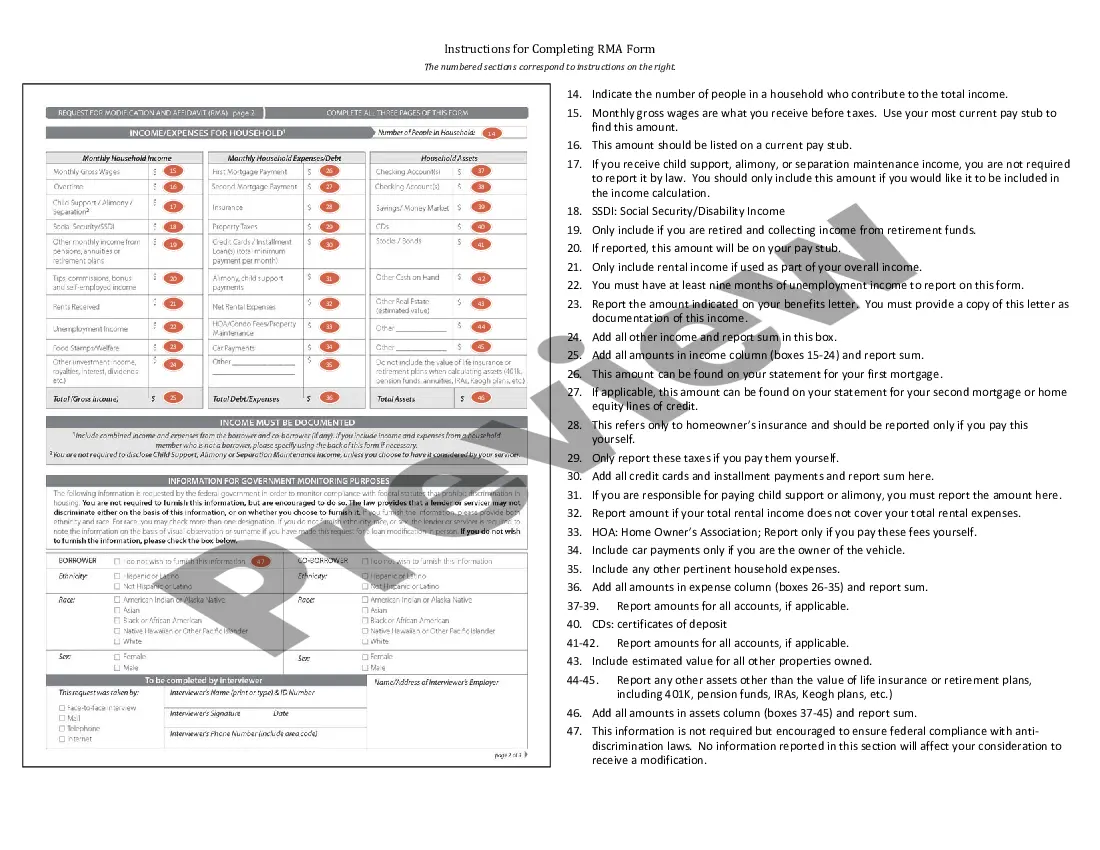

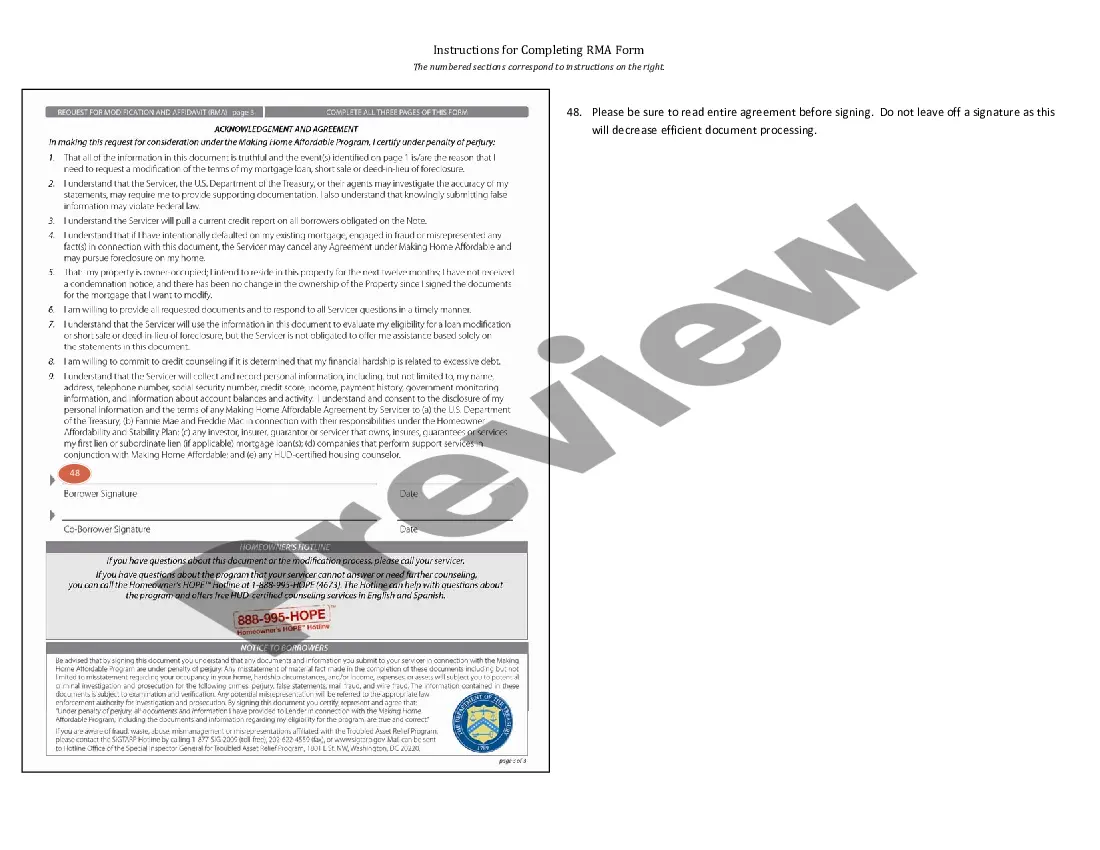

New Hampshire Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

Selecting the appropriate legal document format may pose a challenge. Clearly, there are numerous templates accessible online, but how can you locate the legal form you require? Utilize the US Legal Forms website.

The service provides a vast array of templates, such as the New Hampshire Instructions for Completing Request for Loan Modification and Affidavit RMA Form, suitable for both business and personal purposes. All templates are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the New Hampshire Instructions for Completing Request for Loan Modification and Affidavit RMA Form. Utilize your account to browse the legal templates you have previously obtained. Navigate to the My documents tab in your account to download another copy of the needed document.

US Legal Forms is the largest repository of legal templates where you can find a variety of document formats. Use the service to download professionally drafted documents that adhere to state requirements.

- First, ensure that you have selected the correct template for your area/region. You can review the form using the Review button and read the form description to confirm it is suitable for you.

- If the form does not satisfy your needs, use the Search field to find the appropriate form.

- When you are confident that the form is suitable, click the Purchase now button to acquire the form.

- Choose the pricing plan you desire and enter the required information. Create your account and complete the payment using your PayPal account or credit card.

- Select the file format and download the legal document to your device.

- Finally, complete, modify, print, and sign the obtained New Hampshire Instructions for Completing Request for Loan Modification and Affidavit RMA Form.

Form popularity

FAQ

The loan modification process typically involves several steps, starting with gathering your financial documents and submitting a formal request to your lender. After you submit your request, your lender will review your financial situation and determine if you qualify for changes to your loan terms. Following the guidelines in the New Hampshire Instructions for Completing Request for Loan Modification and Affidavit RMA Form can simplify this process. By clearly following these instructions, you can enhance your chances of receiving a favorable modification.

A loan modification is when a lender agrees to change the terms of your loan to make repayment more manageable. For instance, if you face financial difficulties, your lender might lower your interest rate or extend the repayment period. To assist you with this process, the New Hampshire Instructions for Completing Request for Loan Modification and Affidavit RMA Form provide crucial guidance. Utilizing these instructions can help streamline your modification request and improve the chances of approval.

Filing a motion for reconsideration in New Hampshire requires you to draft a formal request that clearly states why the court should revisit its previous decision. Ensure that you reference any specific errors or new evidence that warrants reconsideration. Utilize the New Hampshire Instructions for Completing Request for Loan Modification and Affidavit RMA Form to help structure and present your motion effectively. It's important to file this motion within the time limits set by the court, so act promptly.

To change your parenting plan in New Hampshire, you should first gather any relevant documentation that supports your request. Then, you will need to file a motion with the court, clearly outlining the reasons for the modification. Remember to follow the New Hampshire Instructions for Completing Request for Loan Modification and Affidavit RMA Form, as these guide you through the necessary legal processes. Finally, be prepared for a court hearing where you can present your case.

The full form of RMA in mortgage is Request for Mortgage Assistance. This term is commonly used in the mortgage industry to describe a formal request from a borrower who is experiencing financial challenges. Understanding this form is crucial for anyone looking to modify their loan terms. By carefully following the New Hampshire Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can ensure that your request is presented clearly and effectively.

In the context of mortgages, RMA refers to the process of requesting assistance from your lender. This is particularly important when facing financial difficulties and seeking to modify loan terms. The RMA helps establish communication between you and your lender, paving the way for potential solutions. Utilizing the New Hampshire Instructions for Completing Request for Loan Modification and Affidavit RMA Form can streamline this critical process.

To petition for a modification of child support in New Hampshire, you must file a motion with the court. This motion should include relevant details about the change in circumstances that justifies your request. If you require detailed guidance, consider utilizing resources available from uslegalforms, which can simplify the process. Accurate completion of necessary forms, including those related to financial changes, is vital.

The RMA mortgage form is a critical document for borrowers seeking assistance from their lenders. It outlines essential information about your current mortgage and your reason for requesting help. By submitting this form, you initiate the process of potentially modifying your loan terms. Follow the New Hampshire Instructions for Completing Request for Loan Modification and Affidavit RMA Form to ensure you fill out this important document correctly.

A hardship letter explains why you are unable to make your mortgage payments. In this letter, you might detail specific circumstances such as job loss, medical issues, or another financial crisis. It’s essential to be honest and straightforward in your explanation. If you need assistance in crafting this letter, refer to the New Hampshire Instructions for Completing Request for Loan Modification and Affidavit RMA Form, which can guide you through the process.

RMA stands for Request for Mortgage Assistance. In real estate, this form is crucial for homeowners struggling to keep up with their mortgage payments. Submitting the RMA allows you to communicate your financial situation to your lender and seek potential modifications on your loan. Understanding how to navigate the New Hampshire Instructions for Completing Request for Loan Modification and Affidavit RMA Form can significantly enhance your chances of finding a sustainable solution.