Puerto Rico Proposal to Buy a Business

Description

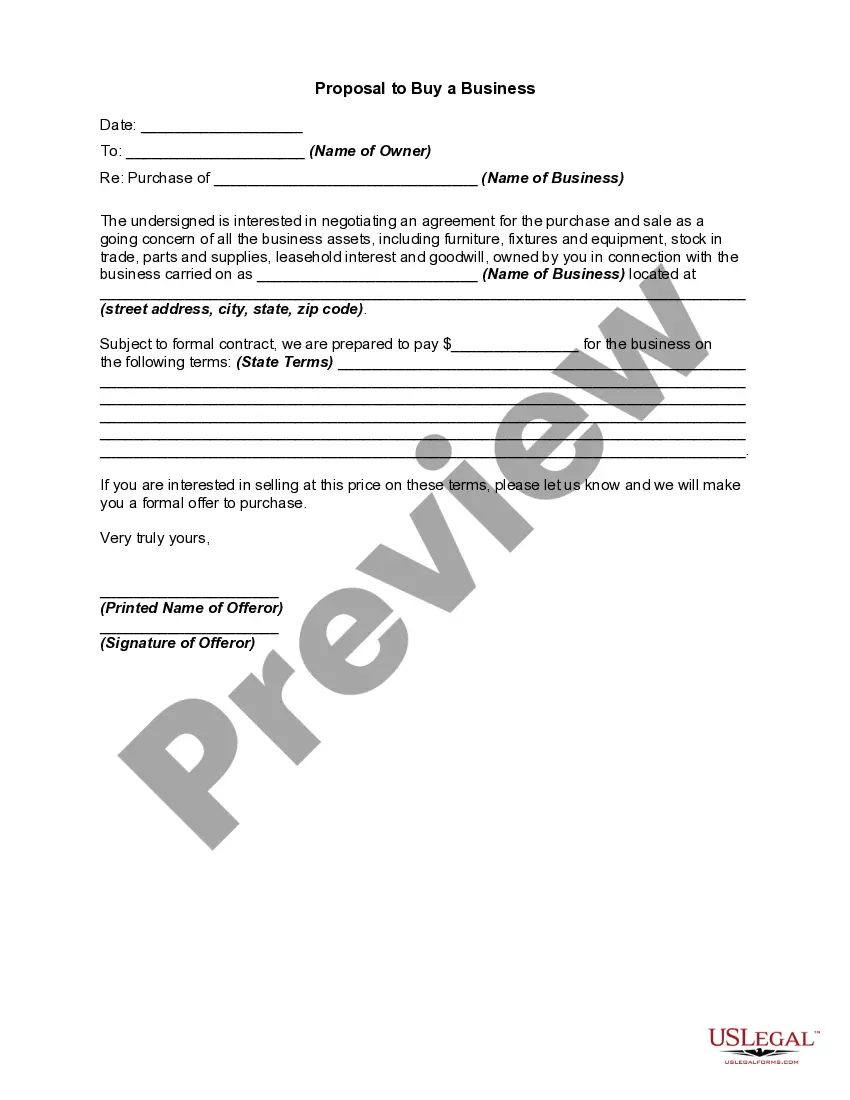

How to fill out Proposal To Buy A Business?

If you aim to obtain legitimate file templates, download, or print them, use US Legal Forms, which offers the largest selection of legal documents available online.

Utilize the site’s straightforward and efficient search function to find the documents you need.

Numerous templates for business and personal purposes are categorized by type and title, or by keywords.

Step 4. After identifying the form you need, click the Acquire now button. Choose the pricing plan that suits you and enter your information to create an account.

Step 5. Complete the transaction. You can use a credit card or a PayPal account to finalize the purchase.

- Utilize US Legal Forms to quickly acquire the Puerto Rico Proposal to Buy a Business.

- If you are a current US Legal Forms client, Log In to your account and then click the Acquire button to obtain the Puerto Rico Proposal to Buy a Business.

- You can also access forms you previously downloaded through the My documents tab in your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form specific to the correct town/country.

- Step 2. Use the Preview option to review the form's contents. Don’t forget to read the details.

- Step 3. If you are not content with the form, use the Lookup field at the top of the screen to discover other variations of the legal form template.

Form popularity

FAQ

Puerto Rico offers businesses the security and stability to operate in a US jurisdiction, while providing an unmatched variety of tax incentives that make it an attractive destination for businesses, large and small.

The economy of Puerto Rico is classified as a high income economy by the World Bank and as the most competitive economy in Latin America by the World Economic Forum.

Businesses receive a corporate tax rate of 4% on export services, and no taxes are owed on earnings and profits distributions. With these unprecedented incentives, Puerto Rico has set the stage for attracting world-class entrepreneurial talent.

Any capital gain or passive income accrued prior to becoming a resident is taxed in Puerto Rico at the prevailing tax rate if the gain is recognized within 10 years of becoming a resident. After 10 years, it is taxed at 5%.

Doing business in Puerto Rico brings with it a range of tax benefits that makes it enticing to investors, including a 4% income tax rate, a 100% tax exemption on distributions from earnings and profits, and a 90% exemption from personal property taxes for some types of businesses.

To start a corporation in Puerto Rico, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Certificate of Incorporation with the Department of State. You can file online or by mail. The certificate costs $150 to file.

How much does it cost to start a Puerto Rico corporation? Puerto Rico charges a flat $150 to file a Certificate of Incorporation as a for-profit corporation. Hire us for a one-time fee of $375, including the Department of State filing fees, a year of registered agent service, and more.

Business opportunities in Puerto Rico ready for investmentManufacturing. Puerto Rico's highly-developed industrial base means it is an ideal location for establishing manufacturing operations.Import/Export.Tourism.Real Estate.

The tropical climate, local foods, and tourist-oriented shopping and activities make it a natural tourist draw. While they are there, tourists enjoy the low sales taxes afforded by Puerto Rico's economy. Puerto Rico is a protected United States Territory. Thus, it offers appealing incentives to American corporations.