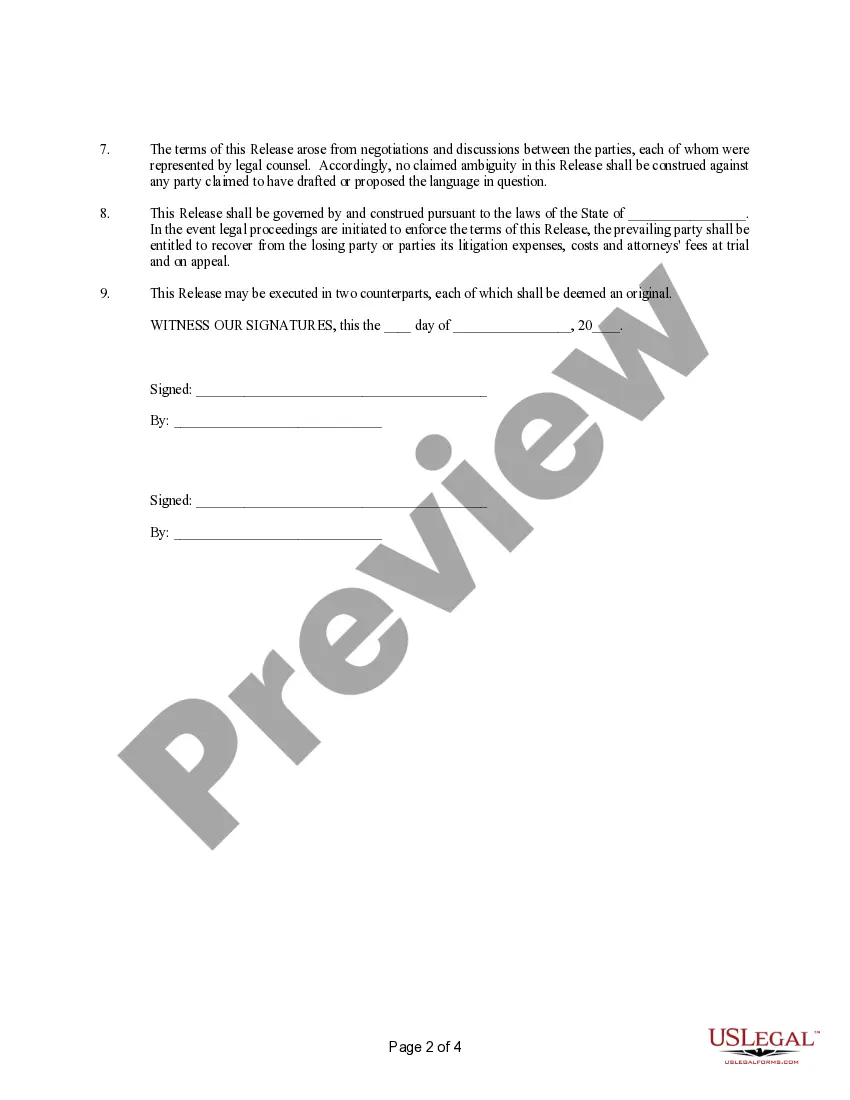

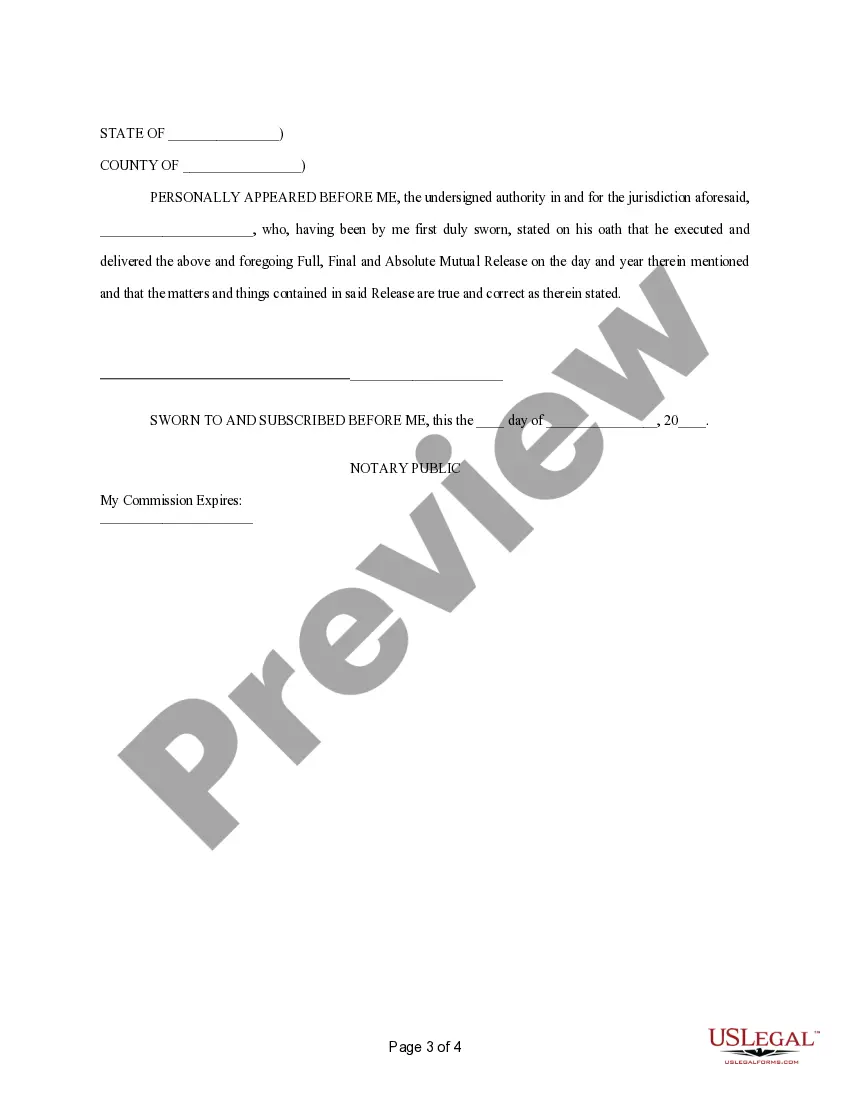

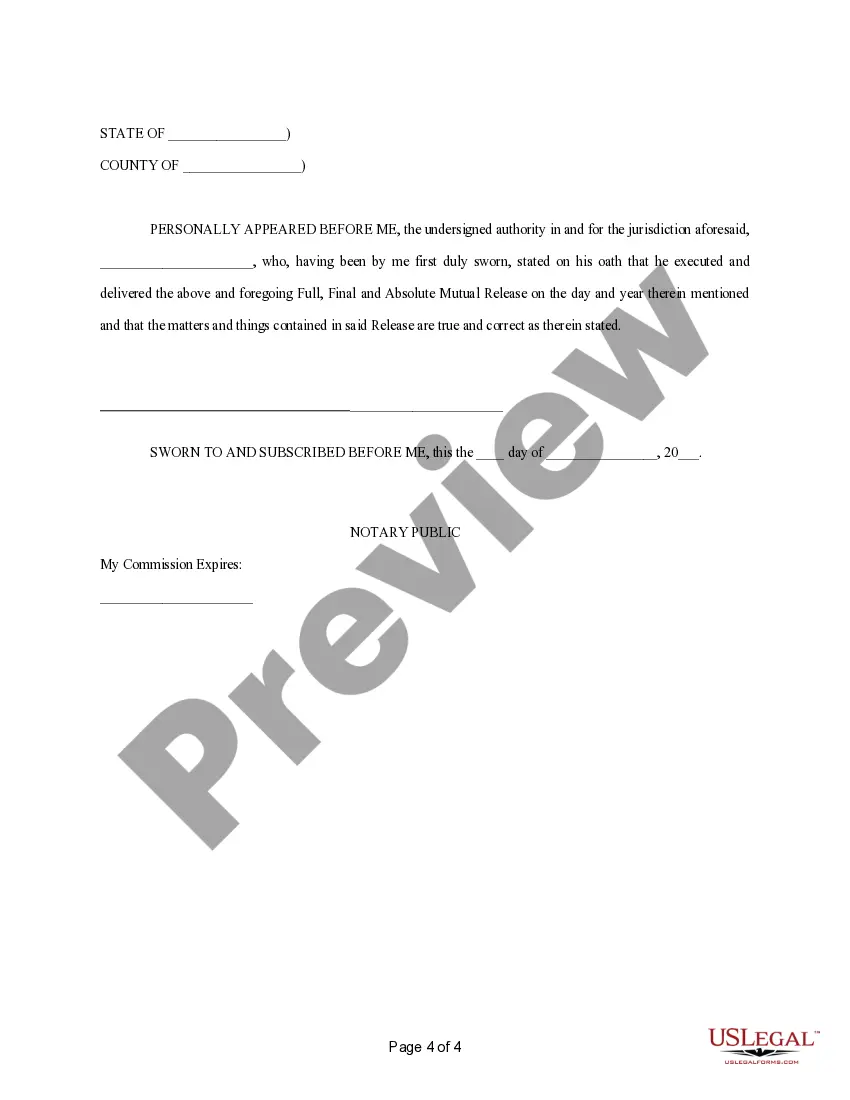

Nebraska Mutual Release of Claims

Description

How to fill out Mutual Release Of Claims?

You can spend time on the internet searching for the authentic document template that fulfills the federal and state requirements you need.

US Legal Forms offers an extensive selection of legal forms that are reviewed by experts.

You can easily obtain or print the Nebraska Mutual Release of Claims from their service.

To find another version of your form, use the Search area to locate the template that fits your needs.

- If you have an account with US Legal Forms, you can Log In and click the Acquire button.

- Then, you can complete, modify, print, or sign the Nebraska Mutual Release of Claims.

- Every legal document template you obtain is yours permanently.

- To get another copy of the downloaded form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Check the form description to confirm you have chosen the right template.

Form popularity

FAQ

Executors in Nebraska typically have up to one year to settle an estate, although extensions can occur under certain circumstances. During this time, the executor must gather liabilities and distribute assets legally. Engaging in a Nebraska Mutual Release of Claims can help facilitate swift resolutions among beneficiaries.

Filing small claims in Nebraska involves completing a form and submitting it to the appropriate district court. You must file your claim where the defendant resides or where the transaction occurred. USLegalForms offers templates and support to help you effectively prepare your claim.

Creditors in Nebraska have a period of four months from the date of notice to file claims against an estate. After this period, they may lose their right to collect the debt. To navigate the complexities of estate claims, a Nebraska Mutual Release of Claims can simplify resolutions between parties.

To file a claim against an estate in Nebraska, you need to submit your claim in writing to the personal representative of the estate. It is important to file your claim within the specified time frame, usually within six months of the notice of the estate's opening. Utilizing resources like USLegalForms can guide you through the process smoothly.

In Nebraska, a spouse is generally not responsible for the debts of their deceased partner unless they co-signed on that debt. However, creditors may seek repayment from the estate. If you are involved in settling an estate, considering a Nebraska Mutual Release of Claims may help clarify financial responsibilities.

In Nebraska, the statute of limitations for most debts is typically five years. After this period, creditors can no longer file a lawsuit to collect the debt. However, many individuals choose to negotiate a Nebraska Mutual Release of Claims to resolve debt disputes before reaching this point, providing a win-win situation for both parties.

In Nebraska, the statute of limitations for filing a lawsuit varies, but it generally ranges from one to ten years, depending on the type of claim. For personal injury claims, you typically have four years to initiate legal action. Being aware of the Nebraska Mutual Release of Claims may encourage parties to settle disputes amicably before the time runs out, ensuring a smoother resolution.

A decree of dissolution in Nebraska refers to the legal process of ending a marriage. This court order finalizes the divorce proceedings, addressing issues such as property division, child custody, and support. A Nebraska Mutual Release of Claims can be beneficial in this context, as it helps both parties agree on the settlement terms, reducing potential conflicts afterward.

In Nebraska, small claims court allows you to seek damages up to $3,600. This court provides a streamlined process for individuals to resolve disputes without the need for extensive legal representation. If you reach an agreement through a Nebraska Mutual Release of Claims, you can avoid escalating the situation to higher courts, which can be time-consuming.

Setting aside a default judgment in Nebraska involves several clear steps. First, you must file a motion in the court that issued the judgment. This motion should demonstrate a valid reason for the default, such as not receiving proper notice of the lawsuit. Additionally, you may need to provide a Nebraska Mutual Release of Claims to ensure that all parties agree to resolve the issue amicably, paving the way for a fair hearing.