"Form of Mortgage Deed of Trust and Variations" is an American Lawyer Media form. The following form is for a mortgage deed of trust with variations.

New Hampshire Form of Mortgage Deed of Trust and Variations

Description

How to fill out Form Of Mortgage Deed Of Trust And Variations?

It is possible to invest hrs on-line attempting to find the legitimate record format that fits the state and federal requirements you will need. US Legal Forms supplies 1000s of legitimate kinds that happen to be examined by specialists. It is simple to acquire or print out the New Hampshire Form of Mortgage Deed of Trust and Variations from your services.

If you already possess a US Legal Forms account, you may log in and click the Download option. Afterward, you may full, modify, print out, or indication the New Hampshire Form of Mortgage Deed of Trust and Variations. Every single legitimate record format you buy is your own for a long time. To acquire yet another copy associated with a purchased type, proceed to the My Forms tab and click the corresponding option.

If you are using the US Legal Forms site initially, stick to the simple instructions listed below:

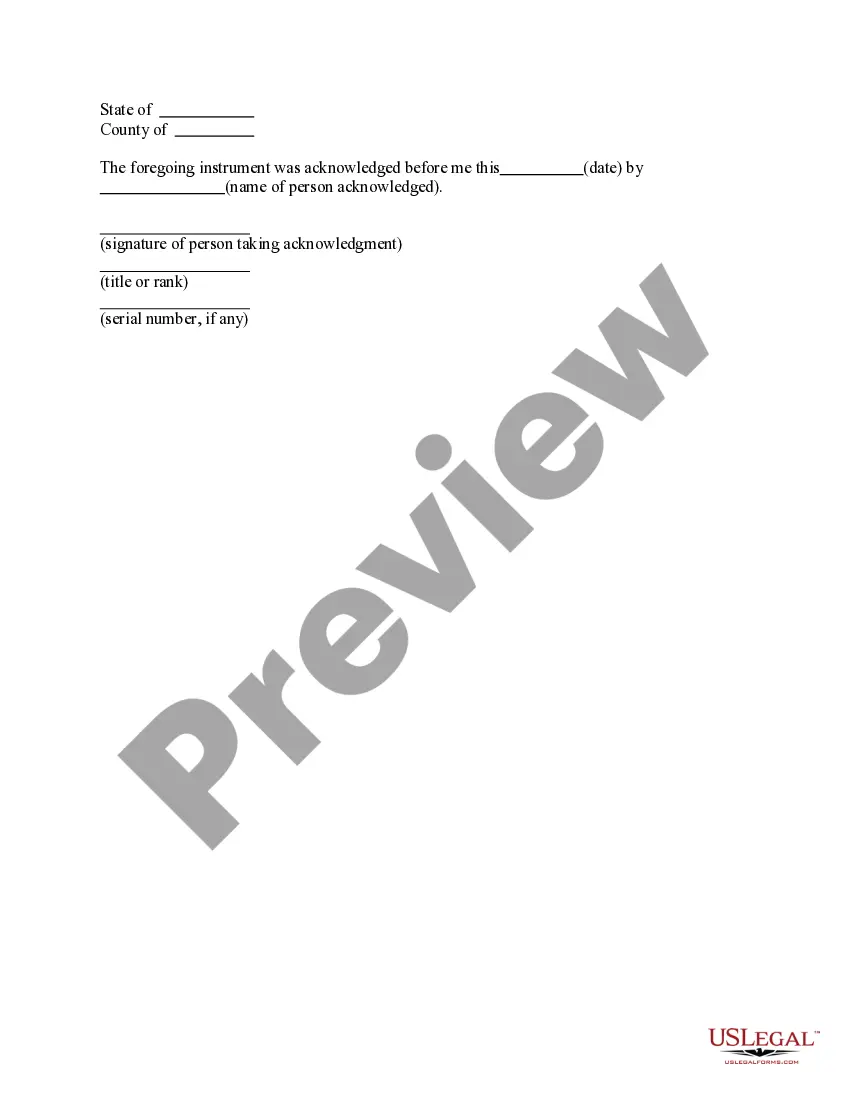

- Initial, be sure that you have chosen the proper record format for the state/metropolis of your choice. Look at the type description to make sure you have picked the appropriate type. If offered, make use of the Review option to look throughout the record format at the same time.

- If you want to locate yet another edition of your type, make use of the Research discipline to get the format that fits your needs and requirements.

- After you have found the format you want, just click Get now to continue.

- Find the costs strategy you want, type in your qualifications, and register for an account on US Legal Forms.

- Comprehensive the purchase. You may use your bank card or PayPal account to purchase the legitimate type.

- Find the file format of your record and acquire it in your device.

- Make alterations in your record if required. It is possible to full, modify and indication and print out New Hampshire Form of Mortgage Deed of Trust and Variations.

Download and print out 1000s of record themes making use of the US Legal Forms site, that provides the most important variety of legitimate kinds. Use professional and condition-distinct themes to handle your small business or personal demands.

Form popularity

FAQ

A deed of variation is a legal document that is used to change the details of an existing trust. In most circumstances, in order to properly execute a Deed of Variation, it is important that the Appointor (sometimes referred to as a Principal or Guardian) along with Trustee consents to the proposed change.

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes.

The deed of trust is what secures the promissory note. The promissory note includes the interest rate, the payment amounts and terms, and the buyer's promise to pay the lender the amount borrowed plus interest.

Ing to the term of a trust instrument, it can be defined into different types. For example: Inter Vivo trust is created when the settlor is alive. Testamentary trust is usually created through the terms of a settlor's will and goes into effect after the death of the settlor.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

Can a trust deed be amended? Once executed, a deed cannot be amended. However, you can have the deed amended or redrafted as many times as you like before you sign it, as long as you are willing to pay the solicitor for the extra work.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.