North Dakota Drafting Agreement - Self-Employed Independent Contractor

Description

How to fill out Drafting Agreement - Self-Employed Independent Contractor?

It is feasible to spend hours online searching for the valid document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

You can download or print the North Dakota Drafting Agreement - Self-Employed Independent Contractor from their service.

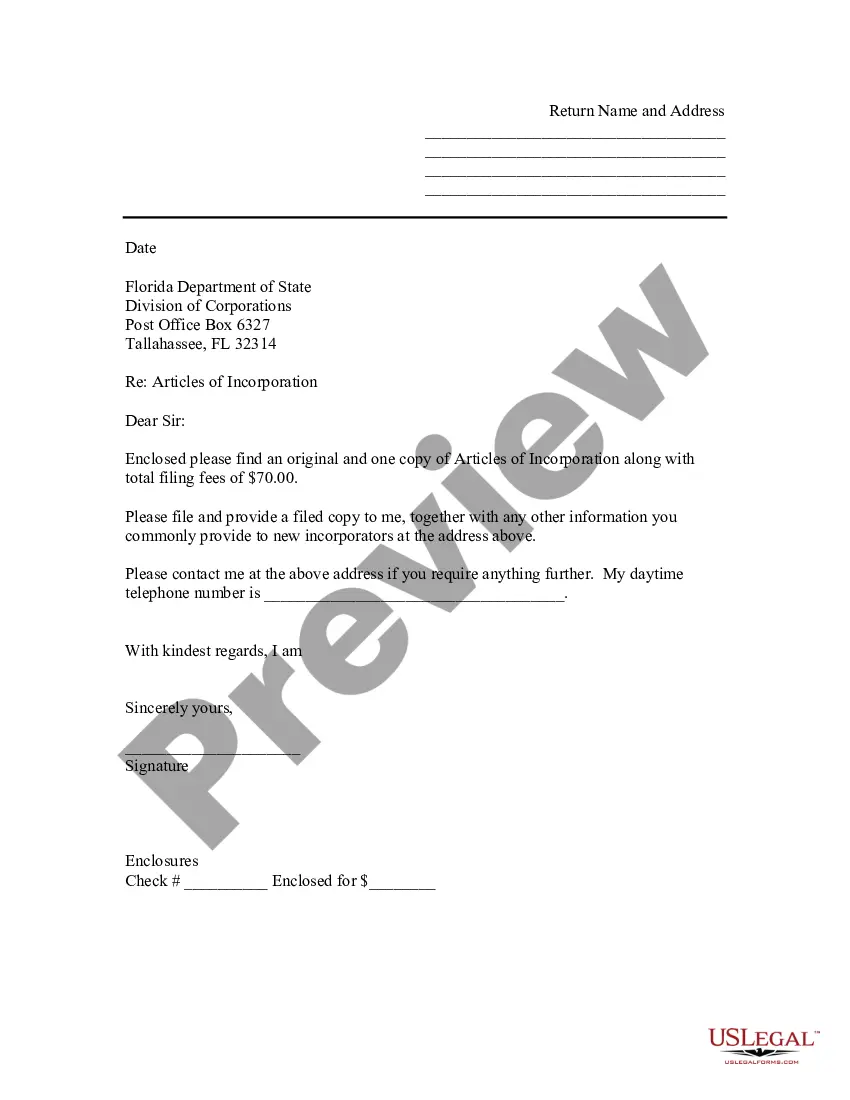

If available, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, edit, print, or sign the North Dakota Drafting Agreement - Self-Employed Independent Contractor.

- Every legal document template you obtain is your property permanently.

- To obtain an additional copy of the purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your area/city of choice.

- Review the form details to confirm you have chosen the right template.

Form popularity

FAQ

Filling out an independent contractor form requires you to gather relevant details about your business relationship. Include your name, contact information, and the nature of the services provided in relation to the North Dakota Drafting Agreement - Self-Employed Independent Contractor. Ensure you specify payment methods and any applicable deadlines. For ease, consider using uslegalforms to access forms designed for your specific needs.

To fill out an independent contractor agreement, start with the correct template specific to the North Dakota Drafting Agreement - Self-Employed Independent Contractor. Clearly define the scope of work, payment terms, and deadlines. Ensure both parties sign the agreement for it to be legally binding. Utilizing platforms like uslegalforms can simplify this process by providing tailored templates.

Typically, either party can draft the independent contractor agreement, but it's best to have one party take the lead. This way, they can ensure that their interests are well represented. However, it’s wise to have a legal professional review the agreement. For ease and accuracy, think about using US Legal Forms for a North Dakota Drafting Agreement - Self-Employed Independent Contractor template, which simplifies the process.

To create an independent contractor agreement, start by outlining the scope of work and the terms of the project. Include details such as payment, deadlines, and any specific requirements. It is essential to ensure that the agreement protects both parties. For a reliable solution, consider using US Legal Forms, which offers a customizable North Dakota Drafting Agreement - Self-Employed Independent Contractor template.

To write an independent contractor agreement, begin by clearly stating the names and contact details of both parties involved. Include important sections such as the scope of work, payment terms, timelines, and confidentiality clauses. A North Dakota Drafting Agreement - Self-Employed Independent Contractor template can guide you through this process, ensuring you don’t miss critical elements.

When writing a contract as an independent contractor, start by defining the scope of work and deliverables. Next, include payment terms, deadlines, and any specific expectations from both parties. You may find that using a North Dakota Drafting Agreement - Self-Employed Independent Contractor streamlines the process and ensures all necessary components are included.

Absolutely, you can write your own legally binding contract, provided it meets certain legal requirements. Ensure that your contract includes essential elements like clear terms of agreement, signatures from both parties, and a date. To support you in this process, consider utilizing a North Dakota Drafting Agreement - Self-Employed Independent Contractor to ensure completeness and compliance with local laws.

Yes, having a contract is crucial for independent contractors because it formalizes the terms of your work. A well-crafted contract protects both you and the client by clearly defining the scope of services, payment terms, and deadlines. Using a North Dakota Drafting Agreement - Self-Employed Independent Contractor can provide you with a strong legal foundation for your freelance engagements.

North Dakota does not legally require an operating agreement for an LLC, but having one is highly recommended. An operating agreement outlines the management structure, responsibilities, and operational guidelines for your LLC, protecting the interests of its members. If you create a partnership with independent contractors, consider using a North Dakota Drafting Agreement - Self-Employed Independent Contractor for clarity in roles and responsibilities.

Yes, an independent contractor is typically considered self-employed. This means that they operate their own business and provide services to clients without being on a company's payroll. Understanding your status as a self-employed individual is essential for fulfilling tax obligations and legal responsibilities, particularly when utilizing a North Dakota Drafting Agreement - Self-Employed Independent Contractor.