Nebraska Notice of Violation of Fair Debt Act - Improper Contact at Work

Description

How to fill out Notice Of Violation Of Fair Debt Act - Improper Contact At Work?

Are you currently in a situation where you require documentation for occasional business or specific reasons almost every day.

There are numerous legal document templates available online, but finding reliable ones isn't easy.

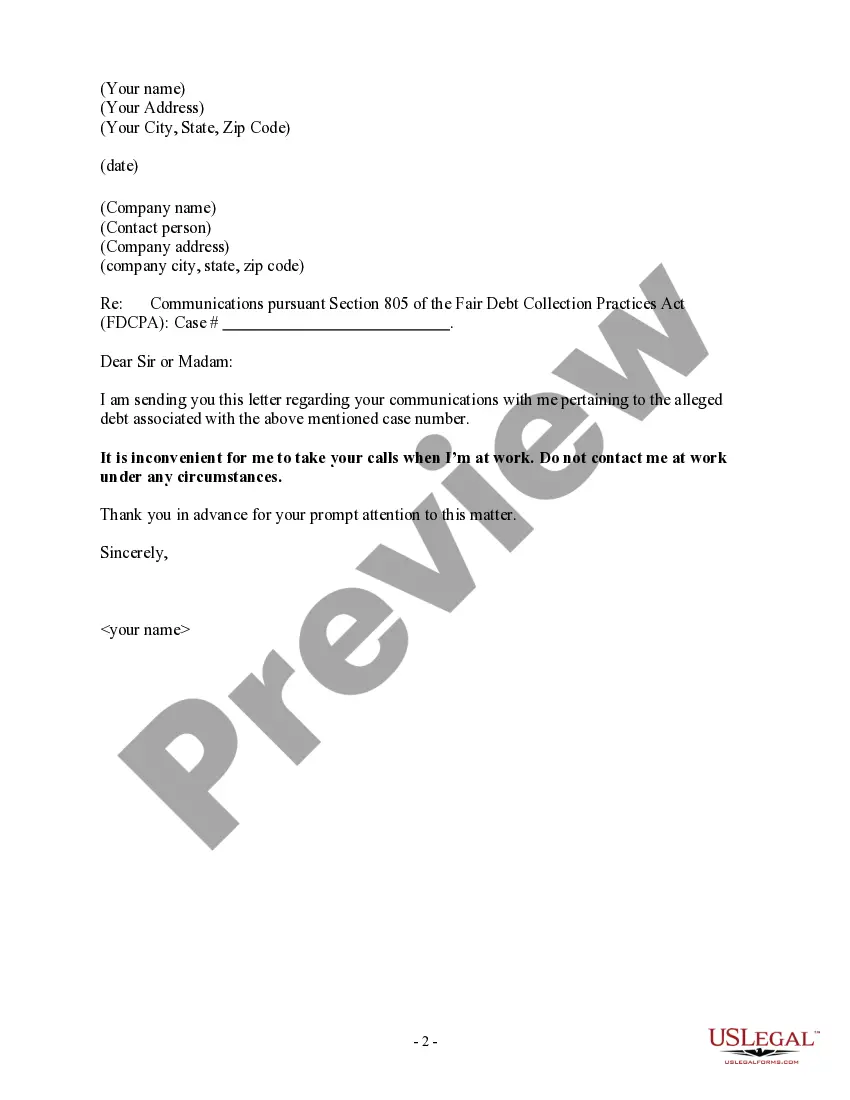

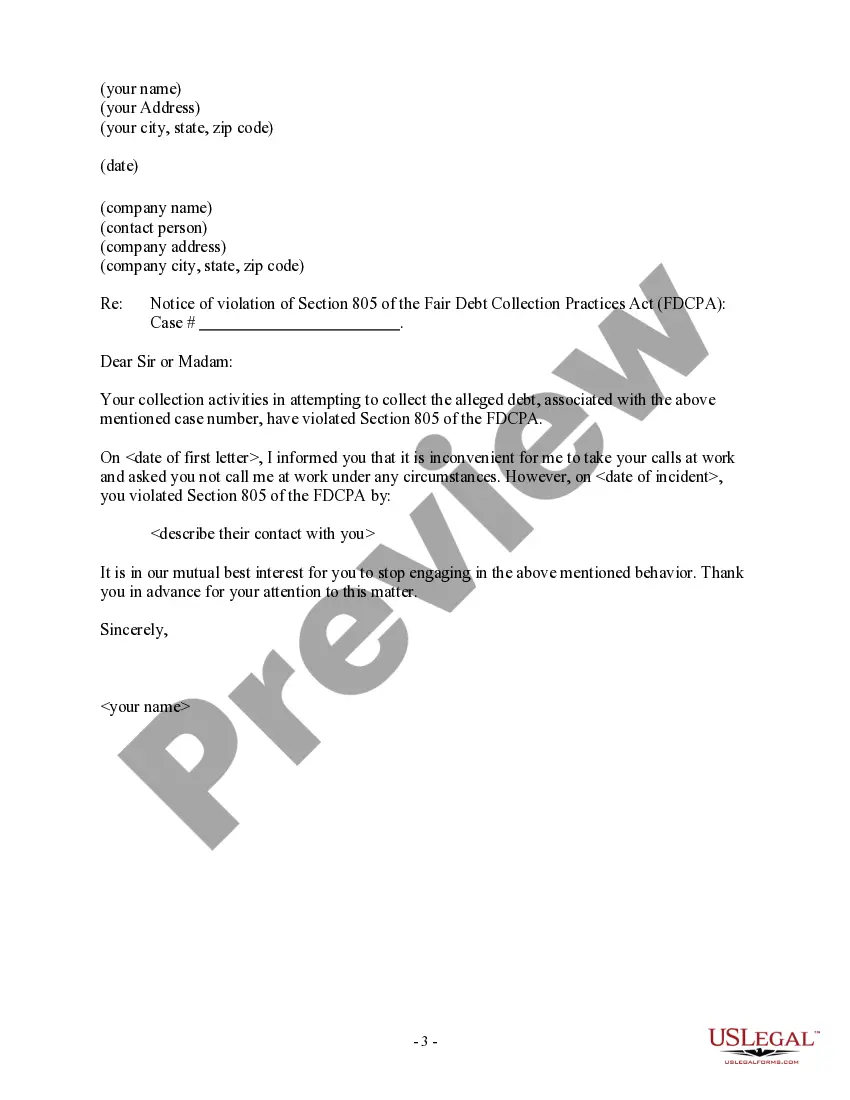

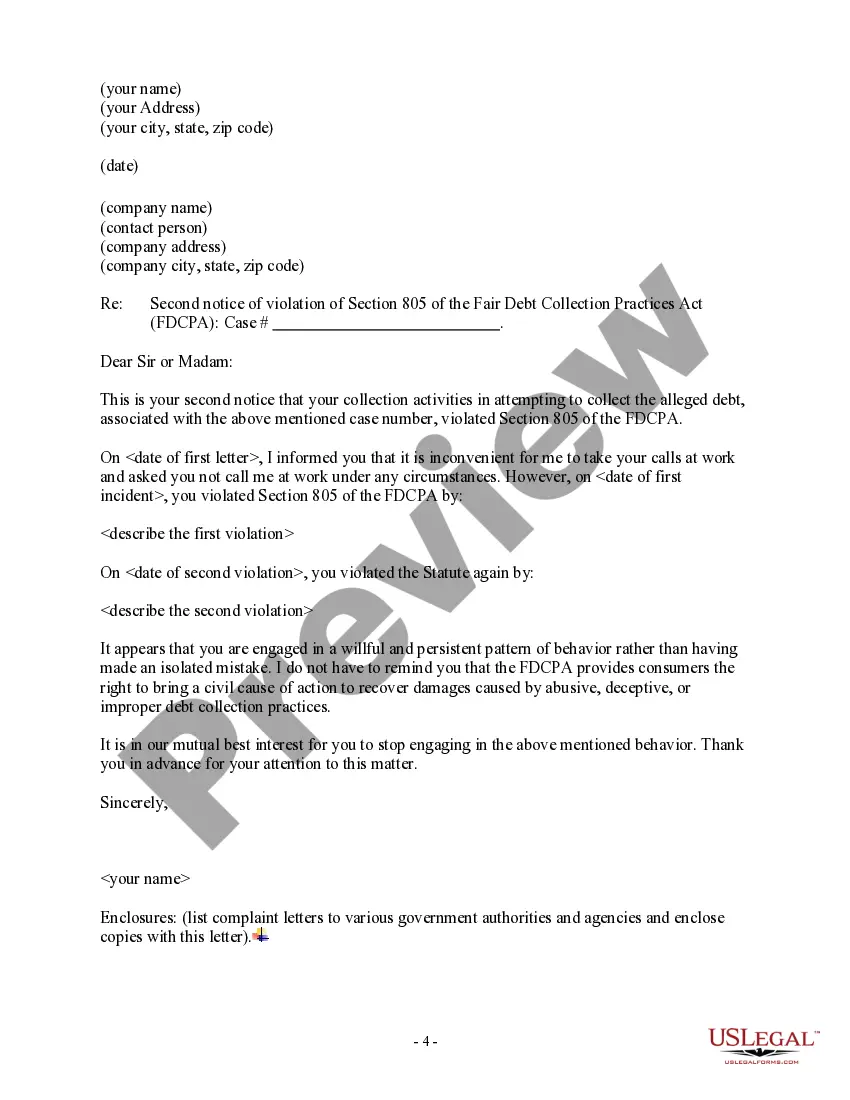

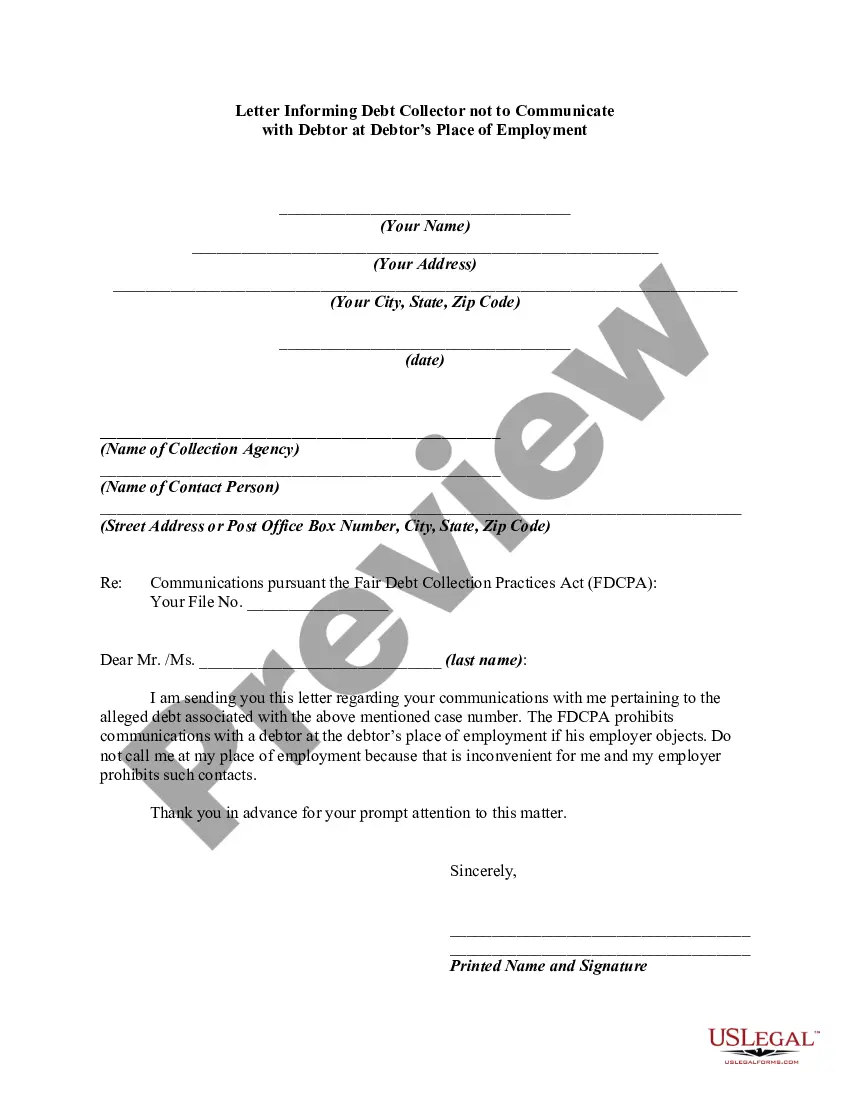

US Legal Forms provides thousands of form templates, such as the Nebraska Notice of Violation of Fair Debt Act - Improper Contact at Work, designed to comply with state and federal requirements.

Choose the pricing plan you prefer, complete the required information to create your account, and finalize the purchase using PayPal or credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Nebraska Notice of Violation of Fair Debt Act - Improper Contact at Work template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for the correct city/state.

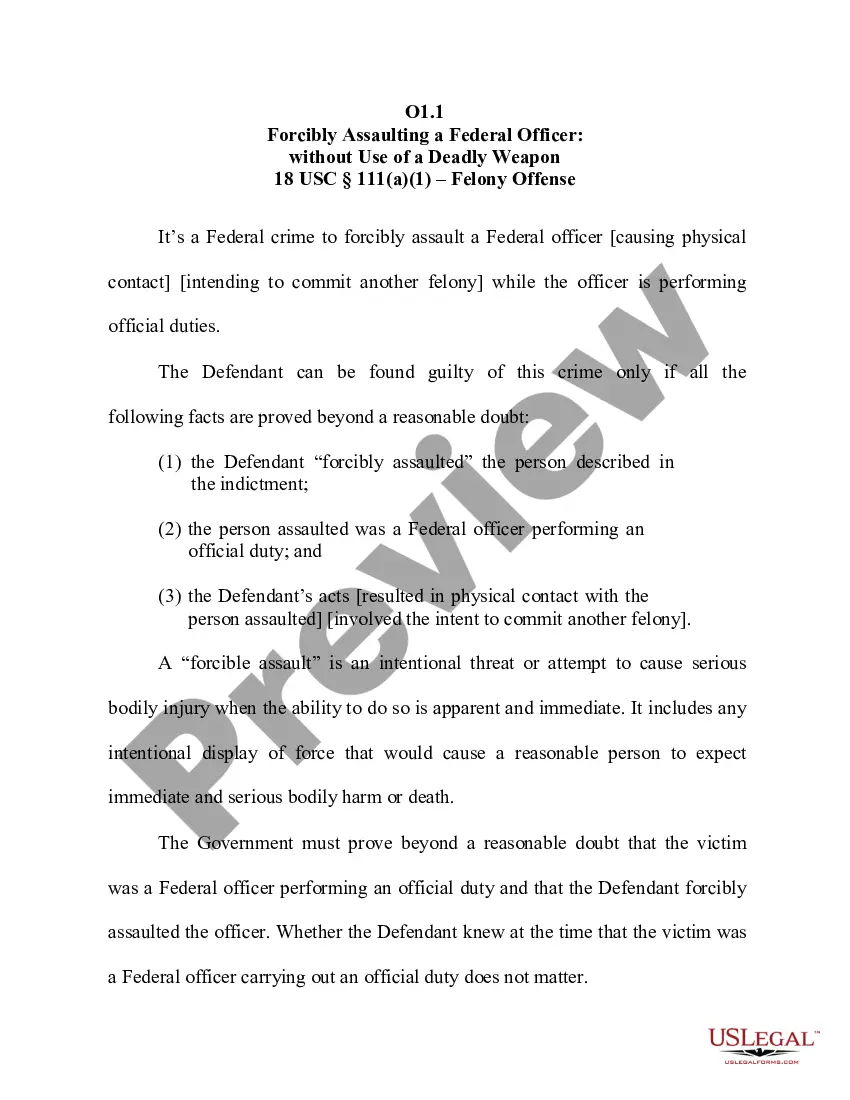

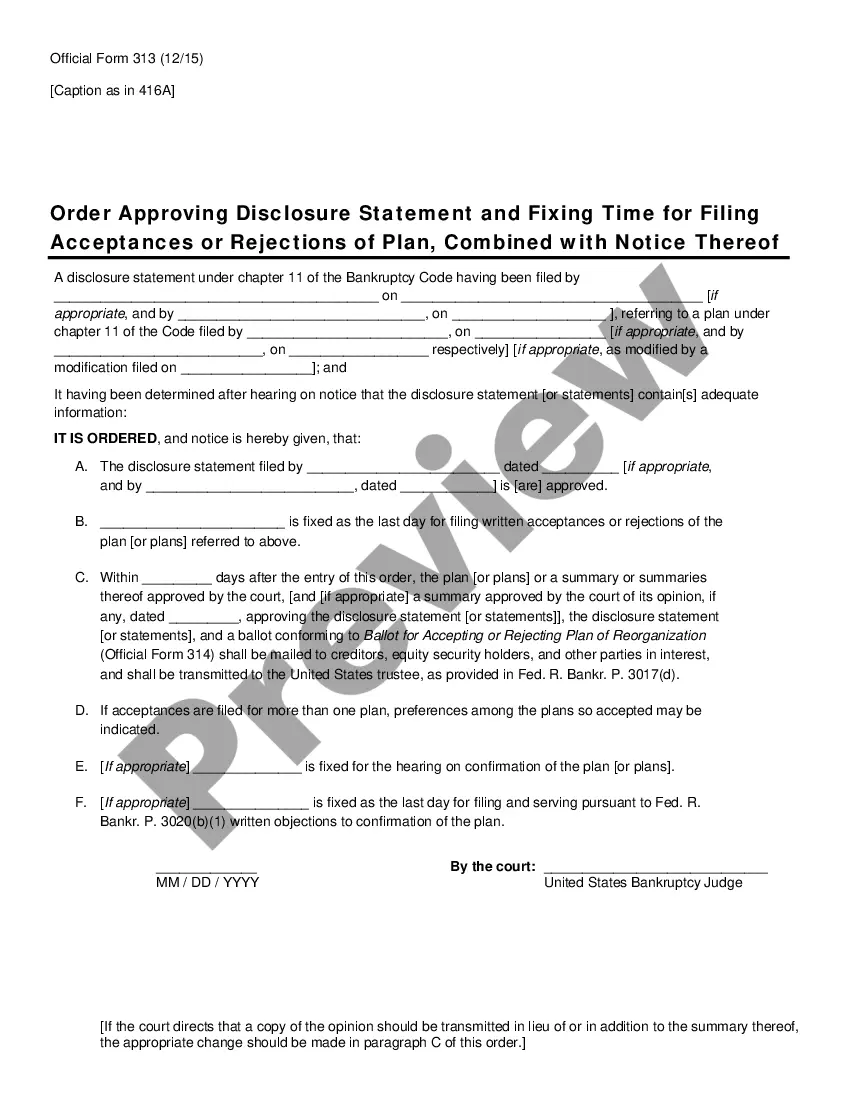

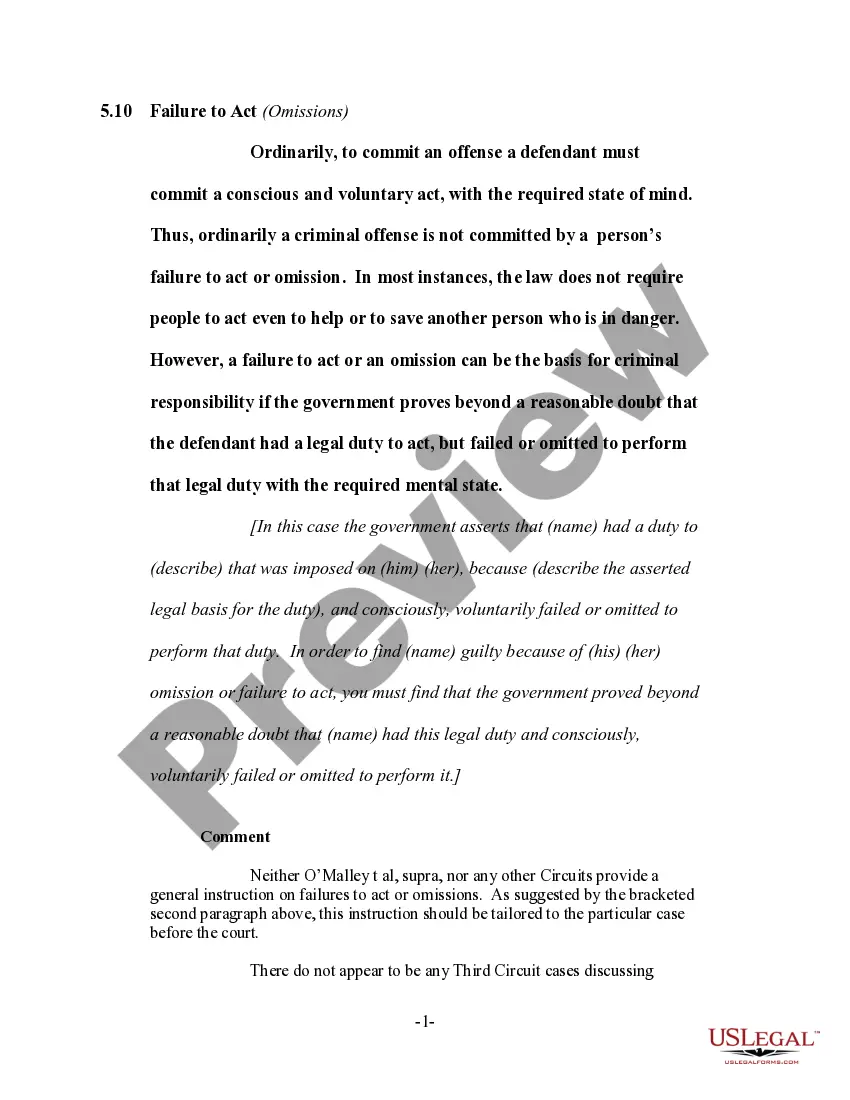

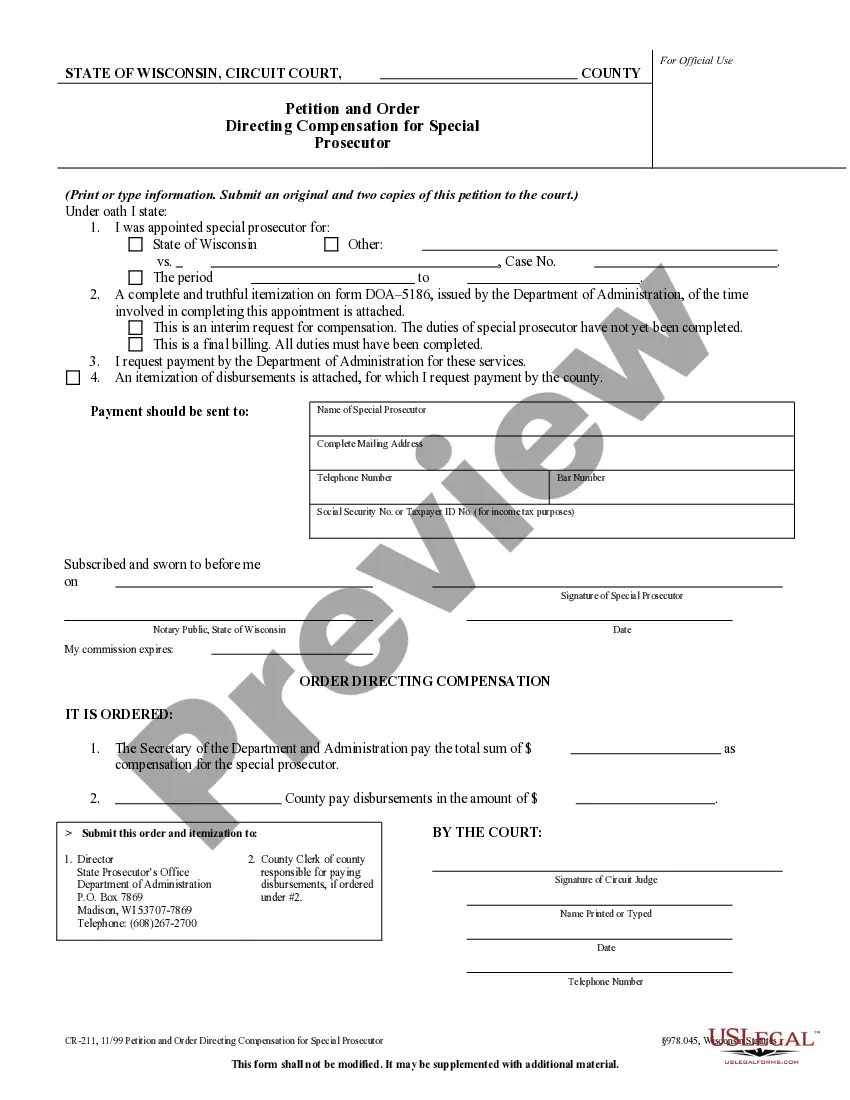

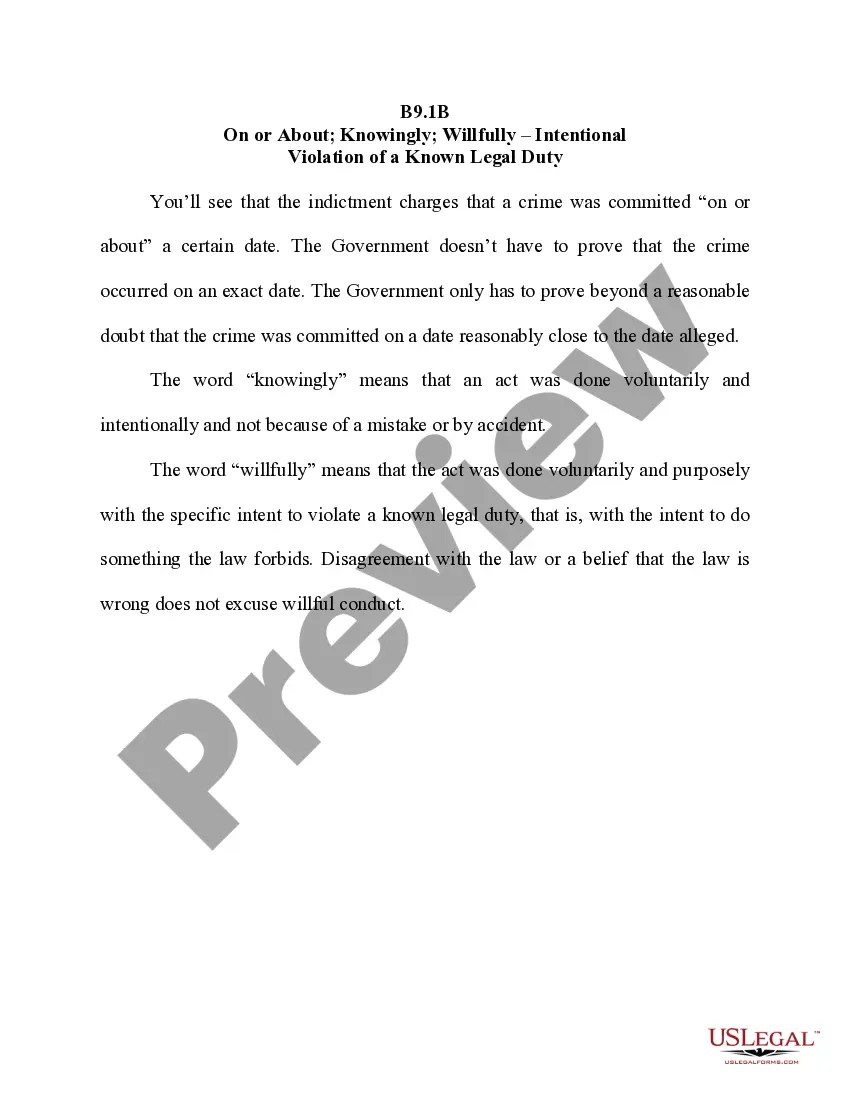

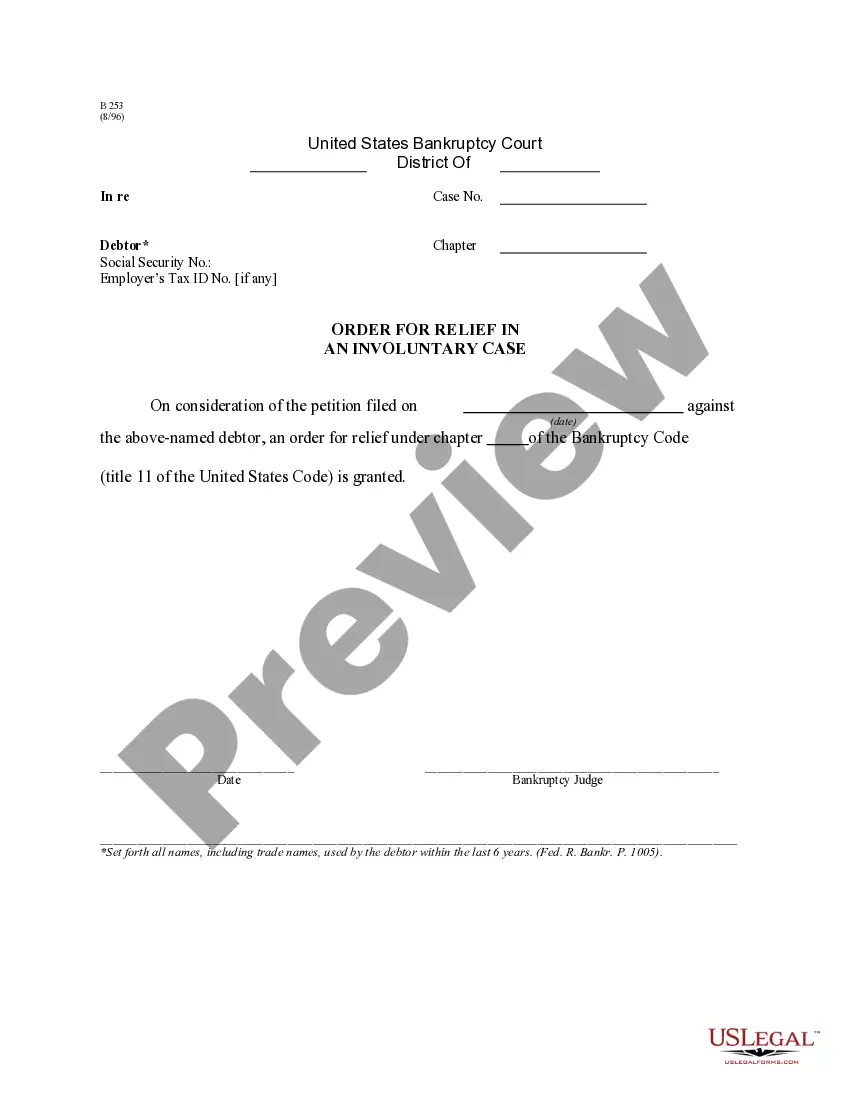

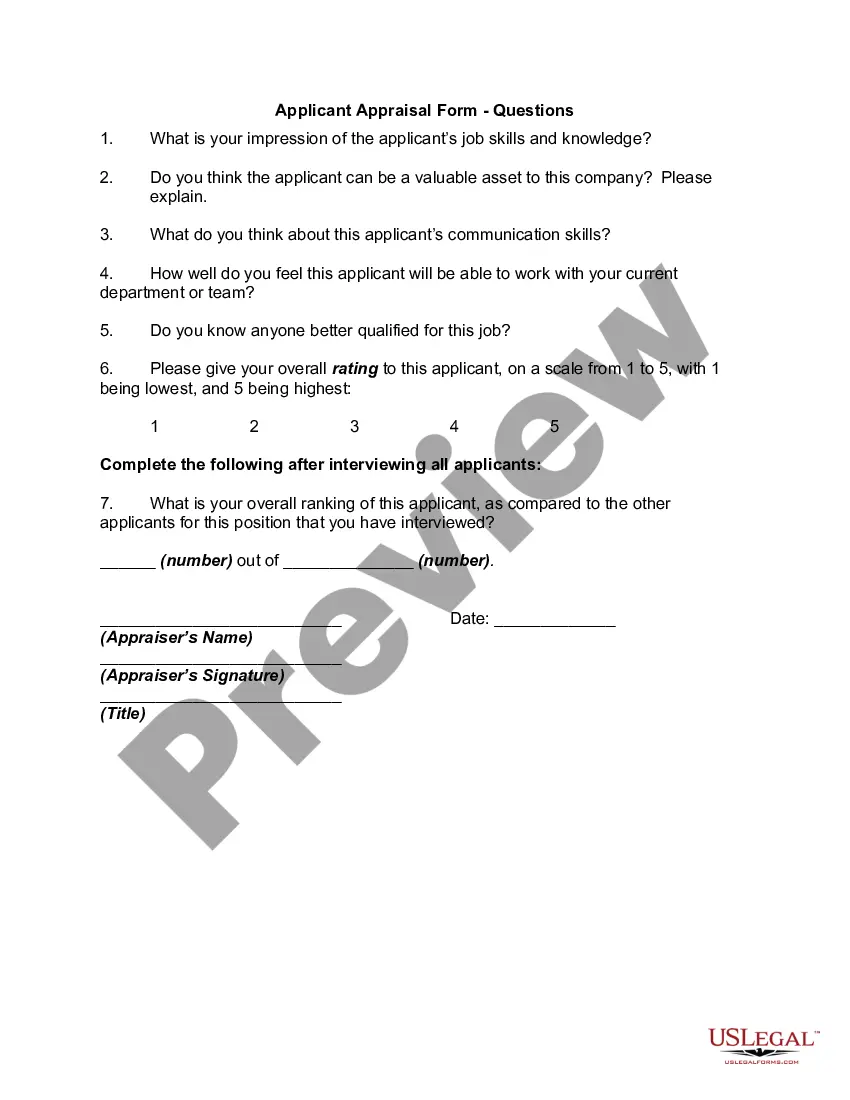

- Utilize the Preview button to review the document.

- Read the description to confirm that you have selected the correct form.

- If the form isn't what you are looking for, use the Search field to find the form that meets your needs.

- When you find the right form, click Get now.

Form popularity

FAQ

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

You can stop debt collectors from calling you at work fairly easily. Simply tell the debt collector that your employer doesn't want them calling your job or that you're not allowed to receive personal calls at work.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

However, a debt collector, like a credit card company, may call you at work, though they can't reveal to your co-workers that they are debt collectors. If you ask the debt collector not to contact you at work, by law they must stop.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

This means that debt collectors cannot harass you in-person at your work. However, a debt collector, like a credit card company, may call you at work, though they can't reveal to your co-workers that they are debt collectors. If you ask the debt collector not to contact you at work, by law they must stop.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

It's not necessarily illegal for a debt collector to call you at work, but the FDCPA prohibits debt collection calls to your job if the debt collector "has reason to know" that your employer forbids those calls.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.