Nebraska Affidavit of Heirship - Descent

Description

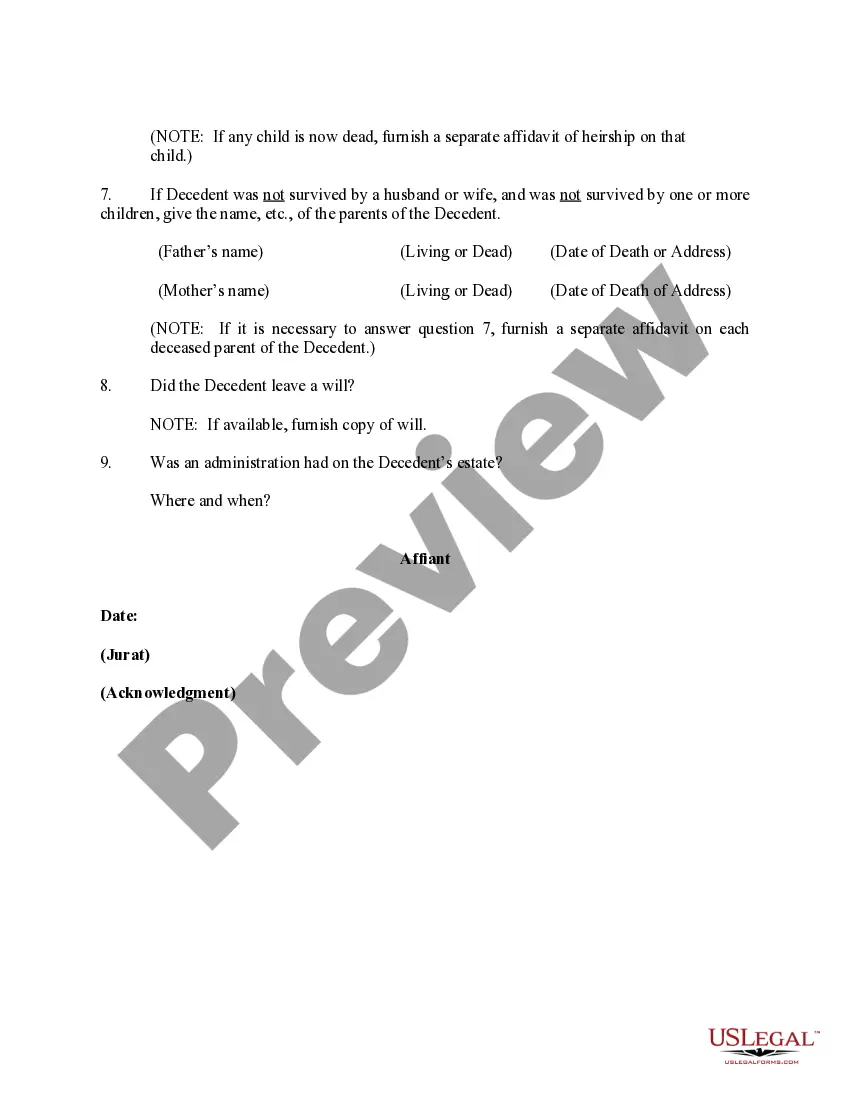

How to fill out Affidavit Of Heirship - Descent?

If you want to comprehensive, obtain, or produce authorized file templates, use US Legal Forms, the biggest selection of authorized forms, which can be found on the Internet. Utilize the site`s basic and handy research to obtain the documents you require. A variety of templates for enterprise and personal purposes are categorized by classes and suggests, or search phrases. Use US Legal Forms to obtain the Nebraska Affidavit of Heirship - Descent in a handful of mouse clicks.

In case you are already a US Legal Forms consumer, log in in your account and then click the Download key to have the Nebraska Affidavit of Heirship - Descent. You can also gain access to forms you in the past acquired inside the My Forms tab of your respective account.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Ensure you have selected the shape for the proper metropolis/region.

- Step 2. Make use of the Review option to look over the form`s articles. Don`t neglect to see the explanation.

- Step 3. In case you are not happy using the develop, make use of the Research discipline towards the top of the screen to find other models of your authorized develop design.

- Step 4. Once you have found the shape you require, select the Acquire now key. Opt for the prices strategy you like and add your references to register on an account.

- Step 5. Method the purchase. You should use your credit card or PayPal account to accomplish the purchase.

- Step 6. Pick the file format of your authorized develop and obtain it on your product.

- Step 7. Comprehensive, change and produce or sign the Nebraska Affidavit of Heirship - Descent.

Every single authorized file design you acquire is yours eternally. You have acces to each develop you acquired inside your acccount. Click on the My Forms portion and decide on a develop to produce or obtain again.

Contend and obtain, and produce the Nebraska Affidavit of Heirship - Descent with US Legal Forms. There are millions of expert and express-particular forms you can use for your enterprise or personal demands.

Form popularity

FAQ

You may be able to avoid probate in Nebraska if you: Establish a Living Trust. Title assets in Joint Tenancy. Probate Fees in Nebraska [Updated 2021] | Trust & Will trustandwill.com ? learn ? nebraska-probate-fees trustandwill.com ? learn ? nebraska-probate-fees

In Nebraska, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.

If you die without a will in Nebraska, your assets will go to your closest relatives under state "intestate succession" laws.

You can file formal or informal probate starting five days after the person's death, and Nebraska probate laws don't have a set deadline for when you must begin the process. Nebraska Probate - Inheritance Funding inheritancefunding.com ? state ? nebraska-p... inheritancefunding.com ? state ? nebraska-p...

Most people are surprised to learn that Nebraska's intestacy laws, which apply when a resident dies without a will, dictate who gets what. For a married person with no children, Nebraska law says $100,000 plus one-half of your remaining assets go to your spouse, and the balance of your assets go to your parents. Publications - Koley Jessen koleyjessen.com ? newsroom-publications-i... koleyjessen.com ? newsroom-publications-i...

Nebraska Inheritance and Gift Tax If you leave money to your spouse, there is no inheritance tax. For other relationships, the following rates apply: Class 1: Parents, siblings, children, grandparents and any spouses/descendants of these relatives. These individuals pay 1% on any value over $40,000.

You must file the affidavit with the register of deeds office of the county in which the real property of the deceased is located and also file, in any other county in Nebraska in which the real property of the deceased that is subject to the affidavit is located, the recorded affidavit and a certified or authenticated ... Affidavit for Transfer of Real Property without Probate Nebraska Judicial Branch | (.gov) ? self-help ? estates Nebraska Judicial Branch | (.gov) ? self-help ? estates

If you leave no spouse, children, grandchildren or parents, your estate would go to your ?next of kin,? as defined in Nebraska law. The portion of your estate that a relative would receive would depend upon how closely he or she was related to you.