If you want to full, download, or print out legal document templates, use US Legal Forms, the greatest variety of legal types, which can be found on-line. Take advantage of the site`s basic and practical look for to discover the files you require. A variety of templates for enterprise and individual functions are categorized by classes and suggests, or keywords. Use US Legal Forms to discover the New Hampshire Contest of Final Account and Proposed Distributions in a Probate Estate within a number of clicks.

Should you be currently a US Legal Forms consumer, log in to your account and then click the Obtain option to obtain the New Hampshire Contest of Final Account and Proposed Distributions in a Probate Estate. You can also access types you formerly delivered electronically in the My Forms tab of your own account.

If you work with US Legal Forms the very first time, follow the instructions beneath:

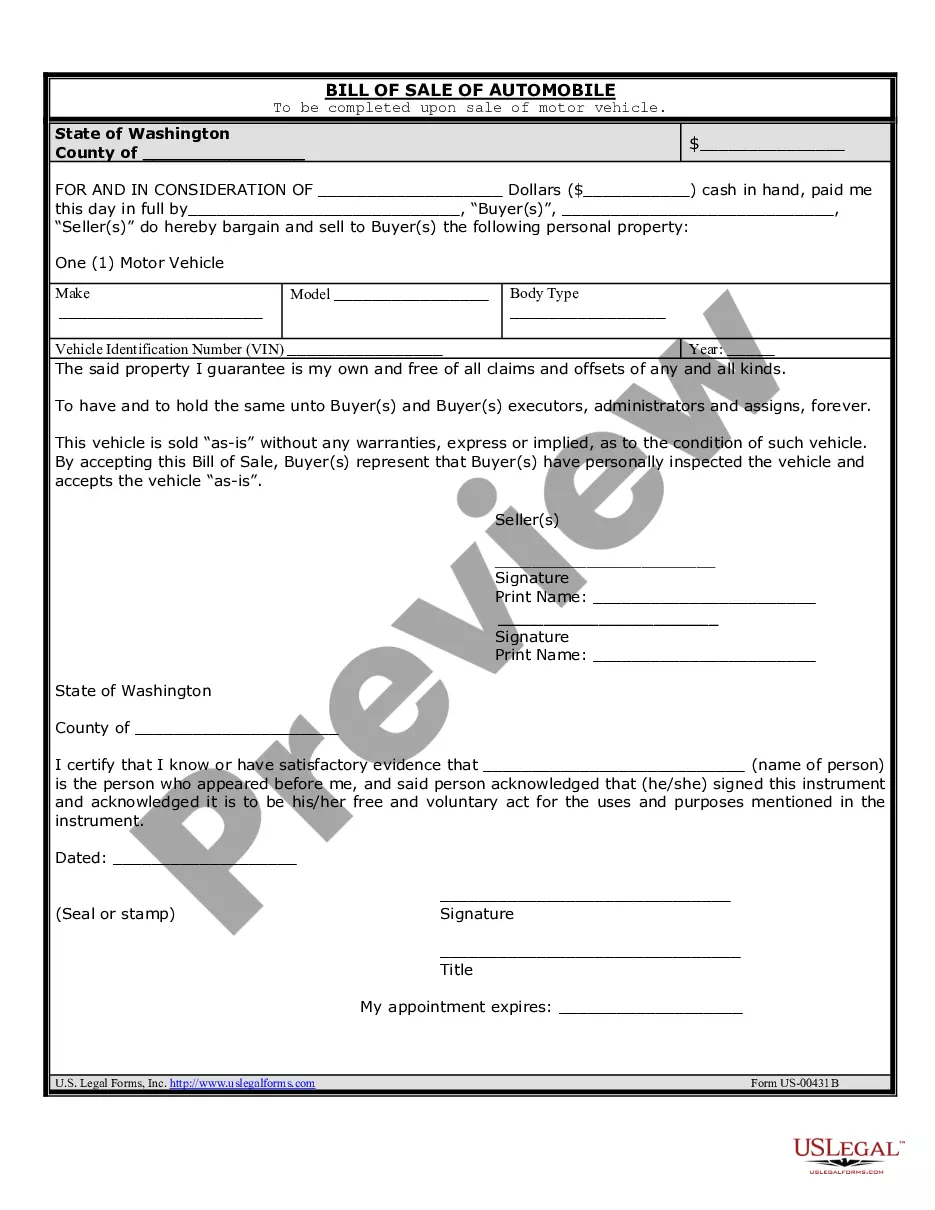

- Step 1. Be sure you have chosen the form for that correct metropolis/country.

- Step 2. Make use of the Review option to examine the form`s content. Do not neglect to learn the explanation.

- Step 3. Should you be unhappy with all the develop, utilize the Lookup field towards the top of the display screen to get other versions in the legal develop web template.

- Step 4. When you have located the form you require, click the Buy now option. Choose the costs prepare you prefer and include your references to register on an account.

- Step 5. Procedure the financial transaction. You may use your charge card or PayPal account to accomplish the financial transaction.

- Step 6. Choose the structure in the legal develop and download it on the system.

- Step 7. Total, revise and print out or signal the New Hampshire Contest of Final Account and Proposed Distributions in a Probate Estate.

Every legal document web template you acquire is your own property permanently. You possess acces to each develop you delivered electronically with your acccount. Go through the My Forms portion and choose a develop to print out or download again.

Contend and download, and print out the New Hampshire Contest of Final Account and Proposed Distributions in a Probate Estate with US Legal Forms. There are thousands of expert and express-certain types you can use for your enterprise or individual demands.