Nebraska Sample Letter for Agreement to Compromise Debt

Description

How to fill out Sample Letter For Agreement To Compromise Debt?

Are you currently in a location where you require documents for occasional business or personal purposes nearly every day.

There are numerous valid document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Nebraska Sample Letter for Agreement to Compromise Debt, designed to meet federal and state requirements.

After finding the appropriate form, simply click Get now.

Select your preferred payment plan, complete the required information to set up your account, and finalize your purchase using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Once logged in, you can download the Nebraska Sample Letter for Agreement to Compromise Debt template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

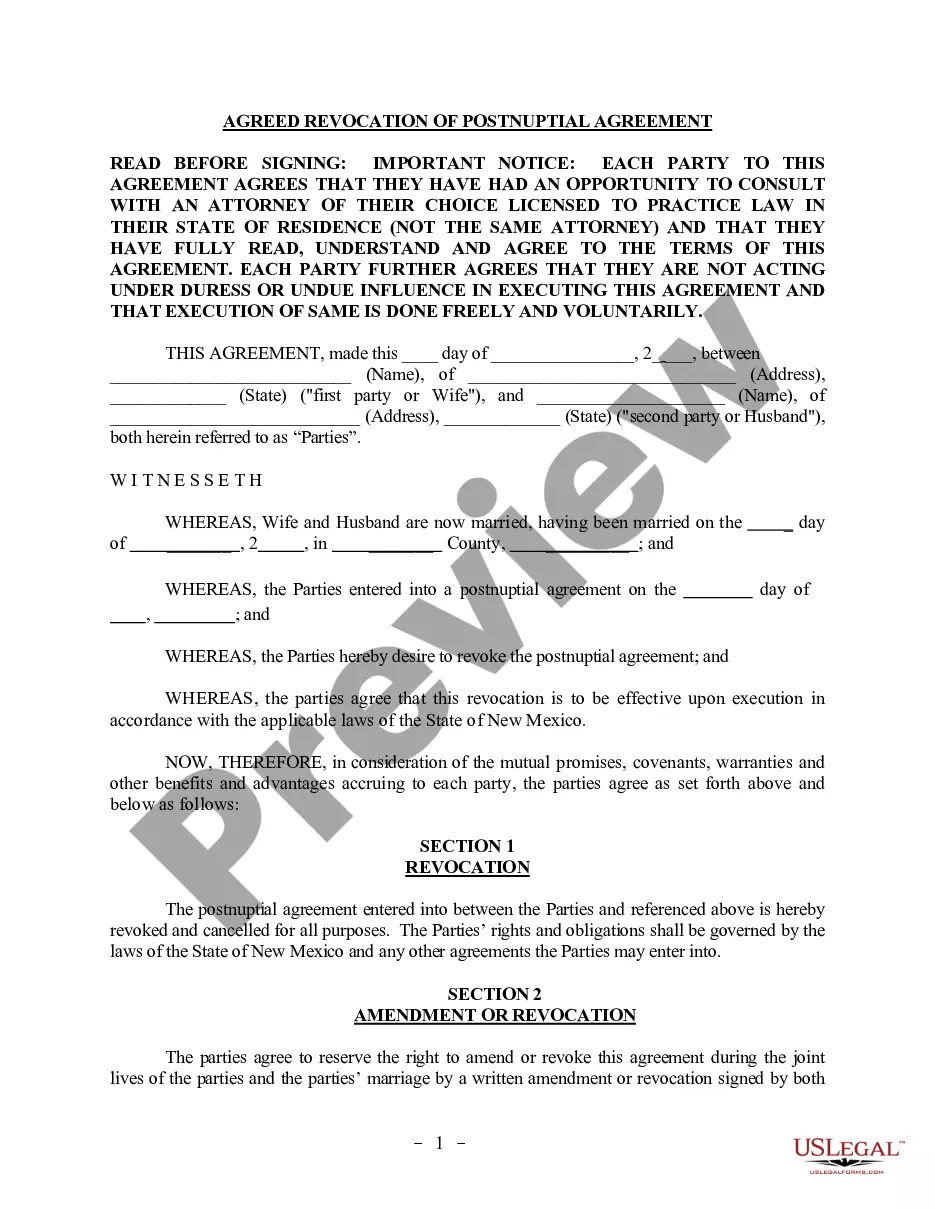

- Utilize the Preview button to review the form.

- Read the details to ensure you have selected the correct document.

- If the form is not what you're seeking, use the Search box to locate the document that meets your needs.

Form popularity

FAQ

To fill out a debt validation letter, start by including your personal information at the top, such as your name and address. Next, clearly state that you are requesting validation of the debt, and include details about the debt, like the creditor's name and the amount owed. You can also mention that you are using a Nebraska Sample Letter for Agreement to Compromise Debt to guide you in preparing your letter. Remember to sign and date the letter before sending it to the creditor.

To write a debt agreement, begin with a clear introduction of both parties involved and the amount of debt. Next, include specific terms such as payment amounts, due dates, and any obligations tied to the agreement. Utilizing a Nebraska Sample Letter for Agreement to Compromise Debt can streamline your drafting process by providing a structured format to base your agreement on.

Writing a debt settlement agreement involves outlining the terms of your negotiated debt repayment. Start by specifying the total amount owed, the agreed-upon reduced payment, and the payment timeline. To facilitate this process, consider using a Nebraska Sample Letter for Agreement to Compromise Debt, as this template simplifies the drafting process while ensuring that you cover all essential details.

The effective 11-word phrase to stop debt collectors is, 'I would like to see verification of the debt, please.' This phrase obligates the collector to provide proof before continuing their collection efforts. By using this phrase, you can gain valuable time to prepare your response, ideally including a Nebraska Sample Letter for Agreement to Compromise Debt to negotiate a resolution.

For debt collectors, the 777 rule emphasizes their responsibility to adhere to ethical practices while collecting debts. It mandates fair communication, prohibits harassment, and requires them to validate the debt upon request. Understanding this rule can benefit both parties in debt negotiation, especially when utilizing a Nebraska Sample Letter for Agreement to Compromise Debt. It provides a solid foundation for open dialogue.

A debt agreement can be a valuable option for individuals struggling with overwhelming debt. It allows you to negotiate a more manageable repayment amount and may prevent bankruptcy. Using a Nebraska Sample Letter for Agreement to Compromise Debt can facilitate this process effectively. Always consider your financial goals and consult with a professional to ensure you make the best decision for your circumstances.

When negotiating to settle a debt, many people consider offering around 40% to 60% of the total amount owed. However, every situation is unique, so it is crucial to assess your financial situation and the credibility of the lender. Utilizing a Nebraska Sample Letter for Agreement to Compromise Debt can help outline your offer and express your intention. Remember, you may need to be flexible during negotiations to reach a mutually beneficial agreement.