Nebraska Waiver of Lien

Description

How to fill out Waiver Of Lien?

Are you presently in a location where you frequently require documents for business or personal reasons.

There are numerous authentic document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms provides a vast array of template documents, including the Nebraska Waiver of Lien, designed to comply with both federal and state regulations.

If you find the correct form, click Purchase now.

Select your desired pricing plan, fill out the necessary information to create your account, and complete the payment using PayPal or a credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Nebraska Waiver of Lien template.

- If you do not possess an account and wish to utilize US Legal Forms, follow these instructions.

- Locate the form you need and ensure it pertains to the correct jurisdiction.

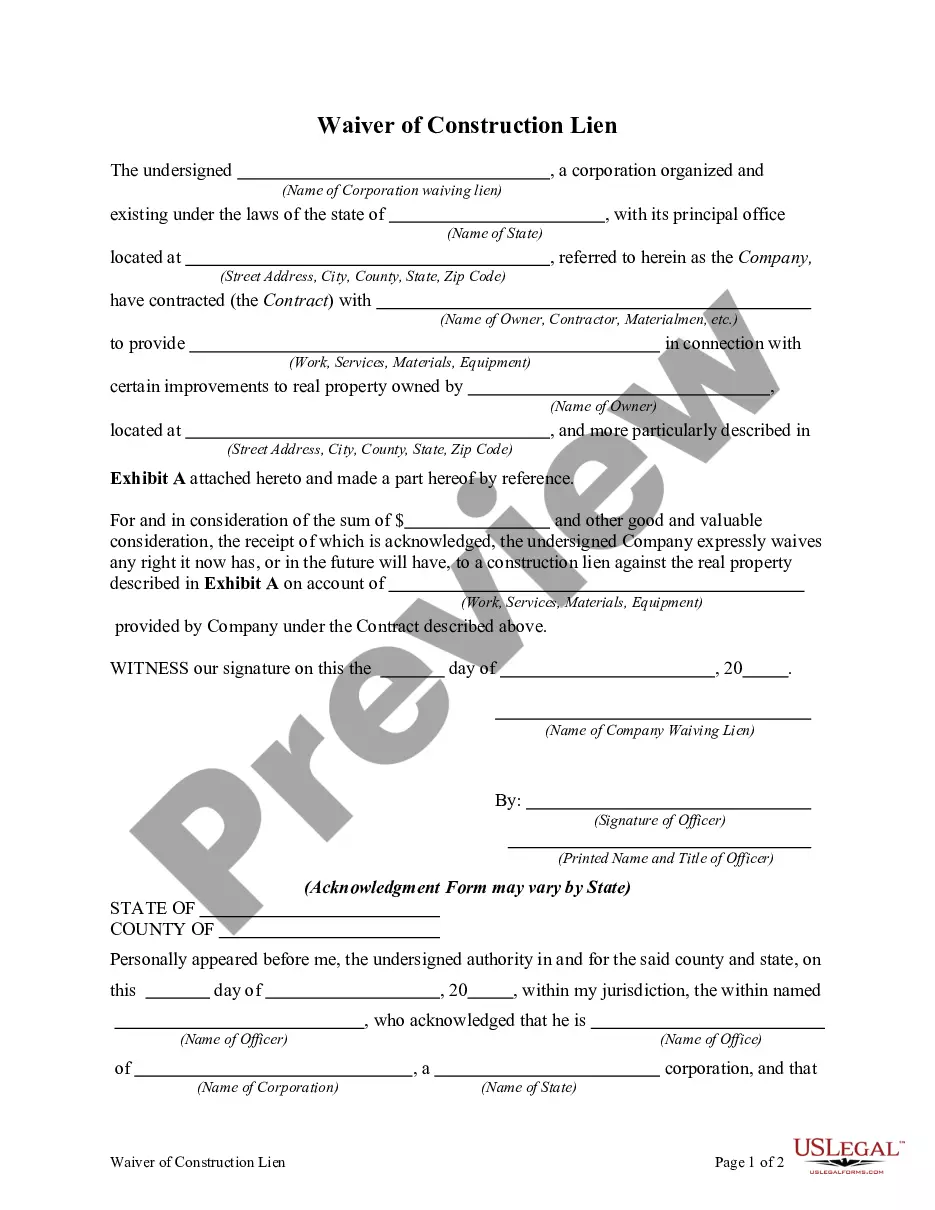

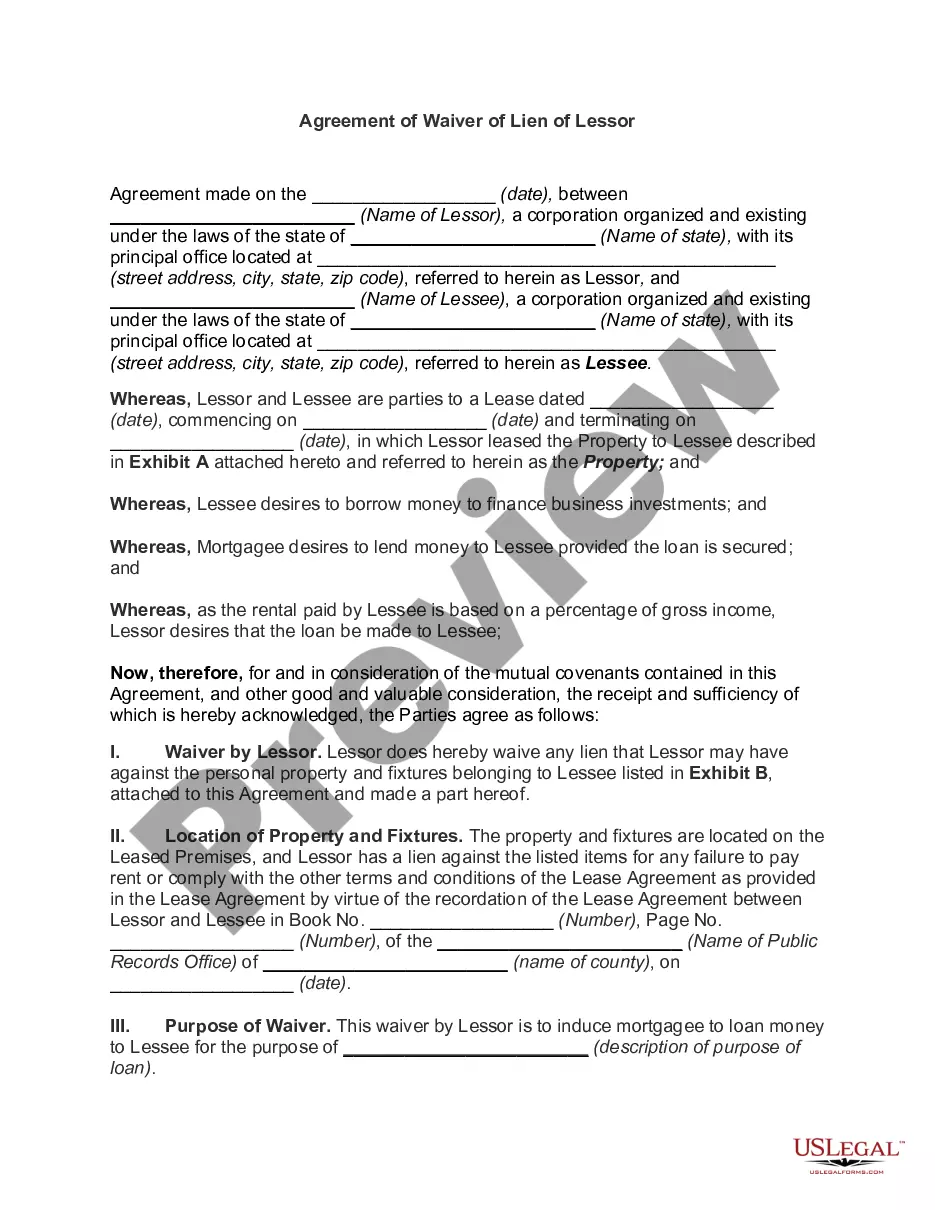

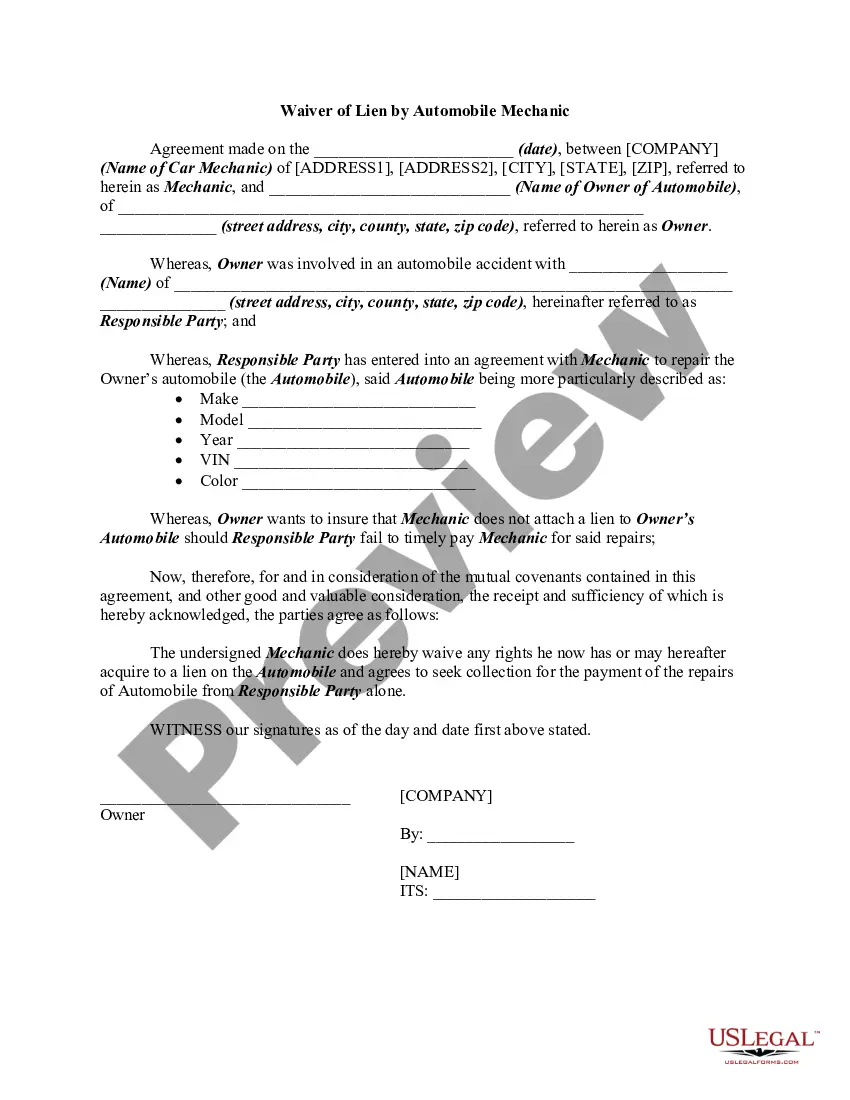

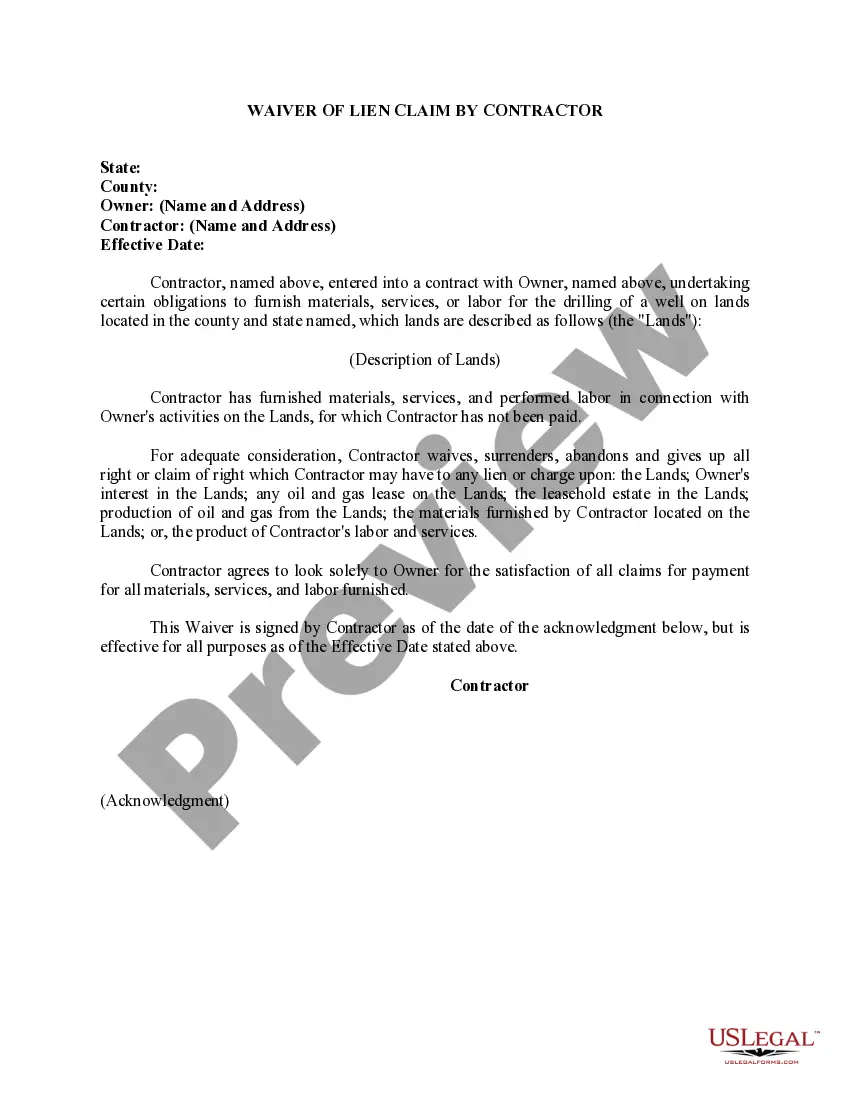

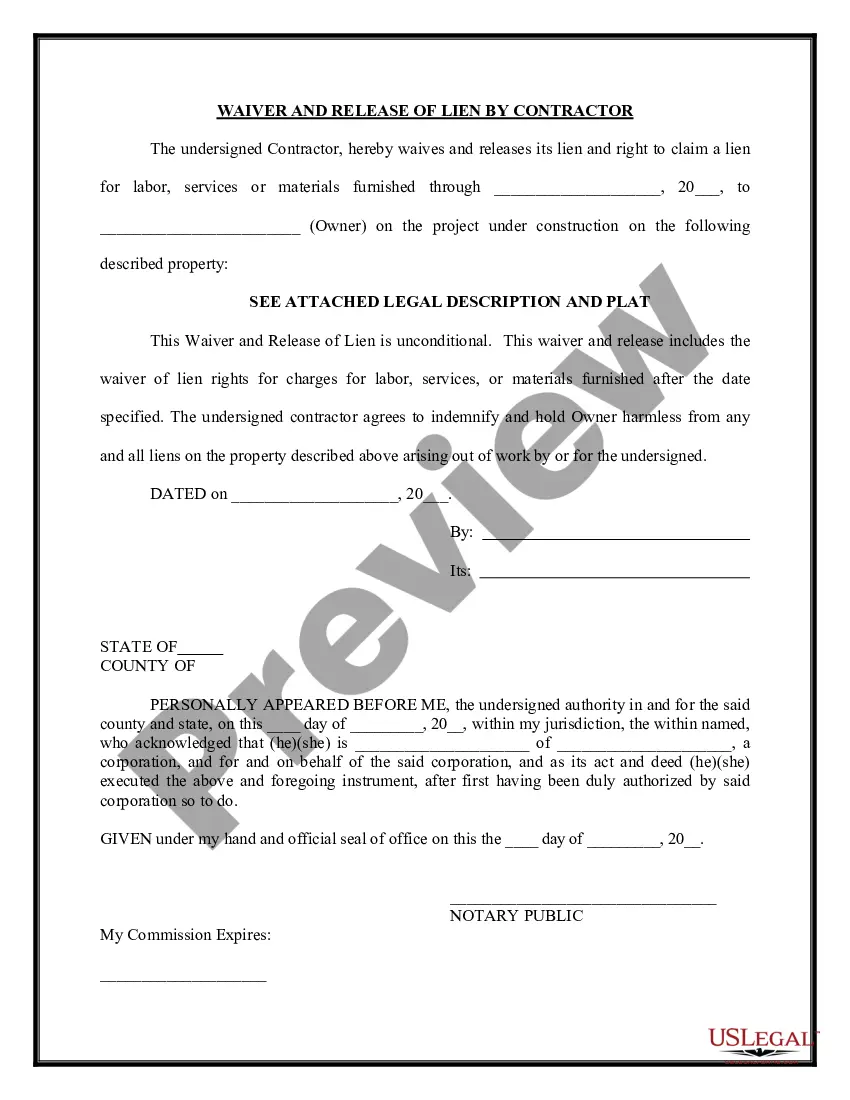

- Use the Preview button to review the document.

- Check the description to confirm that you have selected the right form.

- If the form does not match your requirements, utilize the Search field to find a form that fulfills your needs.

Form popularity

FAQ

The priority of a lien in Nebraska depends on the time of filing and the type of lien. Generally, liens are prioritized based on the order in which they are recorded. Understanding lien priority is crucial for property owners and creditors as it determines the order of payment in the event of a foreclosure or sale.

A lien's validity in Nebraska varies by type. Most liens, like mechanic's liens, are valid for four months unless further action is taken. It is essential to check the specific details associated with each lien to maintain compliance and ensure protection of your rights.

A notice of intent to lien is a formal notification to inform the property owner of an impending lien. This notice typically precedes the actual filing of a lien and serves as a warning that a debt must be settled. It provides a chance for resolution before complications arise, making it vital for anyone involved in property transactions.

To release a lien in Nebraska, you need to file a Nebraska Waiver of Lien with the appropriate recorder's office. This form certifies the release of the lien after any obligations have been fulfilled. It is crucial to ensure that all paperwork is correctly filled out and submitted to avoid any complications.

For property owners, a conditional lien waiver is often the best choice. This waiver ensures that the owner only pays for work completed satisfactorily. It protects the owner from paying for services that are not delivered, making the Nebraska Waiver of Lien an essential tool in any construction agreement.

To remove a lien in Nebraska, you must first understand the lien type you are dealing with. Generally, you can clear a lien by paying the debt associated with it. After settling the debt, the creditor should file a Nebraska Waiver of Lien to officially release the claim against the property.

Typically, property tax liens take the highest priority in Nebraska, followed closely by mechanics' liens. These liens are essential in protecting the interests of those who provide labor or materials for property improvements. If you are pursuing a Nebraska Waiver of Lien or dealing with liens, knowing which ones hold priority can help you make informed decisions.

Filing a lien in Nebraska involves a few key steps, starting with preparing the necessary documentation. You'll need to collect details about the debt or obligation and the property in question. Next, submit your lien to the county clerk or register of deeds to officially record it. For assistance with this process, consider using the US Legal Forms platform, which offers guidance tailored to filing a Nebraska Waiver of Lien.

The priority of liens in Nebraska is determined primarily by the order in which they were recorded. First-in-time usually means first-in-right, with few exceptions like property tax liens. In circumstances involving a Nebraska Waiver of Lien, it’s vital to comprehend how this priority system affects your rights as a property owner or contractor. Knowing your position in the lien priority can protect your financial interests effectively.

In Nebraska, certain liens hold higher priority based on various factors. Generally, property tax liens take precedence over most other liens. Following tax liens, mechanics' liens often rank high because they protect contractors and suppliers in construction projects. Understanding the order of lien priority is crucial when dealing with a Nebraska Waiver of Lien.