North Dakota Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss

Description

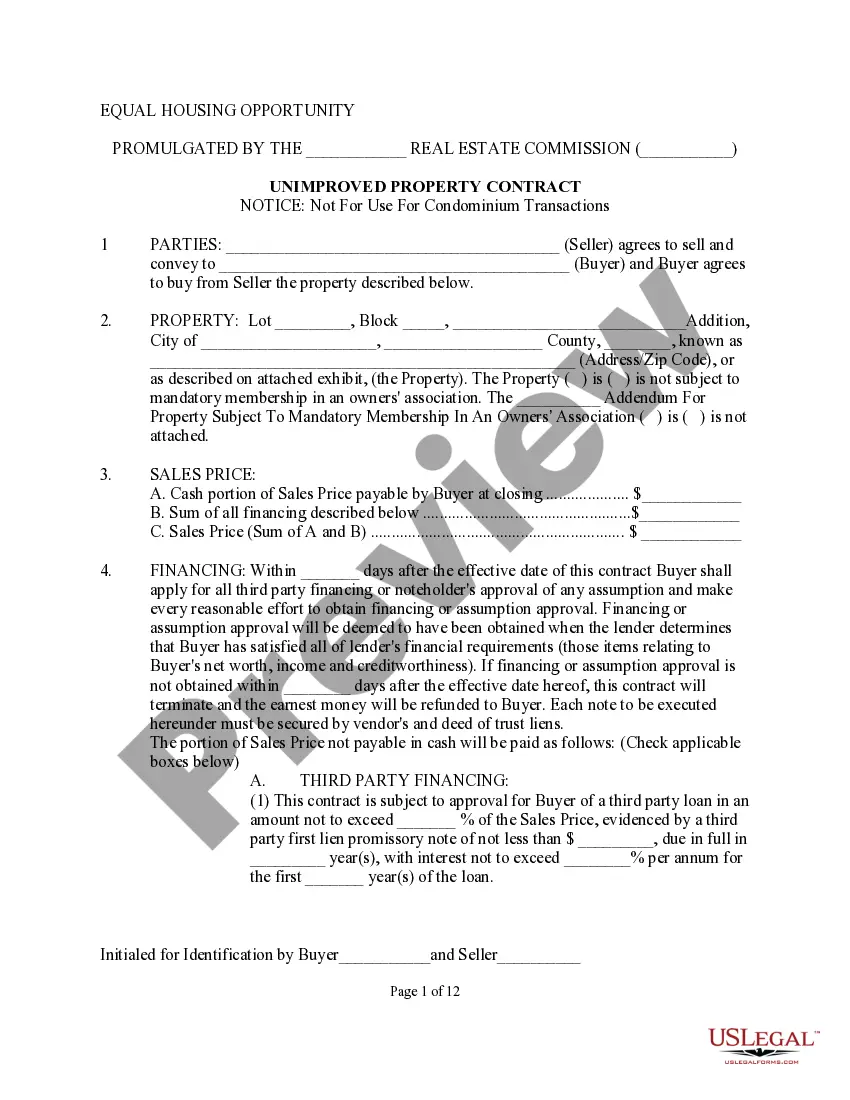

How to fill out Jury Instruction - 10.10.4 Business Loss Vs. Hobby Loss?

If you have to comprehensive, down load, or print lawful document layouts, use US Legal Forms, the largest selection of lawful forms, which can be found on-line. Use the site`s easy and handy look for to obtain the paperwork you will need. Numerous layouts for company and individual functions are categorized by categories and claims, or keywords. Use US Legal Forms to obtain the North Dakota Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss in a few mouse clicks.

If you are already a US Legal Forms customer, log in for your bank account and click the Obtain option to find the North Dakota Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss. You can even entry forms you in the past downloaded from the My Forms tab of your own bank account.

If you work with US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the shape for that proper city/nation.

- Step 2. Utilize the Review method to examine the form`s articles. Never overlook to learn the description.

- Step 3. If you are unhappy using the develop, utilize the Search area near the top of the display screen to locate other variations in the lawful develop format.

- Step 4. Upon having located the shape you will need, select the Buy now option. Opt for the pricing program you like and add your credentials to sign up for an bank account.

- Step 5. Method the purchase. You may use your bank card or PayPal bank account to complete the purchase.

- Step 6. Choose the formatting in the lawful develop and down load it in your product.

- Step 7. Total, change and print or indicator the North Dakota Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss.

Every lawful document format you purchase is yours for a long time. You have acces to every single develop you downloaded inside your acccount. Click the My Forms section and pick a develop to print or down load yet again.

Be competitive and down load, and print the North Dakota Jury Instruction - 10.10.4 Business Loss vs. Hobby Loss with US Legal Forms. There are thousands of expert and express-specific forms you can use for the company or individual needs.