Colorado Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc.

Description

How to fill out Plan Of Merger Between Stamps.Com, Inc., Rocket Acquisition Corp. And Iship.Com, Inc.?

If you want to full, acquire, or print legitimate record web templates, use US Legal Forms, the biggest selection of legitimate kinds, that can be found on the Internet. Utilize the site`s simple and hassle-free search to find the files you want. Numerous web templates for enterprise and personal purposes are sorted by types and suggests, or keywords. Use US Legal Forms to find the Colorado Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc. in just a few click throughs.

When you are already a US Legal Forms consumer, log in in your account and click the Download key to find the Colorado Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc.. You can even entry kinds you formerly delivered electronically inside the My Forms tab of your respective account.

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the form for your appropriate metropolis/land.

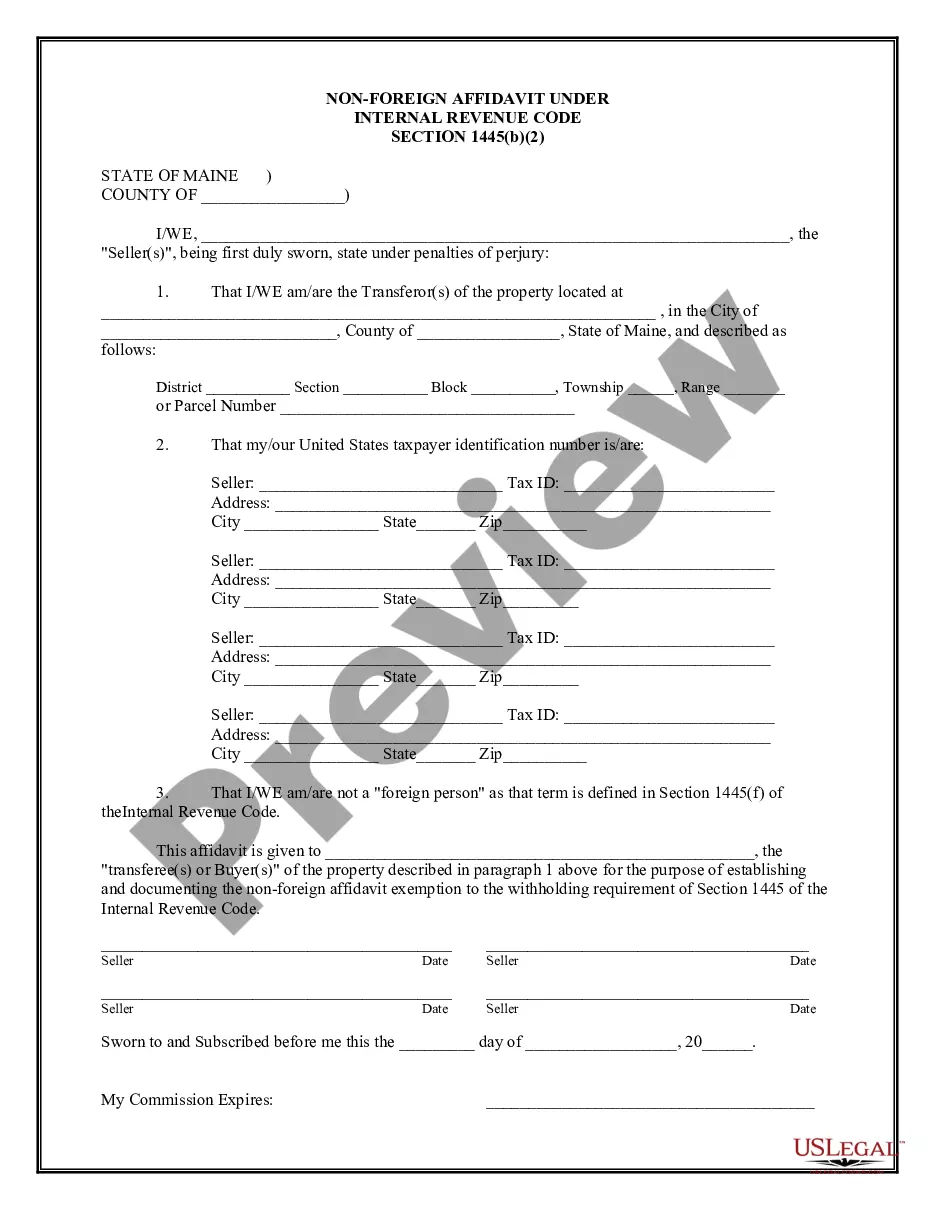

- Step 2. Utilize the Preview method to examine the form`s content material. Do not forget to read the outline.

- Step 3. When you are unsatisfied together with the type, utilize the Look for field towards the top of the screen to locate other variations in the legitimate type template.

- Step 4. When you have identified the form you want, click the Get now key. Choose the pricing prepare you prefer and add your references to sign up for an account.

- Step 5. Approach the deal. You should use your charge card or PayPal account to complete the deal.

- Step 6. Find the format in the legitimate type and acquire it in your gadget.

- Step 7. Full, edit and print or indication the Colorado Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc..

Each legitimate record template you buy is your own property forever. You might have acces to each and every type you delivered electronically inside your acccount. Select the My Forms portion and choose a type to print or acquire again.

Remain competitive and acquire, and print the Colorado Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc. with US Legal Forms. There are millions of skilled and state-distinct kinds you can use for your personal enterprise or personal requirements.