"Instructions for Completing Mortgage Deed of Trust Form" is a American Lawyer Media form. The following form is for instructions for completing mortgage deed of trust.

New Hampshire Instructions for Completing Mortgage Deed of Trust Form

Description

How to fill out Instructions For Completing Mortgage Deed Of Trust Form?

US Legal Forms - one of the largest libraries of legitimate forms in America - provides a wide range of legitimate record web templates you are able to acquire or produce. While using web site, you can get 1000s of forms for enterprise and individual purposes, categorized by categories, states, or key phrases.You will find the most up-to-date types of forms just like the New Hampshire Instructions for Completing Mortgage Deed of Trust Form within minutes.

If you currently have a monthly subscription, log in and acquire New Hampshire Instructions for Completing Mortgage Deed of Trust Form from your US Legal Forms collection. The Acquire switch can look on every single type you see. You have access to all in the past acquired forms inside the My Forms tab of your accounts.

If you wish to use US Legal Forms initially, here are basic guidelines to obtain started out:

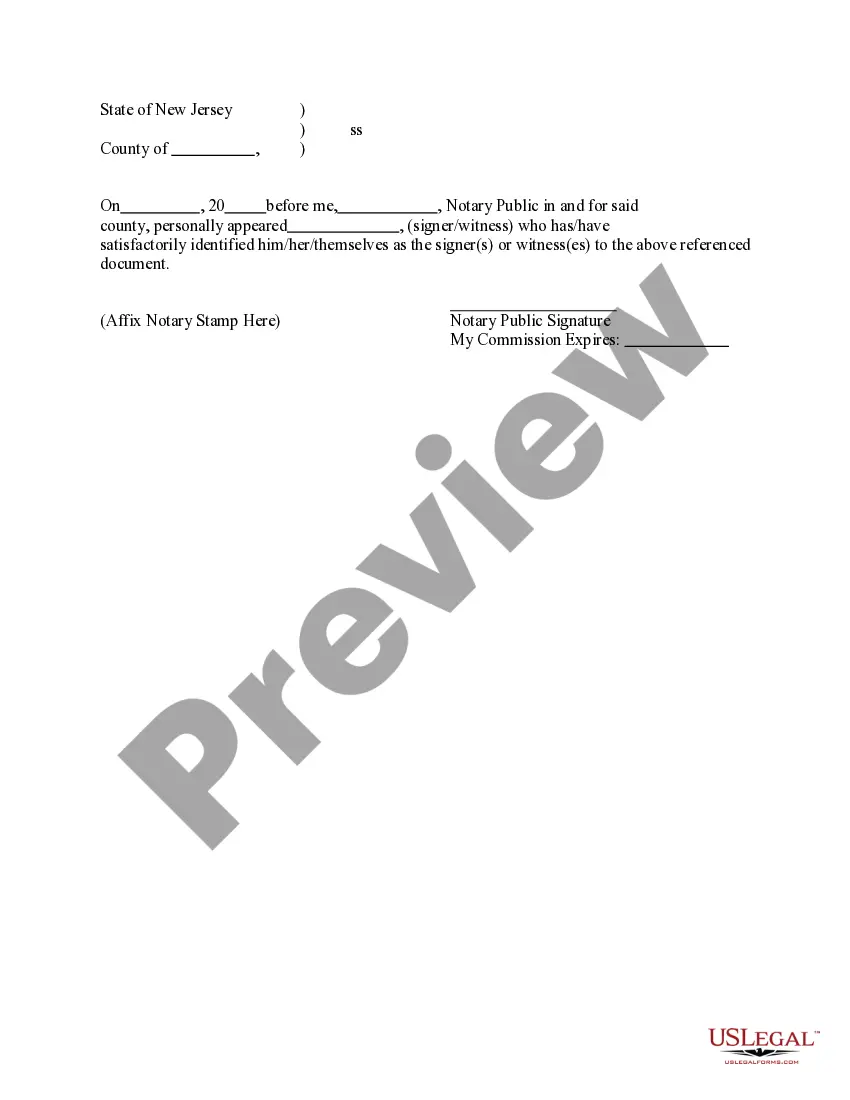

- Be sure to have picked the right type for your personal city/area. Click the Preview switch to examine the form`s articles. Browse the type description to actually have selected the appropriate type.

- In the event the type does not satisfy your requirements, make use of the Search industry at the top of the screen to get the one that does.

- Should you be satisfied with the form, verify your decision by visiting the Acquire now switch. Then, pick the costs program you want and give your credentials to register for the accounts.

- Procedure the financial transaction. Use your Visa or Mastercard or PayPal accounts to finish the financial transaction.

- Find the file format and acquire the form on your own gadget.

- Make modifications. Fill up, modify and produce and signal the acquired New Hampshire Instructions for Completing Mortgage Deed of Trust Form.

Each and every format you included with your bank account does not have an expiration date and is also yours forever. So, if you would like acquire or produce one more backup, just proceed to the My Forms portion and then click about the type you will need.

Get access to the New Hampshire Instructions for Completing Mortgage Deed of Trust Form with US Legal Forms, probably the most substantial collection of legitimate record web templates. Use 1000s of specialist and status-certain web templates that meet your company or individual needs and requirements.

Form popularity

FAQ

A legal document (which may be a deed or other instrument) that creates a trust. The trust document appoints the trustees and states the terms of the trust, including who the beneficiaries are and the trust property that will be subject to the trust.

A legal document that creates a trust, giving a person or organization the right to manage money or property for someone else, and says how this should be done: The trust deed stated clearly what they were entitled to do with the property.

To create a living trust in New Hampshire, you sign the trust document in front of a notary public. The trust is not in effect though until you actually transfer ownership of assets to its name.

Deeds of Trust transactions will always involve three parties - there will be: The Beneficiary (lender) The Trustor (borrower) The Third Party Trustee (holds the legal title, often a title company)

When you signed up for your Trust Deed, you agreed to make monthly payments towards your debts for a set period of time, typically four years. Now these four years are up, any remaining unsecured debt will be automatically written off.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

Any assignment of a mortgage and any assignment of the beneficial interest under a deed of trust may be recorded, and from the time the same is filed for record operates as constructive notice of the contents thereof to all persons; and any instrument by which any mortgage or deed of trust of, lien upon or interest in ...