Nebraska Proposal for Labor and Materials

Description

How to fill out Proposal For Labor And Materials?

US Legal Forms - one of the most significant collections of legal documents in the USA - provides a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords. You can find the latest versions of forms such as the Nebraska Proposal for Labor and Materials within moments.

If you currently hold a monthly subscription, Log In and download the Nebraska Proposal for Labor and Materials from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms within the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the acquired Nebraska Proposal for Labor and Materials. Each format you added to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Nebraska Proposal for Labor and Materials with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal specifications and requirements.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's contents.

- Check the form details to confirm you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the page to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get Now button.

- Then, choose your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

Originally Answered: What is the difference between a letter of intent and an offer letter? Letter of intent (LOI) is a document of one or more LEGAL agreements between two or more parties. LOI is later responsible for a final agreement. Offer letter is something similar to 'Letter of acceptance'(LOA).

A letter of intent (LOI) is a document outlining the general plans of an agreement between two or more parties before a legal agreement is finalized. A letter of intent is not a contract and cannot be legally enforced; however, it signifies a serious commitment from one involved party to another.

A subcontract is the proper document to be used whenever any portion of research from an award is proposed to be performed by another institution, organization or outside company. It is a formal arrangement that is subject to the terms and conditions of the prime award.

A comprehensive letter of intent should address the following:Client authorisation to the contract administrator to represent them.Acceptance of the contractor's offer and definition of the project.The agreed contract sum.Reference to the tender documents and subsequent amendments (with dates).More items...?

A letter of intent is essentially a document that summarizes the major ingredients of a proposed transaction, including the price, payment method, and important target dates (for contract signing and closing). In most cases, the letter of intent is not legally binding, but it is nonetheless regarded as a useful tool.

Yes. You are required to collect sales tax on the total amount charged for the building materials. The charge for your contractor labor is not taxable, provided it is separately stated.

These include: certainty as to key terms; consideration (the 'price' paid under the contract in return for performance by the other party of its obligations; and. a mutual intention to enter into a binding legal contract.

Medicine, groceries, and gasoline are all tax-exempt. Some services in Nebraska are subject to sales tax.

Charges for production and assembly labor are taxable. Charges for repair and installation labor are taxable when the property being repaired, replaced, or installed is taxable. See Sales and Use Tax Regulation 1-082, Labor Charges.

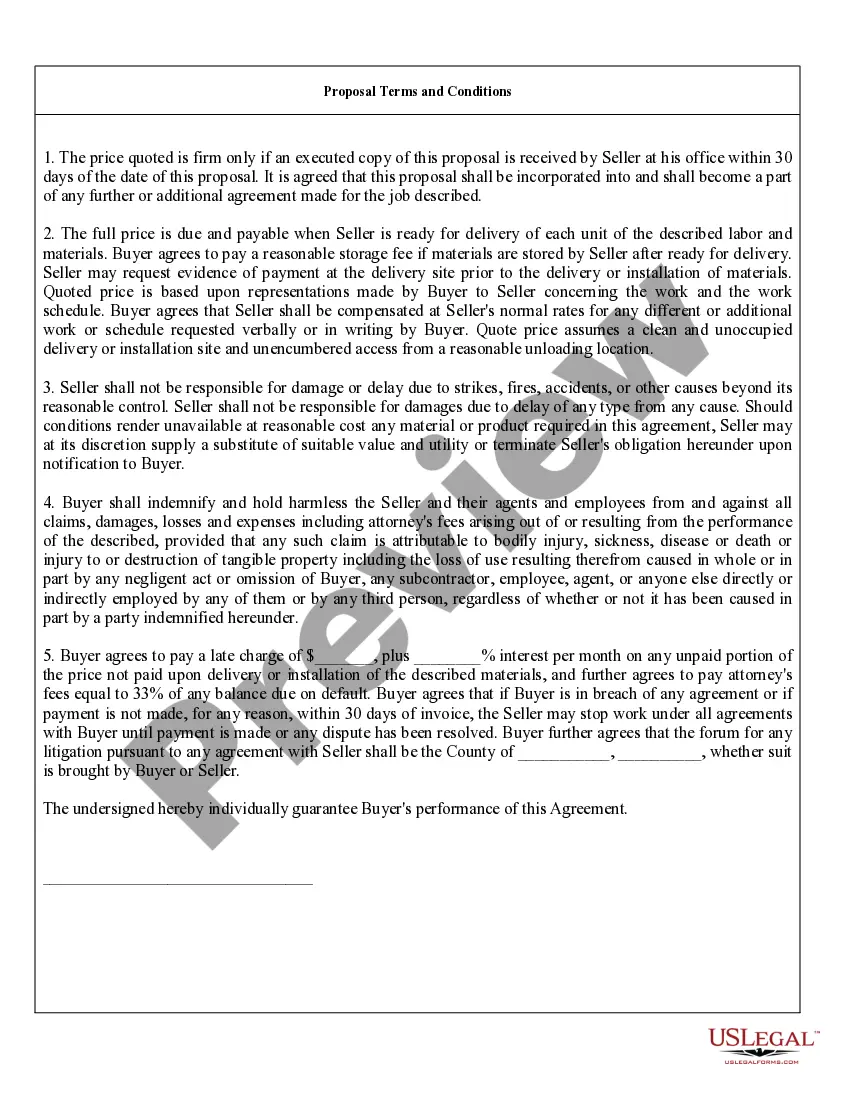

A contractor proposal is a written outline that includes the key terms of the project to be completed by the contractor.