Nebraska Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

How to fill out Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

US Legal Forms - one of the largest repositories of legal templates in the USA - offers a vast array of legal document formats that you can download or print.

By utilizing the site, you will obtain thousands of templates for business and personal purposes, organized by categories, states, or keywords. You can find the latest forms such as the Nebraska Notice of Violation of Fair Debt Act - Notice to Stop Contact in seconds.

If you have an active subscription, Log In and download the Nebraska Notice of Violation of Fair Debt Act - Notice to Stop Contact from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents tab in your account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction.

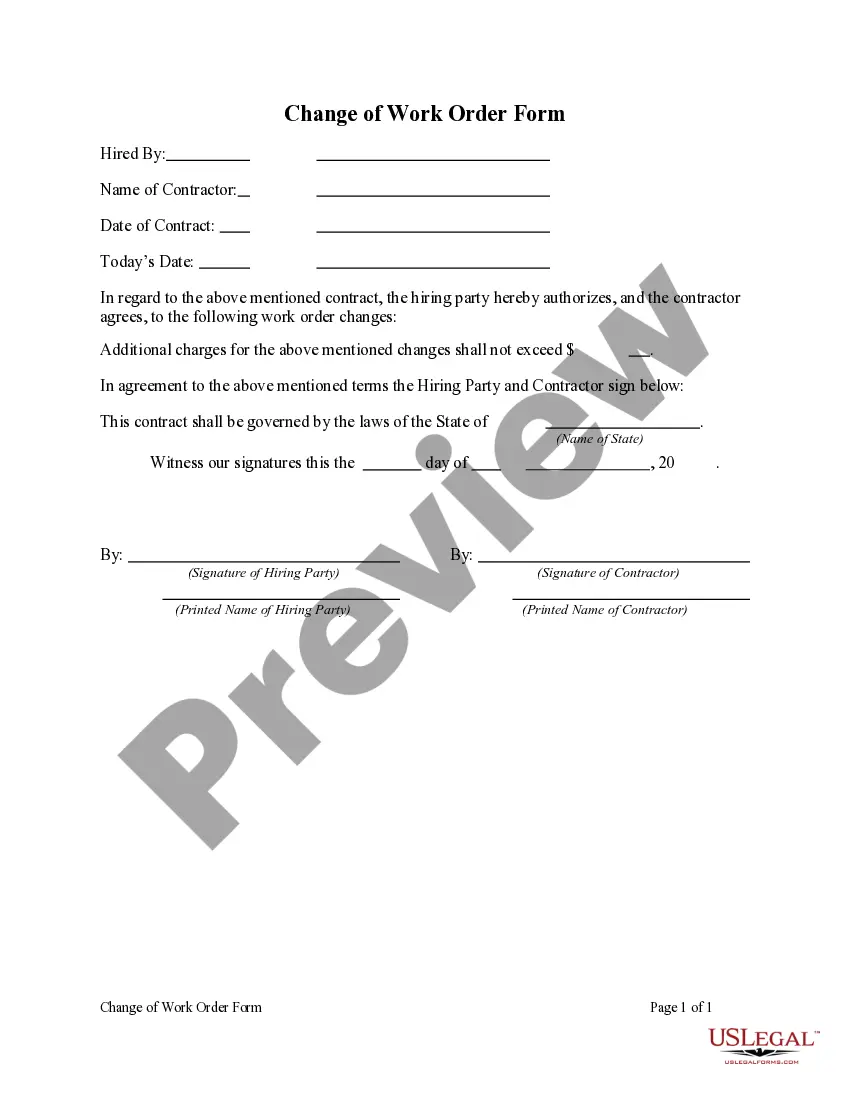

Select the format and download the form to your device. Make edits. Fill in, modify, print, and sign the downloaded Nebraska Notice of Violation of Fair Debt Act - Notice to Stop Contact. Each template you save to your account does not have an expiration date and remains your property indefinitely. Therefore, if you wish to download or print another version, simply go to the My documents section and click on the form you need. Access the Nebraska Notice of Violation of Fair Debt Act - Notice to Stop Contact with US Legal Forms, the most extensive library of legal document formats. Utilize a plethora of professional and state-specific templates that cater to your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

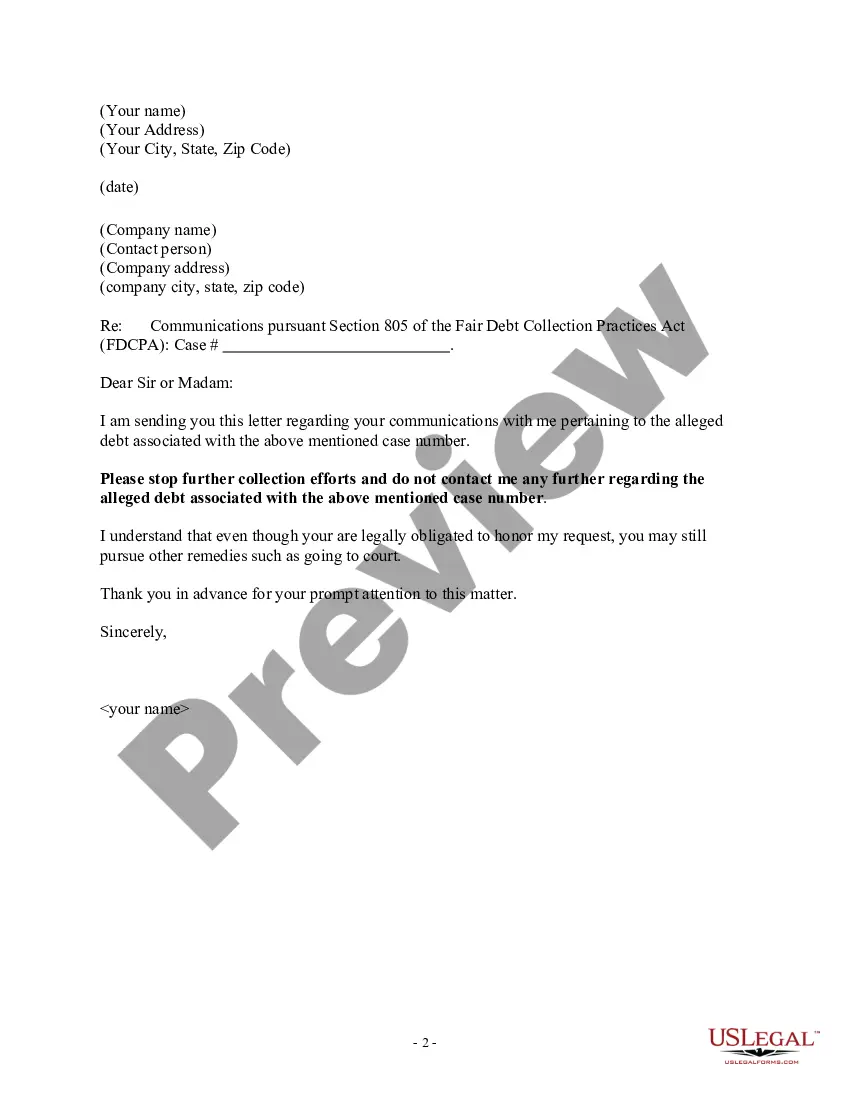

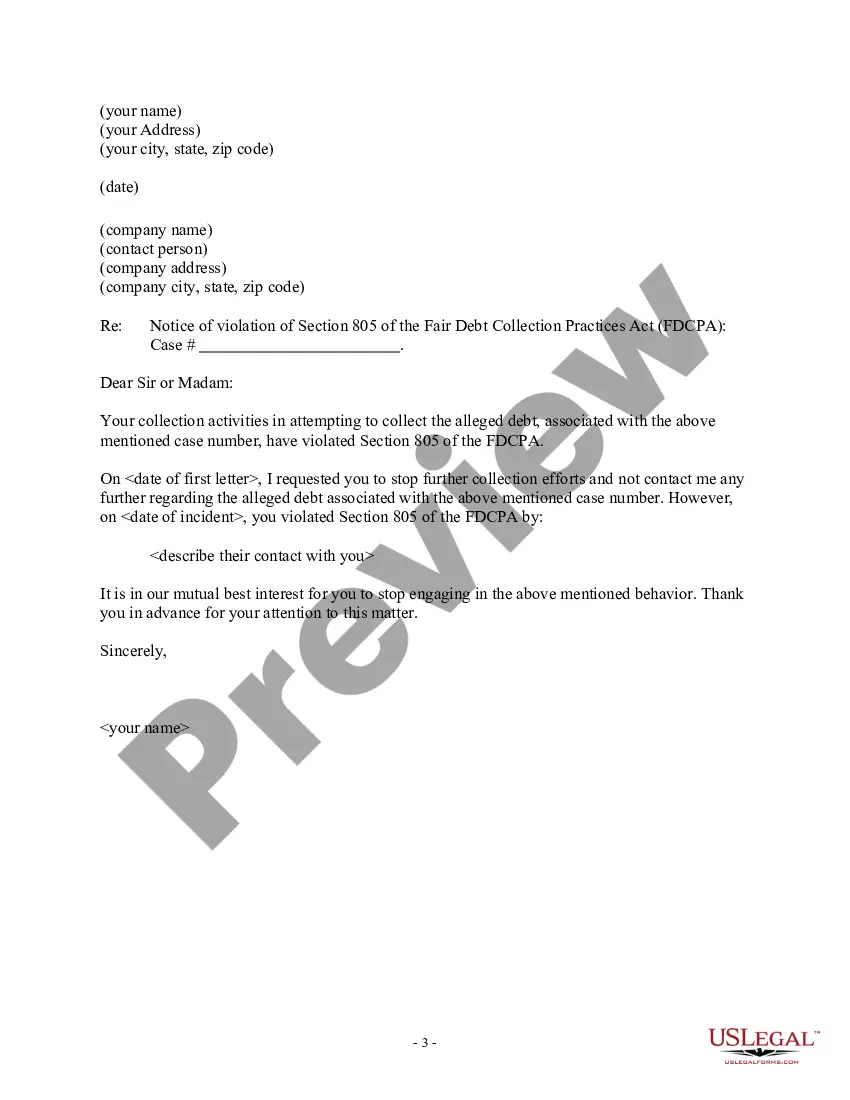

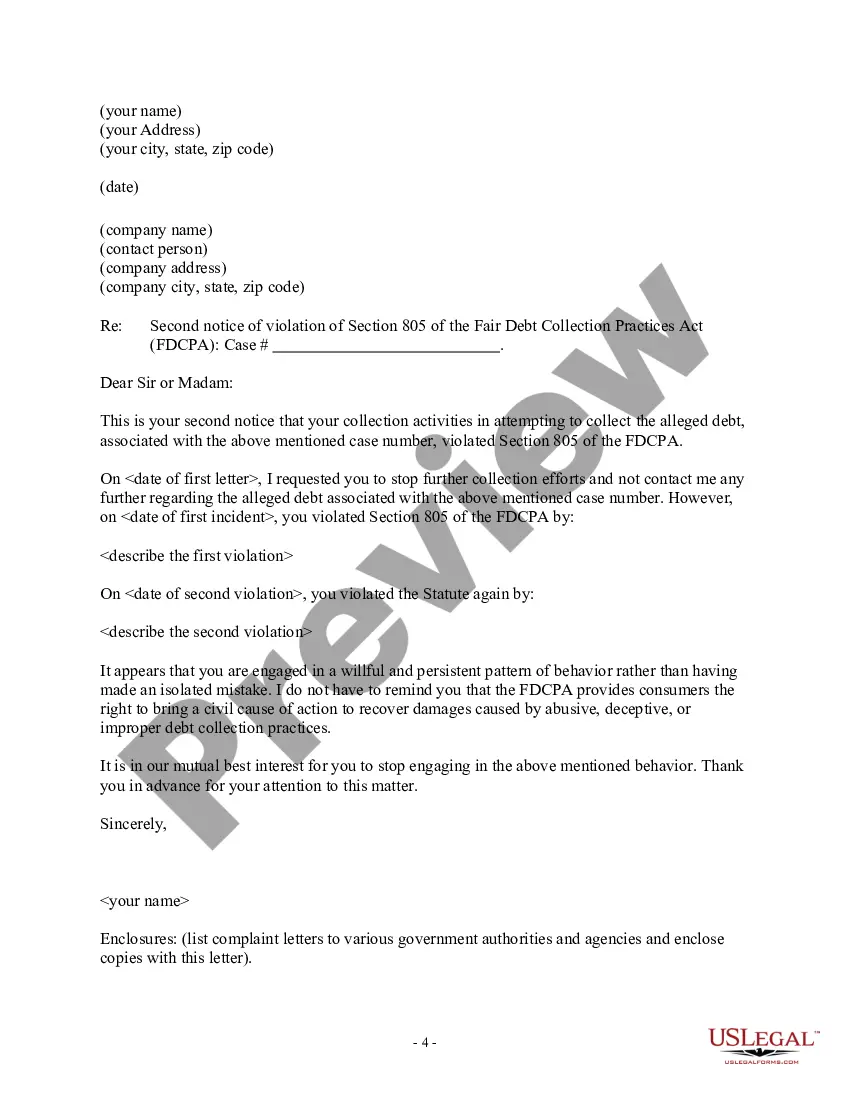

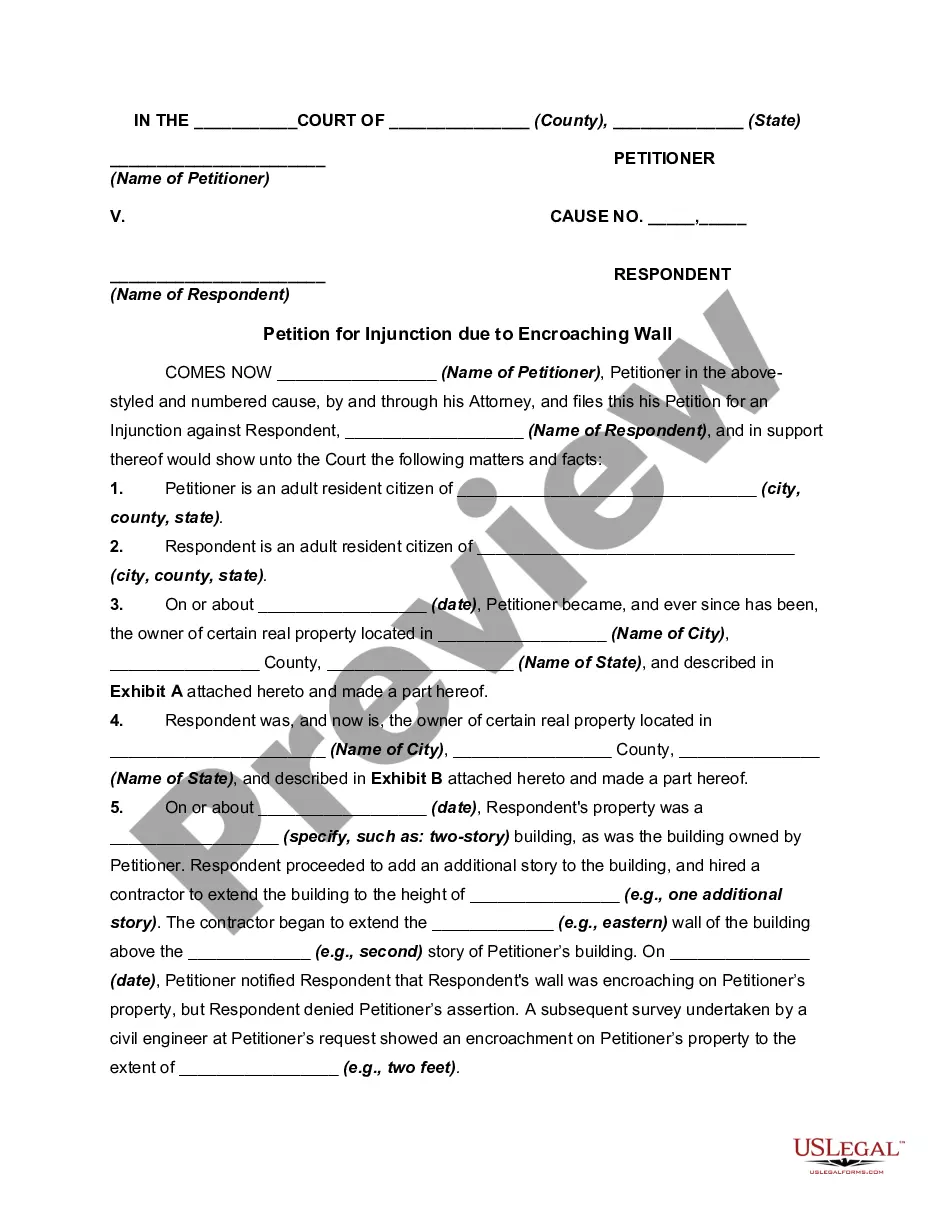

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the content of the form.

- Check the form description to confirm you have chosen the correct template.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

According to the FDCPA, a debt collector can only contact you, your attorney, or a consumer reporting agency. According to the FDCPA, a debt collector can not: Contact you before am or after pm in your time zone or at an inconvenient time. Contact you at your place of employment.

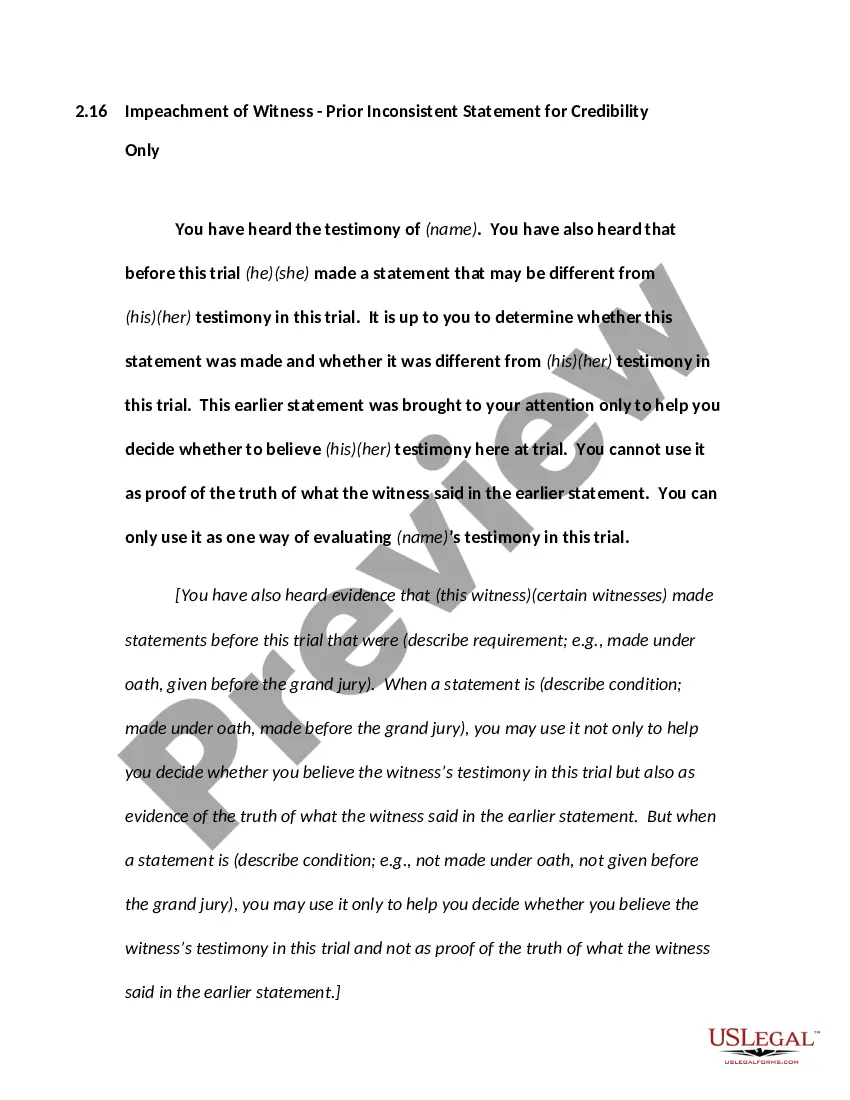

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.

You have the right to tell a debt collector to stop communicating with you. To stop communication, send a letter to the debt collector and keep a copy of the letter. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Dear debt collector, I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

The FDCPA prohibits debt collectors from calling you repeatedly, using profane language, making threats, or otherwise harassing you. If a debt collector is constantly calling you and causing you stress, sending a cease and desist letter can stop the collector from harassing you.

If you believe a debt collector is harassing you, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372). You can also contact your state's attorney general .

Cease and desist letters are legally binding notices to debt collectors telling them to stop contacting you. You don't need a lawyer for this -- just get your debt collector's name, address, and your account information and write a letter telling them to stop all contact, and by law, they have to do so.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.