Nebraska Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard

Description

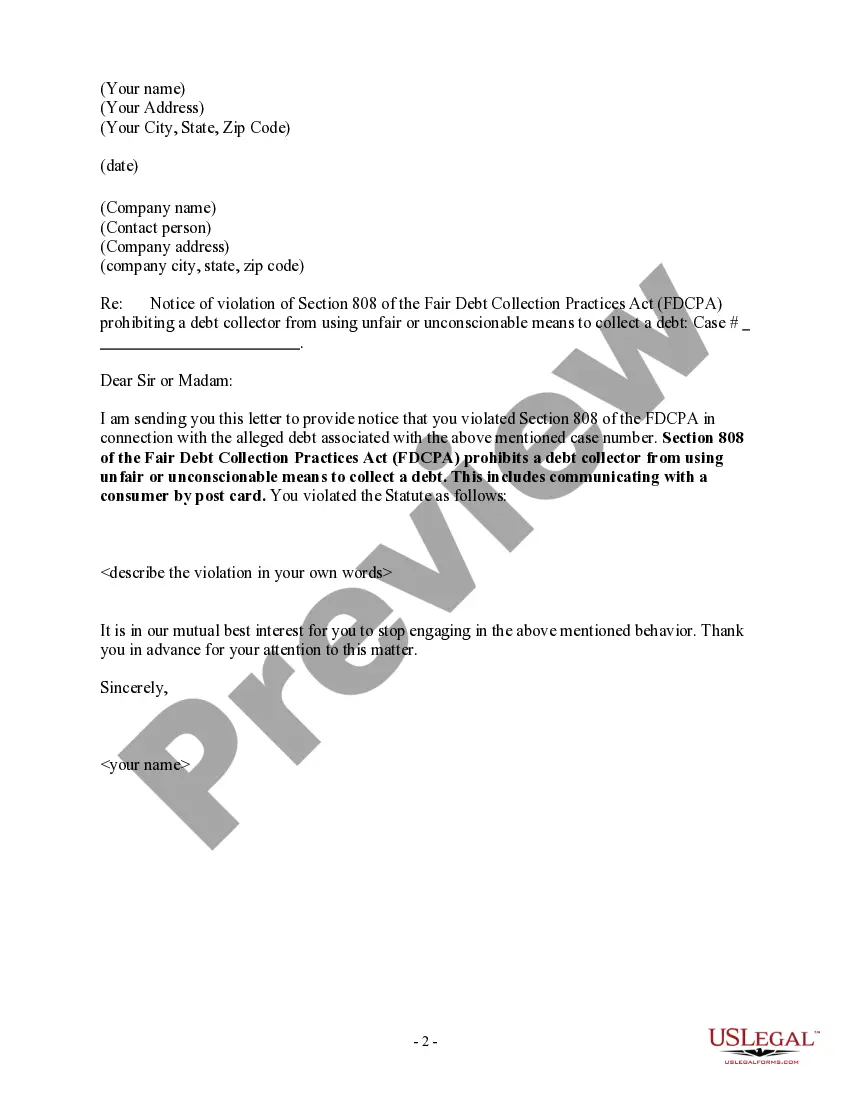

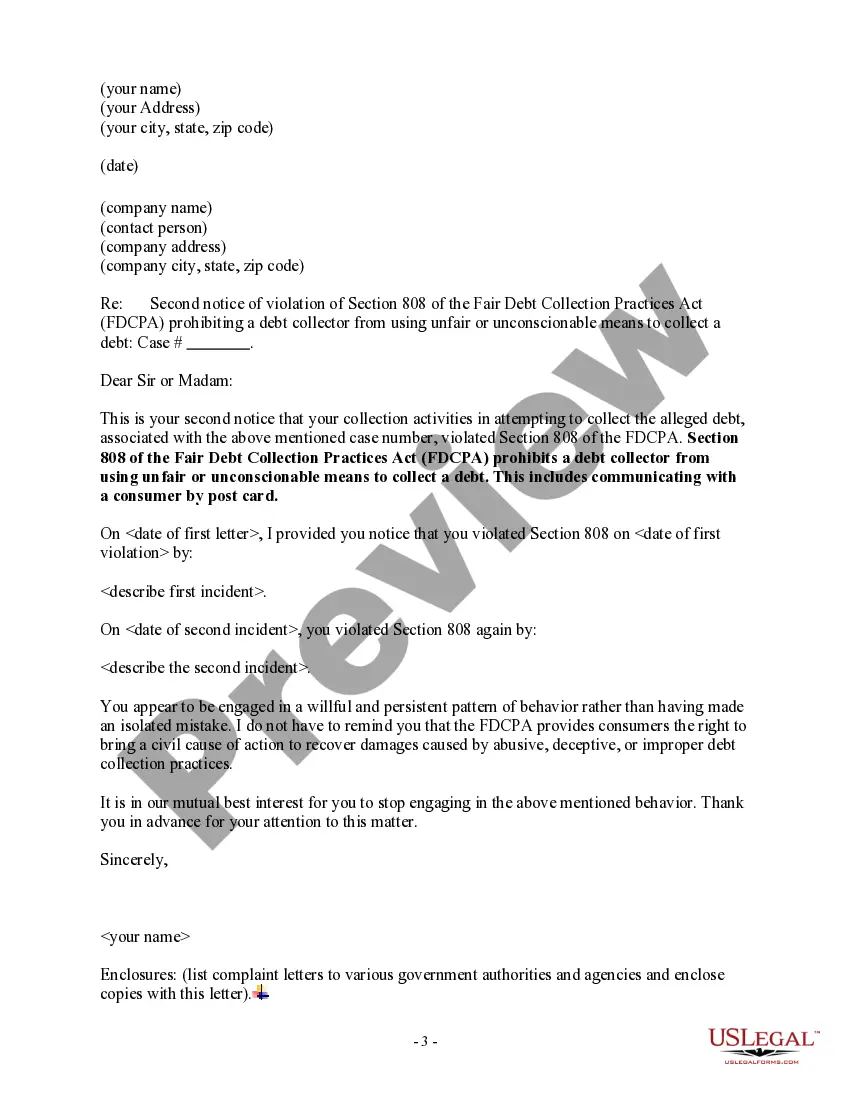

How to fill out Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

If you need to total, download, or print authorized document templates, utilize US Legal Forms, the foremost collection of legal forms, that is accessible online.

Employ the website's simple and user-friendly search to locate the documents you require. Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to obtain the Nebraska Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard in just a few clicks.

Every legal document format you acquire is yours permanently. You will have access to each form you saved in your account. Visit the My documents section and choose a form to print or download again.

Be proactive and download, and print the Nebraska Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Nebraska Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct area/state.

- Step 2. Use the Preview feature to review the form's details. Remember to examine the information.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to look for alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Buy now button. Select the payment plan you prefer and enter your information to register for the account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Nebraska Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard.

Form popularity

FAQ

You have the right not to be contacted at work, and some local and state laws make it illegal for creditors to contact your place of employment if they have reason to know those calls are forbidden.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Many people are surprised to learn that debt collectors can sue debtors for the balance of any outstanding debt. Many times, debt collection agencies will bring a lawsuit for breach of contract because when individuals don't pay the debt they agreed to pay.

Problems Faced by Debt Collection Agents and How to Solve Them!Oral Contracts:Faulty Written Agreements:Money Recovery Issues:Collection Methods Are Not Real-Time:Mobile Borrowers:Too Many Calls:Contacting Wrong People:Customer Bankruptcy:More items...?30-Nov-2019

9 Ways to Outsmart Debt CollectorsDon't Get Emotional.Make Sure the Debt Is Really Yours.Ask for Proof.Resist the Scare Tactics.Be Wary of Fees.Negotiate.Call In Backup.Know the Time Limits.More items...?

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

Steps to Respond to a Debt Collection Case in NebraskaCreate an Answer document.Respond to each allegation included in the Complaint.Put forth affirmative defenses.File a copy of your Answer with the court and serve the Plaintiff.18-Jun-2020

Try not to let all of the calls badgering you from a debt collector get to you. If you need to take a break, you can use this 11 word phrase to stop debt collectors: Please cease and desist all calls and contact with me, immediately. Here is what you should do if you are being contacted by a debt collector.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16-Sept-2020