Nebraska Affidavit of Heirship for Real Property

Description

How to fill out Affidavit Of Heirship For Real Property?

Choosing the best lawful papers format might be a have difficulties. Naturally, there are a variety of layouts available on the net, but how will you discover the lawful form you require? Make use of the US Legal Forms website. The assistance provides thousands of layouts, like the Nebraska Affidavit of Heirship for Real Property, that you can use for business and personal demands. All the types are checked by experts and satisfy state and federal requirements.

If you are currently signed up, log in to your accounts and click on the Down load switch to have the Nebraska Affidavit of Heirship for Real Property. Make use of accounts to check with the lawful types you might have bought formerly. Go to the My Forms tab of the accounts and obtain another backup from the papers you require.

If you are a fresh consumer of US Legal Forms, listed below are easy recommendations for you to adhere to:

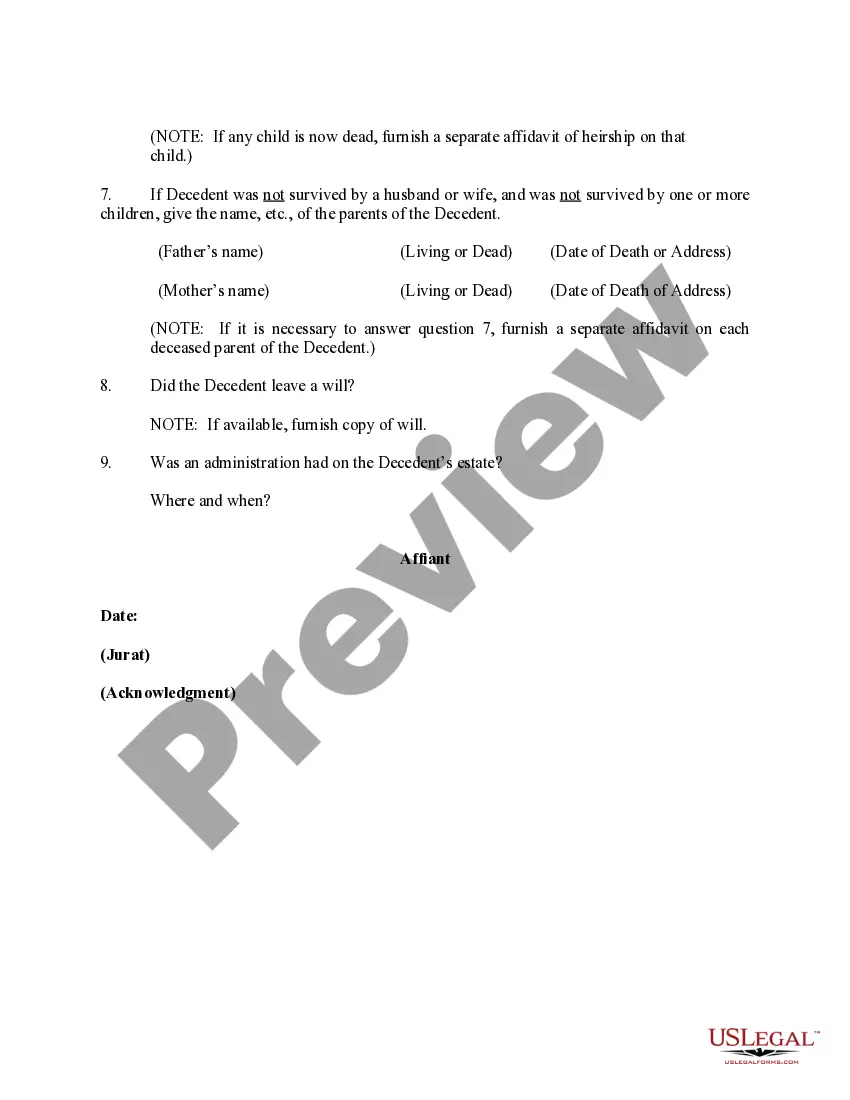

- Very first, make sure you have selected the right form for your personal city/county. You may look through the form using the Review switch and look at the form description to make sure it will be the best for you.

- When the form is not going to satisfy your expectations, use the Seach discipline to get the correct form.

- When you are certain that the form is suitable, go through the Acquire now switch to have the form.

- Opt for the pricing prepare you want and enter in the necessary info. Create your accounts and pay money for the transaction with your PayPal accounts or bank card.

- Choose the file formatting and download the lawful papers format to your device.

- Total, change and produce and indicator the attained Nebraska Affidavit of Heirship for Real Property.

US Legal Forms will be the most significant collection of lawful types in which you can find different papers layouts. Make use of the service to download appropriately-produced papers that adhere to state requirements.

Form popularity

FAQ

You may be able to avoid probate in Nebraska if you: Establish a Living Trust. Title assets in Joint Tenancy.

You must file the affidavit with the register of deeds office of the county in which the real property of the deceased is located and also file, in any other county in Nebraska in which the real property of the deceased that is subject to the affidavit is located, the recorded affidavit and a certified or authenticated ...

An estate is officially considered settled when the executor has completed a series of tasks: submitting the will to probate court, inventorying the estate, notifying and paying off creditors, settling any taxes owed, and distributing the remaining assets ing to the will.

The Nebraska Probate Code provides two methods of presenting a claim against a decedent's estate: A claim can be presented by filing a written statement thereof with the clerk of the probate court or by commencing a proceeding against the personal representative in any court which has jurisdiction.

Step 1 ? Requirements for Small Estate ing to Nebraska statute § 30-24,125, probate is not required if the estate meets the following requirements: The value of the estate is $100,000 or less, not counting any liens and encumbrances. Thirty (30) days have passed from the date of death.

You can file formal or informal probate starting five days after the person's death, and Nebraska probate laws don't have a set deadline for when you must begin the process.

The task of settling a deceased person's estate, also known as probate, falls upon the executor. In Nebraska, this involves several key steps: validating the deceased's will, inventorying their assets, paying off any debts and taxes, and finally, distributing the remaining assets to the designated beneficiaries.

The fair market value of the entire estate of the deceased, less liens and encumbrances (everything the deceased owned minus everything the deceased owes) is $100,000.00 or less.