North Dakota Framework Contractor Agreement - Self-Employed

Description

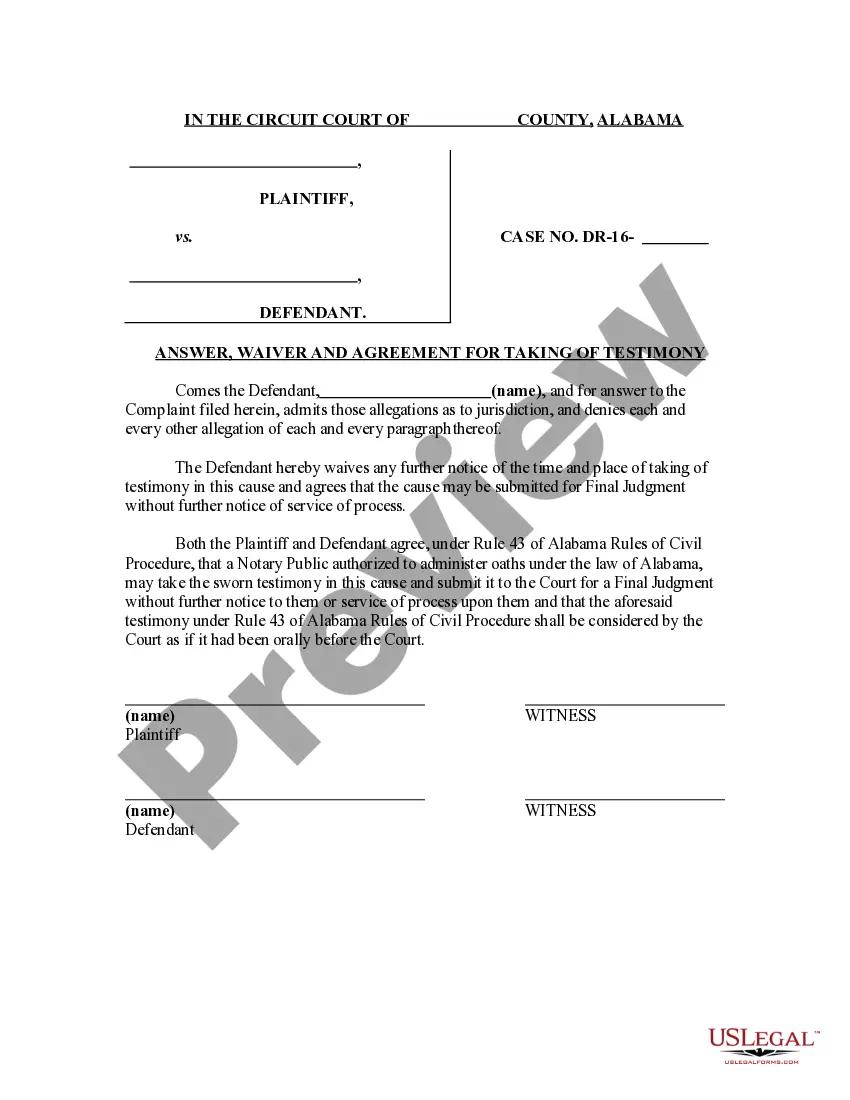

How to fill out Framework Contractor Agreement - Self-Employed?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a range of legal form templates that you can download or print. By using the site, you can access thousands of forms for both business and personal use, categorized by types, states, or keywords.

You can obtain the latest versions of forms such as the North Dakota Framework Contractor Agreement - Self-Employed in just moments. If you already have a subscription, Log In and download North Dakota Framework Contractor Agreement - Self-Employed from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously obtained forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are some simple tips to get started: Ensure you have selected the correct form for your location/state. Click on the Review button to examine the form's details. Check the form information to confirm you have chosen the appropriate form. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, affirm your choice by clicking the Buy now button. Then, select the payment plan you prefer and provide your details to register for an account. Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the purchase. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded North Dakota Framework Contractor Agreement - Self-Employed. Every template you added to your account does not have an expiration date and is your property indefinitely. So, if you wish to download or print another version, simply go to the My documents section and click on the form you need.

- Access the North Dakota Framework Contractor Agreement - Self-Employed through US Legal Forms, the most comprehensive collection of legal document templates.

- Utilize a vast array of professional and state-specific templates that satisfy your business or personal requirements and needs.

Form popularity

FAQ

Creating an independent contractor agreement is straightforward when you use the North Dakota Framework Contractor Agreement - Self-Employed. Start by clearly defining the scope of work, payment terms, and deadlines. You should also include confidentiality clauses and any specific legal requirements pertinent to North Dakota. To simplify this process, consider using a trusted platform like US Legal Forms, where you can easily access templates and customize the agreement to suit your needs.

Absolutely, an independent contractor is classified as self-employed. They operate their own business, manage their own taxes, and do not receive employee benefits. Utilizing a North Dakota Framework Contractor Agreement - Self-Employed can help formalize this relationship and ensure compliance with local laws.

Structuring an independent contractor agreement should include the scope of work, payment terms, and project timelines. You also want to address confidentiality and ownership of work produced. For a solid foundation, consider a North Dakota Framework Contractor Agreement - Self-Employed which offers clear guidelines and protects both parties.

Yes, independent contractors are indeed classified as self-employed. They manage their own business affairs, set their own rates, and control their work processes. If you're an independent contractor, using a North Dakota Framework Contractor Agreement - Self-Employed can provide essential legal protection and structure.

Receiving a 1099 form typically indicates that you have earned income as an independent contractor. This means you are considered self-employed, as you are not directly employed by any organization. Using a North Dakota Framework Contractor Agreement - Self-Employed can clarify this relationship and ensure that all terms are understood.

Whether you choose to say self-employed or independent contractor depends on how you define your work. Both terms indicate that you work for yourself, but independent contractor often implies you have a specific contract for services. When using a North Dakota Framework Contractor Agreement - Self-Employed, either term can be appropriate based on your business model.

To be considered self-employed, you must operate your business independently and not rely on an employer for your primary income. This often includes freelancers, sole proprietors, and independent contractors. If you're looking for a solid framework, a North Dakota Framework Contractor Agreement - Self-Employed can help outline your terms effectively.

Typically, the party hiring the independent contractor drafts the agreement, outlining the terms of engagement. However, it is crucial for both parties to review and agree on the terms before signing. For ease and precision, you can use the North Dakota Framework Contractor Agreement - Self-Employed to ensure that all necessary conditions are included and that the document meets legal standards.

In North Dakota, while an operating agreement for an LLC is not legally required, it is a beneficial document. It outlines the management structure, ownership, and operating procedures, helping to prevent disputes among members. Having this agreement in place complements the North Dakota Framework Contractor Agreement - Self-Employed and provides additional clarity in your business operations.

Filling out an independent contractor form involves entering personal information, tax identification numbers, and relevant business details. You should also specify the nature of the work being performed and payment arrangements. Consider using the North Dakota Framework Contractor Agreement - Self-Employed as a guide to ensure your form captures all necessary aspects and complies with state requirements.