Nebraska Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission

Description

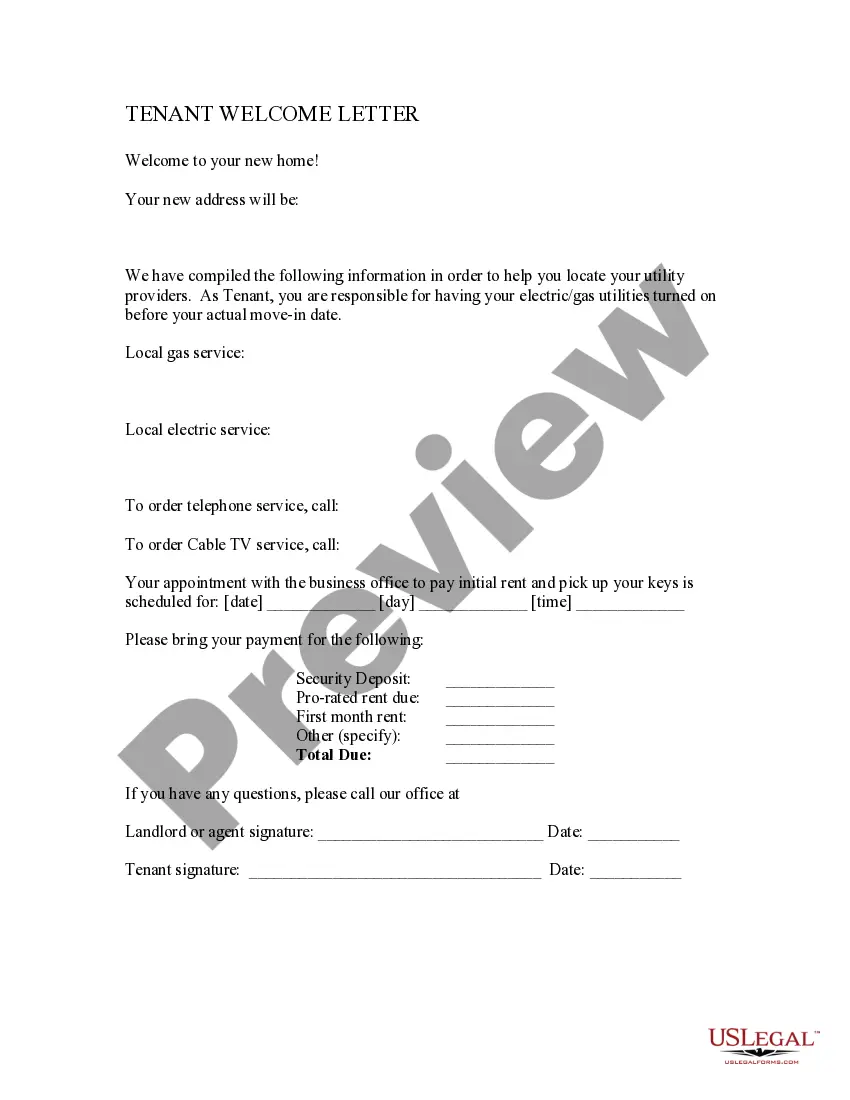

How to fill out Notice Of Violation Of Fair Debt Act - Letter To The Federal Trade Commission?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a diverse selection of legal template designs that you can download or print.

By using the website, you can access thousands of documents for both business and personal uses, organized by categories, states, or keywords. You can find the latest editions of documents like the Nebraska Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission in just a few moments.

If you have a monthly subscription, Log In and download the Nebraska Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the purchase.

Choose the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Nebraska Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission. Each template you add to your account has no expiration date and is yours permanently. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Nebraska Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission with US Legal Forms, the most extensive collection of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- To get started with US Legal Forms, follow these simple steps.

- Make sure you have selected the proper form for your city/state.

- Click the Preview button to review the content of the form.

- Read the form description to confirm you have chosen the correct document.

- If the form does not match your needs, use the Search box at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select your preferred pricing plan and provide your details to create an account.

Form popularity

FAQ

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

A. Administrative Enforcement of Consumer Protection and Competition LawsAdministrative Adjudication.Enforcing Final Commission Orders.Redress After an Administrative Order is Entered.Civil Penalty Enforcement Against Non-Respondents in Consumer Protection Matters.

The purpose of FTC warning letters is to warn companies that their conduct is likely unlawful and that they can face serious legal consequences, such as a federal lawsuit, if they do not immediately stop.

Section 5(a) of the FTC Act, 15 U.S.C. Sec. 45(a), prohibits, inter alia, unfair methods of competition. Unfair methods of competition include any conduct that would violate the Sherman Antitrust Act or the Clayton Act.

About the FTC The FTC's mission is to protect consumers and competition by preventing anticompetitive, deceptive, and unfair business practices through law enforcement, advocacy, and education without unduly burdening legitimate business activity.

The Federal Trade Commission (FTC) amended the Telemarketing Sales Rule (TSR) to give consumers a choice about whether they want to receive most telemarketing calls. As of October 1, 2003, it became illegal for most telemarketers or sellers to call a number listed on the National Do Not Call Registry.

The FTC has the ability to implement trade regulation rules defining with specificity acts or practices that are unfair or deceptive and the Commission can publish reports and make legislative recommendations to Congress about issues affecting the economy.

The FTC enforces federal consumer protection laws that prevent fraud, deception and unfair business practices. The Commission also enforces federal antitrust laws that prohibit anticompetitive mergers and other business practices that could lead to higher prices, fewer choices, or less innovation.

The FTC may also share its information with other government and law enforcement agencies and creates tools and resources to empower consumers. But the FTC also has the power to enforce antitrust and consumer protection laws.

The FTC Act prohibits unfair or deceptive advertising in any medium. That is, advertising must tell the truth and not mislead consumers. A claim can be misleading if relevant information is left out or if the claim implies something that's not true.