A receiver is a person authorized to take custody of another's property in a receivership and to apply and use it for certain purposes. Receivers are either court receivers or non-court receivers.

Appointment of a receiver may be by agreement of the debtor and his or her creditors. The receiver takes custody of the property, business, rents and profits of an insolvent person or entity, or a party whose property is in dispute.

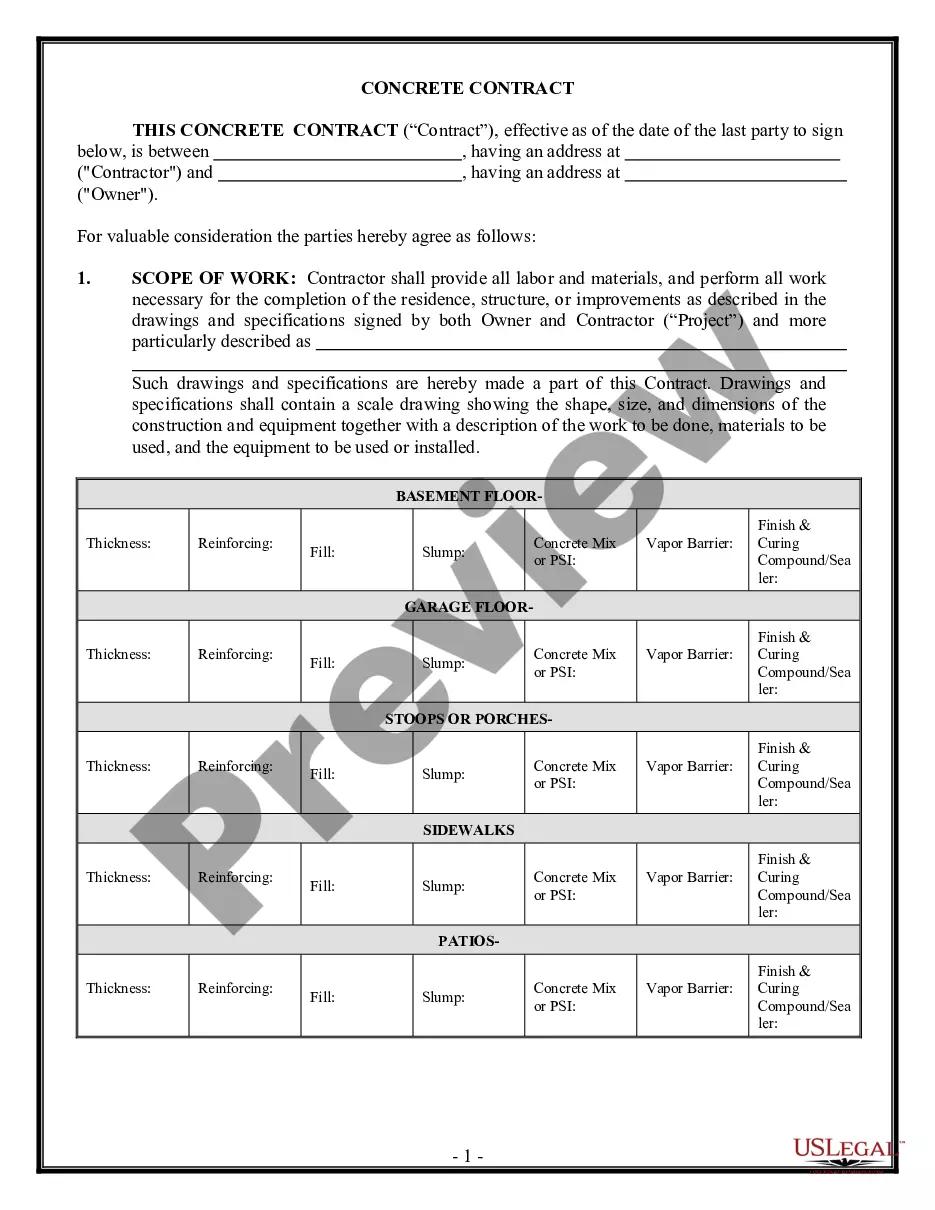

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.