Nebraska Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit)

Description

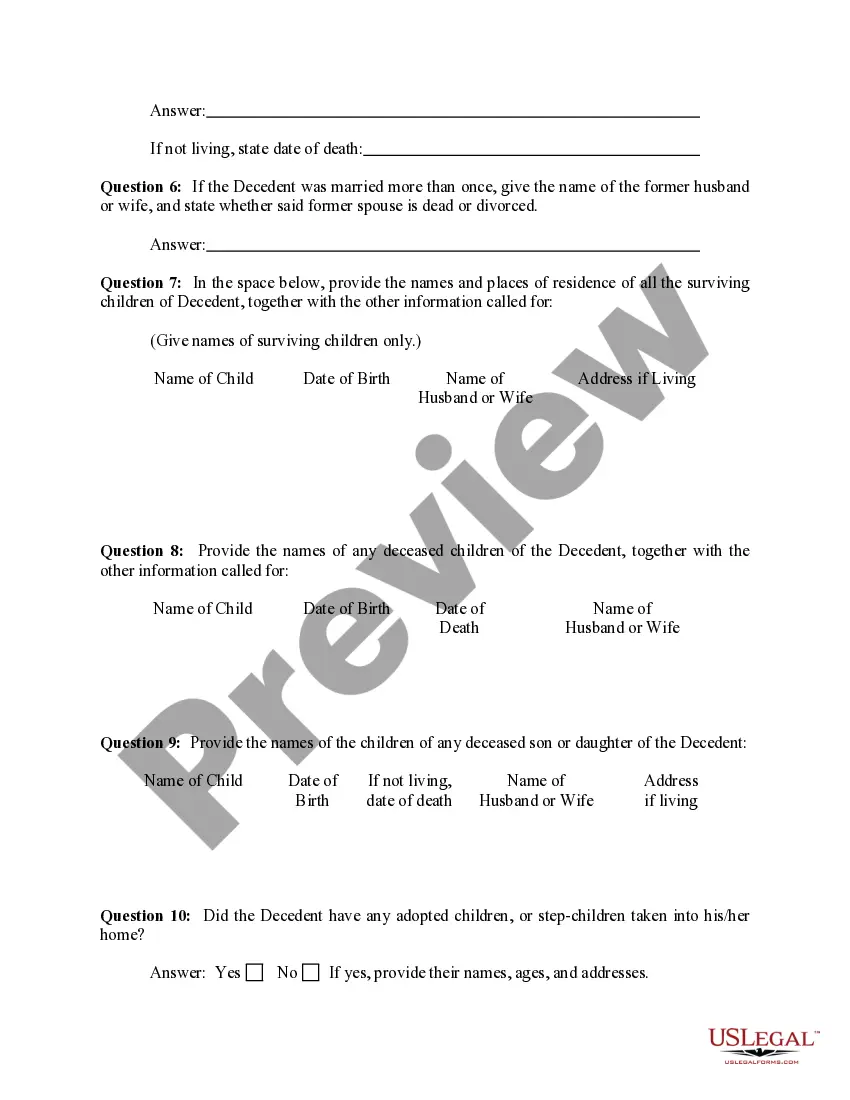

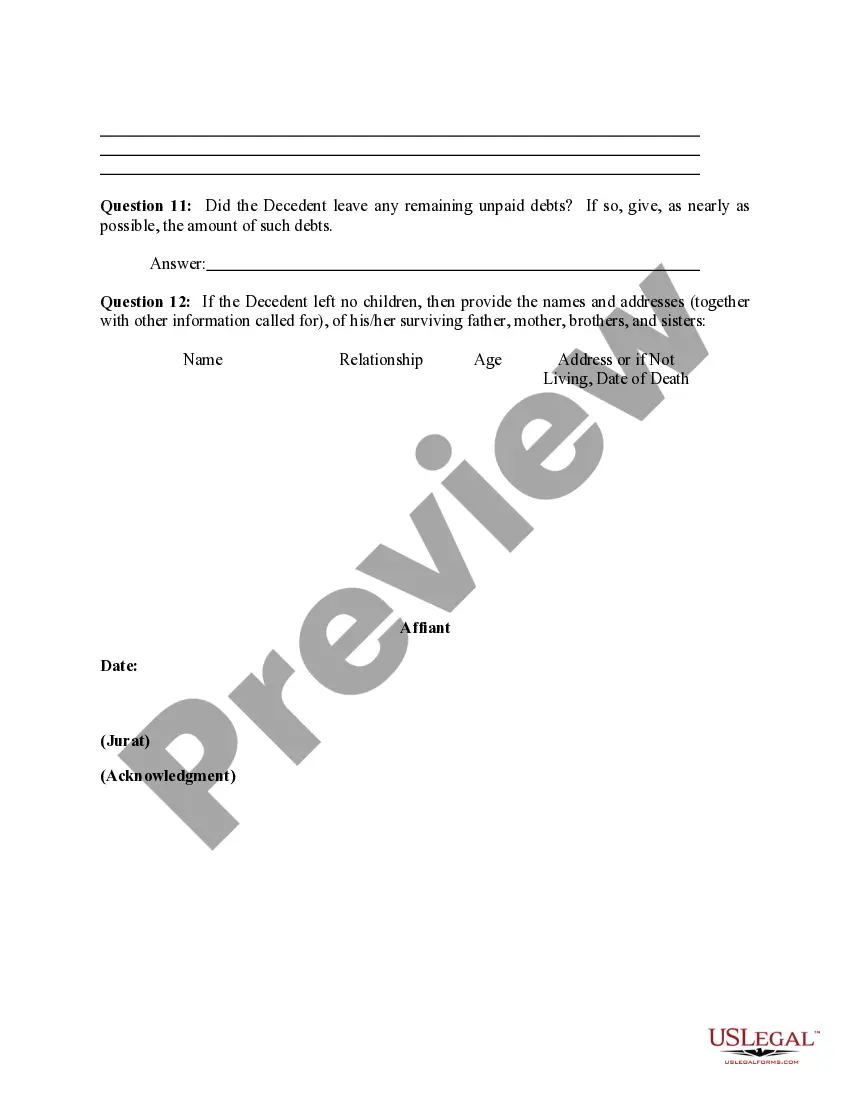

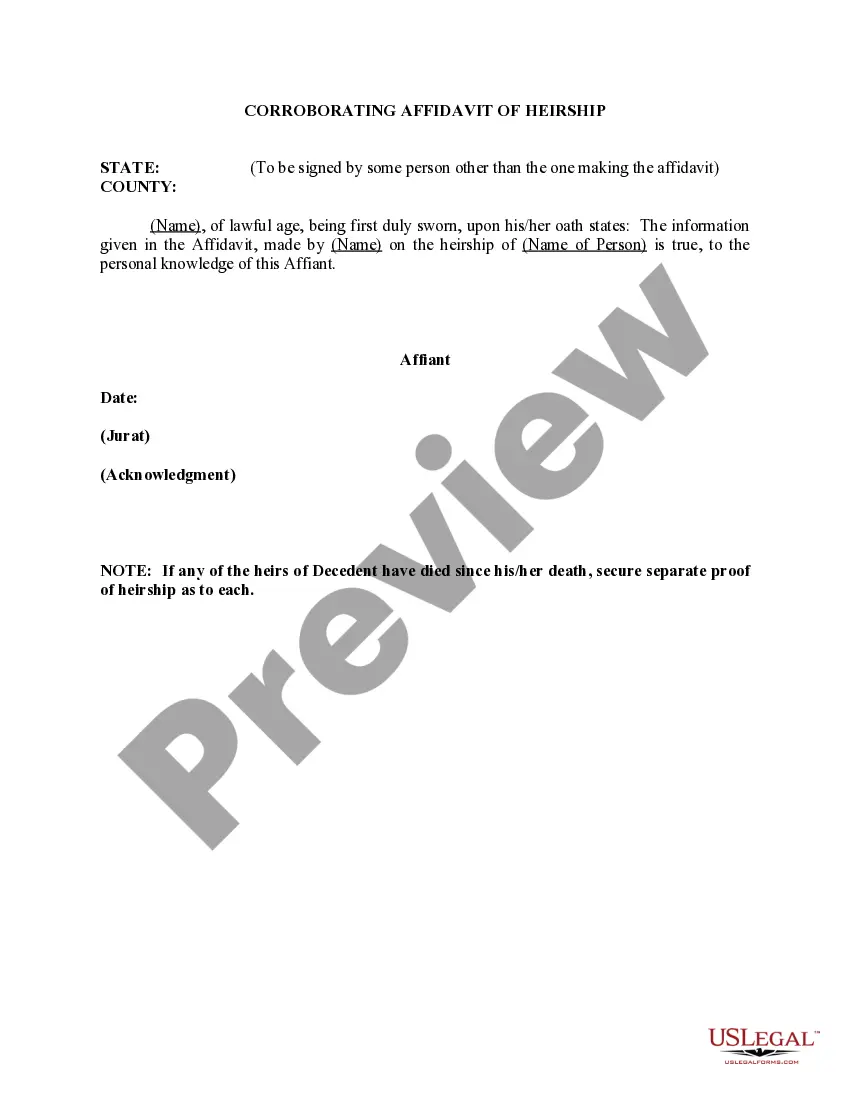

How to fill out Affidavit As To Heirship Of (Name Of Person), Deceased (With Corroborating Affidavit)?

If you want to total, down load, or printing legitimate document layouts, use US Legal Forms, the greatest variety of legitimate varieties, which can be found on the Internet. Take advantage of the site`s simple and hassle-free look for to obtain the papers you want. Various layouts for organization and specific reasons are sorted by groups and states, or keywords. Use US Legal Forms to obtain the Nebraska Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) in just a couple of mouse clicks.

If you are presently a US Legal Forms buyer, log in to your accounts and click the Download option to get the Nebraska Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit). You may also gain access to varieties you previously delivered electronically inside the My Forms tab of your accounts.

If you use US Legal Forms initially, refer to the instructions under:

- Step 1. Make sure you have selected the shape for the right area/land.

- Step 2. Take advantage of the Preview option to look over the form`s content material. Don`t overlook to read the description.

- Step 3. If you are unsatisfied using the develop, utilize the Search field at the top of the display screen to locate other variations from the legitimate develop template.

- Step 4. Upon having located the shape you want, click the Buy now option. Pick the costs strategy you choose and add your accreditations to sign up on an accounts.

- Step 5. Procedure the transaction. You may use your Мisa or Ьastercard or PayPal accounts to finish the transaction.

- Step 6. Find the formatting from the legitimate develop and down load it on your own product.

- Step 7. Full, modify and printing or indication the Nebraska Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit).

Each and every legitimate document template you purchase is yours permanently. You may have acces to every single develop you delivered electronically in your acccount. Go through the My Forms section and select a develop to printing or down load again.

Be competitive and down load, and printing the Nebraska Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) with US Legal Forms. There are many skilled and status-specific varieties you may use for your organization or specific demands.

Form popularity

FAQ

You may be able to avoid probate in Nebraska if you: Establish a Living Trust. Title assets in Joint Tenancy.

You can file formal or informal probate starting five days after the person's death, and Nebraska probate laws don't have a set deadline for when you must begin the process.

What Is a Small Estate? Nebraska Revised Statute §30-24, 125 recites the guidelines. Basically, if a decedent's estate involves less than $50,000 in probatable personal property and/or $50,000 or less in real estate, no probate is required.

In order to obtain Letters Testamentary, an interested party (typically the nominated executor under the will) must petition the Surrogate's Court and provide pertinent information regarding the decedent, relevant parties (spouse, children, etc.), and the decedent's assets.

Specifically, this entails: Locating and taking control of the decedent's assets. Opening the estate with the probate court. Completing a full inventory of the estate's assets. Communicating with creditors and paying debts. Denying invalid creditor claims. Paying applicable taxes, including the Nebraska inheritance tax.

You must file the affidavit with the register of deeds office of the county in which the real property of the deceased is located and also file, in any other county in Nebraska in which the real property of the deceased that is subject to the affidavit is located, the recorded affidavit and a certified or authenticated ...

Most people are surprised to learn that Nebraska's intestacy laws, which apply when a resident dies without a will, dictate who gets what. For a married person with no children, Nebraska law says $100,000 plus one-half of your remaining assets go to your spouse, and the balance of your assets go to your parents.

In Nebraska, for example, probate is required if the total fair market value of all the decedent's personal property, wherever located, less liens and encumbrances, is more than fifty thousand dollars ($50,000).