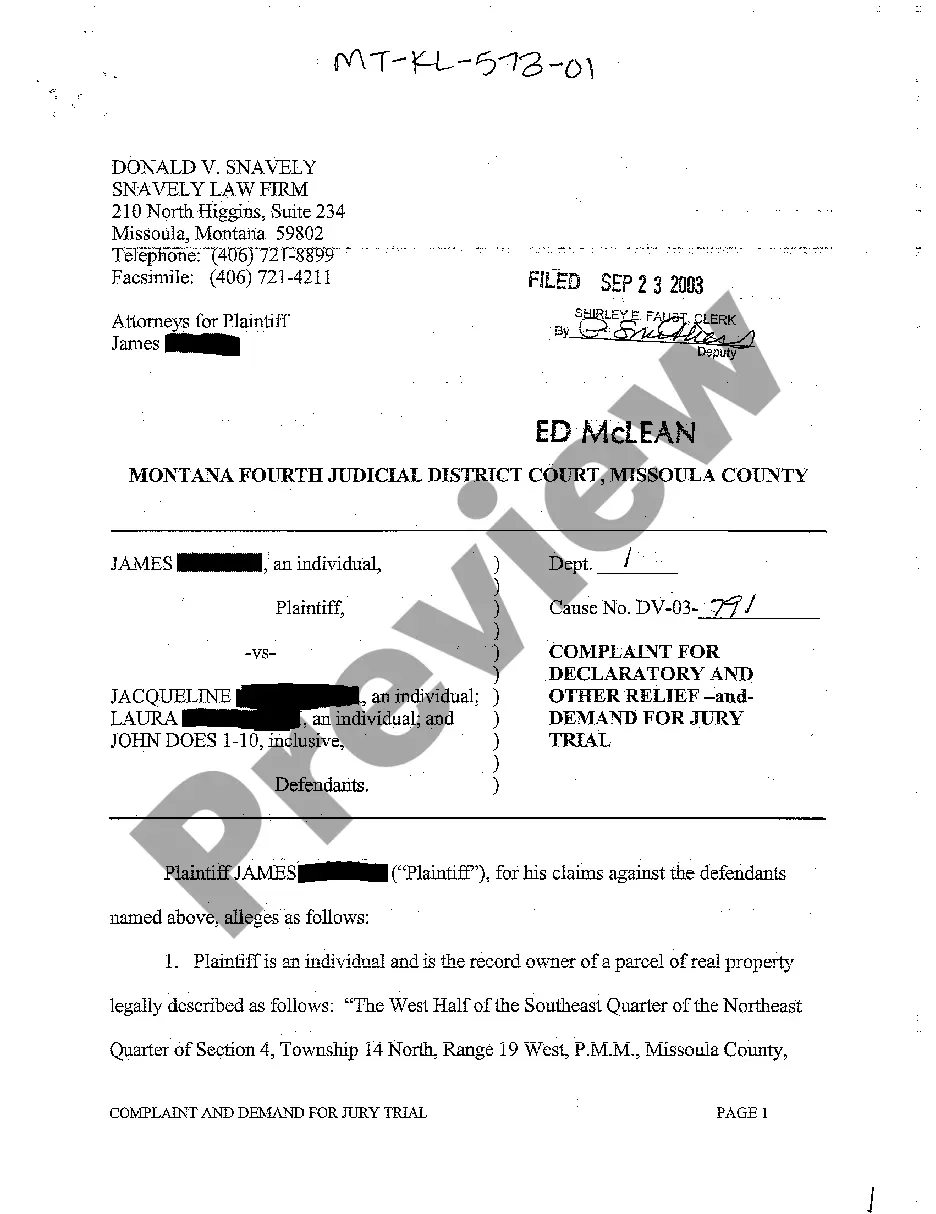

How to fill out Plan Of Merger Between Stamps.Com, Inc., Rocket Acquisition Corp. And Iship.Com, Inc.?

US Legal Forms - among the greatest libraries of lawful forms in the USA - delivers a variety of lawful record templates you may acquire or print. While using site, you will get thousands of forms for company and person reasons, sorted by groups, suggests, or keywords.You will discover the newest versions of forms such as the California Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc. in seconds.

If you have a monthly subscription, log in and acquire California Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc. in the US Legal Forms catalogue. The Obtain button will show up on every single type you view. You have accessibility to all formerly acquired forms from the My Forms tab of your respective profile.

If you would like use US Legal Forms the very first time, allow me to share basic instructions to help you started:

- Be sure to have chosen the best type for the area/state. Click the Review button to check the form`s articles. Read the type outline to ensure that you have chosen the proper type.

- In case the type does not fit your specifications, use the Search area near the top of the monitor to find the one that does.

- If you are content with the shape, validate your choice by clicking on the Get now button. Then, opt for the costs plan you favor and give your qualifications to sign up to have an profile.

- Process the purchase. Make use of bank card or PayPal profile to perform the purchase.

- Find the format and acquire the shape in your device.

- Make modifications. Fill out, revise and print and indicator the acquired California Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc..

Each and every template you put into your account lacks an expiry time and it is your own property for a long time. So, if you wish to acquire or print another backup, just visit the My Forms area and click around the type you want.

Obtain access to the California Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc. with US Legal Forms, one of the most extensive catalogue of lawful record templates. Use thousands of skilled and status-distinct templates that satisfy your small business or person demands and specifications.

Form popularity

FAQ

The Company and each of its subsidiaries is duly organized, validly existing and in good standing (with respect to jurisdictions that recognize the concept of good standing) under the laws of the jurisdiction of its organization and has all requisite corporate or similar power and authority to own, lease and operate ...

There are two basic merger structures: direct and indirect. In a direct merger, the target company and the buying company directly merge with each other. In an indirect merger, the target company will merge with a subsidiary company of the buyer.

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

The Seven-Step Process: Mergers & Acquisition Determine Growth Markets/Services: ... Identify Merger and Acquisition Candidates: ... Assess Strategic Financial Position and Fit: ... Make a Go/No-Go Decision: ... Conduct Valuation. ... Perform Due Diligence, Negotiate a Definitive Agreement, and Execute Transaction:

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

After that, I'll also very briefly introduce you to several other common mergers and acquisitions (M&A) transaction documents, including: Confidentiality Agreements. Letters of Intent. Exclusivity Agreements. Disclosure Schedules. HSR Filings. Third Party Consents. Legal Opinions. Stock Certificates.