Nebraska Personnel Status Change Worksheet

Description

How to fill out Personnel Status Change Worksheet?

You can dedicate hours online searching for the legal document template that meets the federal and state requirements you need. US Legal Forms offers a vast selection of legal documents that are evaluated by professionals.

It is easy to download or print the Nebraska Personnel Status Change Worksheet from your account.

If you already possess a US Legal Forms account, you may Log In and click on the Obtain button. After that, you can complete, modify, print, or sign the Nebraska Personnel Status Change Worksheet. Every legal document template you purchase is yours permanently. To receive another copy of any purchased form, visit the My documents section and select the appropriate option.

Make adjustments to your document if necessary. You can complete, modify, sign, and print the Nebraska Personnel Status Change Worksheet. Access and print numerous document templates using the US Legal Forms website, which offers the largest collection of legal documents. Utilize professional and state-specific templates to manage your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document template for the county/city of your choice. Review the form description to make sure you have chosen the right form. If available, use the Preview option to view the document template as well.

- To find another version of the form, use the Lookup section to search for the template that fits your needs and requirements.

- Once you have found the template you desire, click Buy now to proceed.

- Select the pricing plan you want, enter your credentials, and create an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal document.

- Choose the format of the document and download it to your device.

Form popularity

FAQ

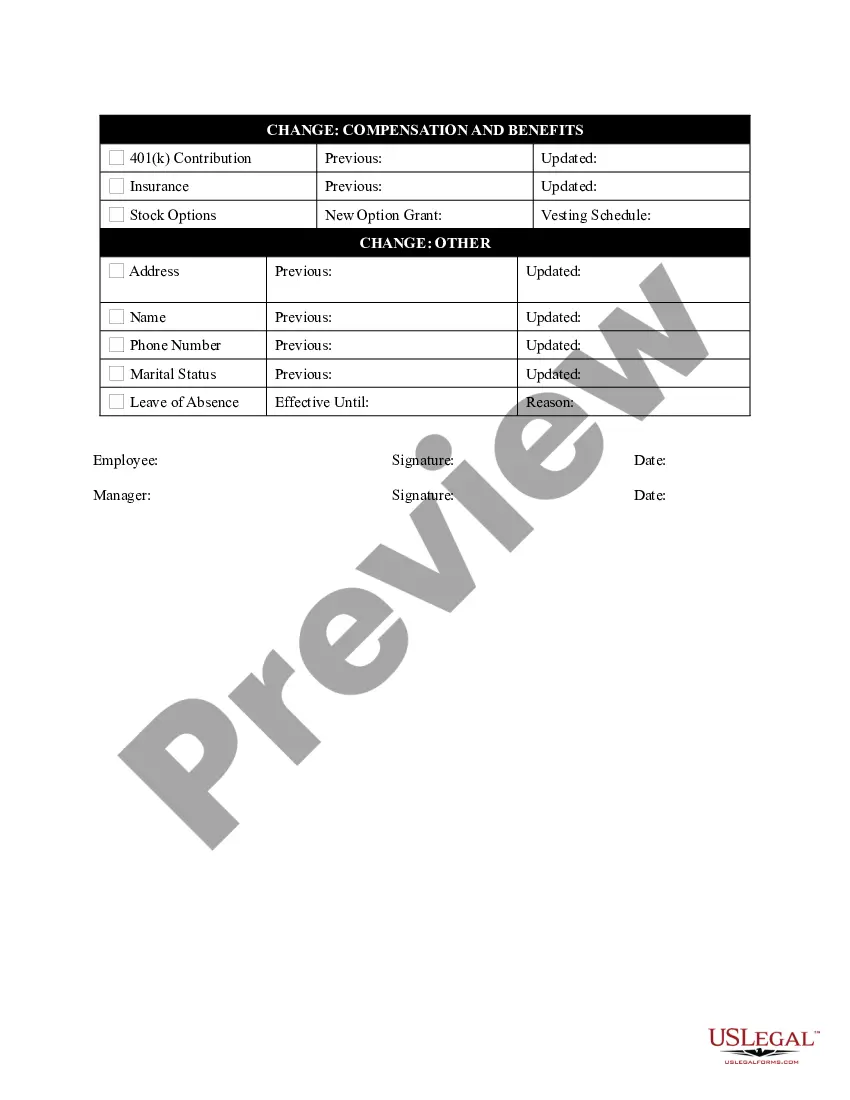

The Nebraska Personnel Status Change Worksheet is a key document that helps employees and employers manage personnel changes effectively. This worksheet allows staff to report changes such as promotions, transfers, or other employment adjustments. By accurately completing this form, you ensure that your employment status is updated properly within the state's systems. Utilizing this worksheet can enhance communication and streamline the transition process.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this.

You will be issued an income tax withholding certificate by the Nebraska Department of Revenue (DOR). If you are licensed for income tax withholding, you must file a Form W-3N, even if no payments were made that were subject to income tax withholding, or if the license was cancelled during the year.

Add your combined income, adjustments, deductions, exemptions and credits to figure your federal withholding allowances. You can divide your total allowances whichever way you prefer, but you can't claim an allowance that your spouse claims too.

If an employee can not document the number of allowances on the Federal W20114 and the documentation supports a lesser number, which number of allowances should be used for Nebraska income tax withholding purposes? The law specifies a withholding rate of 1.5%.

Allowances claimed on the Form W-4N are used by your employer or payor to determine the Nebraska state income tax withheld from your wages, pension, or annuity to meet your Nebraska state income tax obligation.

A Form 941N is required even if no payments were made that were subject to income tax withholding. Paper filers should mail this return with payment to the Nebraska Department of Revenue, PO Box 98915, Lincoln, Nebraska 68509-8915.

Income Tax Withholding Reminders for All Nebraska Employers Form W-3N Due Date. State copies of 2021 Forms W-2, W-2G, 1099-MISC, 1099-NEC, 1099-R, and the Nebraska Reconciliation of Income Tax Withheld, Form W-3N, are due January 31, 2022. E-file Requirement.

The IRS Form 1040 is one of the official documents that U.S. taxpayers can use to file their annual income tax return. IRS Form 1040 comes in a few variations. There have been a few recent changes to the federal form 1040.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.