Nebraska Personnel Change Form

Description

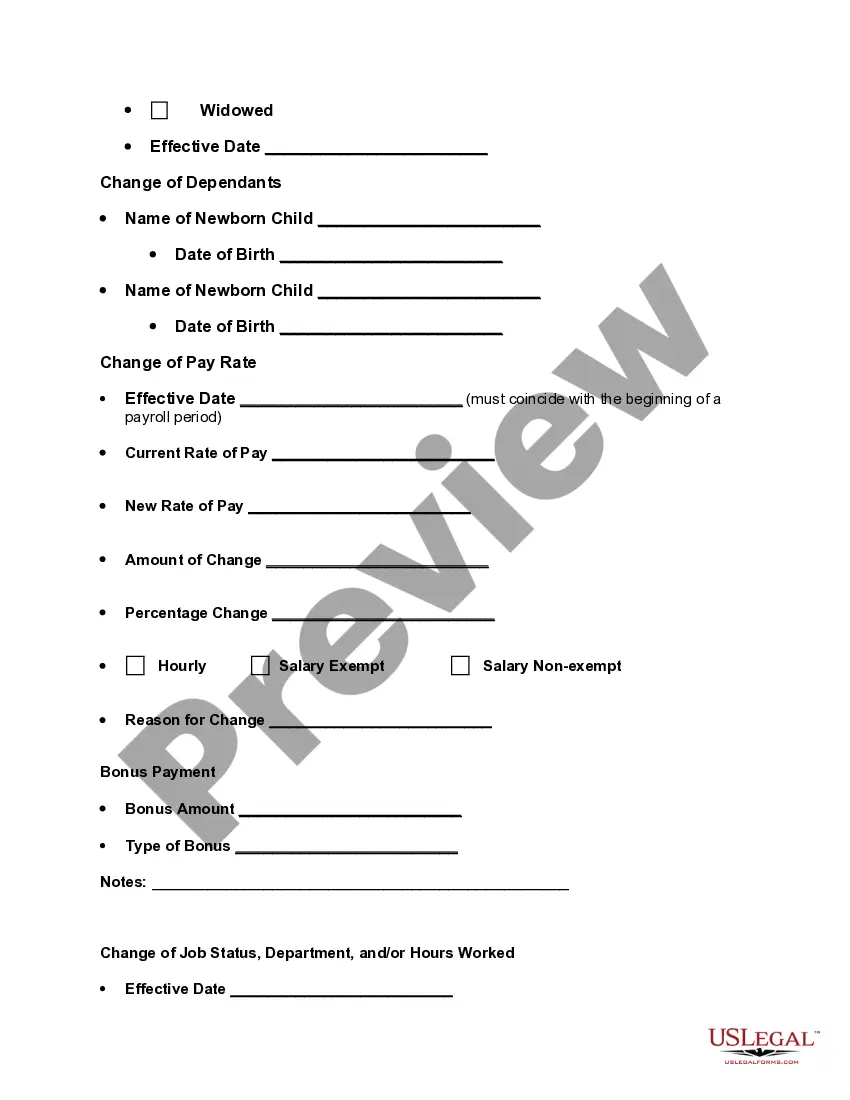

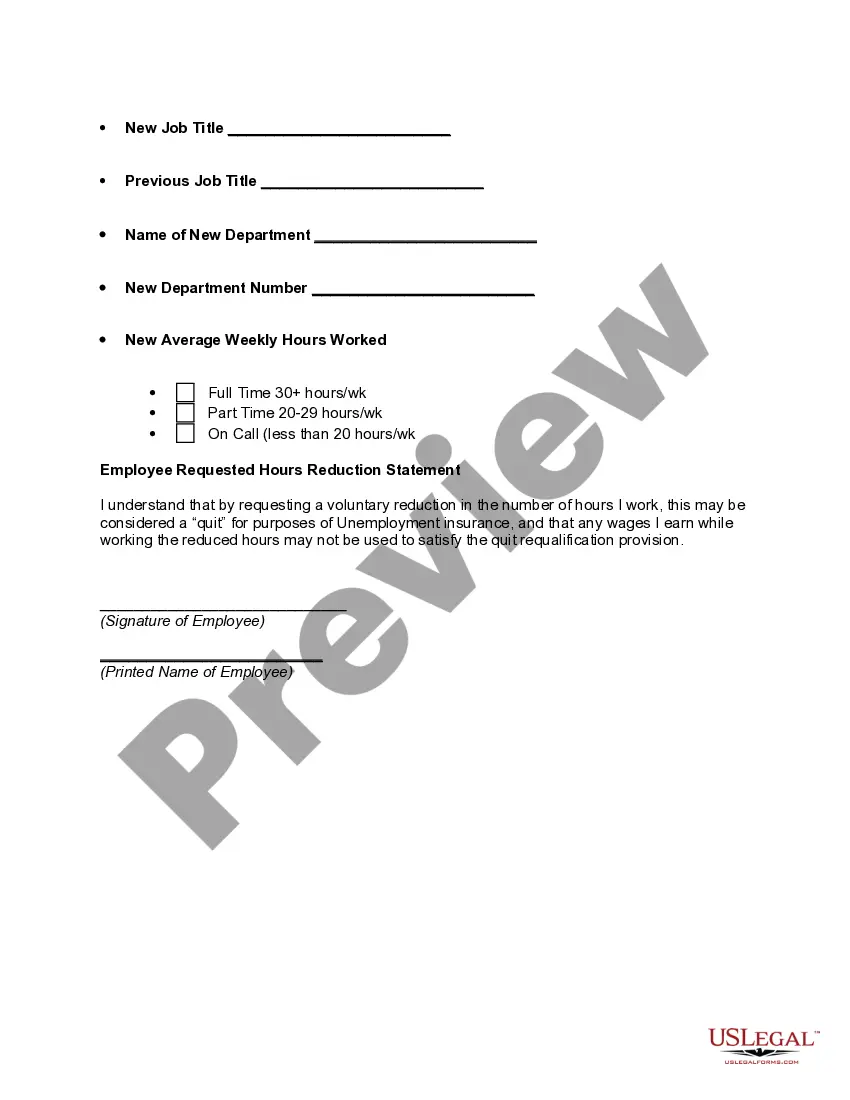

How to fill out Personnel Change Form?

It is feasible to devote hours on the web searching for the authentic documents template that satisfies the federal and state requirements you will require.

US Legal Forms offers a vast array of authentic forms that are reviewed by experts.

You can easily obtain or print the Nebraska Personnel Change Form from my service.

To find another version of the form, use the Search field to locate the template that meets your needs and specifications.

- If you possess a US Legal Forms account, you can sign in and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Nebraska Personnel Change Form.

- Every authentic document template you purchase belongs to you indefinitely.

- To retrieve another copy of any acquired form, visit the My documents tab and select the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have chosen the appropriate document template for the state/town of your preference.

- Review the form summary to confirm you have selected the correct form.

Form popularity

FAQ

The new 2021 Form W-4 remains relatively unchanged after a major overhaul in December 2019. The only notable updates include a few adjustments to taxable wage & salary tables on page 4. For employers, this means that current employees won't face a learning curve when updating withholdings.

If you are licensed for income tax withholding, you must file a Form W-3N, even if no payments were made that were subject to income tax withholding, or if the license was cancelled during the year. When and Where to File.

Nebraska introduced a state withholding certificate for use starting in 2020. The state of Nebraska developed this form due to the significant differences between federal and Nebraska laws.

If you still decide to paper file 1099, make sure to attach 1096 & W-3N and send it to the address below: Nebraska Department of Revenue, PO Box 98915, Lincoln, NE 68509-8915.

941N Nebraska Income Tax Withholding Return.

You will be issued an income tax withholding certificate by the Nebraska Department of Revenue (DOR). If you are licensed for income tax withholding, you must file a Form W-3N, even if no payments were made that were subject to income tax withholding, or if the license was cancelled during the year.

You must give your employer a new Nebraska Form W-4N by February 15 each year to continue your exemption. You cannot claim exemption from withholding if another person can claim you on their tax return; and your total income exceeds $1,100 and includes more than $350 of unearned income.

If an employee can not document the number of allowances on the Federal W20114 and the documentation supports a lesser number, which number of allowances should be used for Nebraska income tax withholding purposes? The law specifies a withholding rate of 1.5%.

To change an address for a business account, mark through the incorrect information and write clearly the new address directly on the tax return; or you can file a Nebraska Change Request, Form 22.